US$100 Oil on the Horizon?

Last year I formed the view that there were opportunities in oil stocks. A handful of oil producers lagged the oil price as equity investors doubted the sustainability of the rebound. But a number of factors suggest that oil, while the price will of course be volatile, is now well into a cyclical bull market.

If you can find a business that managed to successfully navigate the period where oil prices bottomed around US$30 in early 2016 then the chances are good that it will flourish now that the tide has turned.

That search led me to Horizon Oil (ASX:HZN) which, if my thesis is correct and management can execute, could quite reasonably be worth 2-3x current prices. Here’s why.

Horizon Oil - Overview

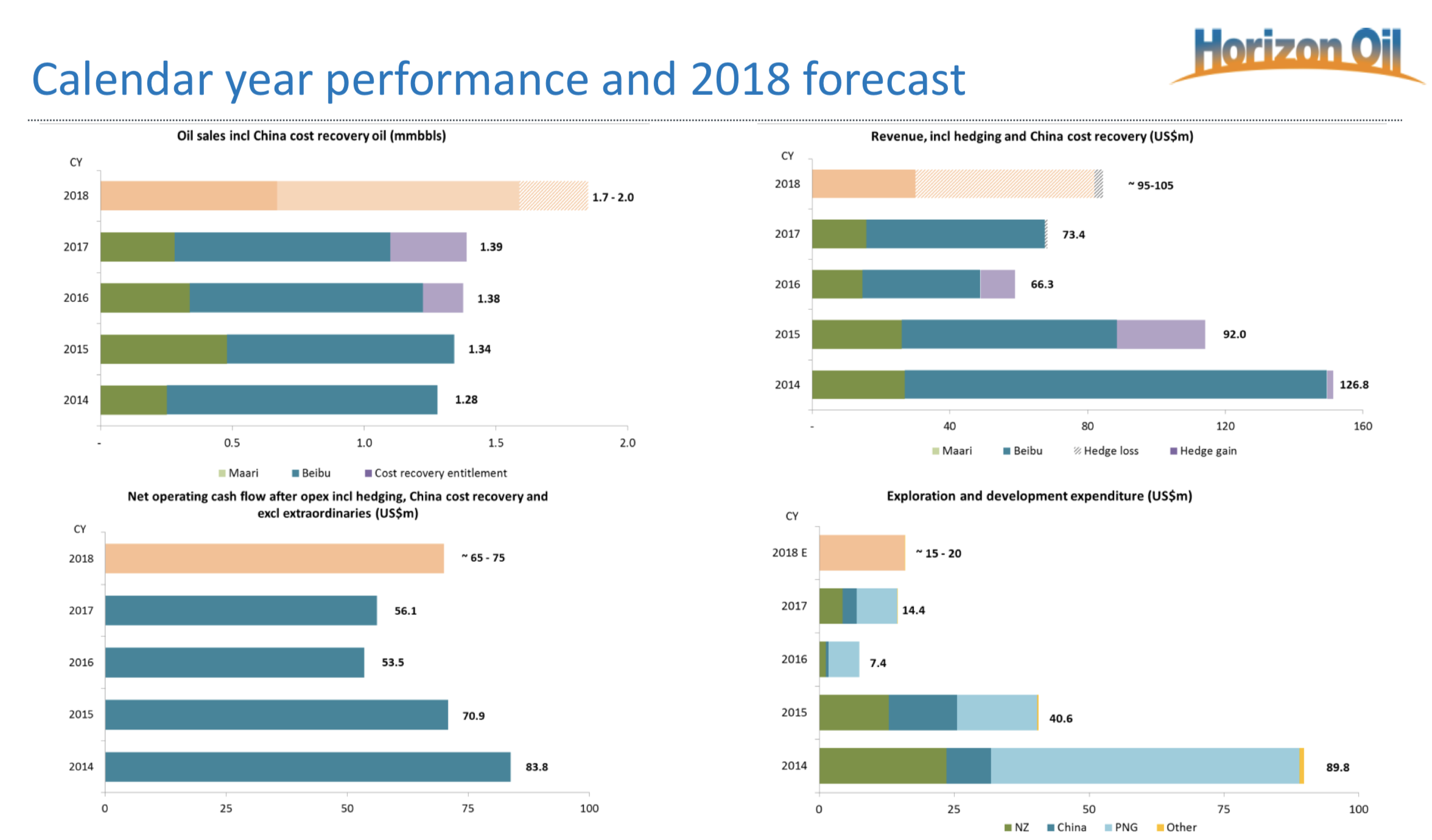

HZN is a low cost oil producer with assets in China (Beibu fields) and New Zealand (Maari/Manaia fields). These assets have consistently produced 1.3-1.4m barrels of oil annually net to HZN, with that figure expected to jump to 1.7-2m this year when the recent acquisition of an additional 16% in Maari closes (expected by end of March).

With operating costs of US$11/barrel and all-in cash costs (inclusive of CAPEX) of US$34/barrel these assets are highly profitable in the current environment.

Management have given guidance for net operating cash flow of US$60-$70m per annum out to 2022.

This year the company expects to generate EBITDAX of roughly AUD$90m. We will look closer at the numbers later but for a company with a (fully diluted) market cap of A$190m and enterprise value of about A$300m this is compelling.

The real upside for HZN is in its transition to become a producer of LNG through its Western LNG (WLNG) project in Papua New Guinea, of which the company currently holds 28%.

Located in the forelands of PNG, WLNG consists of a 2C resource of 2-2.5tcf of gas and 60-70mmbl of condensate (effectively same price as Brent Crude) with the plan being to run gas from a Northern processing hub through a 500km pipeline to a 1.5mtpa LNG plant/near shore liquefaction facility, to be online around 2022/23.

HZN is attractive because not only does the stock look cheap based solely on its producing oil assets, but the company also appears to have quite a unique capacity to self fund a large portion of its LNG project, which at current prices you are effectively acquiring for free. On top of that there are some ‘free kicks’ such as the US$130m milestone payment payable on Final Investment Decision (FID) expected next year, roughly equal to the entire market cap today.

If I’ve managed to get your attention lets dig deeper.

