Where Livewire readers are planning to deploy their cash in the year ahead

One glance at today's headlines would be enough to make a lesser investor pull stumps and hit the showers. The NASDAQ is a bonfire, with roughly a third of its value lost since the start of the year. The pain is less acute in Australia, but still very real, with the ASX 200 down 12%.

But our readers aren't lesser investors. They get their information from Livewire, after all.

But in order for us to provide content that can help inform their investing journey, we need to know key things such as their sentiment, which asset classes and markets they're keen on which ones they're not, and how they plan to position their portfolios accordingly.

The last time we ran one of these was in December last year, and you can find a great overview of those results by my colleague Ally Selby here.

In this year's end of financial year reader survey, which ran from Thursday the 9th of June and closed on the 15th, 1,329 subscribers took part.

The main takeaway for me is that our readers are cautious but opportunistic. To this end, almost half of our readers are putting their portfolios on ice. But time out doesn't mean they're disengaged. They're ready to move, and move they will - but only when the time is right.

This is evident in the responses. Among other things, they're prepped and ready to add stocks to their portfolio in the next 12 months.

Key results:

- 44.9% think it's a good time to do nothing;

- 76.5% believe property values will fall by over 10%;

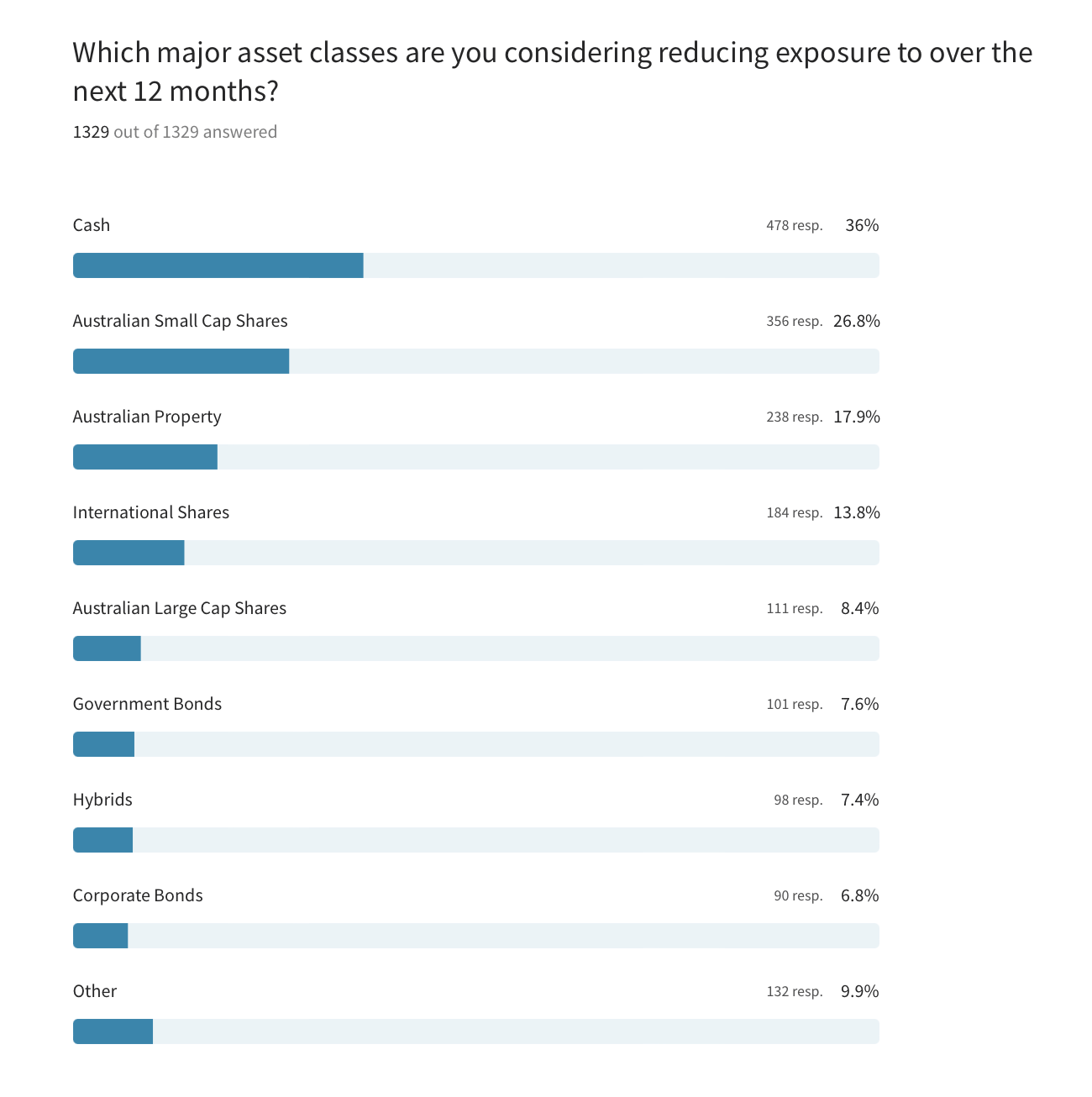

- Cash is the asset allocation most likely to be reduced;

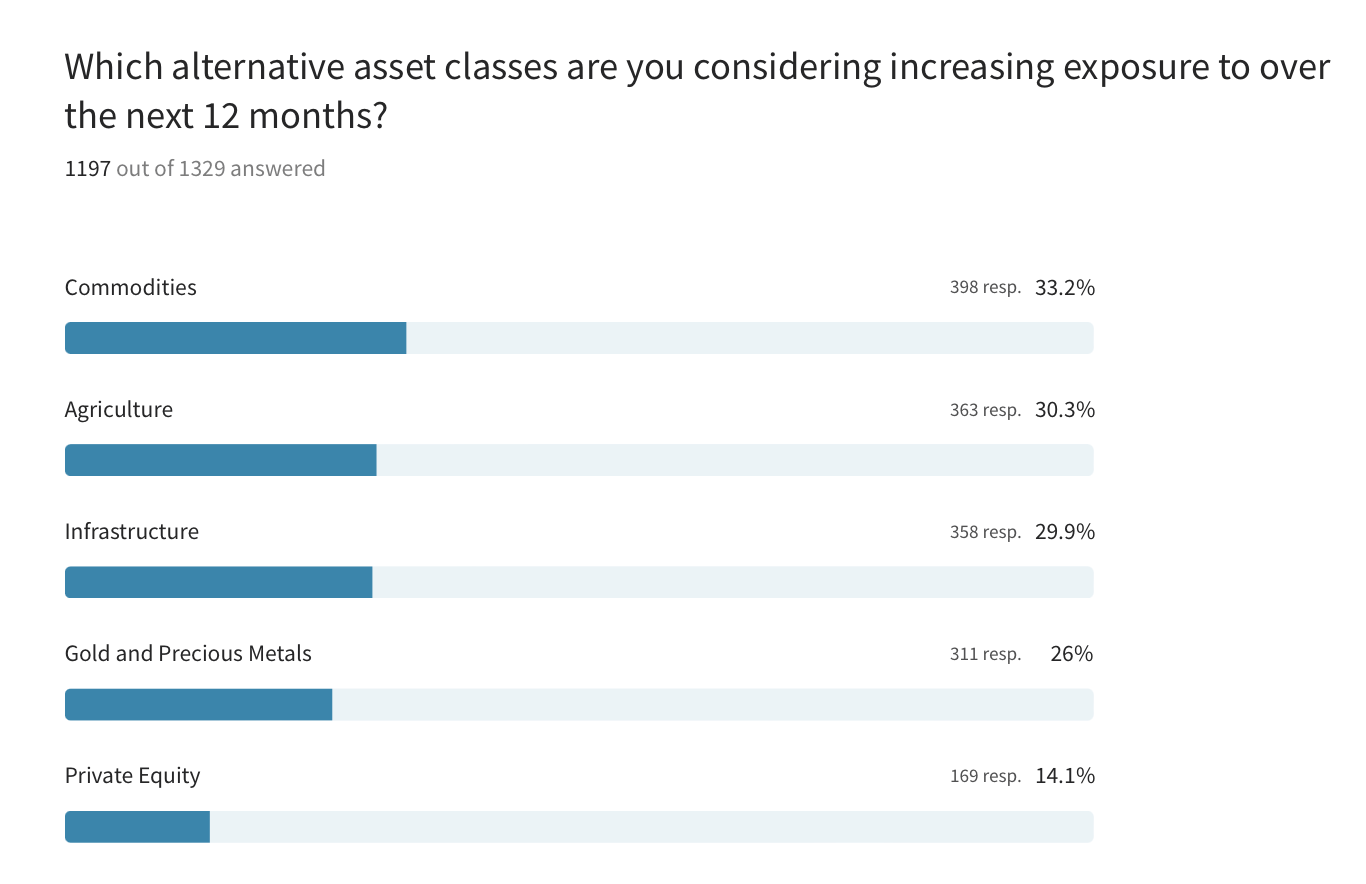

- Commodities is the asset class most likely to be bought;

-

Aussie shares will outperform US shares.

You can find the full set of results here.

Without further ado, let's get into it.

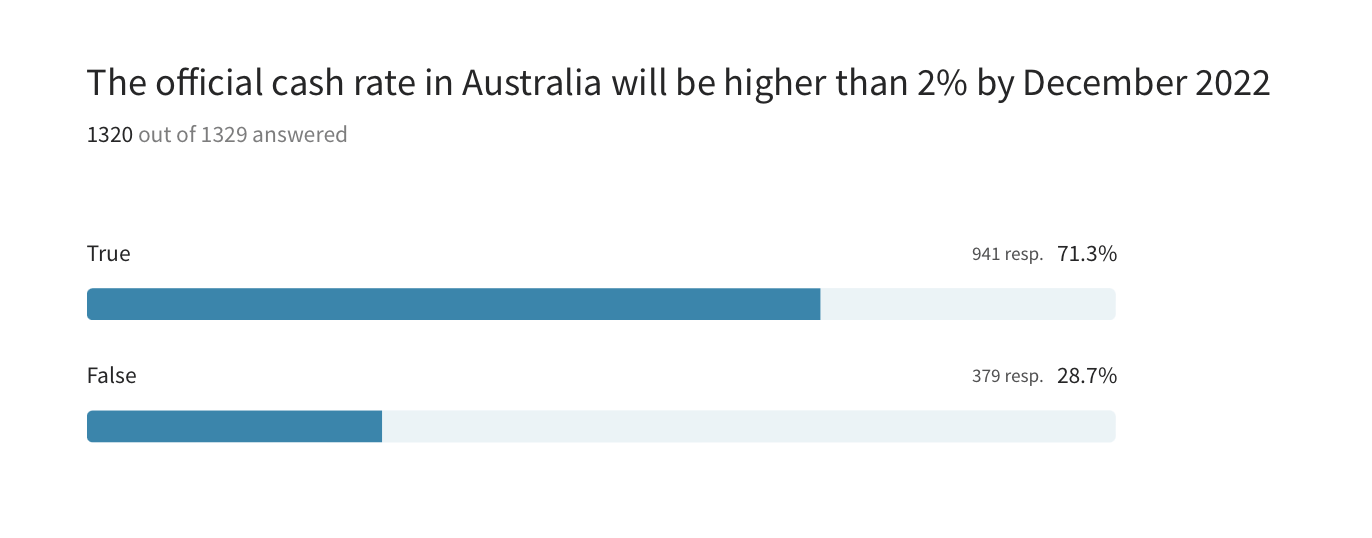

The rate pain is going to be worse than expected

71.3% of our readers expect the cash rate to be over 2% come year's end. If anything, that's conservative.

The ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve has the cash rate at 3.325% in December.

(We'll own that one, we probably should've offered an "over 3%" option to click.)

