What happened to the fixed rate mortgage cliff?

Like many other renters in the country, my landlord recently gave notice that a rent increase will be coming in the next few weeks. Like many, I summoned my inner 'Karen' in a bid to convince them otherwise, and scoured the web to see if there were similar homes available nearby for a cheaper price.

It may be because I live in Sydney's Eastern Suburbs, but realestate.com is looking awfully sparse. Not that I can afford to buy a home myself, but that side of the web is also looking peculiarly lacklustre.

It got me thinking. What the hell happened to the fixed rate "mortgage cliff"?

July and August were meant to bring complete calamity, as fixed-term loans secured during the pandemic period (between mid-2020 and mid-2022) expired. According to CoreLogic, fixed rate mortgages peaked at 46% of secured housing finance (in July and August 2021). Before the COVID period, fixed rate loans typically made up 15% of loan facilities.

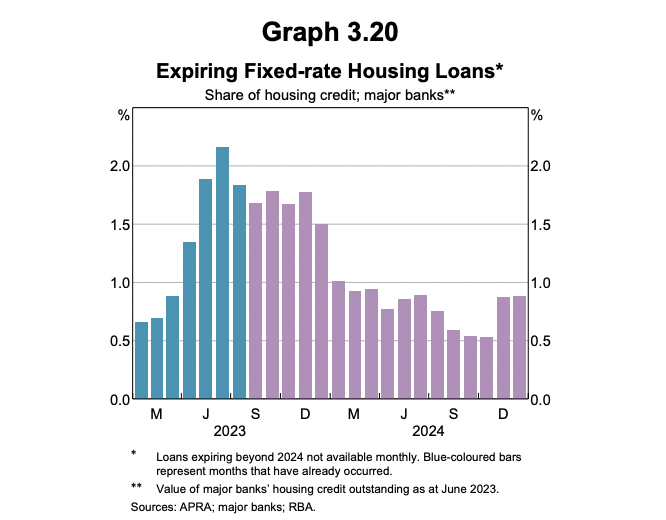

Given that fixed rate terms typically are secured for only three years (or less), in March, the RBA warned that around 880,000 loans would expire by the end of 2023, with a further 450,000 expiring in 2024. It also reported that 590,000 loan facilities had already rolled over to variable rates in 2022.

It probably won't surprise you then that the average mortgage rate has increased by around 275 basis points since May 2022, far less than the 400 basis point rise from the RBA to Australia's cash rate.

"This divergence reflects the high share of fixed-rate housing loans outstanding and, to a lesser extent, the effect of discounting on variable-rate housing loans associated with strong competition between lenders," the RBA wrote in its August statement on monetary policy.

"The share of borrowers rolling off fixed-rate mortgages – taken out two to three years ago at low interest rates – onto much higher rates peaked at just under 5.5% of outstanding housing credit in the June quarter; it will stay high for the rest of this year, before declining in 2024. (see graph below).

"These expiries will see the average outstanding mortgage rate continue to increase as the effect of the rise in the cash rate since May 2022 flows through to a greater share of borrowers."

Why does this matter?

The assumption is that with a further 1.33 million fixed rate loan expiries oncoming over this year and next, there could be some borrowers who may struggle to meet their new (higher) repayments, particularly given how expensive life is today (groceries, electricity prices, fuel prices etc).

According to CoreLogic, the average fixed rate loan with a term of three years or less bottomed out in May 2021 at 1.95% (for owner occupiers). Today, the average variable rate for new owner-occupiers is 5.66%.

"For the average loan size in May of 2021 ($549,498) on a 30-year loan term, this represents an increase in monthly home loan repayments from $2,017 per month to $3,175 or an increase of almost 60%," CoreLogic's head of residential research Australia, Eliza Owen said.

The fear is that we will see an increase in arrears or forced sellers flood the market over the coming months.

In fact, while CoreLogic's Home Value Index has slowed from 1.1% in June to 0.6% in July, new listings increased by 2.8% during the month (which is atypical, given that over the past five years, they have moved -3.6% lower in July).

"The rise in new listings could be at least partially attributed to more motivated selling if homeowners are struggling to keep up with rising mortgage repayments," Owen said.

"It could even be indicative of some homeowners selling based on foreseen issues with mortgage serviceability, with a sizable number of expiring fixed-term facilities toward the end of this year."