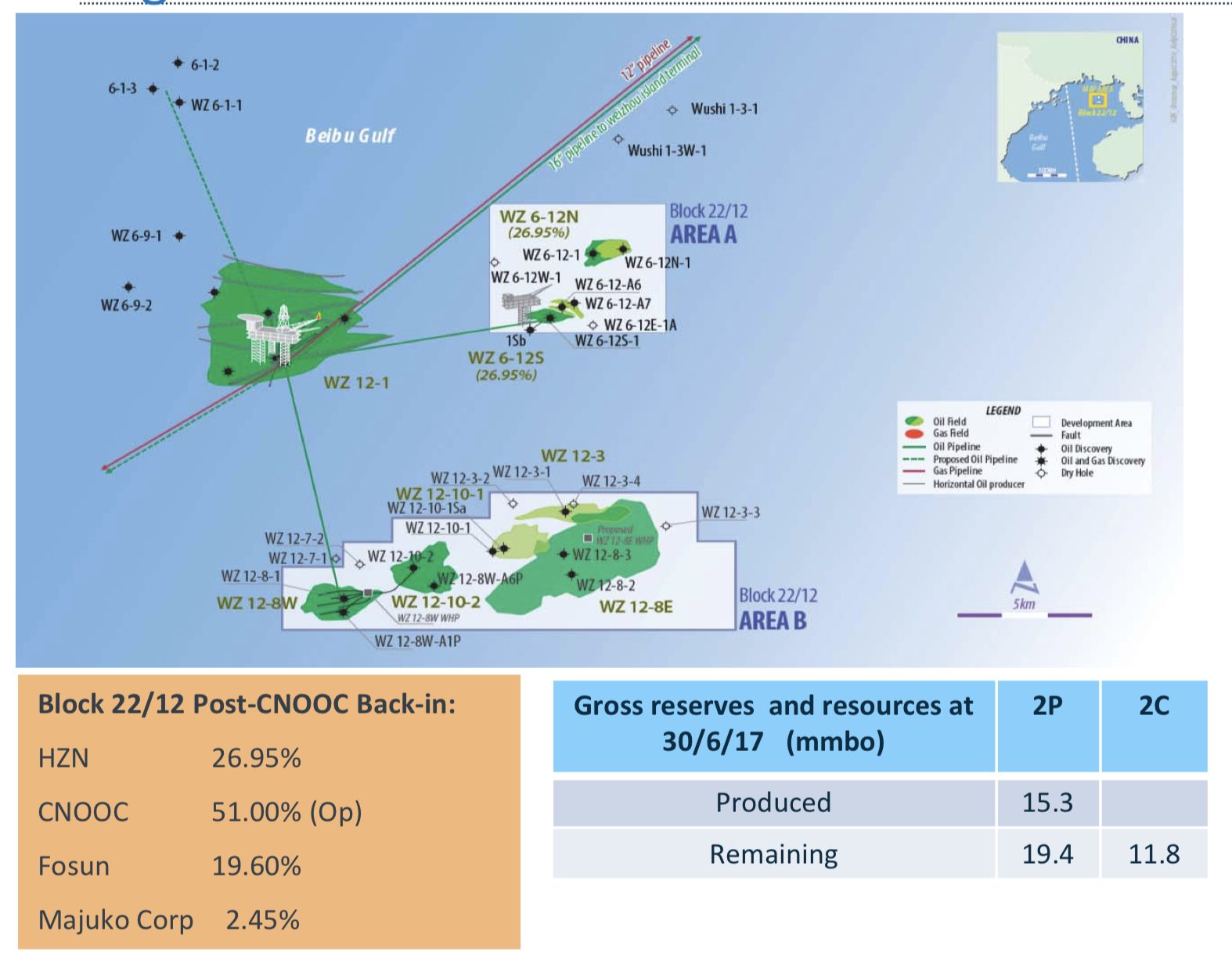

China - Beibu Fields

HZN holds a 27% working interest in Block 22/12 in the Beibu fields, north-west of Hainan. Cumulative production from these fields is north of 15m barrels with reserves less than halfway depleted. Production is running at 9,300 bopd, which is roughly 10% above the average for 1H18. HZN’s share is around 3,300 bopd inclusive of cost recovery entitlements equal to US$76.7m (escalating at 9% per annum) and means HZN receives an effective 34% interest until the cost recovery entitlements are depleted.

The company expects to reach Final Investment Decision (FID) on the undeveloped WZ 12-8E in mid 2018, with 11.1 mmbo of 2C resource and first production scheduled for 2019.

