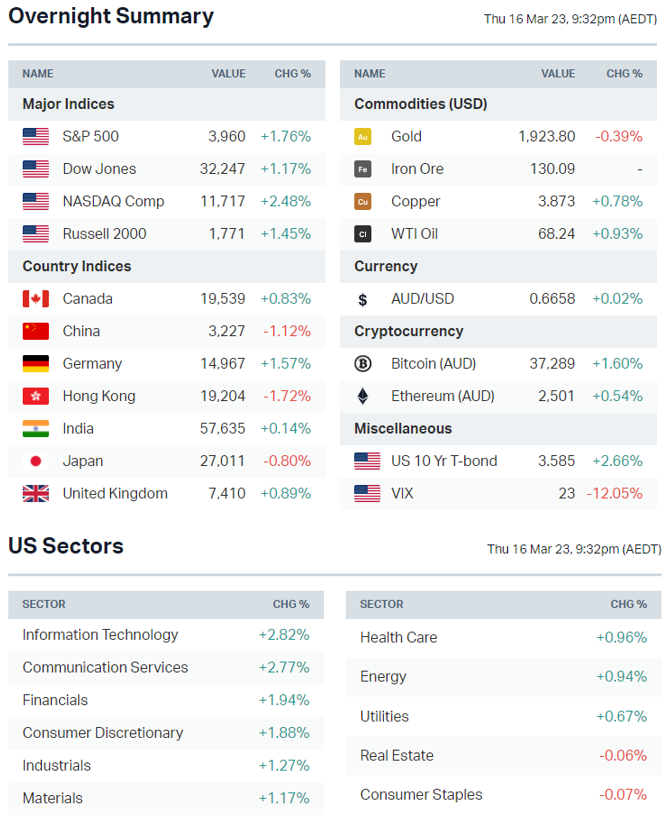

US stocks bounce on Credit Suisse lifeline, ECB hikes rates by 50bps, ASX 200 futures higher

ASX 200 futures are trading 27 points higher, up 0.38% as of 8:30 am AEDT.

Major US benchmarks rallied and closed toward session highs, Credit Suisse receives a liquidity line from the Swiss National Bank, First Republic receives US$30 billion from a group of larger US banks, the US Government is still looking for a buyer for SVB, the Fed rate path has been sent into haywire but settling around another 25 bp hike in March and Goldman Sachs upgrades its US recession odds to 35%.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 opens 0.3% lower but rallies 2.5% off lows

- US 2-year Treasury yield rallied 26 bps to 4.2% – marking a six day streak of moves of 20 bps or more, the longest streak since 1977

- Fed rate hike expectations are beginning to settle around a final 25 bp hike next week with the possibility of cuts in the second half of 2023

BANKING CRISIS

- Credit Suisse to borrow up to CHF50B from Swiss National Bank (Bloomberg)

- Credit Suisse CDS spike to 2008 financial crisis levels (Bloomberg)

- Saudi National Bank says everything fine at Credit Suisse (Bloomberg)

- JPMorgan says Fed's emergency loan program could inject up to $2tn (Bloomberg)

- Large US banks view Credit Suisse exposure as manageable (Reuters)

- First Republic Bank is exploring options including a sale (Bloomberg)

- US government still looking for buyer for SVB (NY Times)

STOCKS

- Snap (+7.3%): US demands ByteDance to sell Tiktok (Reuters)

- Baidu (+3.8%): Shares initially tumbled 5% as its ChatGPT product Ernie Bot disappoints (Reuters)

EARNINGS

Adobe (+5.9%): Beat revenue and earnings expectations in 1Q23. Here are some key quotes from its earnings release:

- "Adobe had a strong Q1, driving record revenue across our Creative Cloud, Document Cloud, and Experience Cloud businesses.” – CEO Shantanu Narayen

- "During the 2022 Holiday Season, e-commerce drove a record $211bn, with 38 days of $3+ billion in daily spend, according to the Adobe Digital Economy Index.”

- "In this environment, the demand for our products continues to be strong as our solutions are mission-critical to customers in a world where digital content and engagement drive the global economy.” – CFO Dan Durn

FedEx (+4.4%): Earnings beat but revenue for the third quarter ended February 28.

- "Third quarter results were negatively affected by continued demand weakness, particularly at FedEx Express. In addition, operating income was negatively affected by the effects of global inflation ..."

- "We're lowering our capital intensity and increasing our return on invested capital. We are entering an era of lower capital intensity at FedEx ... We are prudently deferring and lowering the pace of projects, growing our capacity utilisation, moderating aircraft fleet investment to drive ROIC improvements." - CEO Rajesh Subramaniam

ECONOMY

- Goldman Sachs cuts US GDP growth forecast (Bloomberg)

- ECB cuts through bank turmoil and sticks to 50 bp hike (Reuters)

- Australian employment rebounds back to record lows of 3.5% (Reuters)

- New Zealand GDP shrinks more than expected, raises recession risk (Bloomberg)

-

China home prices rise at fastest pace since mid-2021 (Reuters)

Deeper Dive

The European Central Bank raised interest rates by 50 bps to 3.5% overnight, in-line with consensus expectations. Here are the key highlights and things to consider:

- Rate hike commentary: "Inflation is projected to remain too high for too long...The Governing Council is monitoring current market tensions closely and stands ready to respond as necessary ... The new ECB staff macroeconomic projections were finalised in early March before the recent emergence of financial market tensions"

- Dovish lean: "The elevated level of uncertainty reinforces the importance of a data-dependent approach to the Governing Council's policy rate decision."