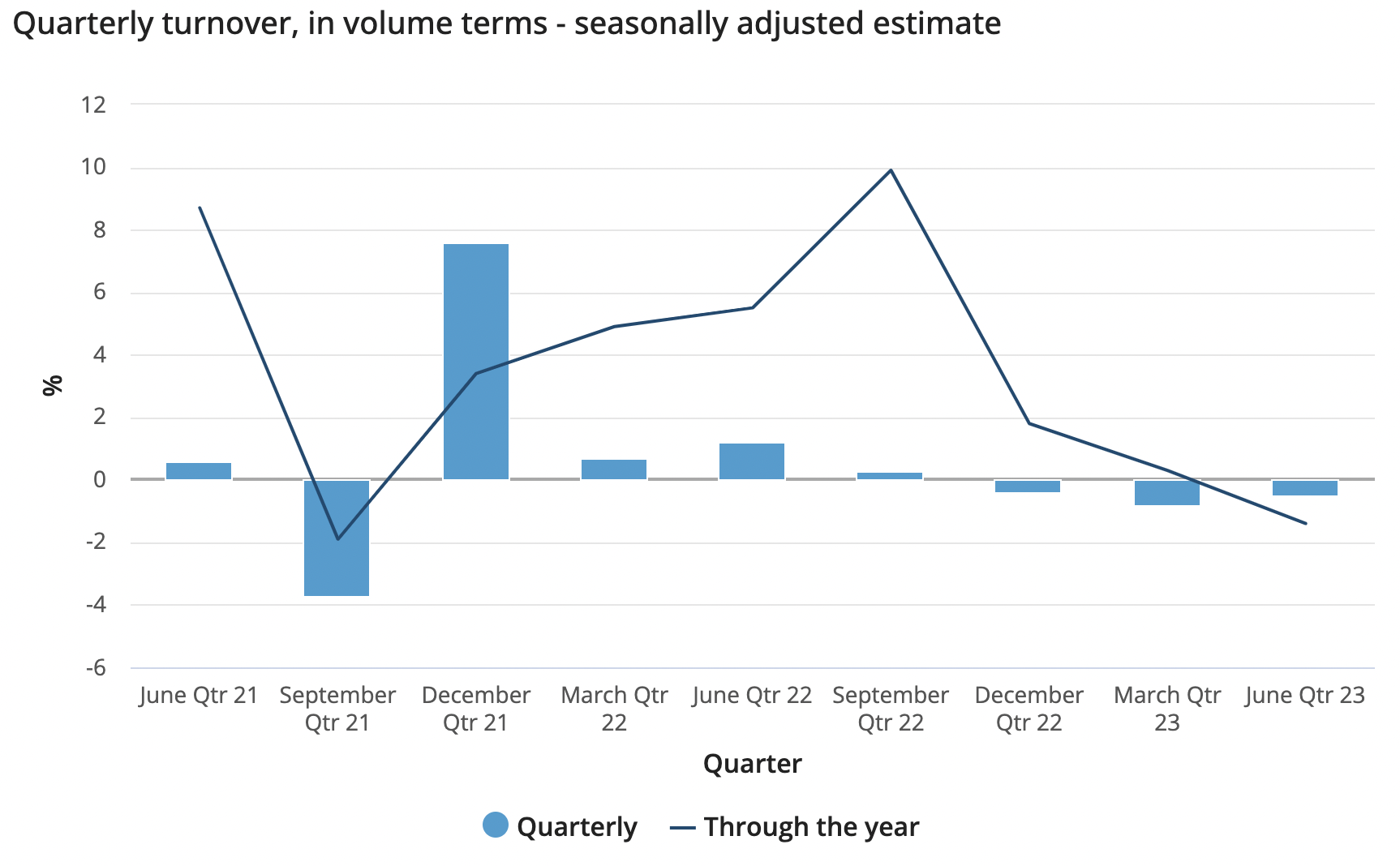

Another often-cited concern is that this extra burden on mortgage holders would result in a slowdown in consumer spending. This is already happening (see below).

Diana Mousina looks to the future (and although there are still storm clouds, it's beginning to look bright)

AMP deputy chief economist Diana Mousina argues that while rental yields and vacancy rates still remain at very low levels, both have started to rise - indicating the market isn't as tight as it was a few months ago.

"If you look at the data for building approvals, they're still down by between 15% and 20% compared to a year ago," she said.

"On top of that, we have record levels of net migration coming back into Australia. Net migration numbers are running at 400,000 a year (new arrivals minus departures for permanent migration into Australia)."

Currently, building approval numbers are sitting between 150,000 to 160,000. To meet this demand, we need to be building at least 220,000 new homes a year, she added.

"Everything has come together to create the perfect storm, which has meant that the rental market is very tight, but we also don't have enough supply in the market, which is leading to problems in the purchasing market," Mousina said.

