Value investing is dead. Long live value investing!

In 1999, financial news source, Barron’s, published an article titled “What’s wrong Warren?” – a reference to the legendary value investor, Warren Buffett.

It is arguably the most famous obituary to value investing.

As history would show, the mourning of value investing was premature.

Nothing was wrong with Warren. He was doing fine as were shareholders of his Berkshire Hathaway (NYSE: BRK.A), who would see the share price rise approximately 870% between the day the article was published and today.

Barron’s epitaph would not be the last time that someone would imply that value investing is an extinct art.

Indeed, just last week I read another article on the subject, this time, it was not dot-com stocks, but artificial intelligence that is sending it to its grave.

My reaction was simple: “We’re doing this again?! Really?”

Not dead, but definitely harder

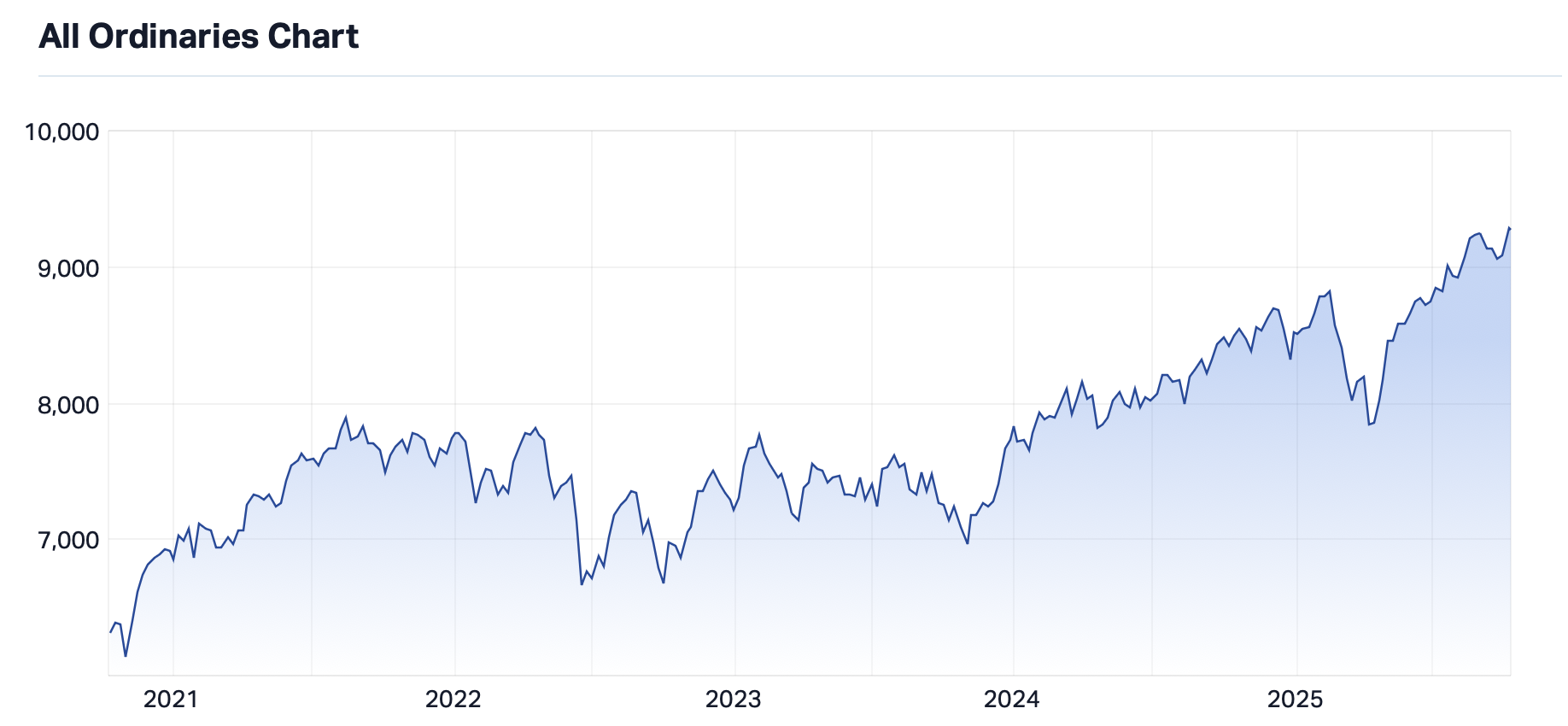

With the All Ordinaries regularly reaching new all-time highs, it’s not a surprise that such commentary would again start to appear.

It’s not just in the level of the index that points to an expensive market with the price earnings multiple for the All Ordinaries currently hovering around 23x, significantly higher than the long-term market average of around 15x.

It is this that has made life so difficult for the value investor.

When most people think about value investing, they think of companies that are on low PE ratios. Stocks that could be called “statistically cheap”.

If this is also how you view value investing, you probably agree that even if value investing is not dead, it is definitely very hard currently.

