We asked you where markets will be in 2024: Here's what 5000 of you said

For the first time ever, this year's Outlook survey expanded its reach to Market Index users. As we navigate through the intricate landscape of financial markets, the convergence of insights from Livewire's dedicated audience and the broader Market Index users promises a wealth of diverse perspectives.

This year's survey results have unveiled some interesting insights into how the readers from each site are seeing markets in 2024. In this wire, we will dissect the responses from each group, and examine the similarities and differences.

Stay tuned for an insightful exploration into some of the perspectives that shape the market outlook for 2024.

1. 'The RBA will cut interest rates in 2024'

- Market Index readers: 70.1% True, 29.9% False.

- Livewire Markets readers: 63.8% True, 36.2% False.

Perhaps unsurprisingly, the prevailing view across both websites is that interest rates will fall throughout 2024. Also interesting is that the Market Index audience was generally more confident in this being the case, while a slightly greater portion of Livewire Markets readers are reserving judgment for the time being.

For more information, Hans Lee's recent wire tackled the topic of when this should be expected to happen, and which asset classes stand to benefit most.

2. 'Small cap stocks will outperform large cap stocks in 2024'

- Market Index readers: 54.4% True, 45.6% False.

- Livewire Markets readers: 66.7% True, 33.3% False.

One of the more significant differences between the two pools: Livewire readers were much more confident that small caps should outperform, while Market Index readers were largely on the fence.

3. 'Donald Trump will win the 2024 US election and become President again.'

- Market Index readers: 35% True, 65% False.

- Livewire Markets readers: True 37.4%, 62.6% False.

In this case, the two groups agreed that a return to office for Trump is unlikely.

4. The "Magnificent Seven" rose 92% on average in 2023 accounting for nearly all of the gains for the S&P500. Indicate your agreement or disagreement with the following statement: 'This trend will continue in 2024.'

- Market Index readers: 44.5% True, 55.5% False.

- Livewire Markets readers: 39.2% True, 60.8% False.

This was one of the more evenly balanced questions, although the majority in both camps believe that we won't get a repeat of 2023 when it comes to the performance of the Magnificent Seven.

5. The all-time high for Bitcoin is around US$69,000. Having rallied recently, it is currently trading around US$44,000. Indicate your agreement or disagreement with the following statement: ' In 2024, it will hit a new all-time high.'

- Market Index readers: 32.8% True, 67.2% False.

- Livewire Markets readers: 31.6% True, 68.4% False.

Both readerships share very similar views on Bitcoin heading into 2024, and it remains to be seen if retail investors can once again be won over by crypto - particularly if interest rates decrease.

