Top pick for a growth economy

The monetary and fiscal stimulus poured into the global economy, in particular the US, over the last 12 months has seen our team find new opportunities for growth and returns. Reliance Steel (NYSE:RS) is a perfect example.

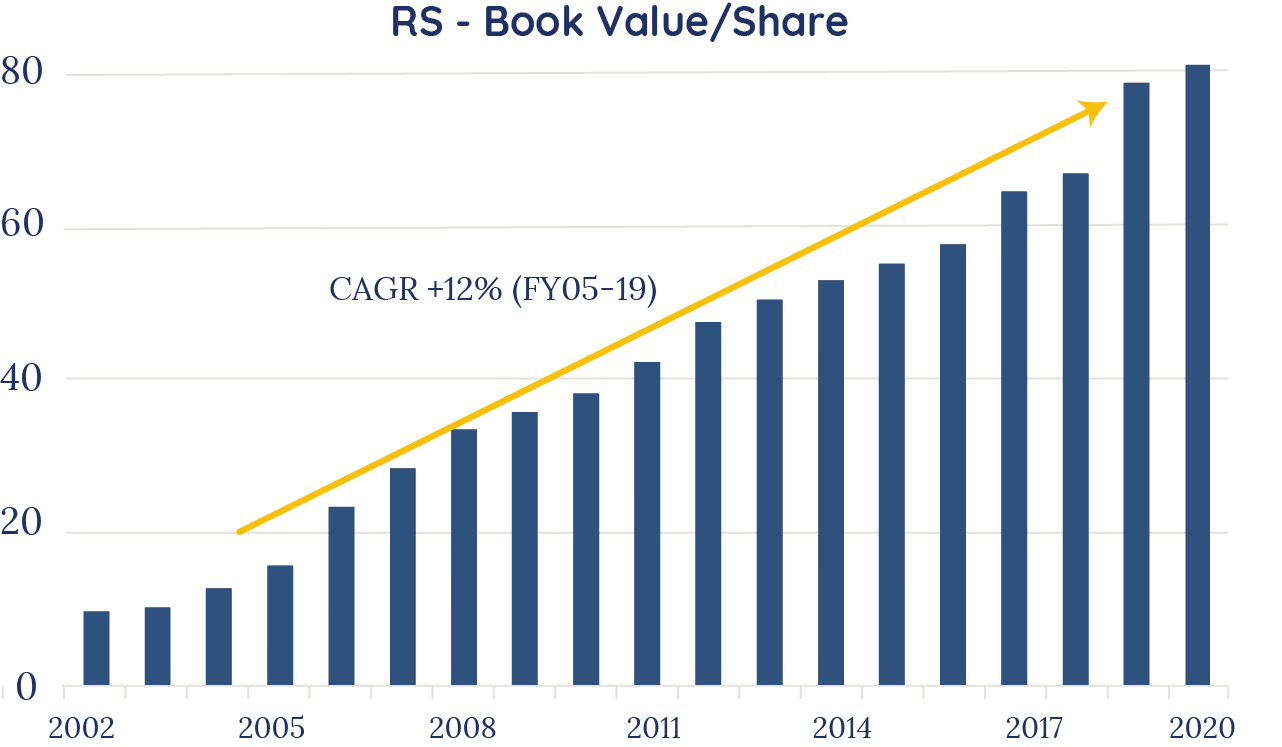

A typical ‘capital allocation-champion’, Reliance is characterised by a long history of generating exceptional returns on incremental capital. Historically, capital deployment has been via highly accretive M&A, investments in new greenfield facilities, and good capital management. Given its low levels of debt, Reliance should have no issues continuing to fund these initiatives, which have all contributed to very strong growth in Book Value/Share.