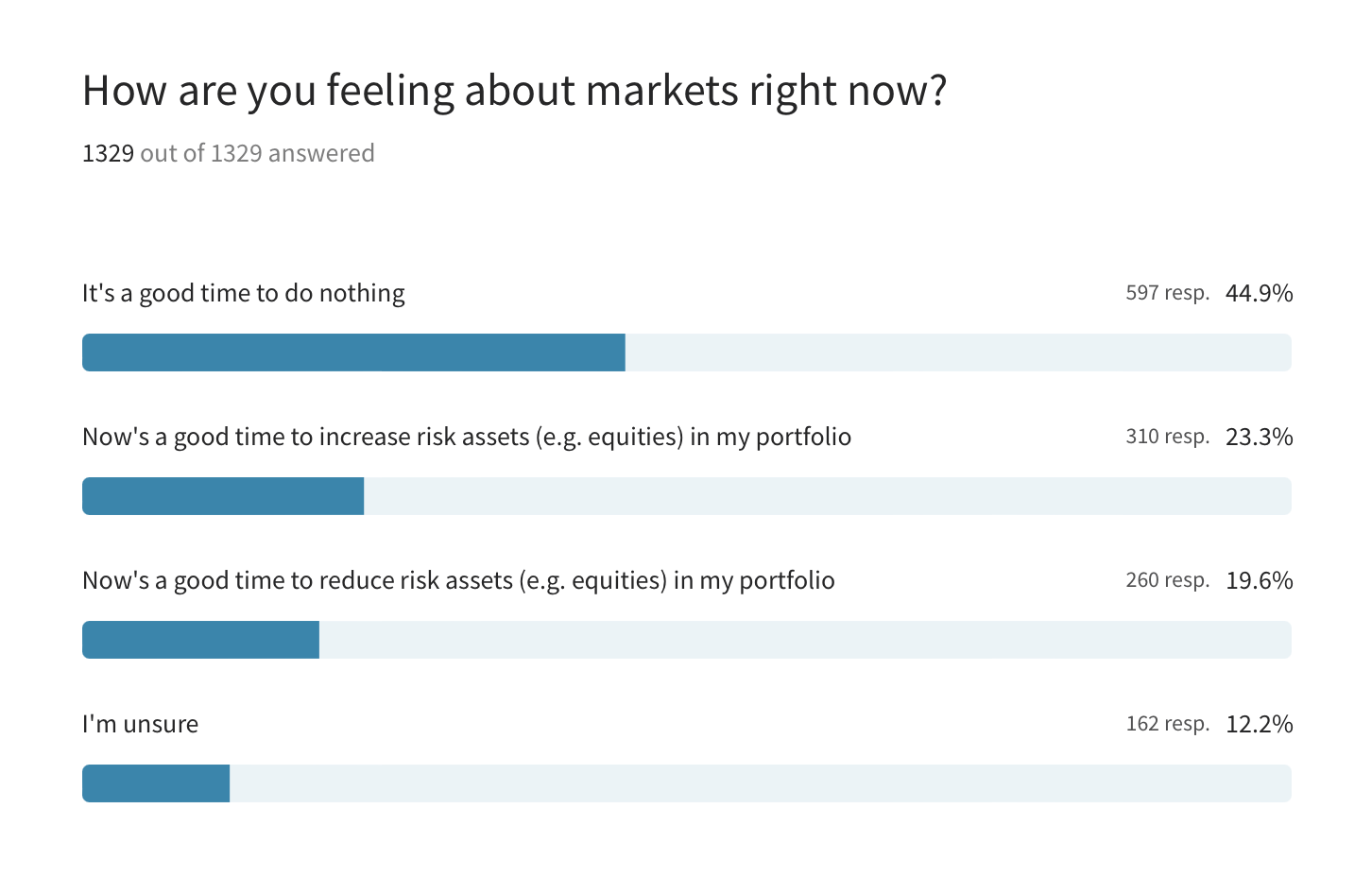

The finger is not quite in the trigger well, but it's close

About 45% of our readers are in a holding pattern, doing nothing, up from 37% when we did our last survey end of last year.

In a way, that figure could be bumped up to 57% if you include the 12% of readers who are "unsure", assuming they're the kinds of responsible investors who need to be confident before making moves.

Who can blame them. Central banks are pumping the breaks while many economists are flagging recession.

Yet more think now is a good time to buy risk assets (23.3%) than sell them off (19.6%).

Taken together, it looks like our readers are cautious but equally chomping at the bit to play the market turn, whenever it comes.

