Want reliable investment returns while avoiding the equity market rollercoaster?

At a time of severe equity market gyrations, an uncertain macro outlook and geopolitical risk, there’s one Alternative asset class that might provide peace of mind.

Infrastructure itself is regarded as a defensive asset class, but given the current energy supply snarls, even the earnings for some of Australia’s listed players in this space are in question.

Turning to the private infrastructure market is one option, but has traditionally been the preserve of large institutions with billion-dollar chequebooks. Unlocking access to this asset class for wholesale and mum-and-dad investors is one of our core goals.

The Invest Unlisted Core Infrastructure Fund’s portfolio features no less than 60 long-dated assets – including eight Australian capital city airports alongside, ports, desalination plants and regulated electricity transmission facilities – both domestic and off-shore.

In this episode of Fund In Focus, I outline the key problems the asset class seeks to address – including rising inflation and interest rates. I also explain how unlisted infrastructure can deliver low levels of volatility that are comparable with bonds, targeting equity-like returns of around 8-10% per annum over the long term

Unlisted Infrastructure adds balance to your portfolio

Tap into the concrete infrastructure assets that have been off-limits to everyday investors for more than 20 years. Find out more.

Edited transcript

Hi, I'm Jonathan van Rooyen. I'm the Chief Investment Officer of the Core Infrastructure Fund. The core infrastructure fund is a 60-asset, $350 million unlisted infrastructure platform that was started in 2015. We've got a six-year track record.