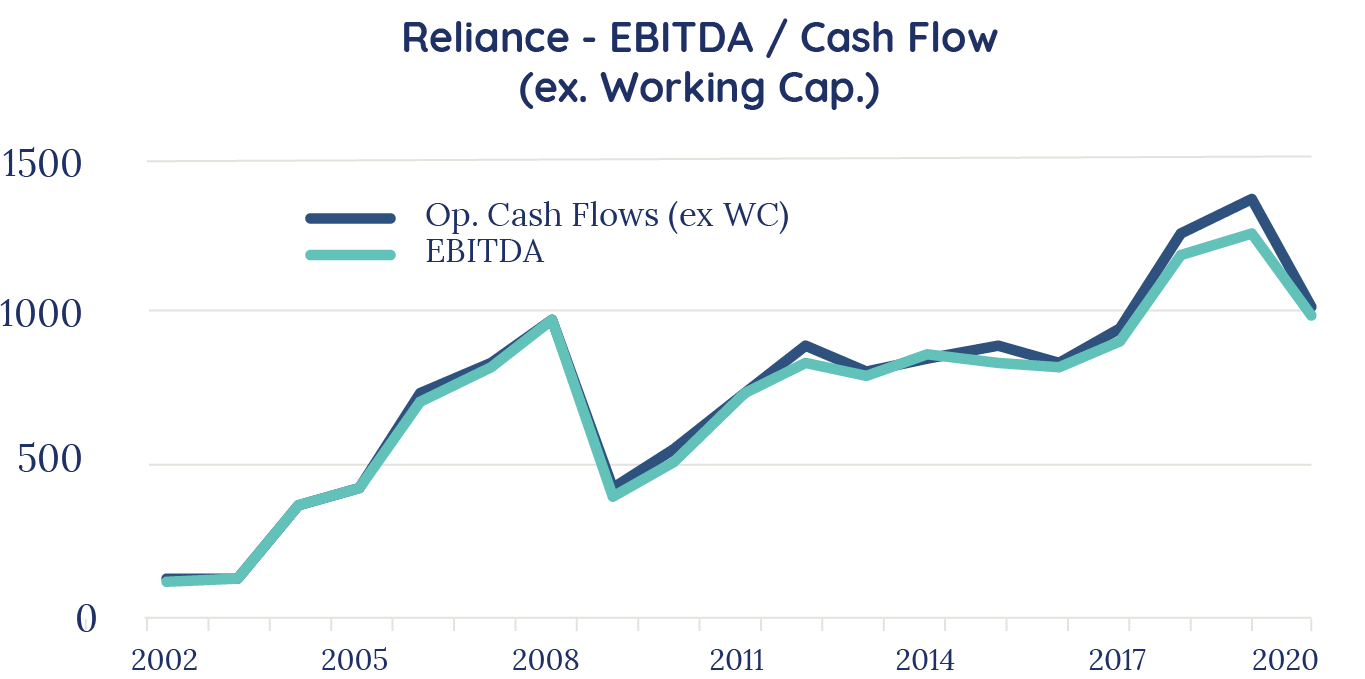

As part of our investment process, we spend a lot of time diagnosing a company’s earnings quality. One particular area of focus is the trend, nature, and size of accruals (the discrepancy between booked profits/costs and cash into the business) because after all it is the cashflows we own not the profits, and it helps us assess how aggressively accounting standards have been applied. As numerous corporate collapses can attest to, accounting is a notoriously grey area!

In the case of Reliance, we believe its earnings quality is solid, with a history of conservative accounting policies. One example of this is when presenting earnings, very few cash costs are stripped out by management as one-off items.

This means that after adjusting for the volatility in working capital flows, there is almost no cash shortfall between EBITDA and operating cash flows.

Room for improvement

An examination of Reliance’s executive remuneration structure also gave us comfort in the business, as it is very much aligned with the goal of creating value for shareholders. As part of our work on Governance we regularly assess management’s Key Performance Indicators (KPIs) given how important these are in driving management’s actions.

We also consider Environmental and Social issues when weighing all investment decisions at Talaria, and feel there is room for improvement for Reliance here.

For starters, we would like to see greater transparency on their Total Recordable and Loss Time Injury Frequency Rates as measures of workplace safety. We would also like to see greater disclosure on its energy intensity and environmental footprint, particularly regarding water intensity, greenhouse gas emissions and any reduction targets.

We’re not suggesting that Reliance is underperforming in these areas, just that more insight on their performance would be appreciated, and in our view in the best interest of the company.

Strong ESG credentials are vital not only for good corporate citizenship but also in identifying those companies that can deliver sustainable growth for shareholders. We are encouraged by the industry’s growing interest in this area, while constantly looking to improve our own.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics