Volatility breeds opportunity: Active investors eye small caps amidst underperformance

There has been much written about the relative underperformance of the small cap index versus their large cap counterparts since the beginning of the interest rate tightening cycle early in 2022. History shows that the relative performance between large and small caps can experience large divergences depending on the macroeconomic outlook, earnings cycle, geopolitical events and importantly the composition of the Index at the time these events are unfolding.

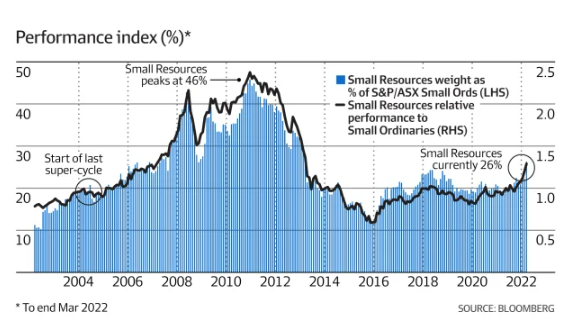

Let’s take a look at two extreme examples in recent times: At the beginning of 2011, after a run-up in commodity prices that rivalled only two other episodes in terms of speed and magnitude over the last century, the Small Resources weight peaked as a percentage of S&P/ASX Small Ords Index at 46%. Subsequently, driven by slowing growth, demand destruction and a supply response, commodity prices collapsed which sent the Small Resource Index down -80% over the following five years.

This obviously impacted small cap returns, leading the index down -12% over the same period and compares to the ASX100 return of +14%. However, it was not all doom & gloom for small cap investors, the Small Industrials index rallied 50% during this time with returns driven by the emergence of businesses such as ARB Corporation (ASX: ARB), RealEstate.com (ASX: REA), Carsales.com (ASX: CAR) and AP Eagers (ASX: APE).

More recently, the small cap index underperformance since the end of 2021 has been the most significant since the GFC. The seeds of this were sown by loose central bank policy and an abundance of liquidity that helped propel valuations to extreme levels and created an environment that was far less discerning about the quality and cash flow of a business.

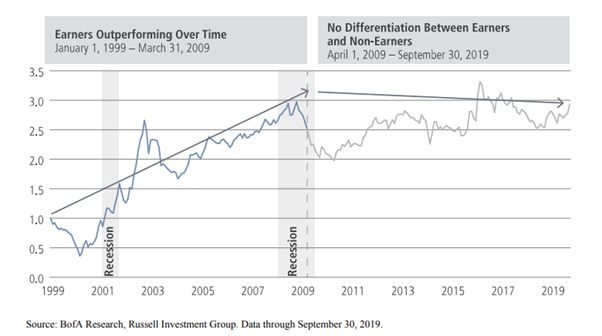

This was further compounded by the rise of passive investing which is not fundamental and has contributed to higher stock correlations. A study of US small caps, measured by the Russell 2000, between Earners vs Non-Earners (Based on Forward 1-Year Earnings Estimates) showed no performance differentiation between these two groups in the 10-year period post the GFC.

In the month prior to the RBA’s first rate rise this cycle, March 2022, more than 20% of the Energy and Materials sectors were made up of loss-making companies within the Index while Healthcare and IT was more than 35% and 45% respectively. Now well documented, the aggressive rate tightening cycle effectively shut capital markets to those companies whose business model relied on external funding.

Given these companies were over-indexed compared to large caps, the small cap index underperformed their large cap counterparts by >22% since the beginning of 2021, a level of dispersion that is more than 20% below its 20-year average.

Volatility has always been a key feature of small caps, but this creates the opportunity for active investors who have a process that is focussed on stock selection rather than indices. While history shows that deploying capital into small caps indices after a period of significant underperformance can be rewarding, the best opportunities come from investing in companies that are well funded, can generate sustainable earnings growth and are run by incentivised management teams.

Given the considerable fear further down the market cap spectrum, we believe there are now opportunities in selective microcap equities where valuations have disconnected from fundamentals.

4 stocks mentioned