.jpg)

The RBA's interest rate hikes have also meant that borrowing capacity has taken a substantial hit. And while Mousina can't say with 100% certainty that we have seen the peak, she does argue that if we continue to see the economic indicators tracking as they have, then "the RBA will likely be on hold until they cut rates next year."

"We have one rate cut every quarter next year in our profile," Mousina said.

"I think by February, we will see much softer GDP growth. Our forecasts are lower than the RBA's. More importantly, we think inflation will surprise to the downside and we think that will give the RBA room to cut the cash rate."

The reason being, a cash rate of 4.1% is not sustainable over the long term given Australia's levels of household debt, she said.

According to ANZ, household debt has more than quadrupled from $530.9 billion to $2,288.3 billion over the last 20 years. Over the last five years, that debt has increased by almost a quarter. According to CEIC data, household debt accounted for 116.6% of Australia's Nominal GDP in March 2023.

"The cash rate needs to be lowered for consumers to sustainably meet their mortgage repayments," Mousina said.

"That's why we think we'll see those rate cuts next year. One a quarter means that the cash rate could be 3.1% or so, which to us, is more likely the neutral cash rate in Australia."

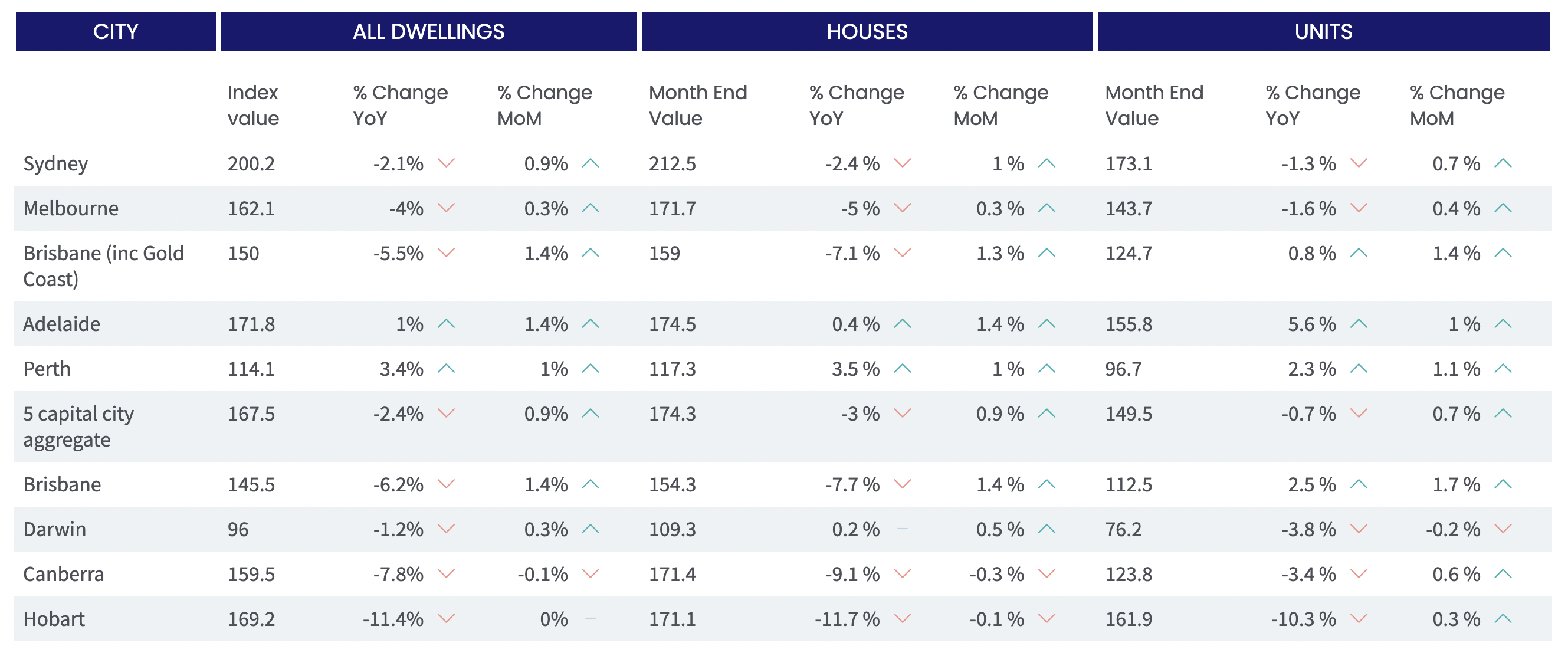

That said, she'd be surprised if we saw another leg up in property prices from here - and while prices have definitely ticked up, they still remain lower than their peak in April 2022.