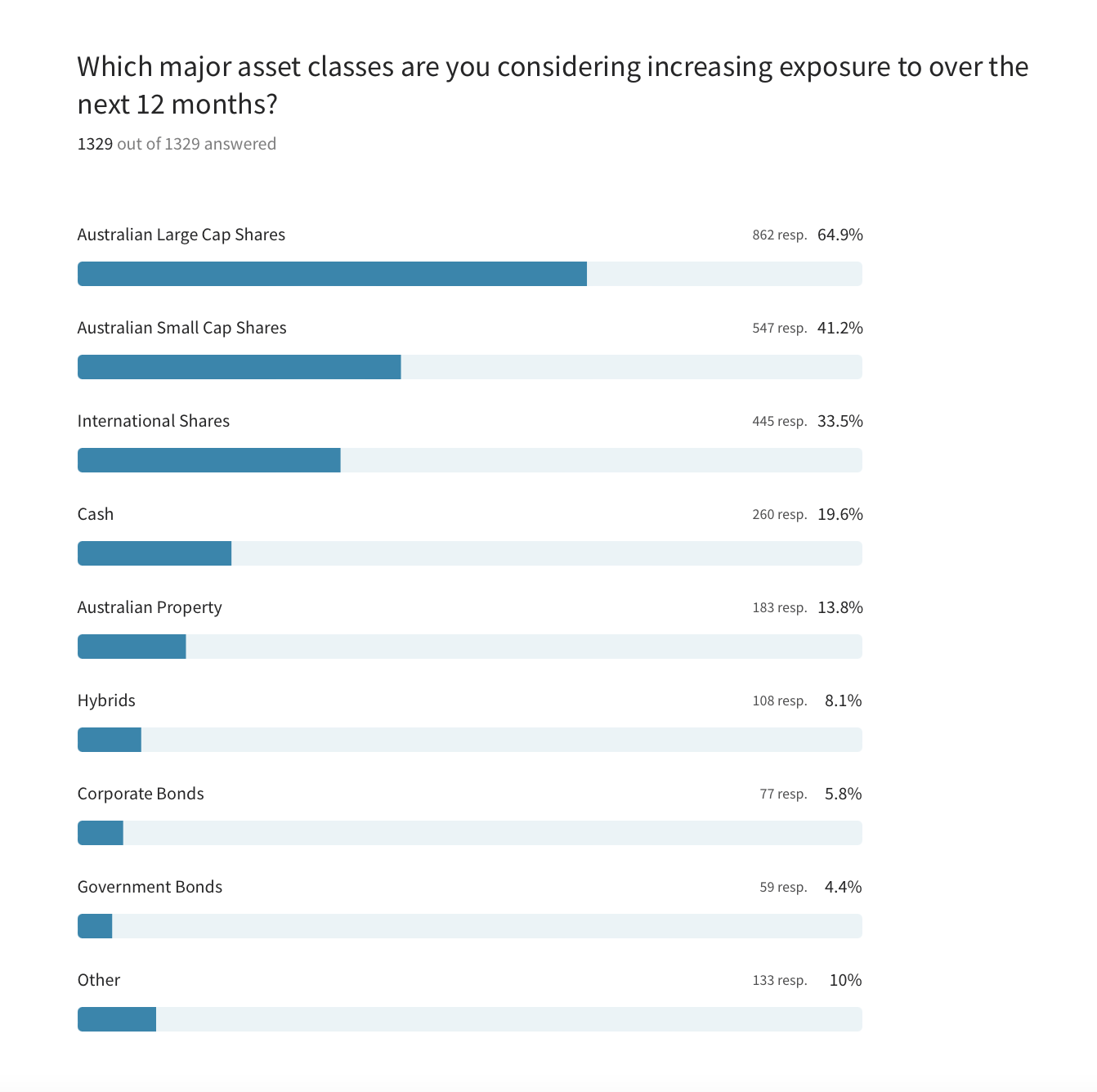

... which feeds into the next point

It's illuminating that in a bear market and economy in the throes of recession fear, 65% of readers are considering upping their allocations to equities over the next year.

Less than 5%, meanwhile, are looking to boost their allocations to government bonds.

This is telling. The ASX 200 is down over 14% year to date. But our readers must think that the dog days will plateau or improve over the next twelve months. After all, from a pure return perspective, you want to be weighted towards equities when a cycle begins its upward climb. Defensive assets, just the opposite.

