Westpac prints first monster, $3.57 billion senior bond deal since before pandemic

Overnight, Westpac printed the first monster senior bond deal from a major bank since before the pandemic. We had repeatedly predicted that a major bank would come to market with a senior deal before 30 June, a view that was rejected by the majors themselves and the market. The consensus amongst analysts was that issuance would not begin until the third or fourth quarter. And the consensus held that the issuance would be small in size. The reality proved very different.

Westpac's outstanding treasurer, aka the Queen of Credit, Jo Dawson, issued US$2.75 billion (A$3.57 billion) of both 5-year and, more unusually, 10-year senior bonds, which were very well received by the market judging from the book size, which was speculated to be over US$9 billion at one point. For full disclosure, we bid for US$400 million of both bonds given the reasonable new issue concession in US dollars, and they have since traded well in the secondary market.

The 5-year Westpac bond issued at 40 basis points over the 5-year US treasury bond while the 10-year priced at 60 basis points over the 10-year US treasury. In Aussie dollar terms, the 5-year bond swaps to about 48 basis points over the bank bill swap rate (BBSW) and the 10-year bond swaps to circa 90 basis points over BBSW.

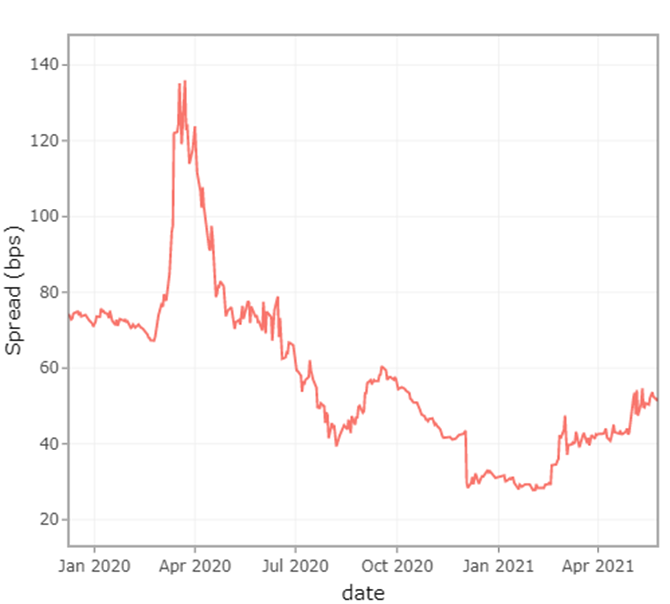

On Coolabah's theoretical, constant-maturity, 5-year senior bond index for the major banks, we have the current point estimate in Aussie dollars at 52 basis points over BBSW, which makes Westpac's US dollar deal look like cheap funding. Indeed, the US dollar market is arguably the cheapest senior funding domain for the majors right now with both Euros and Aussie dollars being more expensive.

Five-year major bank spreads in Aussie dollars have been drifting wider since they tightened into record post-GFC lows of about 28 basis points in December last year. We expect this to continue once the supply-side eventually comes back online in the local market. The image below is a screenshot from our systems illustrating our constant-maturity index for 5-year major bank senior.

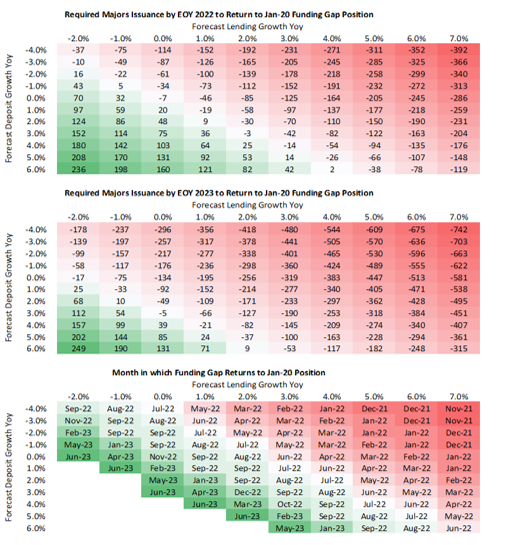

Earlier this year, Coolabah's analysts built detailed financial models that allowed us to forecast the quantum of senior bank bond issuance that will be required as a function of two crucial variables: balance-sheet growth and changes in deposit funding (see image below).

The enormous surge in deposits that flooded into the banking system in 2020 coupled with the $200 billion of very cheap cash available through the RBA's term funding facility radically reduced the need for banks to issue wholesale bonds.

Assuming, however, that this starts to slow down while balance sheets expand more rapidly on the back of the housing boom and a recovery in business lending, it is easy to arrive at the conclusion that the major banks will have to issue around $150 billion to $350 billion of senior debt over the next few years as they repay the $200 billion that they have borrowed from the RBA. That is a perfectly manageable task in global debt markets, although it should see the credit spreads on these bonds normalise somewhat to the 70 basis points region in Aussie dollars.

This informs another one of our forecasts that is playing out right now: the need for banks to boost the cost of their 3-year and 5-year fixed-rate mortgages, which we expect to increase by 25 to 50 basis points over the next 12 months as they seek to recover the cost of this more expensive wholesale debt (vis-a-vis the much cheaper circa 0.1% cost of the RBA's term funding facility).

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $6 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 13 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

2 topics