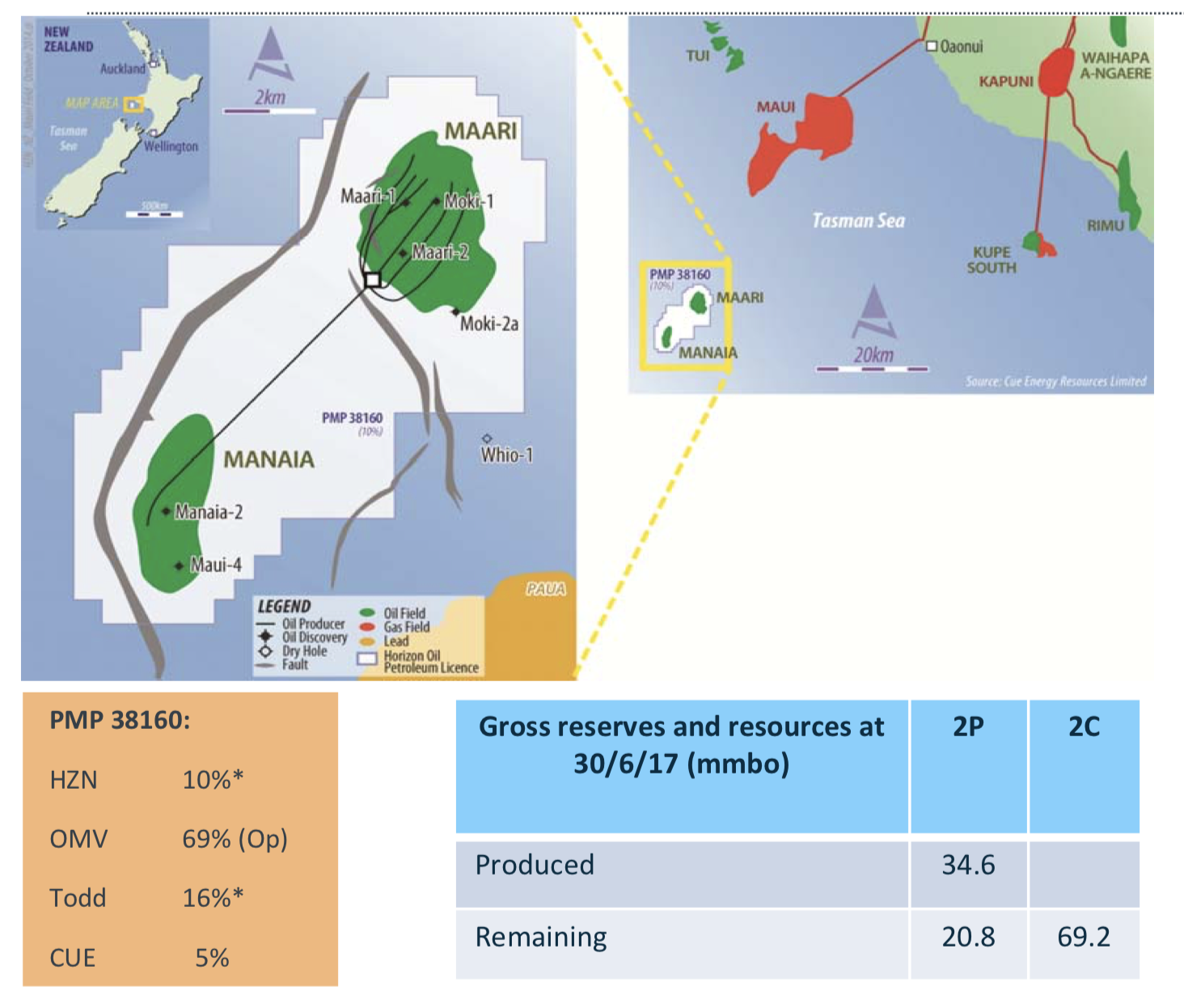

NZ - Maari and Manaia

HZN recently increased its interest in PMP 38610 in the Maari and Manaia fields off shore of New Zealand from 10% to 26% with the deal expected to close by the end of March. It appears as though they got an attractive price with a payback period of <18 months as the seller decided to exit off shore operations.

These fields are producing at ~8000 bopd with HZN’s share at ~2000 bopd once the deal closes. A production improvement program saw the rate of production rise to 8,500 bopd in 1H18 with prospect for further good results.

There is a large 2C resource of 50mmbo in the Moki Zone. This will either extend the production life of Maari/Manaia significantly or could be sold to free up capital.

Oil Price

Before we get into the more exciting aspect of HZN, the LNG prospects, it is worth touching briefly on the oil price. I’m not going to pretend I know where it is going but I’ll give you some things to think about.

‘Consensus’ is for oil to hover around current levels for the next year or so (isn’t that convenient..) but consensus rarely turns out to be right and some research houses are beginning to move their forecasts higher. It is a complex debate but in most cases the X-factor for oil, and where the Bulls and Bears disagree the most, appears to be US shale. When OPEC made the decision back in 2014 to try to maintain market share rather than pull back on supply it coincided with a ramp up in US shale production that simply flooded the world with oil. That (and a China slowdown) led to oil plummeting below US$30 in early 2016.

But today the dynamics are quite different. The bear market in oil created an environment of underinvestment. And while US shale production has once again begun to ramp up in response to rising prices the ability for the key US shale assets to replicate their performance (in terms of growth) of circa 2014 is being questioned by some observers. At the same time global demand for oil, despite the attention given to renewables and EVs, has grown.

