Where to get your Real Estate Income? Listed Property Trusts or Unlisted Property Trusts, questions answered

Fawkner Property

One of Australia’s best long-short equity managers, Tim Carleton from Auscap Asset Management put it very simply:

“Rent – it’s an essential cost for most business and a highly recurring, low risk revenue stream.”

This is why real estate is many investors preferred asset class for consistent, reliable monthly income.

Unlike investing in operating companies which at times can be opaque even in listed equities, notwithstanding the difficulties and lack of transparency in private equity, Real Estate investing is very transparent. As a matter of fact, investing directly into real estate via an unlisted trust can, in many instances, be much simpler and more transparent than listed real estate on the ASX.

The reasons investors choose to invest in any asset class, or sub-asset class is always dependent on the individuals’ objectives. In real estate, why would one investor choose listed property over direct property, or vice versa?

For example, investors with a long-term investment horizon and preference for consistent income may prefer direct real estate. Conversely, traders looking to capitalise on short-term mispricing’s would prefer listed property trusts.

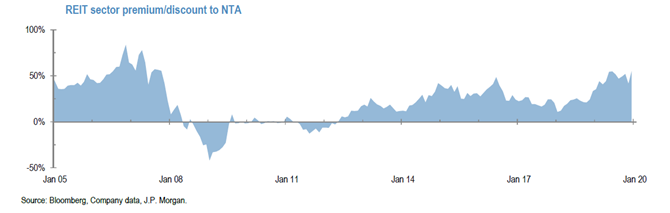

This opportunity arises when the Share Price of an LPT and the Net Tangible Asset backing (NTA) differ, a common feature of listed markets. This does not occur in direct real estate investing as investors always pay the NTA i.e. the actual underlying value of the real estate. Expert equity managers like Carleton, with a deep team of research analysts, describe the strategy of buying at discounts to intrinsic value as ‘special situations’. These can be opportunistic and different to a long-term investment strategy.

Historically, listed real estate has traded at a premium to the value of the underlying real estate as investors pay more for the privilege of liquidity and no stamp-duty. The long-term (25-year) average premium to Net Tangible Asset backing (NTA) is 18.1%. Contrast this to ULPT’s unlisted property trusts which trade at NTA.

There are several questions investors should ask themselves before investing into Real Estate, as this can assist in determining the most appropriate way to obtain that exposure your exposure. We’ve pulled a few quotes from one of history’s greatest investors, Warren Buffet to illustrate the answers below.

1. How long am I looking to invest for?

Investing or trading, in-and-out. Answer: Listed Property Trusts

Investing for long-term wealth creation. Answer: Listed Property Trusts or Unlisted Property Trusts

All investors have different time horizons and objectives. Investing in special situations can be highly profitable in the short term but requires high levels of diligence and expert investing teams, and is a higher risk option. For most investors, long-term financial strategies work best for genuine wealth creation.

As Buffet said in his 1988 letter to shareholders, “(Our) favourite holding period is forever”; he further reiterated in his 1996 letter to shareholders “if you aren’t willing to own (a stock) for ten years, don’t even think about owning it for ten minutes.”

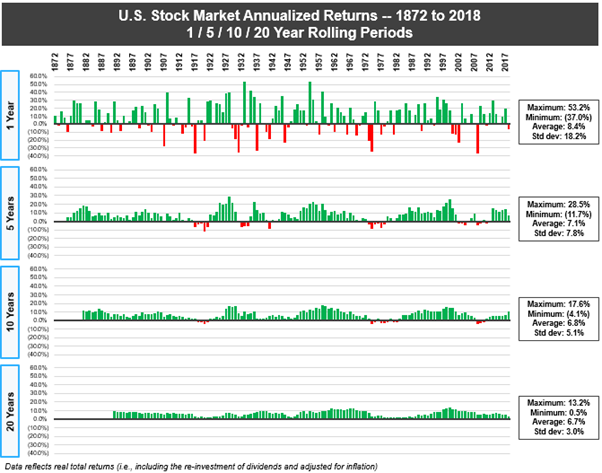

The chart below uses the US stock market to illustrate the strength of long-term investment strategies. The first example (1-year) shows many negative return periods. As we take longer time periods, the range of possibilities narrows and the chance of losing money diminishes greatly. Using Data from 2018, the S&P500 has never lost money over any 20-year period.

