What Mattered Today; Bon Voyage February - a big month

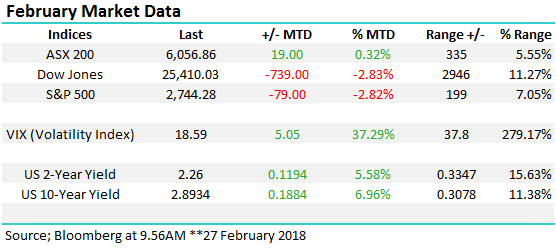

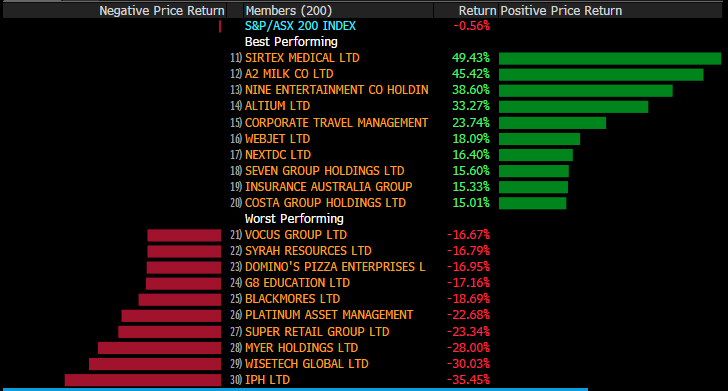

Reflection is all part of the investment process and the month of February has certainly thrown up a lot of material to reflect upon. The month started with a bang as global markets experienced a significant bout of volatility – a range of 11% for the Dow Jones which is clearly significant, while the 280% range for the volatility index was bigger than BREXIT and a number of other major catalysts that sparked a sell off in equities.

By month end, volatility was still higher than the 2016/17 average, but significantly lower than the monthly peak as stocks recovered.

Volatility Index (VIX) Chart

We also had domestic reporting season play out, which overall was marginally better than expected – today was the last official day and no doubt we all breath a collective sigh of relief!! An Improvement in corporate Australia is one reason why the Australian market outperformed US stocks over the period however the outlook for our own interest rates relative to those in the US has most likely been the major catalyst.

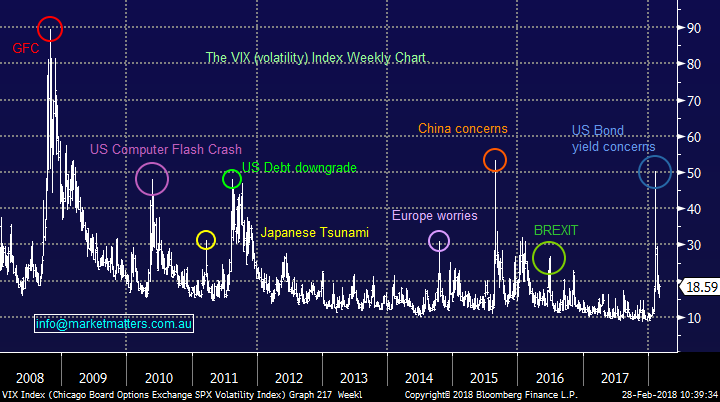

From a sector perspective, the huge performance from CSL over the course of the month, with the stock rallying from a low around ~$140 to a high around ~$160 was clearly the driving force behind the health sectors strong outperformance, notwithstanding the weakness we saw in Ramsay Healthcare today…more on that later.

Monthly performance – Australian sectors

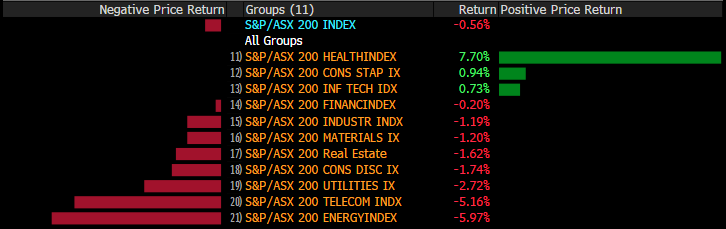

In terms of stocks, some cracking performances from the likes of A2 Milk, Nine Entertainment, Altium and a number of the travel related stocks. We own Webjet on that table and thankfully no stocks on the other side of the ledger (in red).