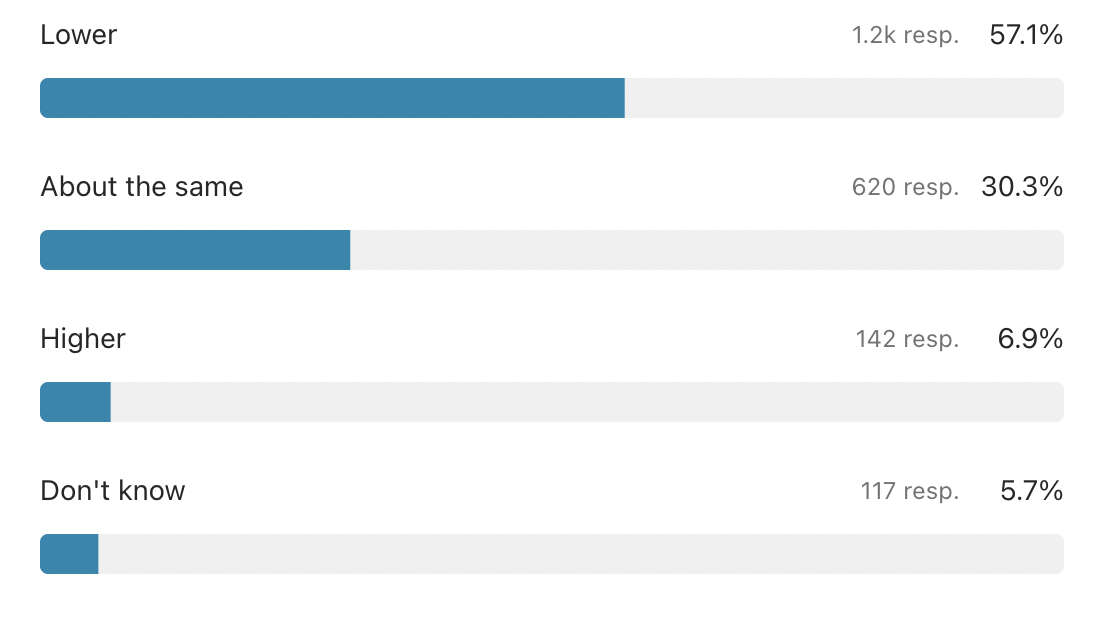

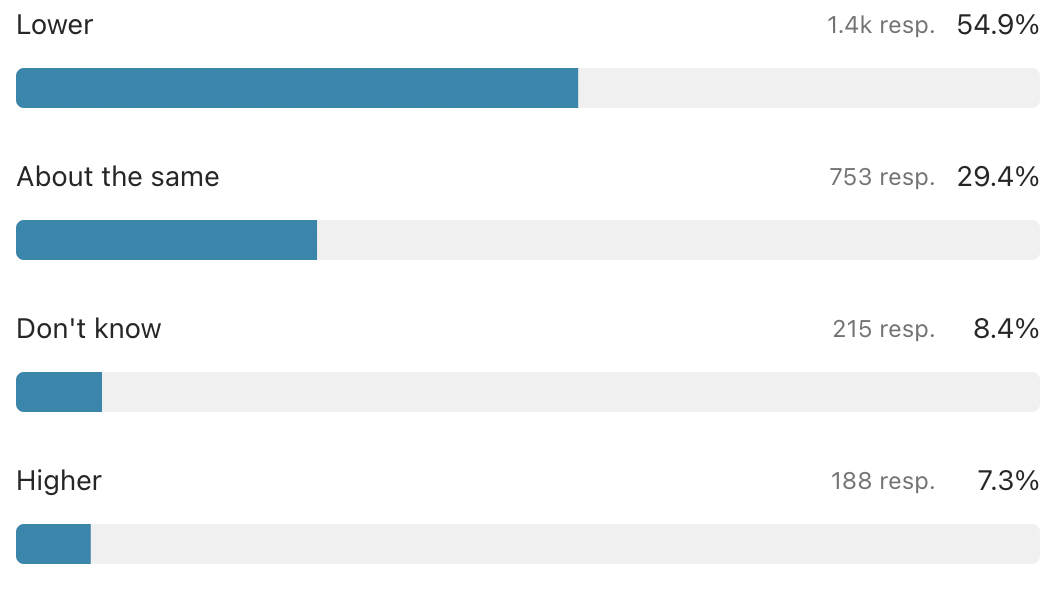

6. Indicate your expectation regarding the statement: 'The US 10-year Treasury note is currently yielding around 4.25%. By the end of 2024, the yield will be...

Livewire readers:

Market Index readers:

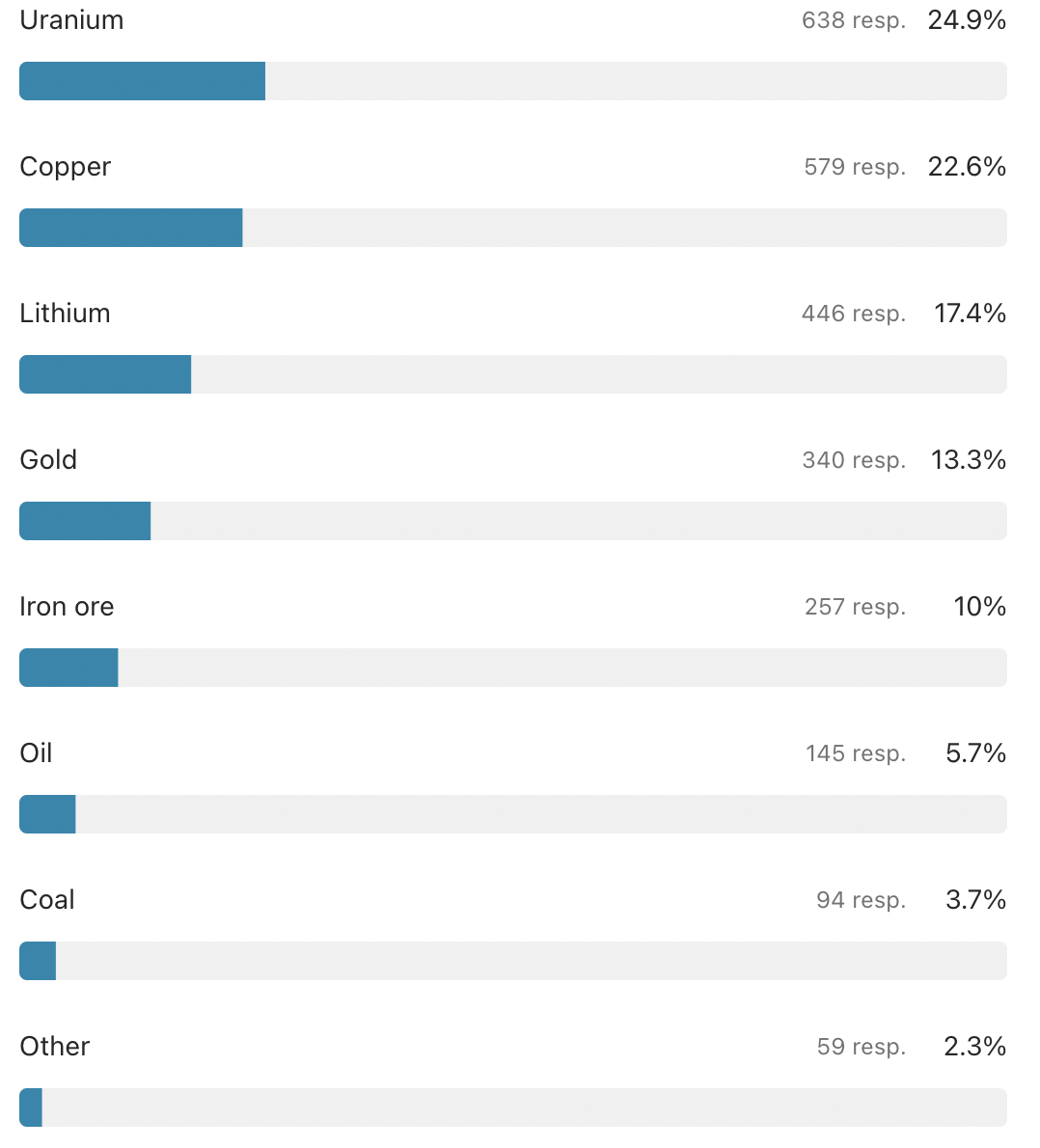

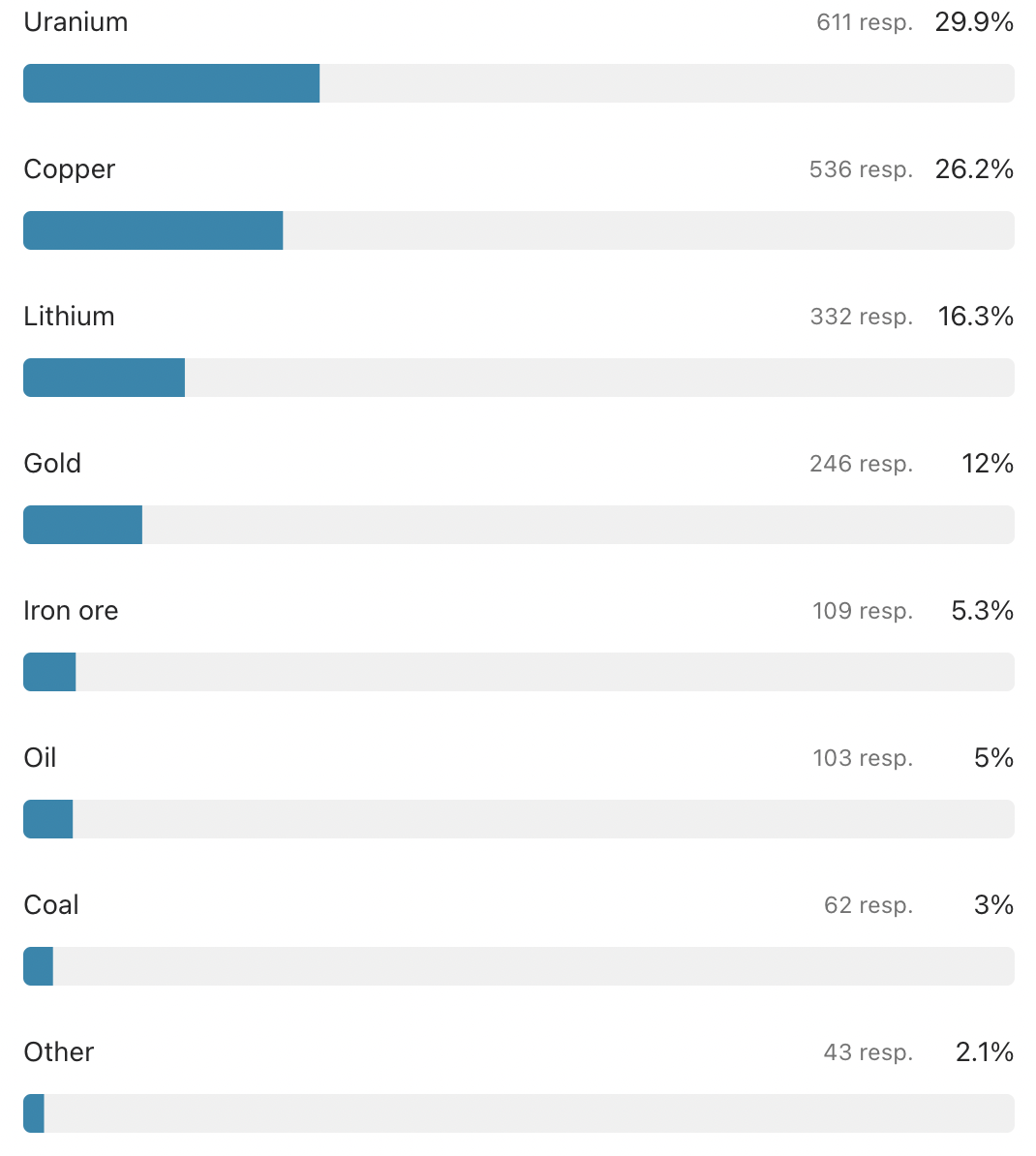

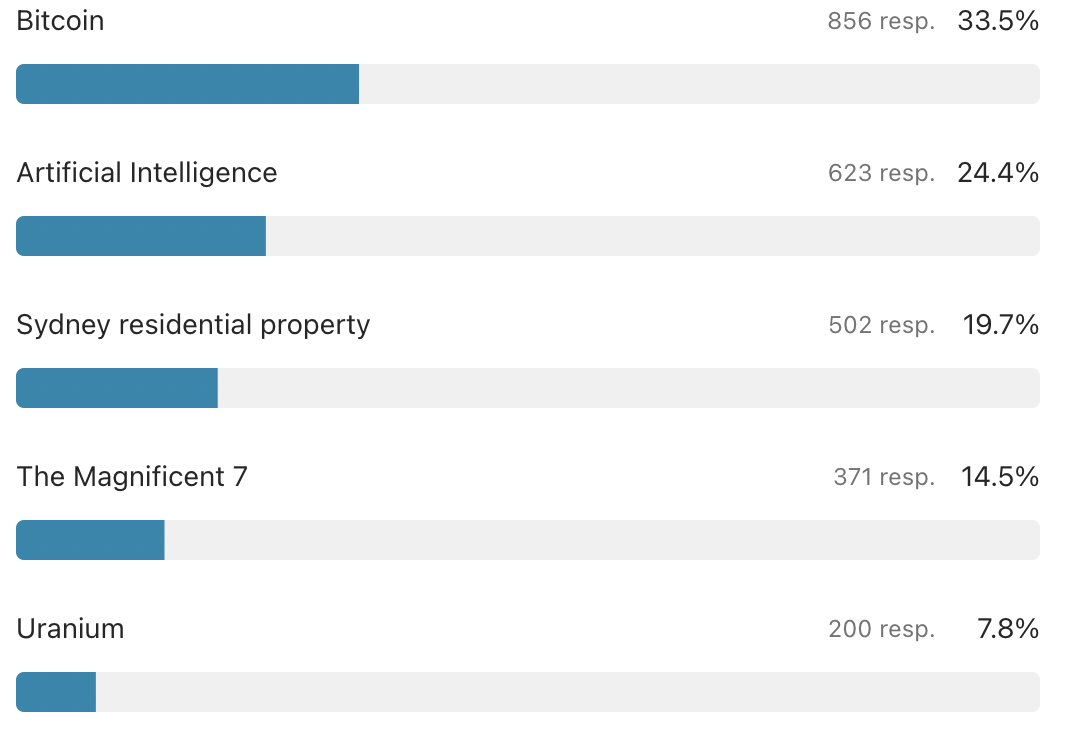

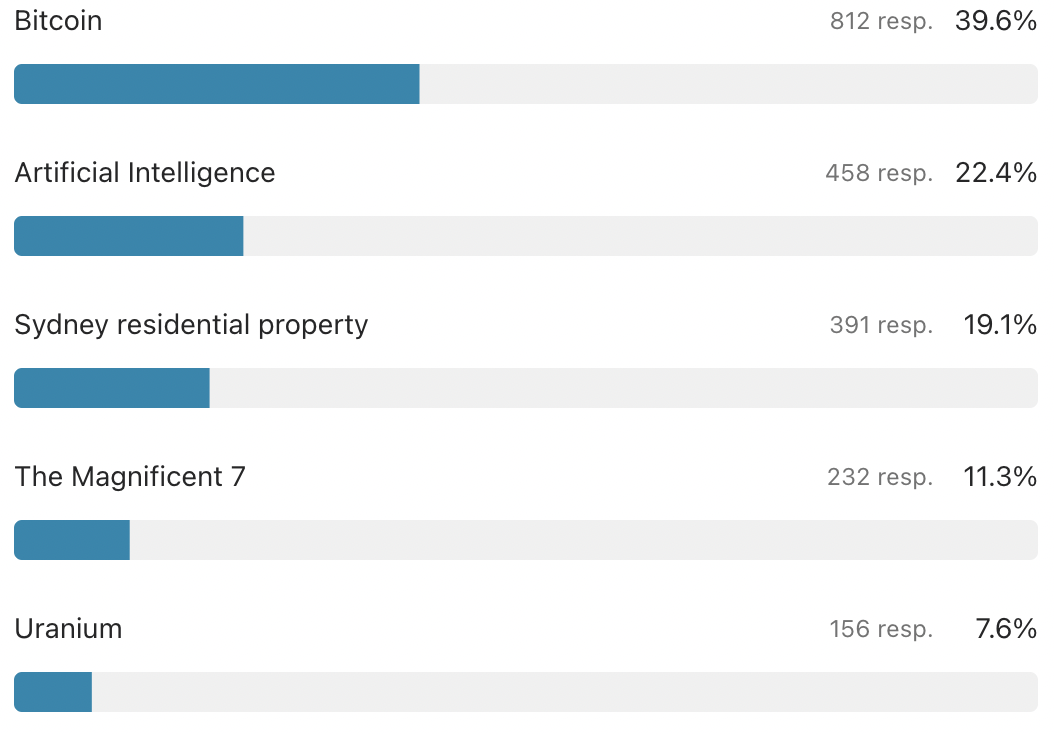

7. Which of the following commodities will be the most exciting in 2024?

Both readerships provided remarkably similar responses to which commodities will be most exciting in 2024.

Market Index readers:

Livewire readers:

8. Which of the following most looks like a bubble?

Market Index readers:

Livewire Markets:

Perhaps unsurprisingly Bitcoin topped the charts for biggest bubbles. Perhaps the more interesting theme for 2024 however will be whether or not ~25% of readers are correct that AI is an even bigger bubble, particularly as so much weighting in international indices is currently devoted to AI-correlated stocks.