- But no forward guidance: There was no forward guidance from the ECB, only the certainty of uncertainty.

- Market funds target pricing: Over the past week, markets have cut September Fed funds target by 125 bps but only 80 bps for the ECB. This goes to show that the banking crisis is expected to take a bigger toll on the US.

- Inflation outlook: "Both headline and core inflation are expected to come down significantly over the next years, reaching 2.1% for headline and 2.2% for core in 2025. Still, the ECB calls inflation too high for too long." - ING Economics

- More hikes likely: "We stick to our view that the ECB will hike two more times by 25bp each before the summer and then move to a longer wait-and-see stance." - ING Economics

US Banking Crisis: Saving First Republic Bank, GDP outlook

A joint statement by the Department of the Treasury, Federal Reserve, FDIC and OCC said "today, 11 banks announced $30 billion in deposits into First Republic Bank. This shows of support by a group of large banks is most welcome, and demonstrates the resilience of the banking system."

This is funny because:

- Deposits flee from regional banks like First Republic

- Deposits enter into larger "to big too fail" banks

- Deposits leave larger banks and back into First Republic (with a small fee)

Cool.

In terms of its impact, JPMorgan says "headwinds to credit growth could subtract 0.5% to 1.0% off of GDP in the coming quarters ... What we are seeing now is qualitatively what should be expected after 450 bp of rate hikes."

At the same time, Goldman Sachs raised its recession odds from 25% to 35%, reflecting increased near-term uncertainty around the impact of small bank stress.

Chart of the Week

This segment of the morning wrap brings you weekly technical commentary on the ASX 200 and some of the more interesting charts in the market. These are not meant as recommendations. They are for illustrative purposes only. Any discussion of past performance is for educational purposes only. Past performance is not a reliable indicator of future return. Always do your own research.

ASX 200 – Bulls hanging on

.png)

It’s amazing how much difference a week can make. This time last week, things were looking moderately positive technically. Now, the uptrend support has been broken (smashed, in fact), the bulls are trying to cling onto the December swing low and keep the uptrend intact.

It still is intact right now (yesterday’s low was five points above the late December low), and we should see some buying today with positive leads from Wall Street, but things are looking far less convincing than a week ago. And that makes sense.

The bank failures in the US have shaken up markets and sapped a bit of confidence locally. If we get a rally today however, there are some suggestions that the current down leg will be complete. That’s because a rally will likely create a buy signal on the RSI as it crosses back above the 30 line, and because yesterday will probably present a volume peak on the down move – i.e. there are no more sellers left in the system (for now). It’s all very short term stuff, but something for the bulls to cling to. There certainly hasn’t been much over the past week.

Auckland International Airport (AIA) – Clear airspace

After a tough week, it was very slim pickings in terms of trending charts on the ASX. Just nine names popped up on my scan lists this morning. One of them was AIA. I actually featured AIA a couple of weeks back, highlighting it as one of the better looking charts going around, and it continues to be. Nice consistent uptrend, rising average volume, and clear airspace for it to rally into – pardon the pun. It’s also not overcooked on the RSI.

Neuren Pharmaceuticals (NEU) – Monster rally

The chart above is NEU and the only reason I highlight it, apart from the monster rally it has had, is to point at that sometimes technicals aren’t going to help you in the slightest. The rally in the past few sessions was driven by an FDA approval for NEU’s Daybue treatment for Rett syndrome. So unless you knew the company intimately and were willing to take a sizable bet on the FDA approval coming back in the affirmative, there is no way that you would have been onto this opportunity. Whilst I love technical analysis, there will always be news driven opportunities where having intimate knowledge of the company would serve you better. The only problem with that is, how many companies can you really have intimate knowledge of?

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Carsales.com (CAR) – $0.285, Vita Life Sciences (VLS) – $0.033, H&G High Conviction (HCF) – $0.02, Vita Life Sciences (VLS) – $0.033

- Dividends paid: Infomedia (IFM) – $0.022, Jumbo Interactive (JIN) – $0.23, Kelsian Group (KLS) – $0.074, Probiotec (PBP) – $0.03, Bapcor (BAP) – $0.105, Estia Health (EHE) – $0.037, Baby Bunting (BBN) – $0.027, Beacon Lighting (BLX) – $).043, Iress (IRE) – $0.30, Platinum Asset Management (PTM) – $).07, IPH (IPH) – $0.155

- Listing: None

Economic calendar (AEDT):

No major economic announcements.

The Morning Wrap was first written for Market Index by Chris Conway and Kerry Sun.

2 contributors mentioned