Why I like these Crazy-Eight China A-Shares

Everybody knows the famous Warren Buffet line on investing:

Be fearful when others are greedy and greedy when others are fearful.

I am not as successful as he, but I do have my own down under version:

When China is collapsing (again) get greedy for any contrarian investment.

I did a bit of rudimentary Google trends investigation and found that China is actually in the midst of (yet another) social and economic collapse.

Ding went my "Peak Stupid" dashboard light!

It is time to assemble my Crazy-Eight list of contrarian A-share bets for 2024.

However, first let us consult the stars, via the venerable Hindustan Times, for a reading on the coming Chinese New Year of the Wood Dragon.

For Dragons in 2024, it's a year of creativity and lots of new ideas. But it's important to stay down-to-earth and avoid being too arrogant. Money-wise, things look good with prosperity on the way.

Call me a scamp, but I bet that will prove more accurate than the think-tank nonsense.

In 2024, remember to answer the door when opportunity knocks.

Just jump straight to the end if you want the skinny on my selections.

Geopolitics from a contrarian viewpoint

Let me start by repeating some current widely held beliefs:

- China is run by one man, and his name is Xi Jinping.

- China is intent on a revisionist program of military-led expansion.

- China depends entirely on access to Western technology to make progress.

- China can be stopped in its tracks with Cold War style containment policies.

While I understand the heartfelt patriotic sentiment that supports these viewpoints, I do not agree with each and every one of those pearls of conventional wisdom.

I think that each of those four assertions is wrong.

Needless to say, we live in a representative parliamentary democracy. Everyone is entitled to their opinion, and it just happens that mine does not align at all closely to the prevailing viewpoint of the financial establishment, as reported in our press.

For the sake of brevity, let me not dwell on why, exactly, I disagree with each and every one of the above statements. Understand that I am an investor. It is not my job to change what the market thinks about the valuation of securities. I don't actually care about that mission.

From my perspective, as an investor, it is my job to exploit situations where I think that the markets have got it wrong, and then to position appropriately when the ratio of perceived investment risk to perceived investment reward looks favorable to me.

The word perceived is key, since we are discussing investor perception.

The contrarian in me becomes excited whenever I discover that my perception is wildly at variance with the common investor perception. I act when I think that the perception gap seems set to close in my favor. That is how I think. That is also how I invest, always.

However, such circumstances are pretty rare. If I see no perceptual chasm in the financial market, then I would be happy to own an index fund.

In my view, the secret to long term success is to wait for the fat pitch.

The courage to act, and the choice of when to act, are matters of pure psychology.

The value of patience to a contrarian investor

In my case, I am mostly at risk of acting too early. For example, I anticipated the likely issue with Credit Default Obligations (CDO) in a broker research note from July 2002.

In that research note, I essentially nailed the key systemic financial risk:

These CDO instruments were un-provisioned financial insurance contracts.

You could readily make money selling insurance, without ever having to demonstrate that you could actually pay out on that insurance promise, in the event of a future claim.

How did I, personally, exercise patience in acting on that insight?

Fast forward to Christmas Eve in 2007. That was not my favored choice of day on which to telephone my boss and resign from my then job to take a new one. However, I could smell financial trouble brewing, and knew that the US firm I worked for was a major investor in several US-listed financial institutions that were heavily exposed to CDO failure risk.

Sound financial decisions involve trade-offs and can be personally vexing.

I left the best boss, and best job, I ever had because I feared my employer would soon be in a lot of financial difficulty. I did this after I had attempted to raise the alarm internally. Since it was not my job to run the company, I left it when it was clear to me that it was in trouble.

I assured my then boss that I loved him to bits, and I was leaving my best job ever because I thought that a major financial crisis was imminent. He understood when I told him I was to join an Australian-based investment bank, which I thought had minimal CDO risk.

For the record, my boss left the same firm a few months later. I rode out the GFC with a great job in a different firm. I was personally invested in cash, gold, and treasury bonds. On the other hand, my former firm went on to be the top institutional investor in all five of the top financial bankruptcies in the USA. Less than one year afterwards, the then CEO was pushed out, all before Christmas Eve of 2008. That is what actually happened.