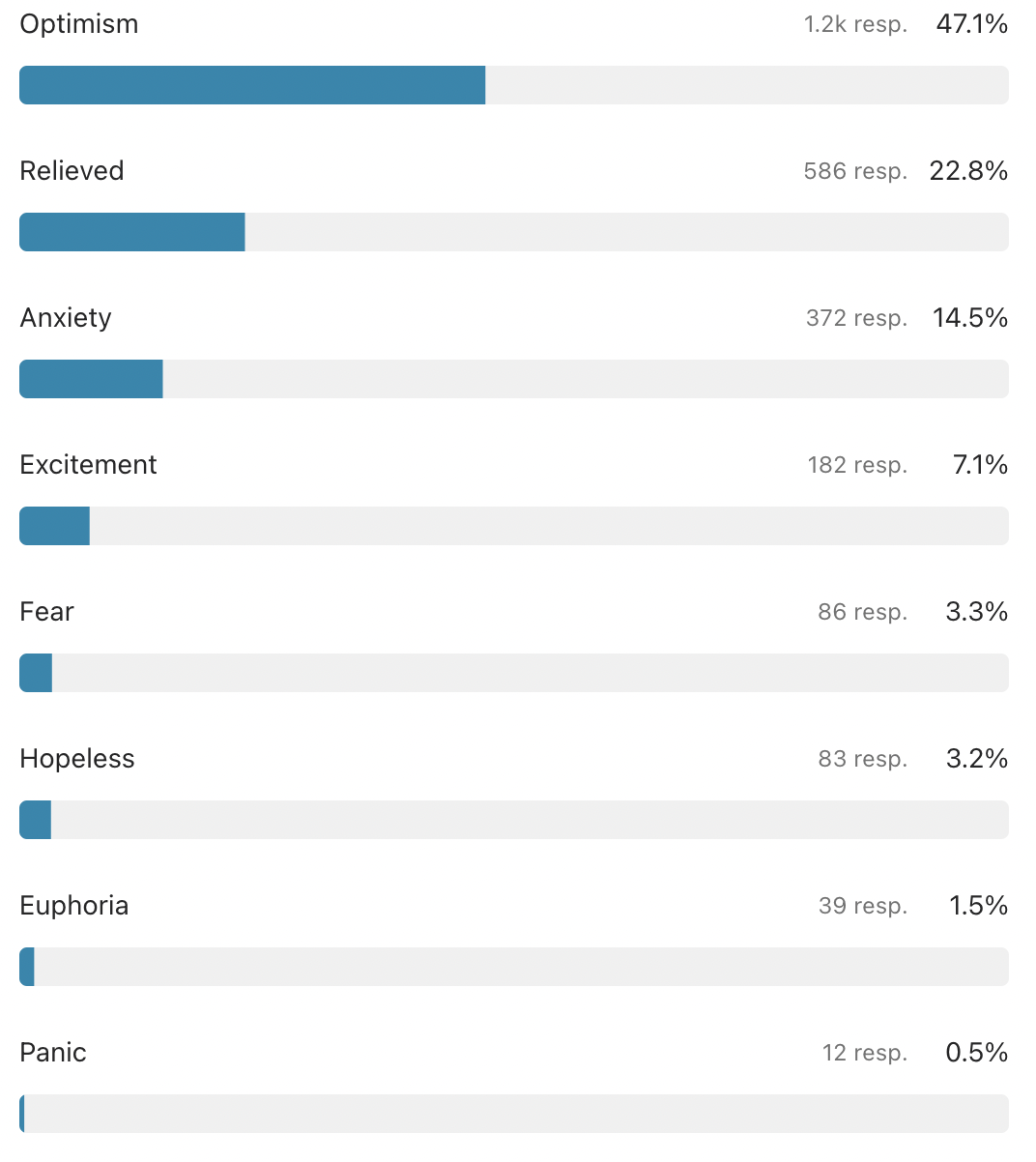

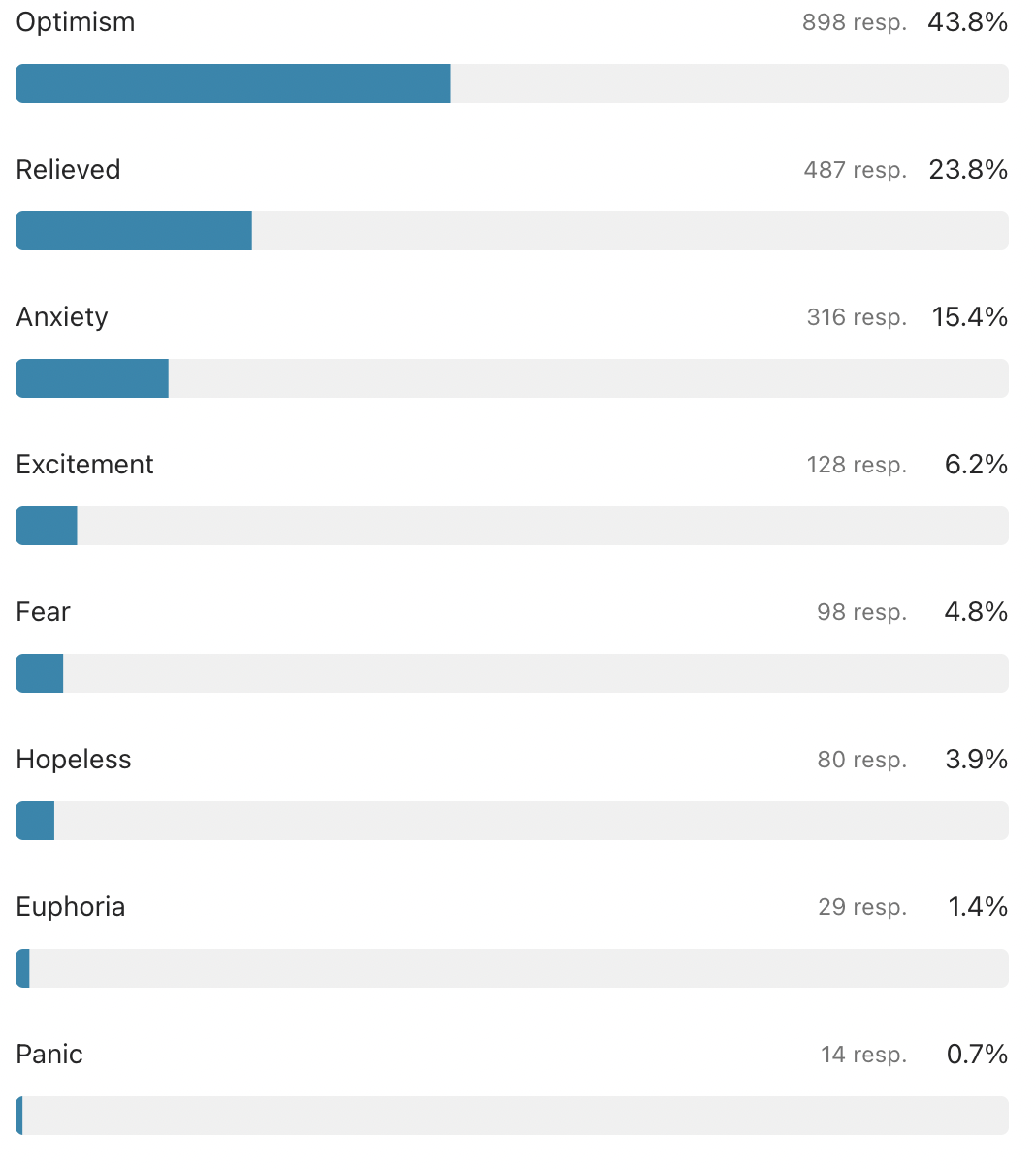

9. Where are you sitting on the cycle of investor emotions?

Great to see most people are far more optimistic than in the past few years! Lets hope that optimism pays off.

Market Index readers:

Livewire Markets readers:

There are a few questions included in the survey that we have not dissected here, largely because they deserve a wire of their own: see Chris Conway's recent piece The 20 most-tipped ASX stocks for 2024 for more details.

Finally, thanks to all survey respondents from both websites for participating. This survey is a great resource and wouldn't be possible without you all.

5 topics

2 contributors mentioned