Source: Robert Shiller, Yahoo Finance, Measure of a Plan Data & Insights

2. Do I want a frequent, reliable income stream?

Investing for consistent, reliable monthly income. Answer: Unlisted Property Trusts

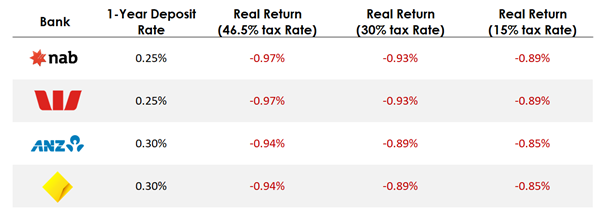

Reliable income streams

at a decent yield have become incredibly hard to find in the record low

interest rate environment. Term deposits are currently delivering holders a

negative return when accounting for inflation and tax as seen below. As Carleton highlighted, finding assets that

are - (1) hard to replicate, (2) easy to understand and (3) have strong and

growing cash flows over time - can provide a strong yield.

Source: Banks, RBA, ABS, ATO 30 June 2021

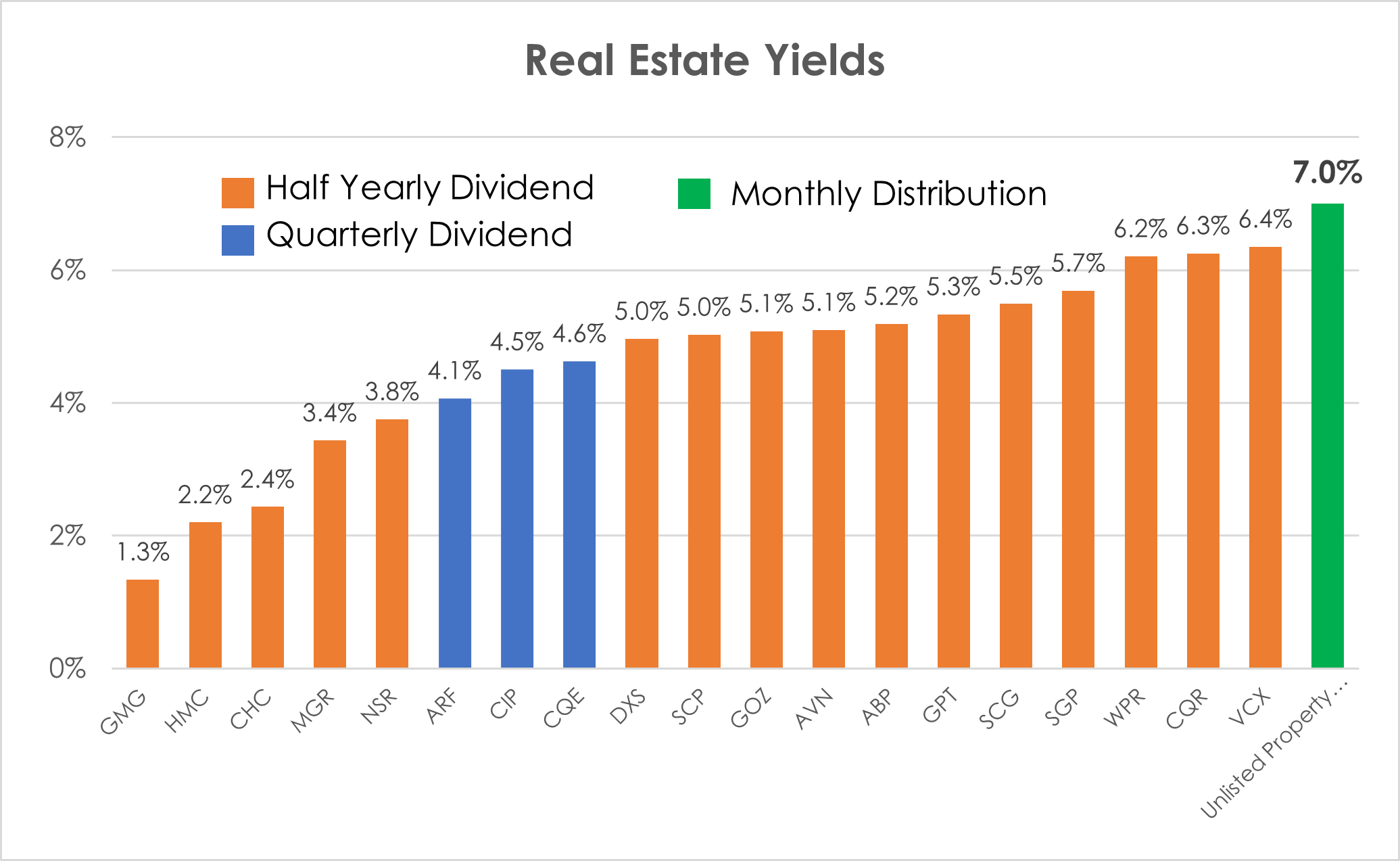

When finding the right Unlisted Property Trust, these can pay investors a monthly yield at 7% per annum with added tax benefits. This contrasts with Listed Property Trust which typically pay investors a dividend twice a year, or in some instances, quarterly. As seen on the chart below, certain ULPTs with institutional grade assets can pay higher distributions and more frequently than listed peers.

Source: Fawkner Property, Refinitiv Data, 23 July 2021

3. Do I want control over the assets that I pick to invest in?

Investing with clarity over exactly which assets you own. Answer: Unlisted Property Trusts

This is an incredibly important differential between LPTs and ULPTs, particularly closed ULPTs. Shareholders in LPTs rely on the executive and management teams to make the decisions of when and where to invest.

This differs from closed ended ULPTs, where investors can see the exact portfolio they are investing into before deciding to invest. Therefore, investors who want full control over what the real estate they want to own would likely prefer investing in unlisted property.

When investing in Listed Property Trusts the management team is just as important as the underlying property exposure you are wishing to invest in as they are in control of the decisions. In his 1994 annual shareholder meeting, Buffet said one of the key yardsticks on how to judge management is “how well they run the business… and seeing how they have allocated capital over time”. Further he stated that you should assess how they have treated management in the past; “see how they treat themselves versus how they treat the shareholders”.