"Borrowing capacity has taken a 30% hit from where it started when the RBA started raising rates," Mousina said.

"Yes, the rental market is tight, and yes, we do have very strong levels of migration, but with the cash rate remaining at a high level, there's not going to be this infinite pool of people who want to get back into an obviously less affordable housing market."

Mousina and her team believe property prices will likely be flat to slightly up over the next few months. She does not believe we will see huge falls in prices from here.

What to watch from here

Even if rates stay where they are today, Mousina believes the impacts of the fixed rate mortgage cliff will be gradual.

"That's still a hit to household purchasing power every single month because you're paying off a very large share of your income on your mortgage," she said.

"It doesn't occur all at once, which is why you haven't seen that degree of forced selling."

That said, property investors and homeowners alike should keep their eyes on the unemployment rate.

"This is really important because that could be why the property market has held up a lot better than expected. By now, we thought that the unemployment rate would be closer to 3.8-3.9% and it's 3.5%," Mousina said.

In addition, property owners should follow the RBA's monthly meetings, and watch if consumer spending numbers continue to disappoint to the downside. Consumer sentiment surveys are equally important, she added.

What Pete Wargent is seeing at the coalface

Over the past six months, property buyer and real estate expert Pete Wargent has seen an uptick in inquiries, but he notes that investors are still too cautious to start their search.

"People are looking for some reassurance or a green light that the interest rate cycle is peaking and it hasn't just been a pause for a couple of months," he said.

"When we do get people on board, there's stock available but it's hard to find quality stock at the moment and when you do, there's still plenty of competition for it. So it's not been easy for buyers' agents, that's for sure."

While it's difficult to see the full impact of the fixed rate mortgage cliff today, Wargent believes we are currently in "the eye of the storm".

"If you look at the major lenders, the biggest volume of fixed rate mortgages will reset from July to October this year," he said.

As a general rule, Wargent believes that when calamity has been forewarned for so long, it often doesn't prove to be as bad as many would think.

"Usually, we get blindsided by the risks that people just haven't thought about, the black swan events, the pandemics, the one-offs," he said.

"Currently, arrears are running around their 20-year historical level. It's almost inevitable that they will go higher from here. You can't take the cash rate from 0% to 4% in a year without there being some fallout. But I don't think it will be a catastrophe."

.jpg)

The future of property returns

With forecasters predicting that unemployment could rise to 4%, Wargent believes we could see selling in regional markets. This is firstly because these areas saw the biggest boom during COVID as owner occupiers moved out of the major cities for a "sea change" or "tree change", and secondly, because it doesn't make sense for property investors' cash flows at a mortgage rate of 6%.

"Some of that is reversing now as people go back to the office two or three days a week, with some people heading back to the cities," Wargent said.

"New listings have been rising over the last two months in some of these regional and secondary housing markets, like regional Queensland, where there is quite a lot of listings coming on."

He pointed to areas such as Logan, Ipswich, and Mackay as examples - areas that had previously seen a substantial amount of investment cash flow and prices rising through the COVID period.

That said, Wargent believes there are some regional markets that can still deliver property investors desirable returns over the next few years.

"The race for space phenomenon is finished now. What will do best will be what they call the 'peri-urban' locations. These are regional areas, but they're still within a two-hour striking distance of a capital city," he explained.

"These are places like Newcastle and the Central Coast for NSW, or Geelong for Victoria. If you look at where population projections, infrastructure investment, and where employment is going, it's generally in those cities that are within a couple of hours' commute time of the major capitals."

Wargent also argues that inner-city apartments could surprise to the upside over the next five years - particularly in Sydney, Melbourne, and Brisbane.

"With immigration starting and international students coming back, that's one place that I think there has been an under-supply, the same goes for middle-ring suburbia as well," he said.

"If you've got the budget and you can afford it, that kind of property would do well."

Meanwhile, Mousina doesn't believe that property investors can expect the same rates of return going forward.

"Compared to what they were over the past 20 years, interest rates are going to be higher over the next 10 to 20 years," she said.

"So to me, that means higher bond yields and lower returns from assets that are linked to interest rates, which are things like property and unlisted assets."

If we return to a sub-2% inflation environment in the next five years, however, then property can rebound strongly, she adds.

"There's very little desire to see property prices fall in Australia," Mousina said.

"Our tax structure makes investing in property very attractive and it's unlikely that the government will get rid of negative gearing tax concessions, or the capital gain tax concession. So you can still make a decent return from investing in property, but it will be difficult to generate the same returns as the last 20 years."

3 topics

1 contributor mentioned