Trending On Livewire: Weekend Edition - Saturday 21st June

The ASX 200 suffered only its second losing week in the last 10 this week, but it was a modest 0.5 percent retreat – nothing to worry about with the index hovering near all-time highs.

Don’t let the small move at the index level fool you, however, as plenty was going on beneath the surface. Santos received a $8.89 per share takeover bid from ADNOC subsidiary XRG, a 28% premium to the pre-announcement trading price. Shares ended the week at $7.70, representing the market’s reservations about the deal, which were outlined by my colleague here.

Aside from the bid for Santos, the rest of the energy names also caught a bid amid escalating hostilities in the Middle East, which raised concerns about potential disruptions to oil supply.

Uranium stocks also got a shot in the arm after Sprott announced plans to purchase $200 million in physical uranium for its trust. Deep Yellow, Boss Energy and Paladin all ended the week 10-30% higher.

It wasn’t all good news for commodities names, with the big three iron ore miners down around 5% each due to a host of factors - falling steel demand, excess supply, heavy stockpiles, and gloomy outlooks.

With the end of the financial year nearing, next week we’ll be featuring content that wraps up the year that was, looks ahead to FY26, and shares some key tips on how to avoid common tax mistakes.

Have a great weekend.

Chris Conway, Managing Editor, Livewire Markets

What you need to know about the new tax on higher superannuation balances

One of the world’s most famous investors in Howard Marks says asset prices are “lofty but not nutty.” Speaking at the Morgan Stanley Australia Conference this week Marks said the US and global economies are on a bumpy track to a soft landing that means investors can be cautiously optimistic. Moreover, Marks says investors shouldn’t panic about daily headlines around geopolitical ructions and always focus on holding companies that steadily grow profits over the long term. That way you can ignore the short term noise and focus on making money over the long term.

Meet Carl and his no-fuss strategy for reliable income

Staying on top of market gyrations and learning to separate the signal from the noise is all part of the investing journey. And for most of us, that journey never really ends. After nearly three decades of investing, Carl Bowden has landed on a no-fuss, yield-first strategy that works for him. In this instalment of Meet the Investor, we meet Carl, a retired 62-year-old who holds just five stocks and keeps it simple, focusing on income above the bank rate. Read on to discover the key lessons he’s picked up along the way and what’s inside his portfolio.

Top 3 Wires this Week

Here are the weeks top viewed or liked wires by our subscribers:

Some of the best wires from our Contributors this week

.png)

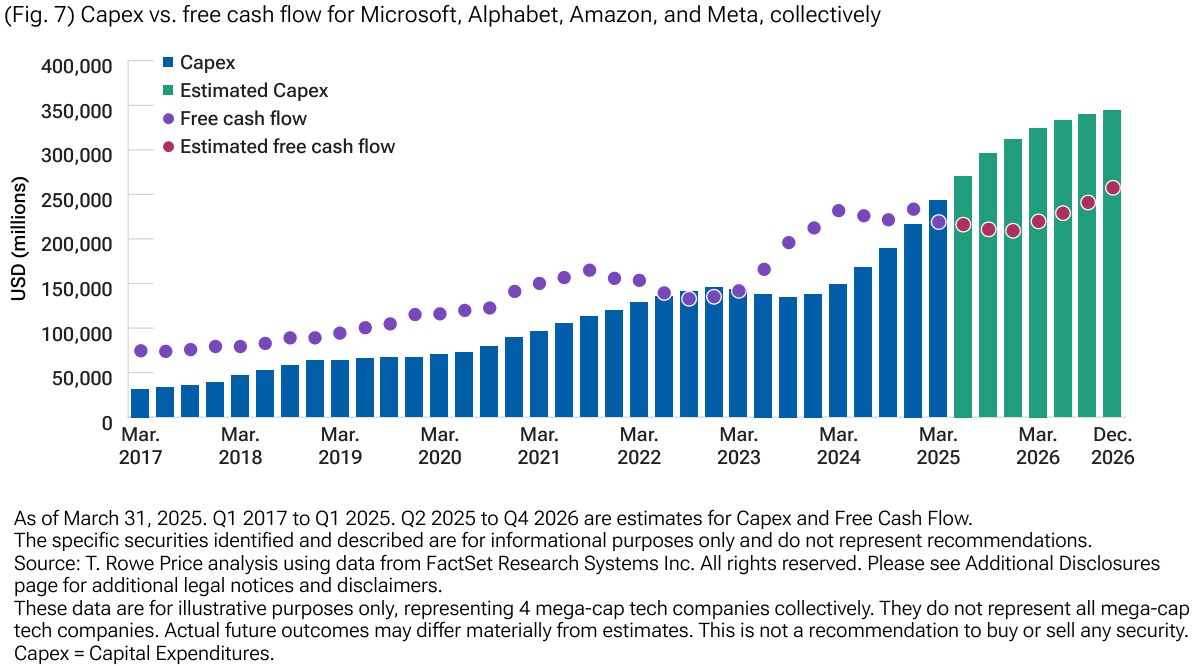

In their 2025 Midyear Outlook, T. Rowe Price highlights that the world’s largest tech companies are projected to outspend their own free cash flow by more than $100 billion in some quarters, based on analysis using data from FactSet. This chart helps explain why the global funds giant is tilting toward value equities. As Tim Murray, CFA, Capital Markets Strategist, puts it: “The advantages of being on the right side of change... appear to have flattened out.” As the AI gold rush heats up, Big Tech is digging deep… but markets may soon start asking when the payoff arrives.

Vishal Teckchandani, Senior Editor, Livewire Markets

Weekly Poll

With market uncertainty swirling and the tariff saga far from over, what’s the #1 trait you’re looking for in stocks right now?

a) Strong free cash flow & dividends

b) Reinvestment into future growth (e.g. AI and technology capex)

c) Defensive earnings & balance sheet strength

d) Attractive valuation

LAST WEEKS POLL RESULTS

We asked "Given stretched equity valuations, rising recession risks, and geopolitical tensions, which asset is most likely to outperform by year-end?"

The poll shows 34% backed equities, 33% favoured gold, 16% chose silver, 11% opted for cash, and 6% picked bonds.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

2 contributors mentioned