Traders remain cautious ahead of the Fed

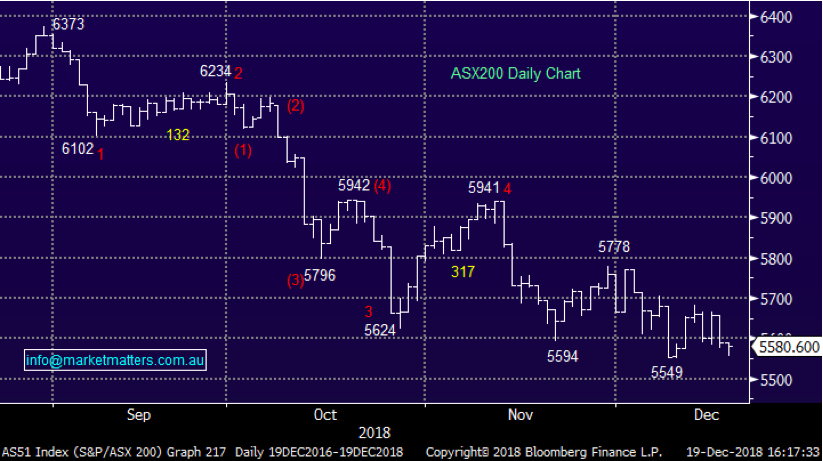

Another fairly choppy session in Australia today similar to what we saw on Wall Street overnight, and as one client suggested– seems to be the new normal. The market was sold early, recovered up until lunch, dipped into the afternoon before a late rally into the close as buyers stepped up on the back of a positive move in US Futures.

The banks were in focus, and we write about them in the Income Report today with the removal of APRA imposed cap on interest only and investment loans. Originally the cap was put in place to try and take some heat out of the property market and improve credit standards – now that has been done, there seems to be no need for the limit. In essence, it now means that the proportion of new loans which are interest only will stop falling which should support house prices – a clear risk factor the banks at the moment. This should also be beneficial for loan growth and therefore earnings growth for the banks, which is the first piece of bullish banking news we’ve seen in a long period of time. We covered the banks today in the Income Note – click here.

That news supported the financial sector today, however all else was fairly soggy, particularly the energy and high value growth areas of the market.

Overall today, the ASX 200 closed down -8 points or -0.16% to 5580. Dow Futures are currently trading up 141 points or +0.60%.

ASX 200 Charts

CATCHING OUR EYE

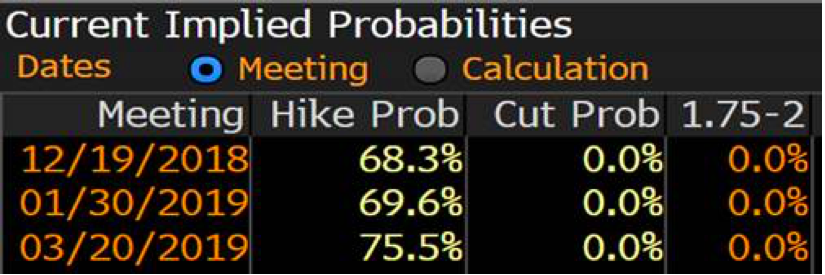

The US Fed; A very influential Fed meeting tonight with the outcome discussed at a 6am (our time) news conference tomorrow morning with Federal Reserve Jerome Powell in the hot seat. As we suggested this am, its proving to be a difficult job with the state of markets pulling one way, yet the U.S economy is actually performing pretty well. The market is pricing a 68% chance for a rate hike which is far from a certainty, however a lot of focus will be put on the likely path forward into 2019. We think they’ll hike tonight, but downplay future activity in 2019.

Broker Moves; Not a lot in terms of broker moves today with Morningstar seemingly the only firm making major changes…Christmas holidays have started, yet it still feels like there’s a lot left in the year still!

ELSEWHERE

- Carnarvon Reinstated at Macquarie With Outperform; PT A$0.40

- Premier Investments Upgraded to Buy at Blue Ocean; PT A$17

- Abacus Property Downgraded to Hold at Morningstar

- SkyCity Entertainment Upgraded to Buy at Morningstar

- Flight Centre Upgraded to Hold at Morningstar

- Magellan Financial Upgraded to Buy at Morningstar

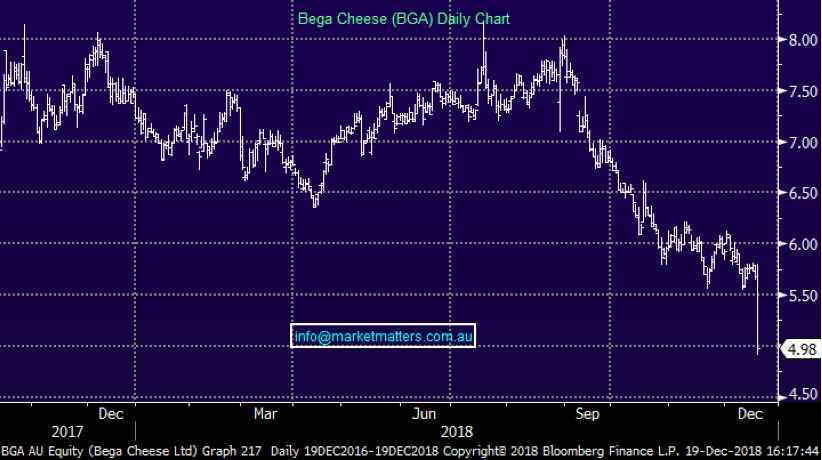

Bega Cheese (ASX: BGA) $4.98 / -12.32%; was the worst performer in the ASX200 today after updating the market with soft guidance for FY19 half way through the year. As with many companies with leverage to the agriculture sector, Bega has blamed the drought for its woes. A lack of rainfall has seen milk production fall and costs increase, eating away at Bega’s production and margins, with milk supply across the industry expected to fall 5% over FY19.

The company guided to $123m-$130m EBITDA in the current financial year, which translates to a net profit of $44m-$48m. EBITDA guidance suggests growth of 12-19% over the year, but this impressive number falls short of market expectations. Analysts’ EBITDA consensus was set at $135.3m for the year, along with a $55.75m net profit number, meaning new guidance has missed EBITDA by 6.5% and profit by over 17%. Today’s fall pushes the stock to near 2-year lows and is languishing well below the $7.10 price they raised capital at back in September. We have previously talked about the value in buying agriculture related stocks into weather related weakness. Bega is trading on a lofty PE of 21.5x forward earnings, but will only manage ~5% growth for the year so by that metric BGA could still have some way to fall.

Bega Cheese (ASX: BGA) Chart

Want to learn more?

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking here.

1 stock mentioned