What will happen if rates stay at these levels?

It's proving more difficult than originally expected to get inflation back to target. Take the US, for example, where the annual inflation rate accelerated for a second straight month to 3.5% in March (its highest reading since September)—compared to forecasts of 3.4%.

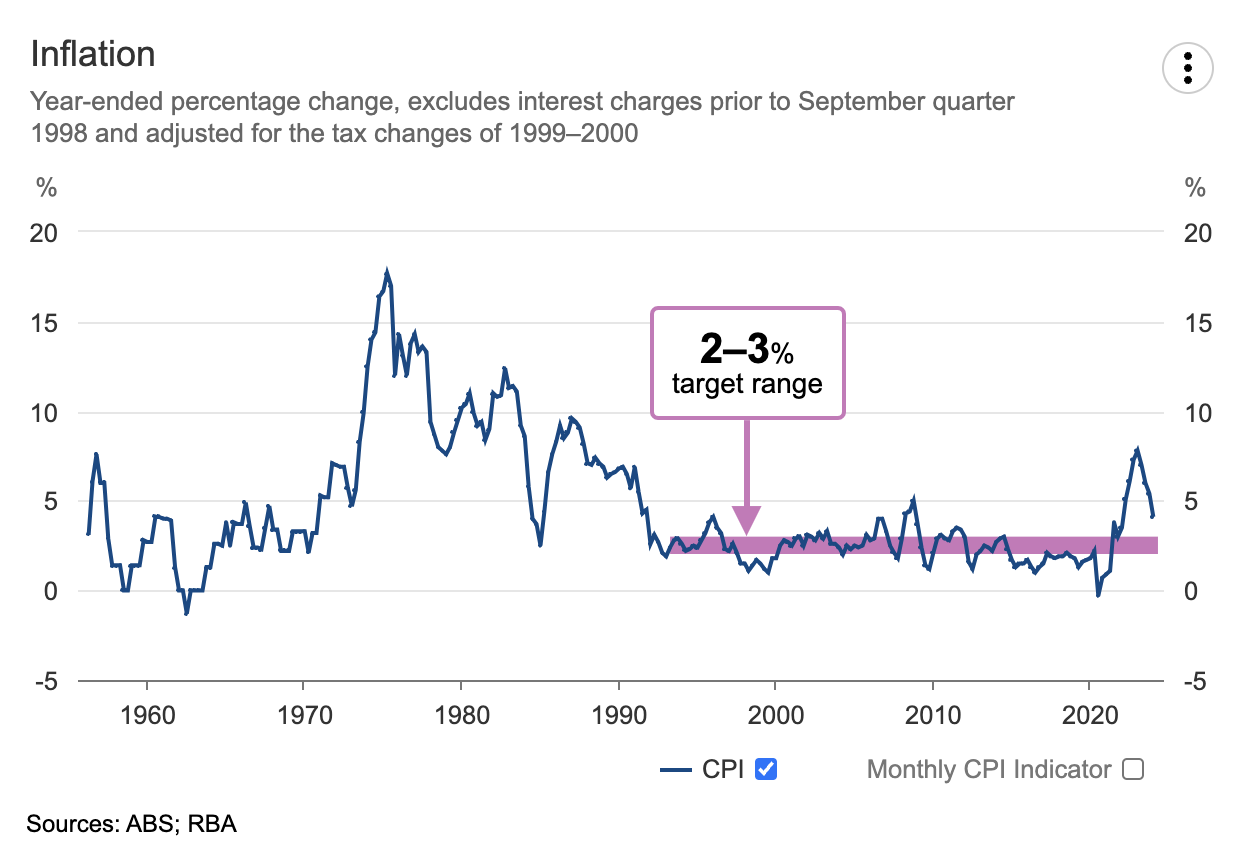

Or Australia, where our latest monthly read (in February) saw inflation tracking at 3.4%. The annual change in the consumer price index to the end of the December quarter was 4.1%. Analysts expect the inflation rate will moderate to 3.2% in the second quarter, before dropping between the RBA's 2-3% target in the third quarter.

So, if inflation remains stickier than we previously thought, what does this mean for rate cuts and the ultimate direction of markets?

Livewire spoke with Wilsons Advisory's David Cassidy to find out.

Note: This video was filmed on Tuesday 9 April 2024. You can watch the video or read an edited transcript below.

Edited Transcript

Equity markets are betting big on easing global inflation. Are there any signs that inflation may be stickier than we may expect?

There's some debate amongst economists as to whether that is just some sort of seasonal adjustment problem in a post-COVID world. But I think there's enough uncertainty to be a little bit cautious about this falling inflation story, at least in the short term. I think it is a situation where inflation is going to cool, but there's a lot priced in, as you said. So, I'll be a little bit nervous coming into these next couple of inflation prints because markets are priced, if not for perfection, certainly for very good outcomes in terms of inflation.

What does that mean for rate cuts and the possibility of a soft landing going forward?

David Cassidy: Well, I think markets have a lot of confidence in the soft landing from the perspective of how strong the economic data has been over the last 12 months. This widely feared recession just hasn't seemingly eventuated. So, I think there's no doubt the US economy is looking resilient. I guess there's still a concern that if inflation doesn't come down, the Fed won't be able to cut, and there's a risk of recession or some accident in the financial system down the track. So soft landing, I think, is still looking like the central case, but the longer rates stay at these levels, the more risk of something going wrong either in the real economy or the financial system at some point over the next 12 to 18 months.

Could it just be that we face a decade of inflation trending higher than it has the last decade?

So, I think there is probably going to be a little bit more inflation relative to the previous 10 years. But then we've got situational influences like AI, which should ultimately be deflationary. So I don't think we've got a really nasty decade ahead of us in terms of inflation, but I think in contrast to the previous decade, the tendency was to undershoot a little bit. We might have to get used to overshooting a little bit, but the base case is not going to be too bad.

And how does everything compare to the situation in Australia?

Possibly, to complicate matters, we've got some fairly generous tax cuts coming on July 1, so that's a consideration. The base case is that Australia as well as the US can ease policy in the second half of the year, but the market does seem to be pushing those cuts out. The market now, I think, is priced for just one cut this year, in the case of Australia in November. I think we can at least do that and possibly get one a little bit earlier. But it is a situation at the moment where inflation is above the RBA's 2% to 3% target. It's a little bit above 3%. We probably won't be back in that band till next year. It makes it a little bit tricky for the RBA as to exactly when they use policy and by how much.

How would you allocate to risk and defensive assets with all that in mind?

I think things are looking a little bit more normal in terms of valuations in the case of Australia. So I think we've got a pretty good base case, macro setup, soft landing, and rate cuts. Generally, equities like that. Bonds don't mind that sort of backdrop either. So I think from that perspective, both asset classes, the main defensive and risk asset classes, have merit.

Equities look a little bit expensive, particularly in the US, but I am cognizant of the fact that there's a very good structural story around the US equity market in terms of tech. So we're left fairly neutrally weighted between risk and defensive at the moment.

Ally Selby: Okay. Well, thank you so much for your time today, David, it was a pleasure to have you on The Pitch.David Cassidy: Thanks for having me.

Ally Selby: If you enjoyed that too, don't forget to subscribe to Livewire's YouTube channel. We've got so much great content just like this every single week.Learn more

Wilsons Advisory think differently and delves deeper to uncover a broad range of interesting investment opportunities for their clients. To read more of our latest research, visit our Research and Insights.

3 topics

1 contributor mentioned