What Mattered Today; G8 Education cops some heat

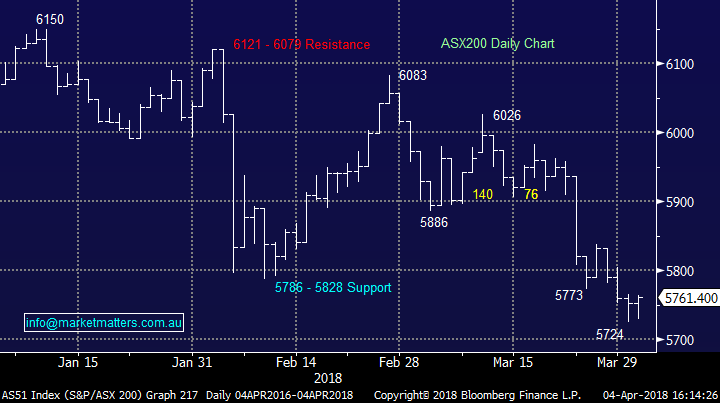

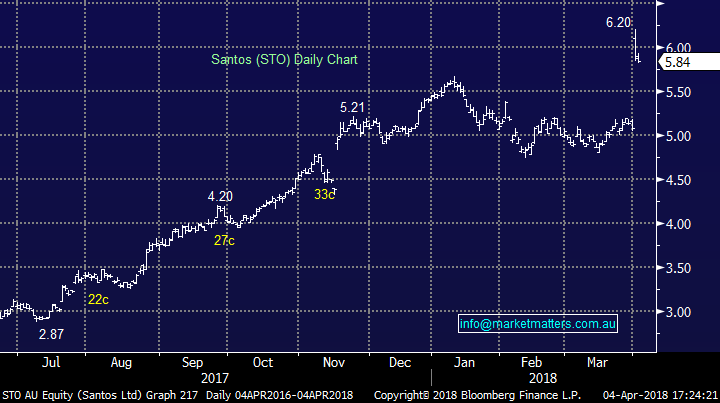

A bullish day overall despite the market only adding +9pts, it was the strong move up from the daily lows (+34pts) that caught the eye - CBA interesting here and its starting to look reasonable from a technical standpoint as it enters a seasonally strong period (as discussed in the last few reports). We had a decent order to fill today on the buy side of CBA– over 100k shares and there was no real appetite from funds we speak to be a seller of any size. Two things worth mentioning here – the public sentiment remains weak, which we know but there’s no real appetite to sell volume at these levels which tells us that CBA is susceptible to a strong bounce on the hint of a slight sentiment shift (to the upside). Elsewhere the resources were fairly neutral today, Blue Sky (BLA) came back online post the short report we discussed late last week, while G8 Education (GEM) was battling a broker downgrade from Morgan Stanley + news that it’s ex-Chair has been charged by ASIC.