To see what stocks our readers have their eyes on, check out Hans Lee's piece here.

.jpg)

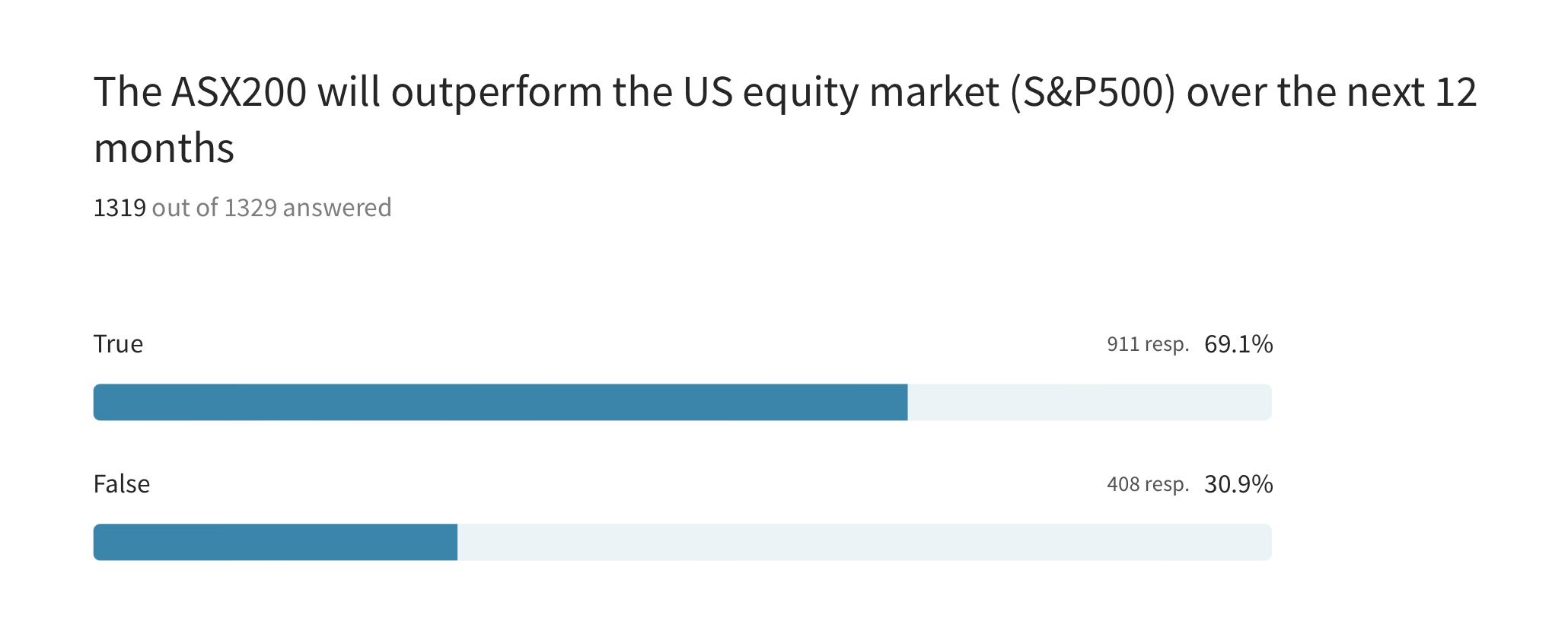

Domestic shares could be the way to go

As the well-worn disclaimer goes, "history is not a reliable indicator of future performance."

Our readers seem to think it is, though. The ASX200 has outperformed the S&P500 this year, and almost 70% of our readers reckon this outperformance will continue for the next year. Looks like the ol' Aussie investing home bias is here to stay.