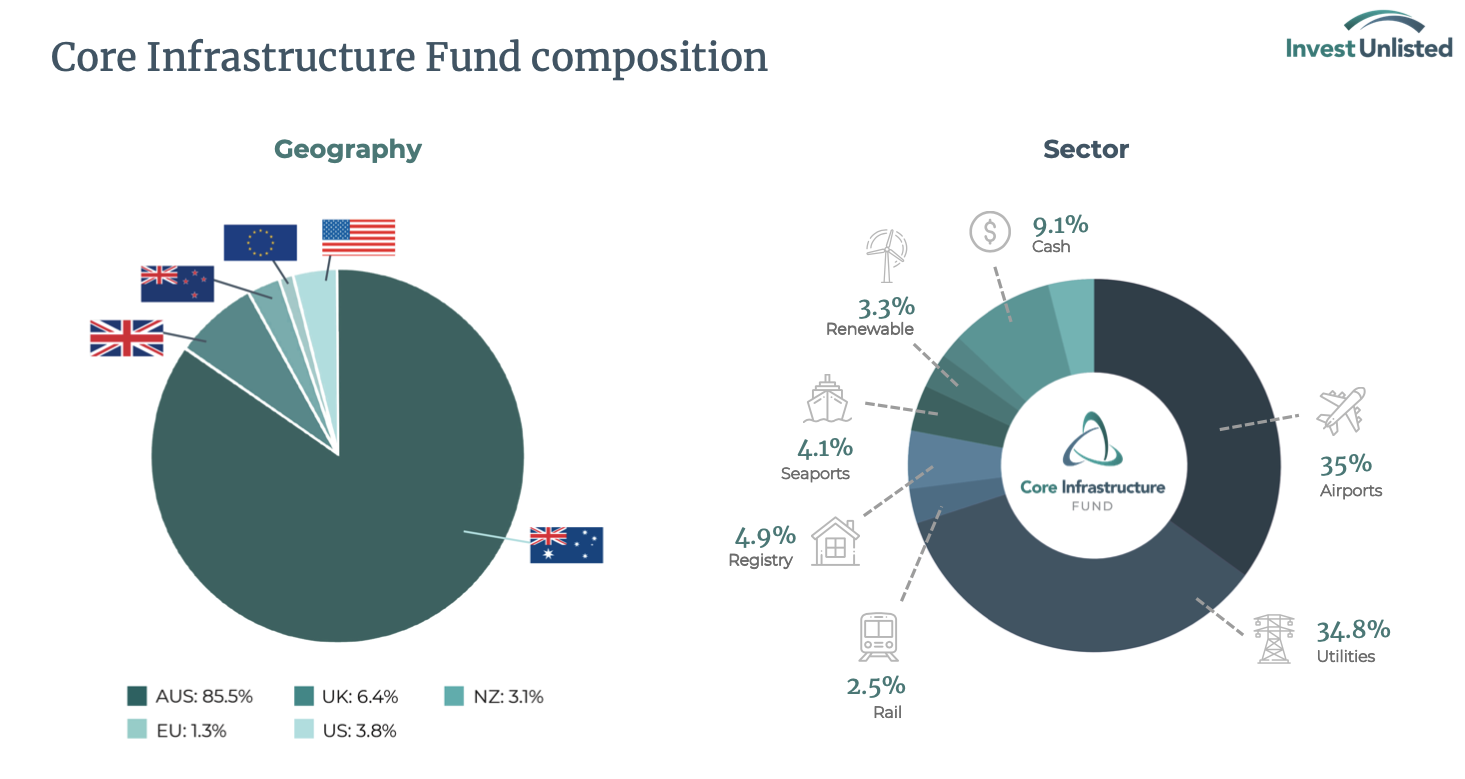

In terms of our vision for the Core Infrastructure Fund, diversification. So, so important and we are the most diversified. We've got 60 unlisted infrastructure investments. Our vision is to be the premier wholesale unlisted infrastructure index for Australian and wholesale investors, but also access.

We want to democratise this asset class for those wholesale investors. For the mom and dads of Australia in terms of being able to access the types of assets that the likes of large institutional investors only access. I'll talk about it in a moment about some of those allocations that we typically see from those investors.

Then finally, and probably most importantly, we want to deliver bond-like volatility, so low volatility, but with equity-like returns over the life of our performance.

So, what problems are we facing now and what problems does this 60-asset unlisted fund solve?

Interest rates, inflation, market volatility. In terms of interest rate protection, about over a third of our portfolio has got full pass-throughs of interest rates. Regulated assets like regulated transmission and distribution businesses in New South Wales and South Australia and here in Victoria are uniquely positioned to benefit from the decarbonization and the net-zero investment that's currently transitioning through our economy.

Inflation protection. We invest in public-private partnerships which have got full pass-throughs of inflation. Where revenues are indexed to actual inflation or CPI increases so that in some ways, some of our assets are agnostic to inflation increases which is really quite extraordinary in terms of what we're all facing now with those inflation headwinds.

Then finally, those 60 assets don't have any impact in terms of or not impacted by the market volatility because we don't have listed investments in the portfolio.

In terms of the overall portfolio mix, over a third of our investments are in Australian airports.

For those wholesale investors who held and had investments in Sydney Airport, there is no other option for wholesale investors to invest in Australian airports other than through funds like ours.

We don't just have one investment, we've got eight Australian capital city airports. From a diversification perspective, that's a really exciting outlook for us.

How are those airports performing? Some of the traffic numbers are at above COVID levels on the domestic route already and really some of those forecasts are not predicted to, if you think about it to be any different out to 2023, but they're actually outperforming those 2019 numbers already.

Quite an incredible positioning, with around a third of the portfolio being regulated assets with full inflation pass-throughs and another third of the portfolio from a post-COVID recovery perspective.

