Updating our market thoughts as the ASX trades to our 5925 target

The ASX200 has now hit our 5925 target region from the recent bounce making us far more cautious short term, however its worth keeping in mind some interesting stats.

1 – November is seasonally the second worst month of the year for local stocks, with an average decline of -1.86% over the last decade, however that stat is very much dependent on the market’s fate in October. A good October = poor November and vice versa.

2 – Since WW2 following the American mid-terms US stocks have been higher 100% of the time one year later and this obviously includes the full mix of Democrat and Republican victories in both the House and Senate.

3 – The average rise over the year following the mid-terms is a huge +17% and that’s not from any panic lows in the year but simply after the vote.

Hence followers of these statistics would be looking for weak days to buy both local and US stocks, but we question if after the longest bull market in history whether it’s time for the 100% result from the last 18 mid-terms to have a hiccup on the 19th .

We actually see 2 likely scenarios unfolding over the next few weeks:

A – The market experiences a corrective pullback towards 5800 prior to an assault well above the psychological 6000 area.

B – The October weakness returns with a vengeance and stocks retest, and probably break, the 5600 area.

At this stage MM’s preferred scenario is A, implying the next 100-point for the local market is down, some of this will come from a few major stocks trading ex-dividend next week.

Global Indices

The US high valuation / growth end of town started Octobers decline which led to an almost contagion like sell-off in global stocks and it appears to have heralded the end of the markets bounce, at least for now. The NASDAQ closed last week -2.3% below its Wednesday high compared to the Dow which only retraced -1.1% and remains within striking distance of its all-time high.

I’ve gone out on a limb below and shown how we expect stocks to move in the next few weeks but it’s important to understand that a few “big” hours in either direction could change this picture – current volatility should not be underestimated.

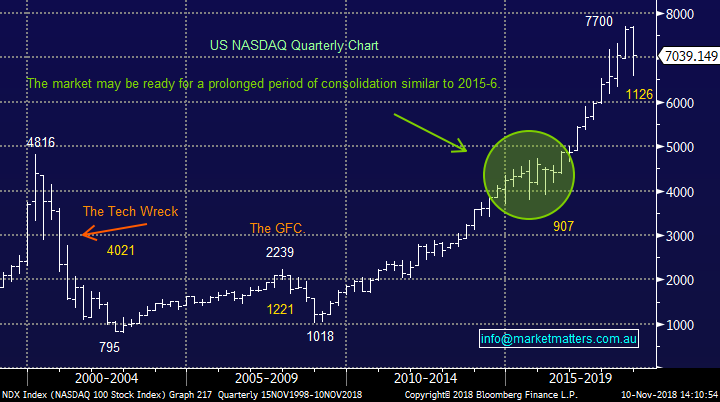

US NASDAQ Chart

Interestingly the less high growth / tech based Dow looks far more constructive than the NASDAQ, it closed less than 4% below its all-time high on Friday, even after a 202-point pullback.

Investors remain concerned that the post GFC economic recovery is faltering with leading indicators like weak car sales catching peoples attention which is causing the outperformance by the more traditional blue chips as opposed to the growth dominated NASDAQ.

US Dow Jones Chart

Before investors panic they should consider MM’s long term outlook for US stocks and in particular the high growth / valuation NADAQ index:

Our view is the NASDAQ is likely to spend the next few years consolidating post GFC gains in a very similar manner to 2015-6 – our “best guess” is now between 8000 and 6000. If we're correct this is an extremely exciting time for active investors with their finger on the pulse in a period where human emotions, led by “Fear & Greed”, can significantly hinder an investors returns.

The important point is to remain flexible, be prepared to sell strength and have ammunition to buy panic weakness.

NASDAQ Chart

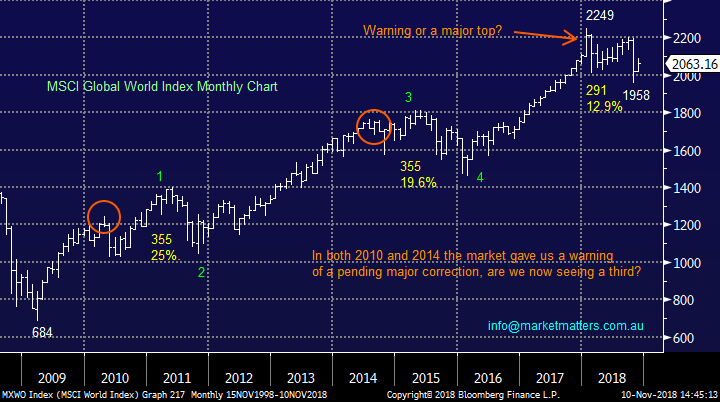

Moving on from the US to the global equity market as a whole and the technical picture here may surprise many but we have to look at markets in the cold light of day, not how they “feel” during any particular week.

1 – The bullish uptrend from its 684 low back in March 2009 remains clearly intact.

2 – The chart pattern has been literally copybook stuff since the GFC low including two identical retracements of 355-points.

3 – The market traded in a perfect Neutral Pattern (normal distribution) between January 2018 and October 2018 before the spike down to 1958.

