What lies ahead for Australia's economy?

In March 2020 the Reserve Bank (RBA) of Australia was the first central bank to cut interest rates explicitly in response to the Covid-19 outbreak. To further support the economy, it also decided to implement unconventional monetary policy measures when the pandemic started.

The central bank recently pointed to its July meeting as the next point when it will reassess both its quantitative easing (QE) and yield curve control (YCC) stimulus programmes.

In particular, it is set to decide on extending its YCC, moving its three-year yield target to the November 2024 bond from the current April 2024 security in order to maintain the same impact on the yield curve. The outcome could provide an insight into when the RBA will start hiking rates.

It is also expected to provide an update on whether it intends to extend its QE programme once the current $100bn purchase target is completed in September 2021.

While the policy interest rate is likely to remain at its effective lower bound of 0.10% for the next couple of years, the RBA’s extension of its unconventional monetary policy tools is not a done deal.

What comes next?

The decision will have clear implications on markets, in particular on the Australian dollar, which has underperformed the other G10 commodity currencies in the past couple of months as central banks in other developed economies, such as Canada and New Zealand, have switched to a more hawkish tone.

Thanks to accommodative monetary policy, large fiscal stimulus and near-zero community transmissions of the virus in recent months, the Australian economy has recovered much faster than expected. The unemployment rate, currently at 5.5%, has fallen almost 2 percentage points from its recent peak and is close to the pre-pandemic level of 5%.

Strong consumer spending and the upswing in house prices have led the recovery, supported heavily by low interest rates and large fiscal transfers. This positive momentum has now extended to the production side of the economy as business conditions surveys are hitting new record highs. Even more importantly, surveys of employment intentions have been strengthening and are signalling that improvements in the labour market are on the cards.

Despite the strong positive economic momentum, inflationary pressures remain subdued. Headline CPI inflation rose by just 1.1% y/y in the first quarter of 2021, compared to a year earlier. Even with the recent rise in energy prices, we think that there is still much to be done for the RBA to meet its 2-3% inflation target.

Our view is that the economy has excess spare capacity. The unemployment rate still has at least another percentage point to fall to reach the RBA’s estimate of 'full employment', which is somewhere between 4.0-4.5%. Consequently, wage growth is likely to remain low and as labour costs account for the largest component of business costs, this should keep underlying price pressures subdued, and overall inflation well below the RBA’s target (see chart 1).

The RBA believes that in order to see inflationary pressure pick up in the economy, wage growth, currently running at 1.5%, needs to be sustainably above 3%. This task will be even more challenging for the RBA to achieve at a time when the closure of Australia’s international borders since March 2020 have largely hit the service sectors, mostly through a drop in tourism revenues.

Recovery in service sector key to inflation

The service sector is a key driver of the Australian economy, representing over 70% of the country’s GDP and employing four out of every five Australians.

In particular, education-related travel and tourism were Australia’s fourth and fifth largest exports overall in 2018-19, just after exports of iron ore, coal and natural gas. These services have benefitted from strong demand from overseas students seeking education and successful tourism campaigns attracting increasing numbers of international visitors, especially from China.

In particular, since the start of the new millennium, exports of Australian services to China have grown at an average annual rate of 20%. China has become Australia's largest services export market, with exports to China being greater than those to the US and the UK combined.

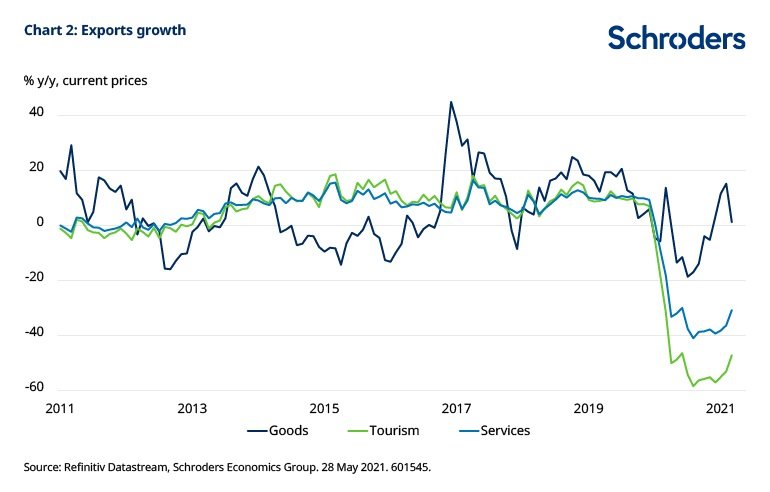

While closed borders have helped the country minimise coronavirus cases and deaths, they have severely hit the services sector through a large drop in tourism revenues. As chart 2 shows, tourism-related exports have fallen sharply since March 2020 and are still far below their pre-pandemic level.

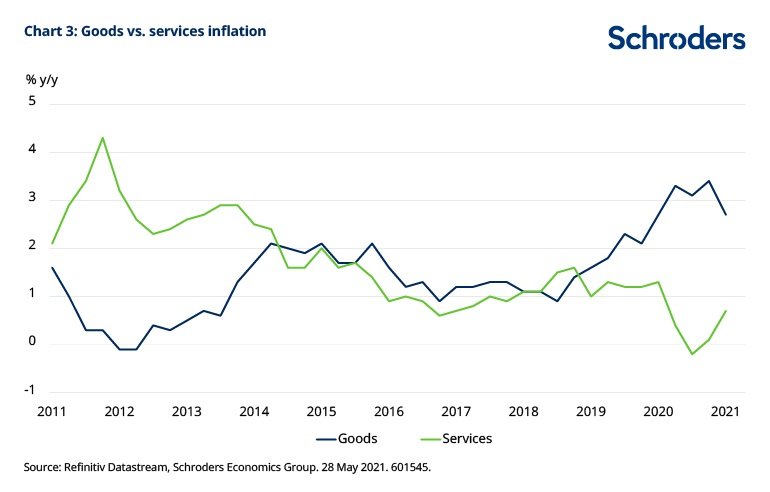

The drop in tourism revenues is also having clear implications on prices. A closer look at recent inflation dynamics highlights how closed borders have hit prices in the service sector. Specifically, chart 3 highlights an increasing divergence between goods and services inflation. Service sector prices, which represents almost 60% of the inflation basket, dropped sharply at the start of the pandemic on the back of Covid restrictions while goods prices accelerated, supported by consumption spending.

We expect these inflation dynamics to continue in the near term. Australia’s vaccine rollout is seriously lagging other advanced economies, and the majority of the population is not expected to be vaccinated until early next year. It is likely that the economy needs to see a full recovery in the service sector to see higher wage growth and stronger inflationary pressures.

Although the tailwinds to Australia’s surprisingly strong recovery should slowly weaken, easy policy settings will buy time for stronger wages growth to eventually assume the slack. If the economic strength continues, it is hard to make the case that the economy needs emergency-level stimulus, especially give the budget was not one of austerity. Fiscal policy has been recalibrated for recovery; it is now time for monetary policy to be recalibrated. We expect the RBA to phase out yield curve control to allow for more flexibility to manage the ongoing recovery via their Quantitative easing program. Should we see a shift in tone from the RBA at the next monetary policy meeting, the Australian dollar should re-establish its outperformance against its G10 peers, having underperformed other G10 commodity currencies in the past couple of months.

Stay up to date with all our latest news

Hit the 'follow' button below and you'll be notified every time we post content on Livewire. To learn more about our capabilities, please visit our website.

1 topic