“Wall Street hammered!” What now?

To this day, the closest I have ever seen markets get to financial Armageddon was the Global Financial Crisis in 2008.

There really was nowhere to hide.

Not only were asset prices plummeting across the board, but almost every financial institution, regardless of its reputation and history, had its solvency questioned. Some of those financial institutions would, in fact, not survive.

The biggest example was Lehman Brothers.

The 158-year-old investment bank was the fourth largest firm at the time – it would find itself with a new title, the largest bankruptcy in US history.

On the day of its collapse, the S&P 500 fell 3.4%.

On Friday, that same index fell 2.7% as Donald Trump shocked the market by announcing new tariffs on China.

So, given that Friday’s fall was less than 1% away from the event that started, what is arguably, the most turbulent period in financial history, should we be worried?

Well, no.

The price of admission

During my time at university, I was frequently taught that risk was related to volatility.

As someone who had already been investing for at least ten years at that time, this is a view that I never agreed with.

Based on my experience, and perhaps my personal investing style, volatility is not risk. It is the price of admission that an investor is required to pay over the long term in exchange for access to one of the best wealth building tools in the world.

Risk, on the other hand, was the risk of permanent loss of capital.

This view of risk would allow me to successfully navigate frequent market corrections and multiple share market crashes.

How did I do it? Well, I didn’t panic.

History rhymes

During the GFC, many would lose a lot of money as they sold assets as they, and the wider markets panicked. However, for those that could choose patience, the experience would have been very different.

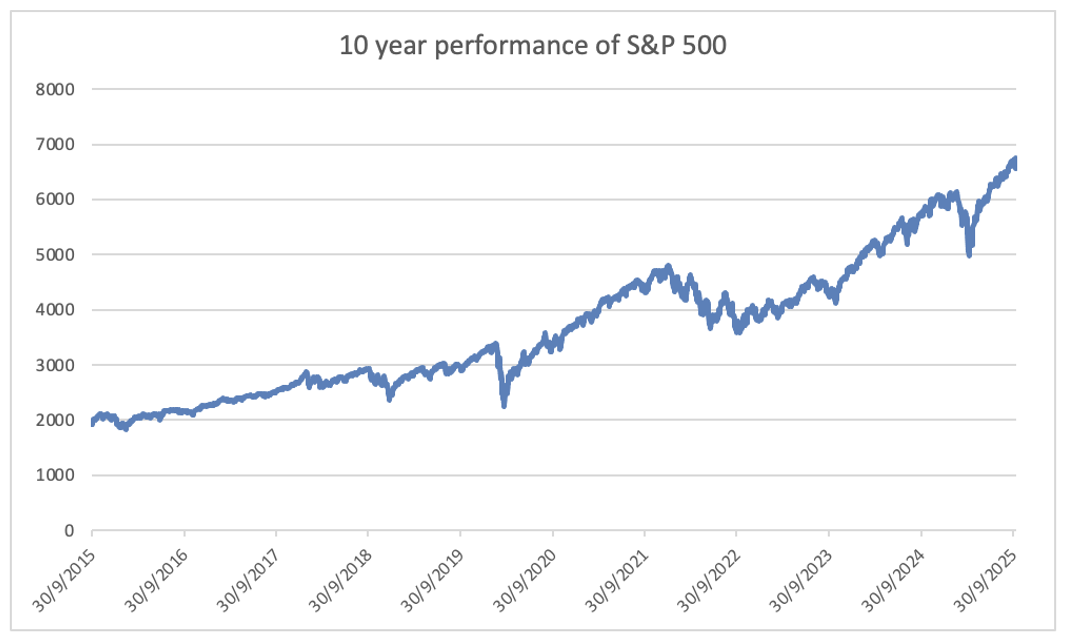

The S&P 500 is currently 423% higher than the level it was the day before the Lehman Brothers bankruptcy.

And it wasn’t just the GFC that investors had to sit through during this period.

The COVID pandemic was also another turbulent period.

In fact, COVID was arguably more volatile than the GFC. In fact, there were at least 13 trading days where the S&P 500 either rose or fell by more than 5% in a single day, which included a day in March where the index fell by almost 12% in a single day.

Now that is volatility.

What do the numbers say?