And don’t think that Saudi Arabia and Russia, who both have milestone economic and political events approaching in the near term, haven’t been planning this for some time. With Saudi Arabia listing Aramco and a Russian election this year the incentives are strong to hold back on supply and support the oil price. It seems unlikely that they will emulate their “retain market share” strategy this time around.

If US shale is now the X-factor then we are likely in for more volatile swings than in past periods when OPEC was the primary swing producer. The US companies are independent, highly competitive and with purely economic incentives. They won’t manage supply and demand to help level out prices, they will make hay when the sun shines and get poured on when it doesn’t. So just as the oil price over shot to the downside it would be reasonable to expect that it may well do the same to the upside.

And while I’m not quite bullish enough to fully subscribe to the theory myself, there is a small group of analysts pointing to the possibility of oil touching the US$100 mark this year. Most importantly it is backed up by excellent research, which is well worth reading.

Circling back to HZN it is worth noting that when they give guidance of US$60-$70m of net operating cash flow annually out to 2022 they are using consensus oil price forecasts. These consensus forecasts are currently around US$60.

The take away point here is that if the price of Brent Crude averages around the US$60 level over the next couple of years then HZN is positioned to be an excellent investment. And if it turns out that oil is indeed heading anywhere near the US$100 level then the leverage for HZN is substantial.

Western LNG

If the cash flow from the NZ and China assets comprise the value investing thesis for HZN, then the WLNG project represents the blue sky story.

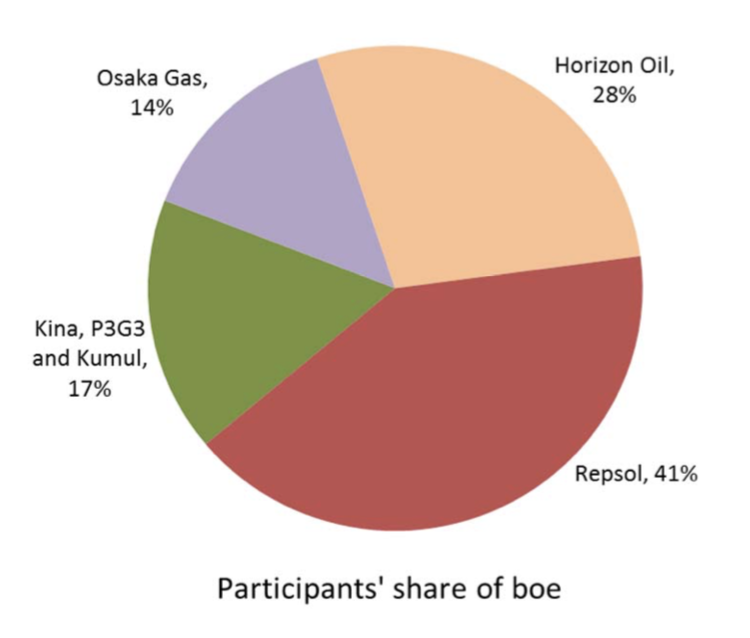

WLNG is an aggregation of four prospective gas fields in the forelands of PNG. HZN has an effective interest of 28% alongside JV partners Repsol, Osaka Gas, Kina Petroleum and the PNG Government through Kumul Petroleum.

What makes HZN interesting is that it appears zero value for WLNG is being priced into the stock. This does not appear rational given 2018 is likely to be a year where management make important strides towards progressing the project.

To be fair the market may be waiting for clear signs that the project will proceed to Final Investment Decision. Repsol, the largest JV partner, is considered to be looking to exit WLNG. If and when that sale goes ahead we will have 1) a clear indication that the project will indeed proceed given the buyer is almost certain to be keen to get things going, 2) a look-through valuation on HZN’s remaining stake and a means for the market to assess what it is worth and then price some of that value into the stock.

There are no shortage of natural buyers including Oil Search, Santos and Chinese interests.

This is a big project - we are talking in the vicinity of a $4b build, a 5-6 year payback period and a 20+ year project life. Usually these projects can be dilutive to equity investors due to the substantial CAPEX required. But HZN is quite uniquely positioned.