4 – The close back above 2040, in the direction of the trend, is very bullish targeting almost 10% upside, and probably more.

MM is bullish global equities from a risk / reward perspective with stops below 1950 i.e. around 5% below Fridays close.

At this junction we remember what we’ve written on more than one occasion over recent weeks - “the path of most pain for bearish fund managers is probably up to fresh-all time highs”

MSCI World Index Chart

Updated Macro Outlook

This is the time to stand back and consider the bigger picture especially as the longest bull market in history stares down its 10-year anniversary – simple statistics tell us that the likelihood of a meaningful correction is increasing every month that passes. We see a 4 major factors looming that will dictate how we invest into 2019 and beyond:

1 – The market has rallied strongly post-GFC and is generally trading between fair value and expensive depending on what sectors are under the microscope i.e.do not chase strength.

2 – Central banks have commenced normalizing interest rates led by the Fed i.e. global interest rates are going up and the easy monetary environment is over - it will become an amazing case study in years to come analysing / attempting to comprehend negative interest rates in some parts of the world!

3 – Earnings season in the US, especially the banking sector, was solid but we are entering a huge period for correct stock / sector selection with any corporate misses being punished mercilessly. A few years ago they were regarded as buying opportunities, not today.

4 – While the US mid-terms are behind us we still have plenty of political / economic uncertainty on the horizon including the US-China trade war, BREXIT and the Italian budget concerns.

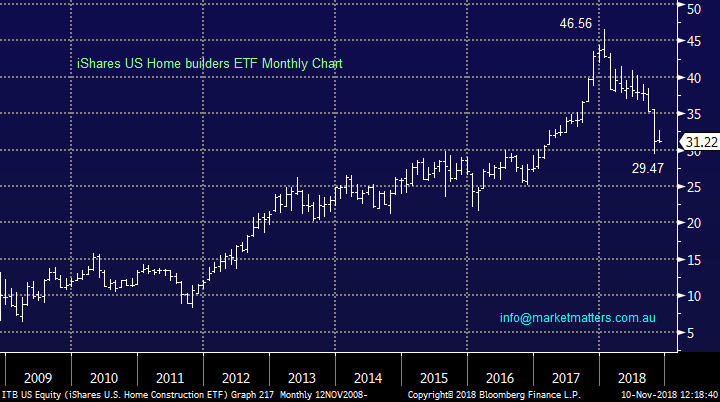

Markets are now assuming the US will go into a recession in 2019/20 as is best illustrated by the almost 40% correction in the US construction stocks during 2018 - over the same time US indices have been making fresh all-time highs albeit in a very choppy manner.

Stocks / sectors exposed to economic growth are having a tough time locally and globally as markets get set for what it believes will be the next global economic step – a recession – just look at James Hardie (ASXJHX) and Boral ASX:BLD)

Our concern for equities is that fund managers maybe wrong as many have already been in 2018, perhaps the obvious recession is not next. Wages and input costs are rising suggesting that inflation could become the elephant in the room, we must all acknowledge that the greatest amount of fuel in history has been thrown on this fire since the GFC.

If inflation does kick in rates will rise faster than many imagine and in our opinion very few are positioned for this scenario, including us – high inflation is generally good for gold, oil and materials, certainly there are no signs that fund managers are chasing these sectors today with crude oil correcting over 20% in the last 2-months i.e. this is something to watch for as the market impact will likely be dramatic.

We stick with our opinion that global bond yields are going higher hence we have no interest in the “yield play” end of town, even if they do enjoy a “bid tone” in periods of unease i.e. Real Estate and Utilities are not for us until further notice.

US Building sector Chart

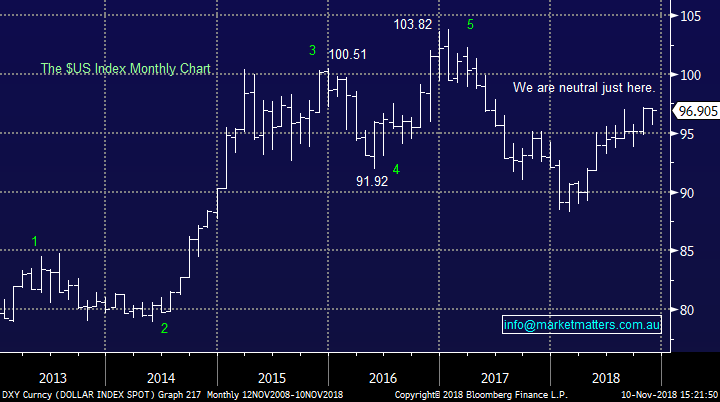

The $US has become a key barometer to the health of stocks in 2018 as it’s attracted funds in terms of uncertainty / major volatility, hence a handle on the $US is a handle on stocks.

MM has nailed the $US in 2018 calling it down early followed by a strong rally which is what’s unfolded, so what now?

Unfortunately the pictures unclear at present, we can see a rally towards 100 which implies stocks lower or a correction back towards 94 which would probably be accompanied by equity strength, we see a 50-50 picture for the $US = no help!

The $US Index Chart

Want to learn more?

This is an excert from the Market Matters Weekend Report sent to members each Sunday. Market Matters also publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking here.