Within equities, our readers are 50-50 on growth stocks

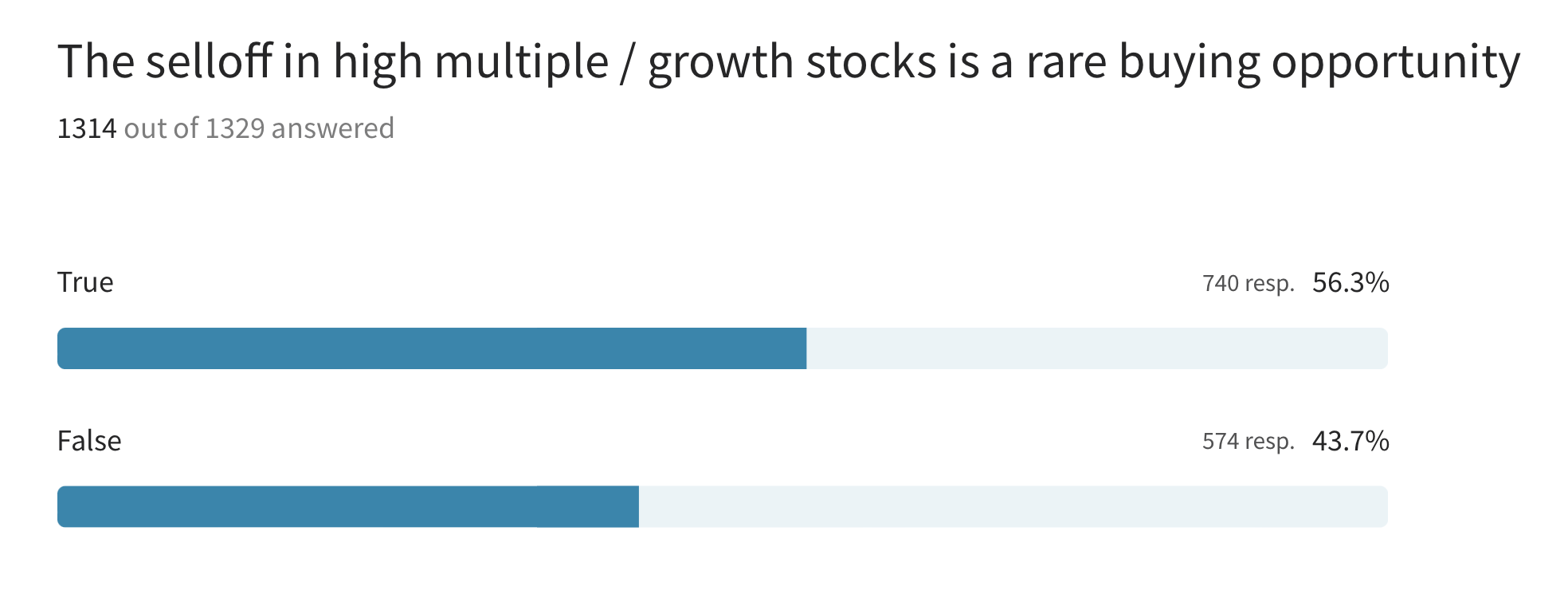

Long duration growth names have been hit hardest this sell-off. The ASX 200 Growth Index is down over 18% this year, while the tech-heavy Nasdaq Composite is down almost 30%.

This is due to their high price to earnings multiples and the outsized discounts that need to be applied to their future cash flows in light of higher rates.

But in the investment world, sell-offs often spell opportunity. The jury is out on this point - it's a roughly 50-50 split among readers as to whether the growth name sell-off is a buying opportunity.

Why hold cash, even if it's earning a bit more than it has previously?

Assuming no withdrawals, a pool of capital is a zero sum game. If you reduce cash, which 36% of our readers plan to do, you have to put it somewhere. It might be pulling an overly long bow, but to me it adds to the theme running through these results that our readers are hungry to invest, but not just yet.