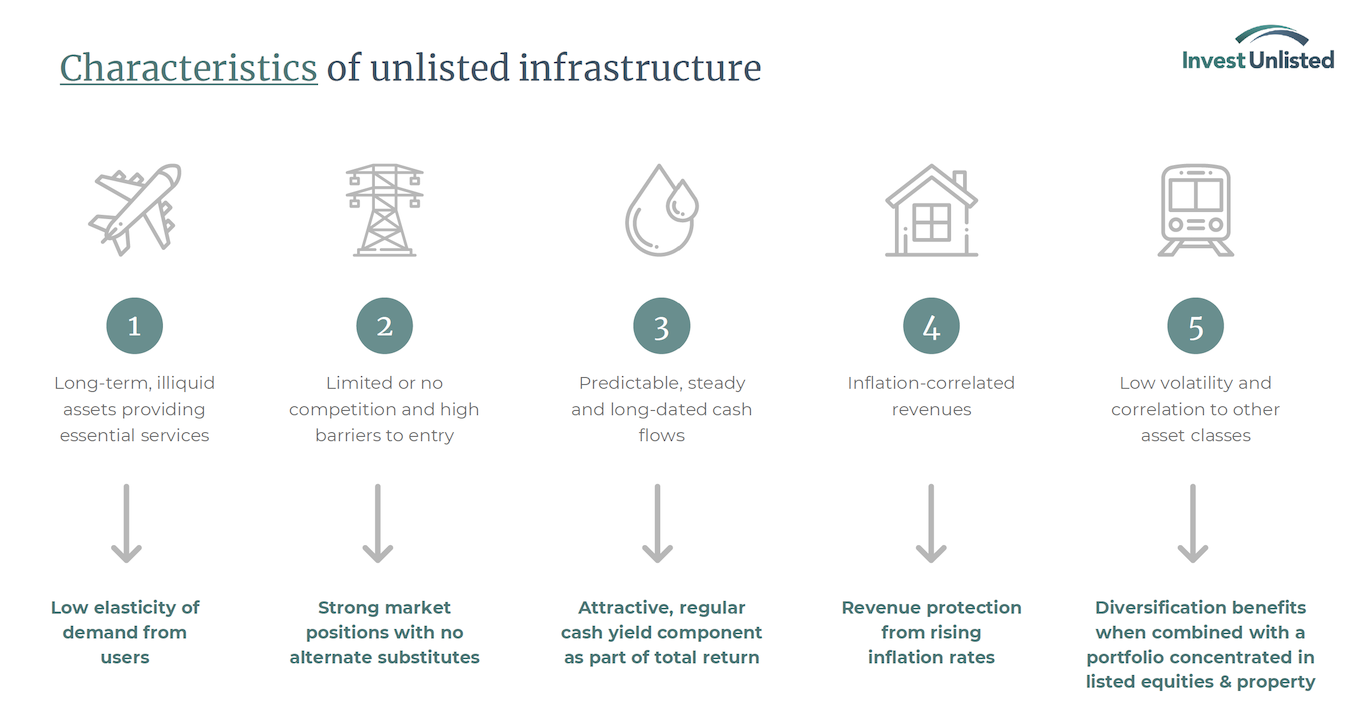

Then what are the characteristics of this unlisted infrastructure asset class?

Long-term illiquid in nature, so long dated concessions.

Limited or no competition with high barriers to entry or very large competitive moats.

Predictable, stable, steady cash flows with very high EBITDA margins. Then as I touched on before, inflation correlated. It’s quite a unique asset class in the context of what we're all facing.

Then finally low volatility and a low correlation with other asset classes. When I talk about bond-like volatility, but with equity-like return, that's where we see the asset class performing and what it's actually done historically for a long period of time.