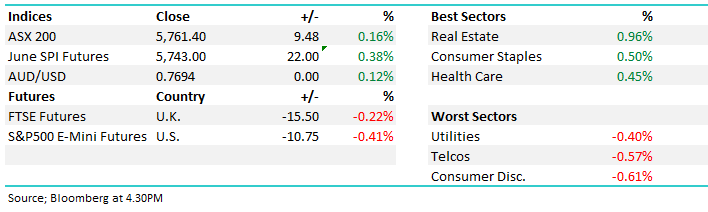

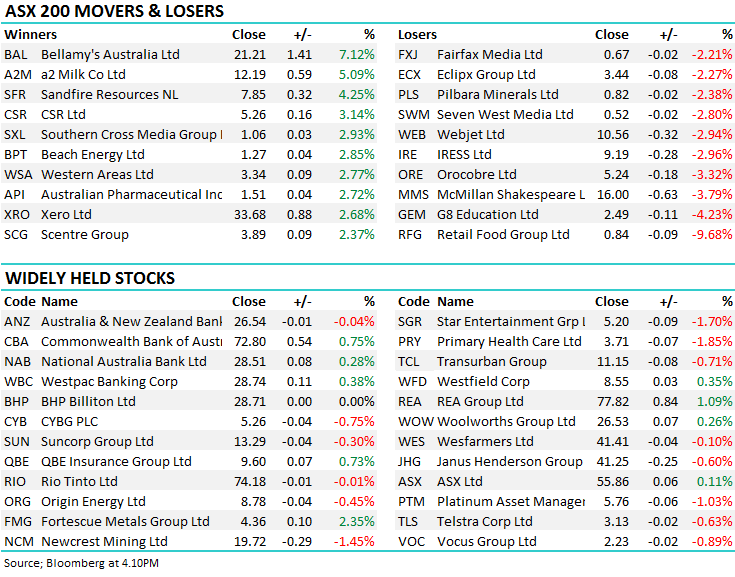

On the market today, the Real Estate stocks did best – a sector we covered in today’s income report (click here) while the retailers were weak despite a better than expected retail sales print. By the close the ASX 200 had added +9pts or +0.17% to 5761 – another decent result overall given the negativity first up.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; A reasonable amount on the docket today with JP Morgan wielding most weight with their negative calls on G8 Education and Japara having most impact…

· BHP (BHP AU): BHP Upgraded to Sector Perform at RBC - CLOSED FLAT at $28.71

· Carsales.com (CAR AU): Carsales.com Upgraded to Neutral at Credit Suisse; PT A$13.50 – FELL -0.37% to $13.32

· CSL (CSL AU): CSL Upgraded to Buy at UBS; PT A$175 – ADDED +1.18% to $157.84

· Estia Health (EHE AU): Estia Health Rated New Neutral at JPMorgan; PT A$3.55 – FELL -1.49% to $3.30

· G8 Education (GEM AU): G8 Education Cut to Equal-weight at Morgan Stanley; PT A$2.80 - FELL -4.23% to $2.49

· Japara (JHC AU): Japara Rated New Underweight at JPMorgan; PT A$1.80 – FELL -3.38% to $2.00

· Regis Healthcare (REG AU): Regis Healthcare Rated New Overweight at JPMorgan; PT A$4.45 – ADDED 1.39% to $3.65

In terms of G8, JP Morgan downgraded their occupancy assumptions now expects a 77.7% occupancy level in 2018, versus a prior forecast of 78.8%. While it is seen recovering slightly to 79% in 2019, it is weaker than its previous expectation of 80.5%. We’ve talked about G8 a number of times as an income investment, however the earnings are simply too volatile / unpredictable at this juncture.

In terms of the Chairs run in with ASIC, the SMH reporting that Hutson has been charged with attempting to pervert the course of justice, following an ASIC investigation of G8’s takeover bid for Affinity Education in 2015. G8 has not been names but clearly not a good look!!

G8 Education (GEM) Chart

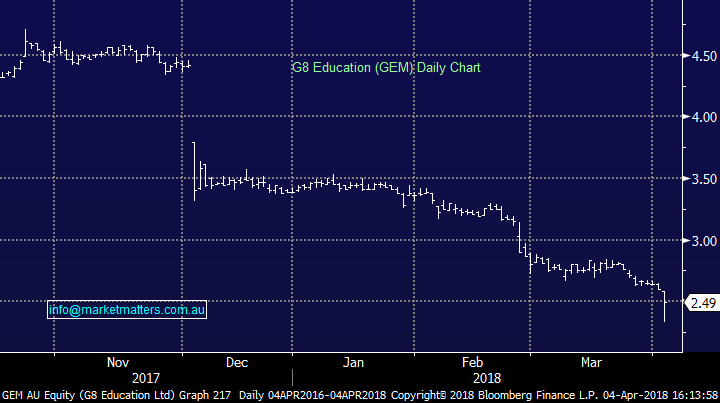

Santos (STO) $5.84 / -0.85%; Reports this am that Harbour Energy’s bid for Santos may still face issues from Australia’s Foreign Investment Review Board, given sensitivities in the nation’s gas sector – it’s a political issue so anything can happen and that explains the discount to the bid price – today the stock was lower reflecting the uncertainly.

Santos (STO) Chart

Have a great night

James & the Market Matters Team

This is an extract from the Market Matters afternoon Report. For a free 14 day trial of our full service CLICK HERE

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

2 stocks mentioned