4. Am I willing to be diluted if I don’t agree with new acquisitions or can’t invest more capital?

Choosing your investment with clarity for the long-term. Answer: Unlisted Property Trusts

Between March and July 2020 during the COVID-19 pandemic, Listed Property Trusts in Australia raised over $3.1billion in new equity capital. For investors that could not, or did not want to, participate in these abrupt capital raisings the average dilution to retail shareholders was 18.70%. I.e. New shares were issued and purchased by institutional shareholders, diluting the value the shares owned by of retail shareholders.

Whilst some open-ended unlisted property trusts have variable strategies, most closed ended Unlisted Property Trusts have defined portfolios from the outset.

5. What is the quality of the property(s) I own?

Investing to own institutional grade properties? Answer: Listed Property Trusts or Certain Unlisted Property Trusts

Listed Property Trusts own over $100bn of Real Estate in Australia. The largest assets in which LPTs own are Office (over $44bn) and Industrial (over $22bn). Given their size and ability to raise capital, large institutional grade assets are often owned by LPTs as they can afford to pay prices that direct investors or ULPTs cannot. As a result, LPTs own assets of from very small values all the way up to multi-billion-dollar valuations.

For example, Chadstone Shopping Centre, Australia’s premium retail centre owned by Vicinity Centres has a value of $3.88bn. Conversely, it is rare to see unlisted property trusts owning assets above $500mn dollars. However, the size of the asset has no correlation with the size of the return on your investment.

Investors looking to own institutional grade property should look at ULPTs managed by high calibre managers that have the capacity to transact on larger assets or at LPTs.

4 topics

1 stock mentioned