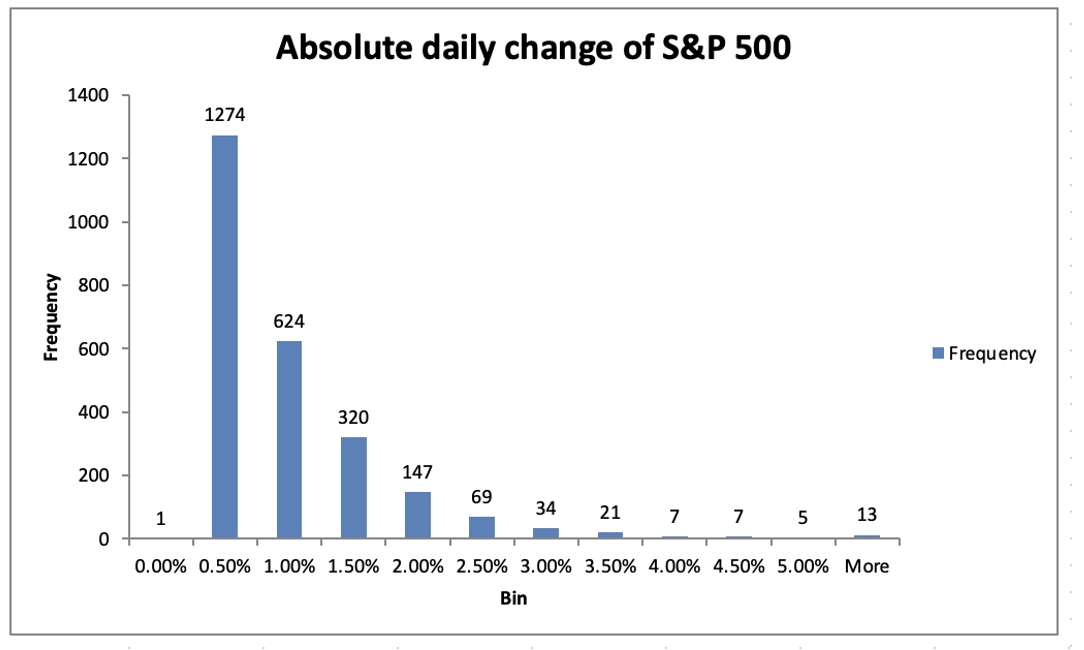

Granted, large movements are not very common.

Over the last ten years, over a total of 2,522 days, there have only been 156 days where the market has increased or decreased by 2.5% or more.

During this period, the average daily move of the S&P 500 was only 0.1%.

So, it isn’t a surprise that when we do experience such a day, especially when the market falls, that we forget history and start to panic.

Numerous studies of loss-aversion have frequently shown that people typically feel the pain of loss more than they do the joy from an equivalent day, and many argue that it is as much as double the magnitude.

Expand your mind, or time

But what about the long-term?

Star Wars producer and creator, George Lucas, once said, “Don’t avoid the cliches, they are cliches because they work”.

And there is no greater cliché in investing than “invest for the long-term”.

The last ten years have hardly been a “calm” period.

On top of the COVID pandemic, which plunged global economies to a halt, we’ve also had extreme inflation, geopolitical instability and war, amongst other “crises”.

Yet, despite all of this, if you invested in the S&P 500 ten years ago and proceeded to spend the following period meditating in a cave, you’d re-enter the real world today with a compounded annual return of 12.5% before dividends, or 14.9% including dividends.

Keep calm and stay invested

As scary as the daily headlines might be, history clearly shows that over time, such headlines tend not to matter.

In fact, just this morning, we are already seeing some of the fear subside as Trump, again, starts walking back from his tariff threat. Imagine you were someone who sold in panic, crystallising a loss, only to potentially see the market rise again.

We don’t live in a news cycle anymore but rather a news washing machine.

As Viktor Shvets, Macquarie Capital’s Head of Global Desk Strategy, recently told the audience at Livewire Live:

“Thursday something happens, by Monday morning it’s fixed. Let’s go for lunch – everything is good now”.

Strong returns will go to those who are able to stay calm.

I’d argue the better question to ask, when the markets are in a hurricane of uncertainty, is not whether you should get out, but whether, in the panic, one might find some great long-term investment opportunities.

As shown in the numbers above, that is how the story typically ends – a recovery in asset prices followed by a march ever higher.

4 topics