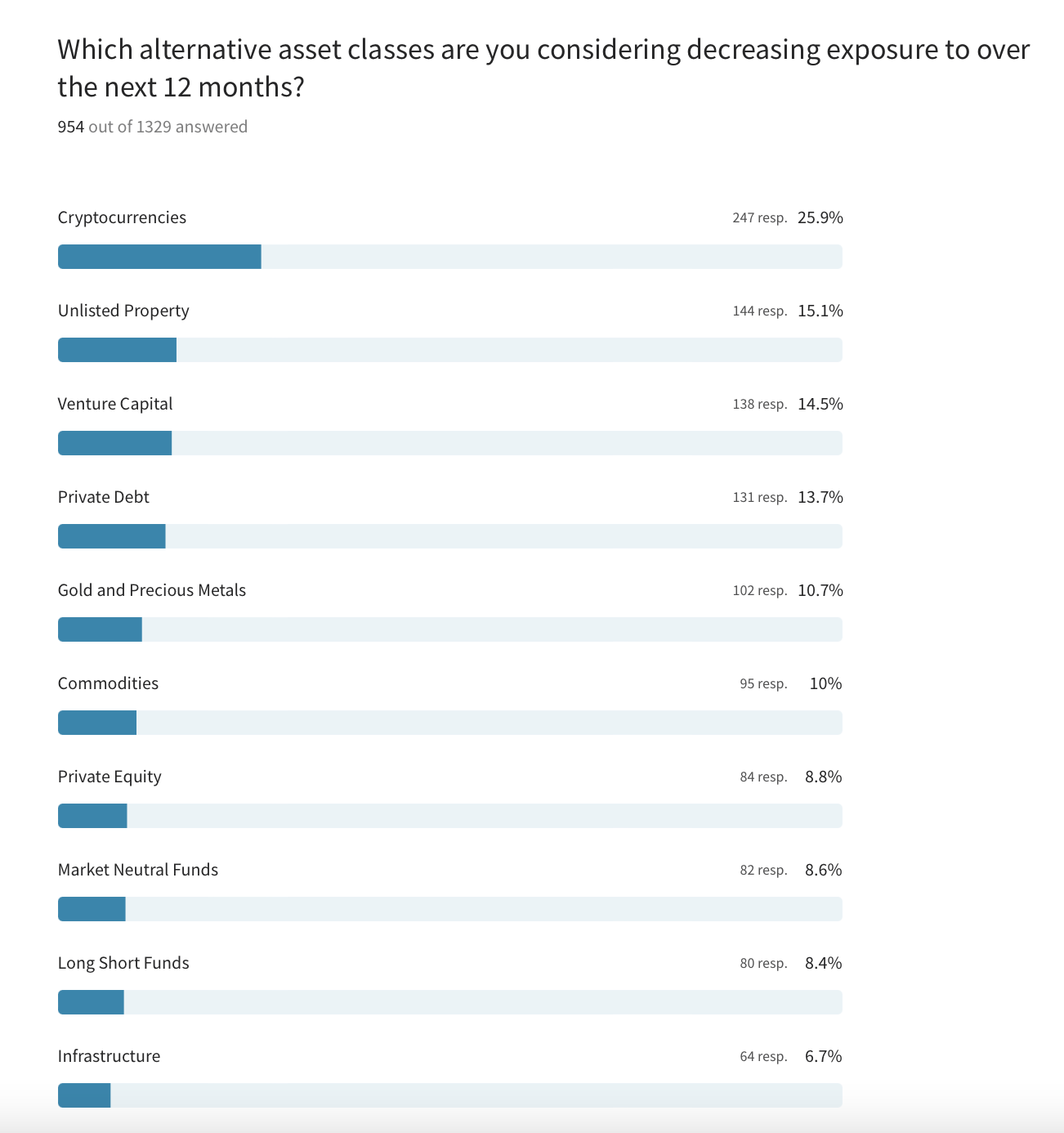

Is crypto dead?

It might be, according to the 26% of readers who are considering offloading it. Bitcoin's down 55% since January, and at this point it's a mug's game knowing where it will go to from here. If it bounces, selling will be an exercise in crystallising losses. On the other hand, if it continues to crash then selling now will stem the bleed. One thing is for certain, it's not an asset class for the feint of heart.

Unlisted property is the asset class next most likely to be sold by our readers. The pain is real, if listed property is any bellwether. Charter Hall Group is down a whopping 47% this year, while Goodman Group is down almost 35%.

It's a different story for commodities though...

While the rest of the market has was in the hurt locker in the first , commodities stocks in the ASX 200 put on about 20%, but those gains have been mostly wiped off this month.

Our readers are keen on the sector though (33.2%), as they are with agriculture and infrastructure.

The same can't be said for market neutral funds and venture capital which got 3.9% and 4.1% of the votes respectively.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 contributor mentioned