Who are the ESG leaders of tomorrow?

Firetrail Investments

Sustainable investing is a phenomenon.

According to the Global Sustainable

Investment Alliance , US$35.3 trillion, or

more than a third of all assets in five of the

world’s biggest markets, are now managed

sustainably. Looking ahead, accounting giant

PwC forecasts between 40-60% of mutual

fund assets will be ESG focused by 2025. According to Barrenjoey, the Australia/NZ market has $US26bn in ESG in funds under management, with net inflows into ESG products of around $US10bn per annum.

Interest in sustainable investing has been fuelled in-part by media coverage of extreme weather events, geopolitical tensions, and post-covid societal changes.

Investors have also increasingly questioned the ESG credentials of the companies they are investing in. Assisted by external ESG ratings providers, equity markets have been quick to identify companies that are sustainable champions and have re-rated their share prices significantly.

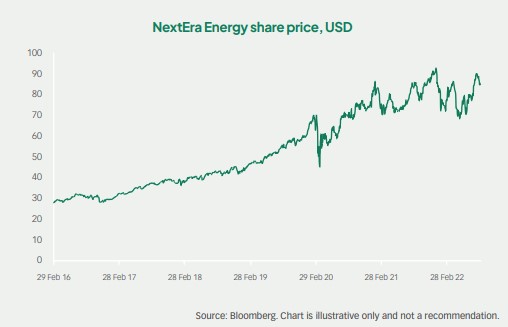

For example, NextEra Energy is the world’s

largest producer of wind and solar energy. The

company is rated AA by MSCI. At the start of

2017, the company traded on a price/earnings

multiple of 19x. Today the company trades on

a multiple of 34x. NextEra has generated a

5-year annualised return of 22%, versus a sector

median of 11%.

Large companies have also benefited from the

ESG investing phenomenon. There is a focus on

companies that display corporate best-practice,

which often means building an in-house

sustainability department that has the capacity

to implement the right policies to achieve a high

ESG score. It is often the larger, higher quality

companies that have had the financial resources

to do this.

The ability of the mega-cap growth and quality companies to achieve a high ESG rating has led to many investors allocating capital to sustainable strategies that are highly correlated with a standard global equity approach, which also exhibits a similar factor bias and risk profile. This has led to underperformance of the average ESG global equity portfolio of around 630 basis points relative to the MSCI AC World Index.

At Firetrail, we believe that it is important

to look beyond the current champions

in positive change that often trade on

expensive valuations and are often owned by most global equity funds (think Amazon, Alphabet, and Meta). By backing overlooked

companies that are early in their positive

change progress, and facilitating their

journey through stewardship, it is possible

to generate meaningful alpha for clients. As

these companies improve their sustainability

credentials in the eyes of the market, their

share prices are likely to re-rate higher.

There are three investment signposts investors should look for to identify the ESG leaders of tomorrow.

1. Sustainable

companies deserve

premium valuations

– Companies that

the market perceives

to have sustainable

characteristics, such

as good environmental

practices, a social license

to continue operations

over the long-term,

or strong corporate

governance, deserve

premium valuations

relative to companies

that do not.

2. Share prices follow

earnings – No matter

how undervalued a

company may seem, if earnings expectations

are downgraded, the share price will

generally fall. Companies generally reach

fair value when they meet or beat market

earning expectations.

3. The market is slow to recognise positive

change – Companies can change for the

better or worse. Fundamental analysis is the

best way to uncover companies that can

benefit from positive change in their business,

industry, or markets.

A improving ESG proposition from a company also creates shareholder value as it facilitates top-line growth, reduces costs, minimises regulatory and legal interventions, improves employee productivity, and optimises investment and capital expenditures.

Looking beyond the traditional sustainable champions, towards the leaders of tomorrow, is an approach to global equity investing that is rarely used by investors today. Sustainable investing isn't an investment risk to be managed, it is an enormous investment opportunity.

4 topics

Expertise