HZN own 28% and have flagged their intention to right-size their stake. This will free up substantial cash but also reduce the amount of capital required from HZN for the build-out due to a lower % ownership. They will then receive a US$130m payment on FID and will have access to the US$60-$70m of annual operating cash flow from their oil assets out to 2022, all going to plan. The PNG Government have the right to back-in through project funding for a 22% stake. Throw in some debt funding and they are a long way to covering their expected investment without needing to turn to the market for large sums.

These sorts of projects are complex, multi-year builds and will inevitably have stops and starts over this period. But the fact that today’s price reflects minimal to no success suggests there is downside protection and the upside can take care of itself.

And as for the LNG price, sentiment turned 180 degrees in 2017 as (primarily) Chinese demand was stronger than the market anticipated. But demand from across all of SE Asia is expected to grow substantially in coming years to the point where some are beginning to suggest that the supply shortfall originally anticipated for 2022 may now be brought forward a few years.

All of this drove the LNG price higher in 2017.

The Quick Numbers

With that said lets dive into some simple numbers.

The fully diluted equity value of HZN at a share price of 11c is A$190m. This assumes all the 6c options are exercised which is highly likely given they are now well in the money.

Net debt at the half year stood at just under A$120m (management are targeting Net Debt/EBITDAX of <1.5x by mid-2018 and the balance sheet is strong) giving us an EV of around A$300m today (accounting for the purchase of the Maari stake and option conversion).