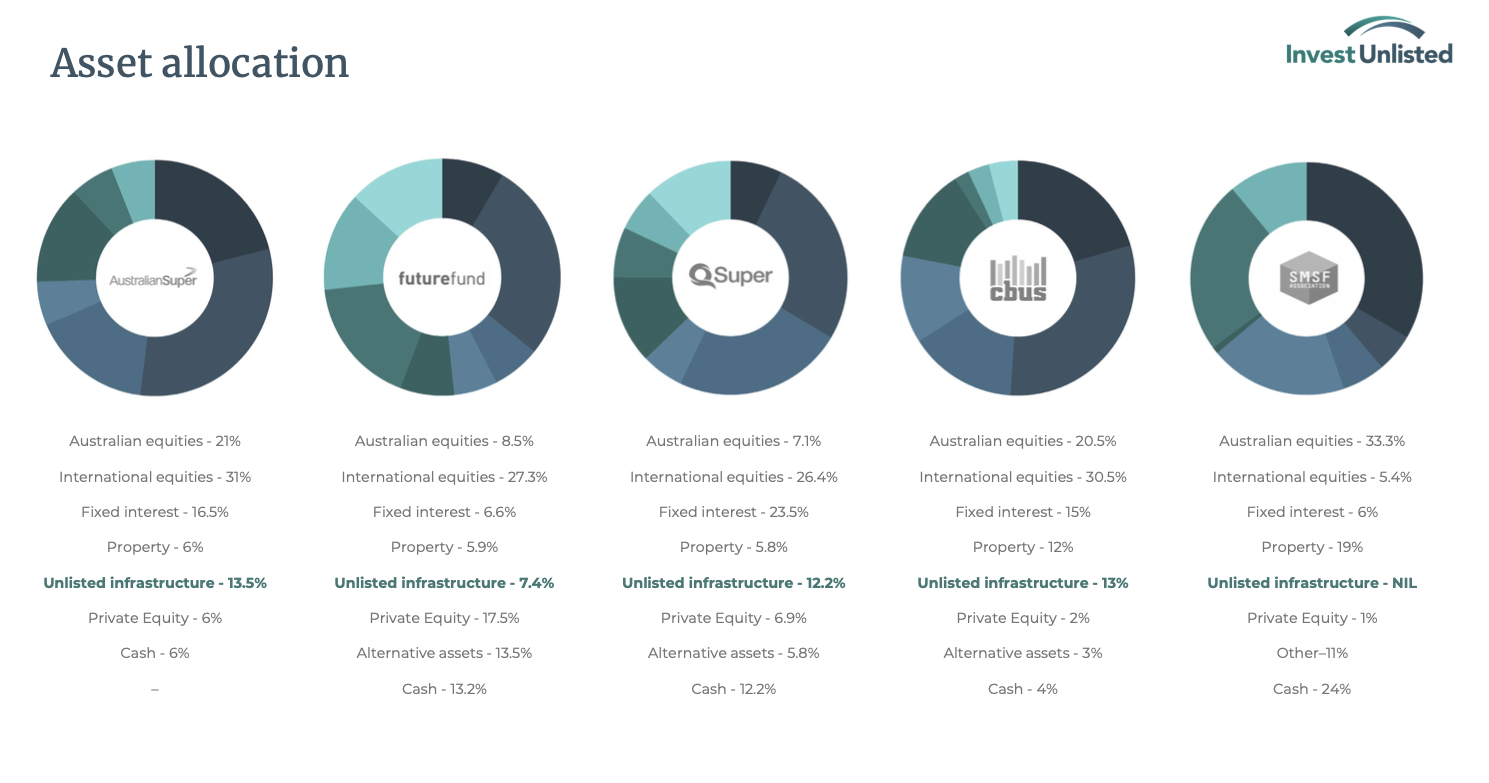

What are the big boys and girls doing in terms of investing? The big institutional investors, the likes of Australian Super with an allocation of around 13.5% of the total portfolio to this unique asset class called unlisted infrastructure.

Similarly, one of Australia's best-performing institutional investors, The Future Fund. Around 7.5% of the total portfolio is allocated to the types of things that we invest in across our 60 assets. Airports, toll roads, ports, desalination plants, regulated transmission utilities.

That's what the core infrastructure fund is about. It's about democratising the asset class for the retired dentist or the grade nine teacher who wants to allocate down to a minimum of $50,000 into these types of assets that typically have been in the realm of those very large institutional investors. We create access and that's what I talk about when I talk about democracy. We are giving access to those moms and dads who want to get the benefit of the cash flows that those large institutional investors have invested in.

For financial advisers and wealth groups, we're on the likes of Netwealth, Powerwrap, Xplore, and Hub. We can take monthly applications and you get a monthly statement and we provide quarterly reports.

About 85 cents on the dollar or 85% of the investments are here in Australia. They're in the types of assets I've touched on across the Australian states.

In terms of performance, around 10.5% is our 12-month performance to 31 March 2022. We are looking good for the last 12 months and on a look-forward basis, again, with the inflation headwinds and interest rate challenges, we're quite excited about the portfolio and how it's positioned for the years ahead.

Again, it's all about diversification, diversification, diversification. 60 assets and we also hold about 15% of the portfolio directly into assets that we've chosen specifically for that purpose. One of the most important challenges for investors is when you've got a fund manager with lots of money burning a hole in their pocket, with these rising rates and the challenges to be part of an investment bidding into that sort of environment and in a highly competitive market with others at the same time to buy assets and rising prices.

We invest in long-dated portfolios that have got what's called a very low vintage risk. These assets have been around for, in the case of our largest allocation, for around 25 years so they've stood the test of time of GFC, of Ansett pilot strike, of all the types of things that we've experienced in the last 20 years, including recently COVID.

Back to inflation and interest rates. The types of the business models we invest in are those that are predictable, consistent and transparent, with low volatility.

We don't buy power stations. We're not interested in the generation component. We're not interested in the retail component or the consumer component of the energy mix in our case of our regulated assets.

We want the transmission and the distribution. We want the predictability, the consistency to know that return profile that we've delivered will turn up every year, year on year, on average over that five year plus horizon.

Where do you get access to unlisted infrastructure and how can you access our core infrastructure fund?

We have a website which is available, and in partnership with our good friends at Livewire, we are available just one click away.

We've also had an independent party come run the ruler over us to give us their expert opinion, so we are very transparent about our reviews, we're transparent about our assets, and we love to hear from you.

Thanks for watching this Fund and Focus Today. If you'd like to find out more, please visit our website at investunlisted.com.

1 fund mentioned