Best & Worst on the stock front for February

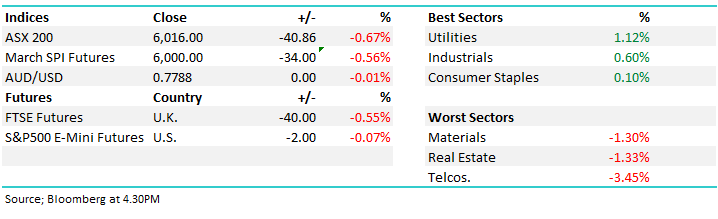

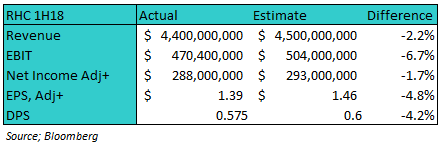

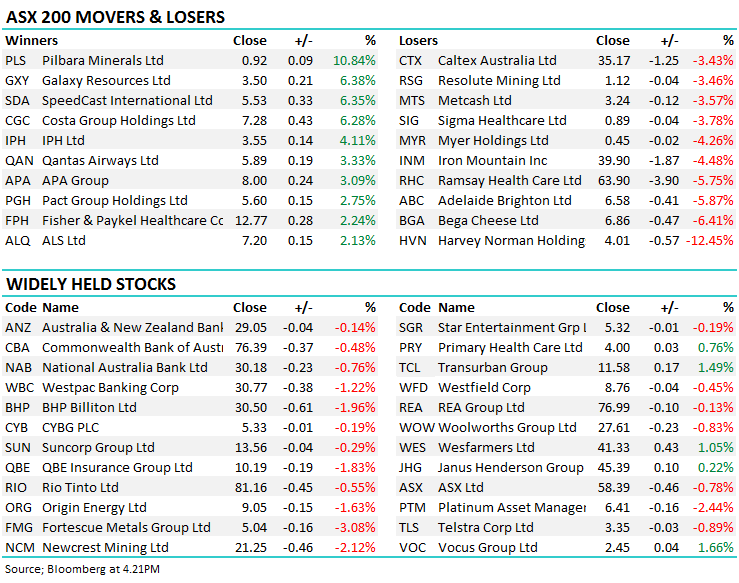

On the market today, the ASX 200 lost -40pts or -0.68% to close the month out at 6016. Volume was massive, nearly ~$8bn given there was some big portfolio changes and the rebalancing of the MSCI index on the close.

As suggested this morning, considering the Dow was up 400-points yesterday and 2440-points over the last 19-days, the 300-point pullback overnight following such aggressive comments from the Fed we believe illustrates the short-term strength of US stocks – the next 24-48 hours will tell if we are too optimistic! We remain bullish global stocks into March / April targeting fresh 2018 highs and all-time highs from many indices.

As suggested this morning, considering the Dow was up 400-points yesterday and 2440-points over the last 19-days, the 300-point pullback overnight following such aggressive comments from the Fed we believe illustrates the short-term strength of US stocks – the next 24-48 hours will tell if we are too optimistic! We remain bullish global stocks into March / April targeting fresh 2018 highs and all-time highs from many indices.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

CATCHING OUR EYE

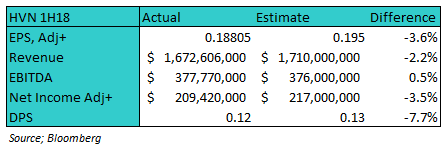

1.Harvey Norman (HVN) $4.01 / -12.45%; Ah Gerry – there’s only so much talking one person can do to support their own book!! Today the furniture and appliance retailer (and dairy farmer and real estate developer) was sold hard after reporting soft numbers for the first half + concerns that plagued the retailer at full year result about 6 months ago continued to be impair the numbers.

Last year’s record profit was propped up by favourable property revaluations, which disappointed to the downside this time around. ‘Tactical Support’ for franchisees, i.e. bailing out debt laden franchises, also increased by 10% in the first 6 months of the year while EBIT margins also came under pressure, falling almost 50 basis points to 5.57%. It seems Harvey Norman couldn’t catch a break this time round, with Gerry’s ‘diversification’ efforts also causing pain. The dairy joint venture Gerry pushed HVN into in 2015 has come back to bite, with a $20.7 mil write down coupled with a $4.6mil loss for Harvey Norman in the joint venture. All in all a messy result where none of the various aspects of the business seem to be performing to standard. Retail is a tough place to be at this point in the business cycle, and Harvey Norman is clearly struggling. With margins coming under pressure, maybe soon we will see Gerry’s milk on the shelves of Harvey Norman!! (Harry’s comment).

We wrote the following in our Income Report today which is relevant here….We bought into the ‘Amazon’ panic adding Harvey Norman simply because it was a clear value play that offered an exceptional yield, however the quality of the business is questionable. We bought well but sold as our reason for holding (value) became less attractive. We took a ~13% profit at $4.44 + the 0.17c dividend however the stock did reach ~$4.61 – showing we do sell early at times. Today the company reported and is trading down ~15%. We also hold Nick Scali (NCK) however the is a call on quality rather than the sector generally (or deep value for that matter). Overall though, we are negative the retail sector and have very little interest from a sector perspective at this juncture.

Harvey Norman Chart

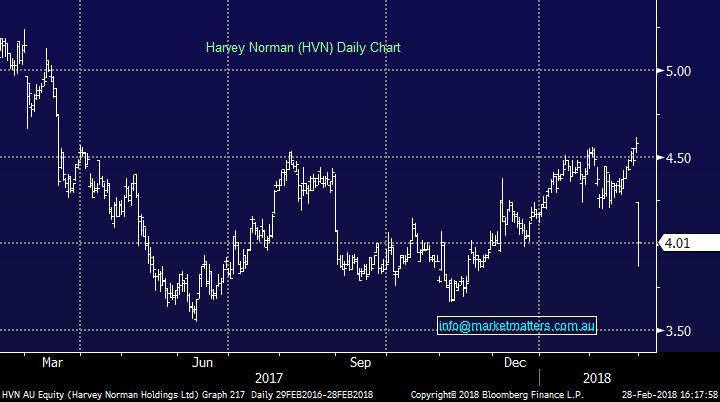

2. Ramsay Healthcare (RHC) $63.90 / -5.75%; Obviously a high quality company although in our view, they trade lower from here even after such a big drop in share price today. The results in all were miss on the numbers and you simply can’t miss when you’re priced at such a lofty valuation – although in fairness, it has come down in recent times. Revenue missed, $4.4bn v $4.5bn expected, profit missed slightly, the trends in the domestic business are weakening (ditto for HSO) and they are undergoing a big re-structure of their French operation. There are clear positive long term drivers for this stock / aging populations / Govt’s supportive of private funding mechanisms, however it seems the short term outlook is less clear / positive and the stocks may struggle here. We are targeting $55 on the downside .

Ramsay Daily Chart

Have a great night

James & the Market Matters Team

The above is an extract from the Market Matters Weekend Report. For a free 14 day trial of our service CLICK HERE

2 stocks mentioned