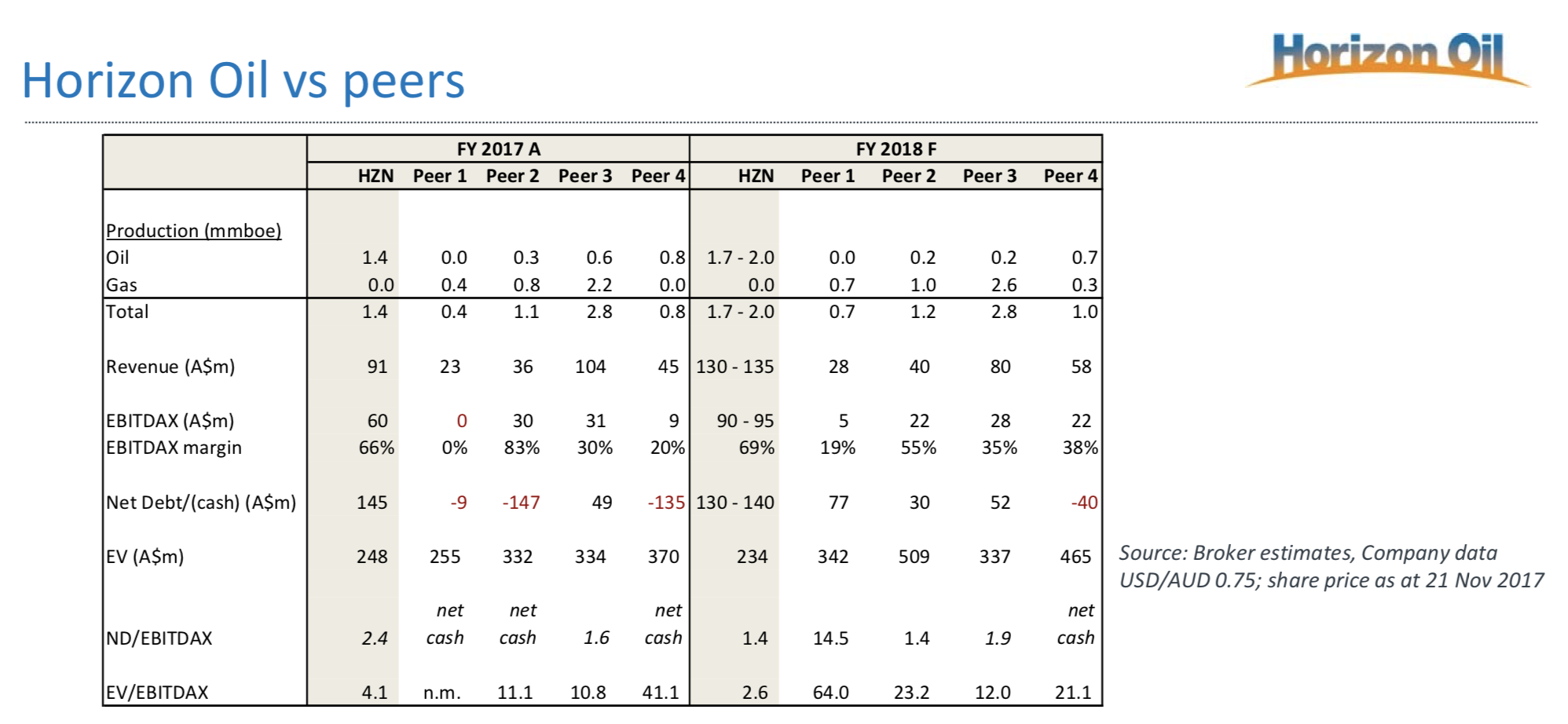

The company has given guidance for EBITDAX of A$90m for the next 12 months. That puts HZN on EV/EBITDAX of 3.3x. A material discount to peers, as the table below from HZN’s AGM highlights (data as of 21 Nov 2017).

CAPEX is anticipated to remain around current levels this year, call it A$25m. And interest expense, which is quickly declining due to accelerated repayment of the subordinated debt, is likely to be around A$15m.

You are left with free cash flow in the vicinity of A$50m annually. A healthy free cash flow yield and ample capital to continue repaying debt and investing back into the business.

Then we have the milestone payment which is payable from Osaka Gas to HZN on FID of the WLNG project, expected around mid to late 2019 and worth US$130m (A$160m). That essentially covers HZN’s entire current market cap. As progress is made on WLNG the market will have to begin to price this payment into the stock.

Then there is the question of what HZN’s 28% stake in WLNG is actually worth.

That is a difficult task and the best we can do is to work off a fairly broad range. But there are a few key figures that are useful in evaluating WLNG.

In 2013 when Osaka Gas purchased a stake in WLNG off HZN the look-through valuation of this deal valued HZN’s remaining 28% stake at approximately US$140m (A$180m), inclusive of the conditional FID milestone payment, or just over 10c per share.

In 2016 an Independent Expert produced an un-risked valuation for HZN’s WLNG stake of US$274m-US$552m (A$342m-A$690m), or 20-40c per share. Keep in mind this is an un-risked valuation, but it gives you an idea of the potential blue sky.

And in the near term we may see another look-through valuation if Repsol exits its stake in WLNG. If this deal eventuates and reinforces a valuation equal to or better than the implied valuation at the time the deal was struck with Osaka, then the share price should react positively.