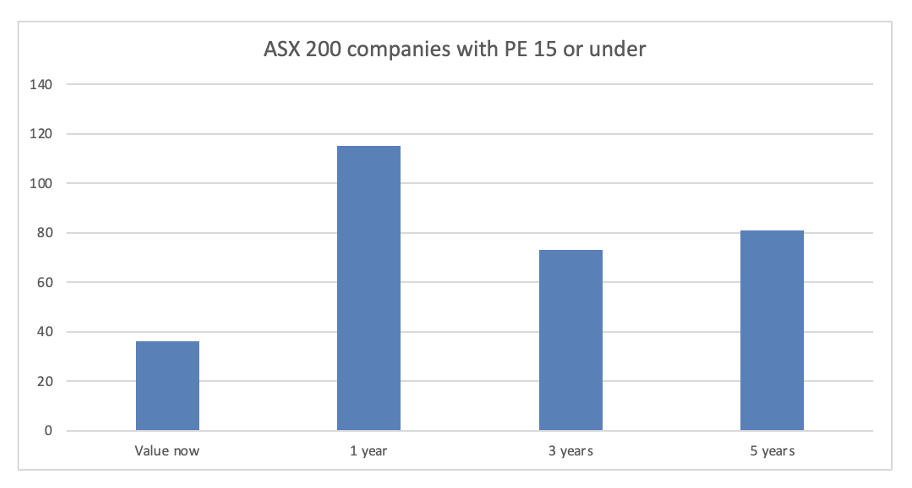

As shown above, when I investigated earlier this week, the universe of “statistically cheap” stocks is the lowest it has been for some time.

The evidence shows it still works

However, the evidence shows that value investing is still an extremely successful investing strategy.

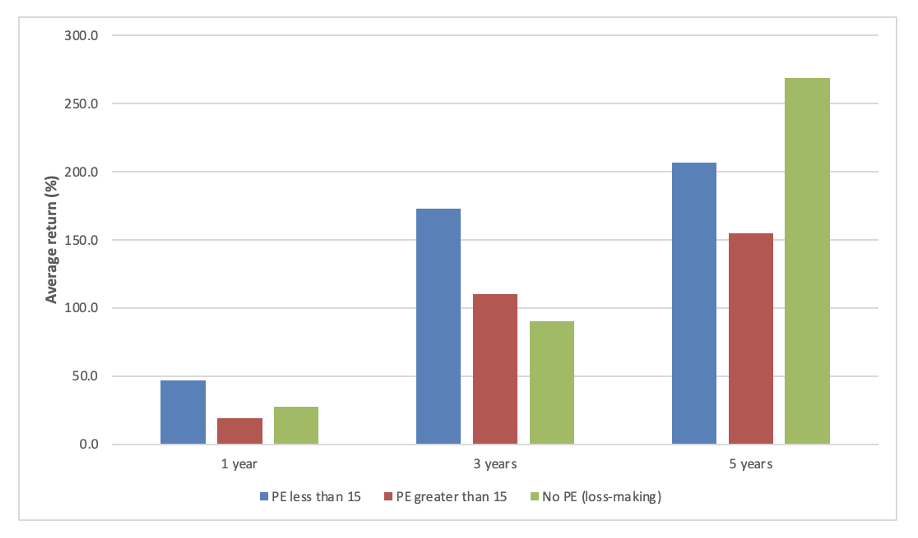

When looking at the performance of the constituents of the ASX 200 over the periods of one, three and five years, those who at the time had a PE under 15x was the best-performing cohort in all but one timeframe – the exception being over five years where companies with no PE (loss-making) performed better.

Interestingly, the worst performing cohort was the cohort of companies whose PE ratio at the time was higher than 15x.

It might not be easy, but this would indicate that value investing is not dead. In fact, it seems very alive.

What makes value investing so hard?

So, if the numbers show that value investing works, why is it so hard?

It comes down to mindset.

A mistake many value investors make is that they focus too much on buying shares in companies trading on a low PE ratio. But a PE ratio does not make a company cheap. It is completely possible that a company trading on a PE ratio of 40x can be cheap and another one trading at 10x can be expensive, depending on the growth.

The key is not the PE ratio but answering the question, what is the market missing?

For a company to be cheap, it must not be valued correctly. This means that the market must be assuming something that isn’t correct.

But going against the market is hard.

This is especially true when, like now, the market is booming as it means that any error from the market is likely going to be biased towards overvaluing a company rather than undervaluing it.

This means that at the moment of peak interest in the share market, the value investor typically sits on the sidelines and watch everyone brag about how much money they are making.

The return of value

One thing that anyone who has studied value investing will know though, is that the market tends to operate in cycles.

Markets boom and then bust. Value investing is dead, until it isn’t anymore.

This is exactly what happened after Barron’s questioned whether something was wrong with Warren Buffett.

Rather than herald the end of bargain hunting, maybe it is a sign that current prices are too high. This was the view of Allan Gray’s Simon Mawhinney, who told the crowd at Livewire Live that large cap valuations on the ASX are “nuts”.

If this proves to be true, it won’t be tales of value investing’s death that fill the pages, but its phoenix-like return from the ashes.

5 topics

1 stock mentioned

1 contributor mentioned