TS Lim: The surprise bank levy

It is ironic that the patron saint of bankers St Matthew was a former tax collector. In any case, he wasn’t around to help the big end of town this time as the Treasurer has just introduced a 0.06% levy on banks with liabilities over $100bn from 1 July 2017. Although still short on details and with more clarity to come soon, we expect the mechanics of the levy to be broadly similar to those in the UK. The tax base should exclude shareholders’ equity (Tier 1 capital), customer deposits (those that are guaranteed under the Financial Claims Scheme) and other operational liabilities (including policyholder and tax liabilities and employee entitlements).

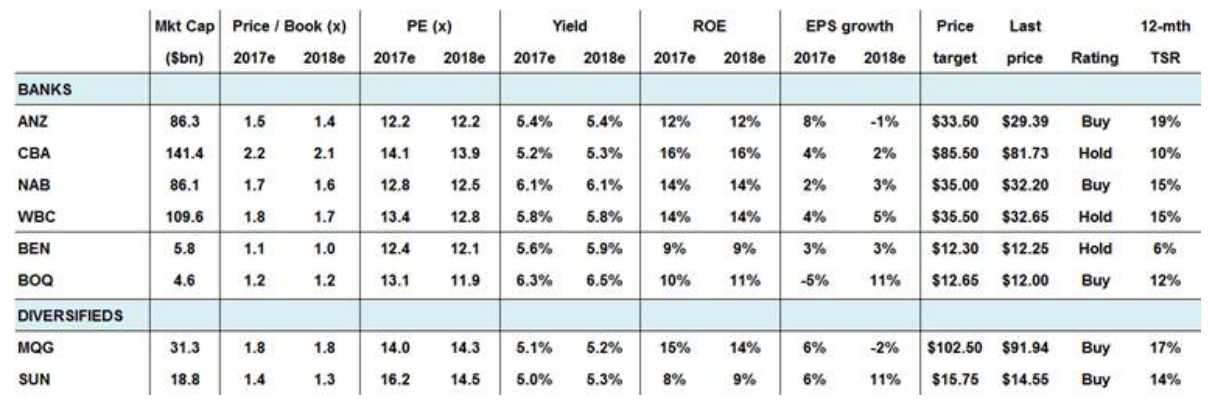

Treasury expects the levy to raise ~$1.5bn p.a. over the next four years or <5% of combined bank earnings. While questions over implementation remain unanswered, we view this as a politically astute way of fending off a banking royal commission (the levy being the lesser of two evils), levelling the playing field for regionals in a much more practical way and increasing the coffers to maintain the country’s credit rating (that will benefit the major banks). All else being equal and further assuming 50% of customer deposits are guaranteed, estimates of 2018 earnings declines are: 4.5-4.6% for ANZ and NAB; 3.6-3.7% for CBA and WBC; and 3.6% for Macquarie Bank.

The banks are unlikely to sit still and will probably respond in the usual manner – possibly pushing through a mix of subtle rate rises in the mortgage space, other income increases and further cost reductions. Our analysis suggests it would not take too much too offset the incremental taxes, perhaps 10-15bp rate rises across the mortgage book that are considered manageable or ~5% cost reductions for the majors that are viewed as achievable given the large branch networks in place.

SUN, MQG and NAB top of our pecking order. On the basis that the banks will not lie back and think of Canberra, we have chosen the middle ground in terms of outcomes (i.e. with higher taxes mitigated in part by efficiency gains). Earnings estimates are thus lowered by 2-3% across the forecast horizon and the revised price targets are: ANZ $33.50 (previously $34.50); CBA $85.50 (previously $86.50); NAB $35.00 (previously $35.50); and WBC $35.50 (previously $36.50). MQG’s price target is unchanged and SUN’s price target is increased to $15.75 assuming ~$1.5bn extra surplus capital from the likely sale of its Life unit. All ratings are unchanged and SUN, MQG and NAB remain our favourites.

Contributed by TS Lim

6 stocks mentioned