Based on the above it is within reason to suggest that just HZN’s WLNG stake is worth between 10c-40c a share assuming you believe management can continue to progress the project. I will assume the lower end of the range and scale up as management ticks all the boxes.

Making things a whole lot easier is the fact that the current share price appears to imply zero value from WLNG. Investors paying todays price are getting the producing oil assets for an attractive deal, and all the (potential) upside from WLNG thrown in for free.

If management can continue to progress WLNG closer to production over the coming months, and the market gets a sense that the FID is approaching, then the stock will have to price in some of that value.

Re-Rate Coming

Upcoming catalysts include completion of the Maari acquisition, a sale by Repsol to a more aggressive buyer, right-sizing of HZN’s WLNG stake, independent resource certification for WLNG and continued strengthening of the balance sheet. Corporate activity is always a possiblity given the heightened interest, particularly from Chinese buyers, for quality LNG assets.

The primary risk is of course any oil or LNG price weakness while longer term the risk comes down to execution.

Keep in mind that HZN was once well known to all the big brokers and fund managers. When the oil price crashed all broker coverage ceased and most fund managers dumped the stock. As sentiment has turned, and given the company is already well known in the investment community, the re-rate might be quite rapid.

Spheria Asset Management recently went substantial in the stock and if the above thesis is correct then other funds will follow.

I expect HZN to trade above 20c this calendar year.

5 topics

1 stock mentioned