I don't say this to gloat. The outcome, for everybody, could have been a great deal better.

I say it to emphasize that I am a contrarian individual. I do what I think is right, not popular.

If I think that I am surrounded by people whose mission is to jump off a cliff, then I feel no obligation whatsoever to join them. My own father used to say to me:

You are not your brother's keeper.

He was a very religious man, involved greatly in pastoral service as a minister in the Church. He knew, full-well, that I was an opinionated atheist, but he also knew that there is no social value in scolding people for their own choices in life.

You make your own bed, and you lie in that.

Why do I think this is the appropriate time to invest in China?

In simple terms, the global inflation story is moderating, and it looks like we are set up for a general market recovery from tight financial conditions. This is especially true for emerging markets, like Brazil and Mexico, which are among our favoured single country picks.

There is nothing especially controversial about this call. It is normal to see a period of market consolidation, through investor rotation away from safe-haven investments, once monetary conditions begin to ease. We are not completely out of the woods yet, but I would expect a classic period of US dollar weakness, firmer commodity prices and yield curve steepening.

Paradoxically, I think the story of this cycle, that is now passing, is that the US yield curve did correctly tell us what would happen outside of the USA, namely recession. This reflects the extreme importance of US monetary conditions for the health of the global economy.

What has fooled everyone, including me, is the absence of a US recession.

Rarely do investors have the luxury of knowing why something that was widely anticipated did not, in point of fact, happen. It could just be a question of timing. However, clearly something did support the U.S. economy through this extraordinary period of monetary tightening.

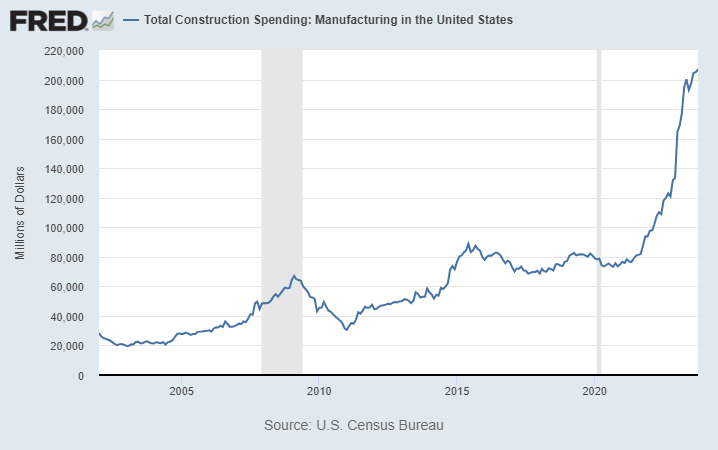

While I, like many, expected a U.S. recession in 2023, the signs are that the economy has likely dodged a bullet. In casting around for an exceptional factor, I am struck by the boom in Total Construction Spending: Manufacturing in the United States, as per the U.S. Census Bureau.

It is important to put this chart in the proper perspective. In the period from 2002 through to 2022, U.S. Construction spending for new factories grew by a factor of four. In the two years since that time, it has nearly tripled. This has been an extraordinary boom.

The proximate cause of this activity boom is the Biden Administration fiscal support provided by tax incentives for U.S. private business to build new factory capacity. This has occurred via the CHIPS and Science Act (2022), and the Inflation Reduction Act (2022). There are fiscal measures, within both acts, to support a significant expansion in US capacity.

The resulting factory construction boom has helped support U.S. economic activity through the period of monetary tightening, through the usual multiplier effects of construction.

This was specifically noted by the U.S. Department of the Treasury in a penetrating analysis from June of 2023, Unpacking the Boom in U.S. Construction of Manufacturing Facilities.

There are two key findings to note, which I selectively quote, from that article:

- The boom is principally driven by construction for computer, electronic, and electrical manufacturing—a relatively small share of manufacturing construction over the past few decades, but now a dominant component.

- While it can be difficult to compare such granular data across countries, the surge appears to be uniquely American—not mirrored in other advanced economies.

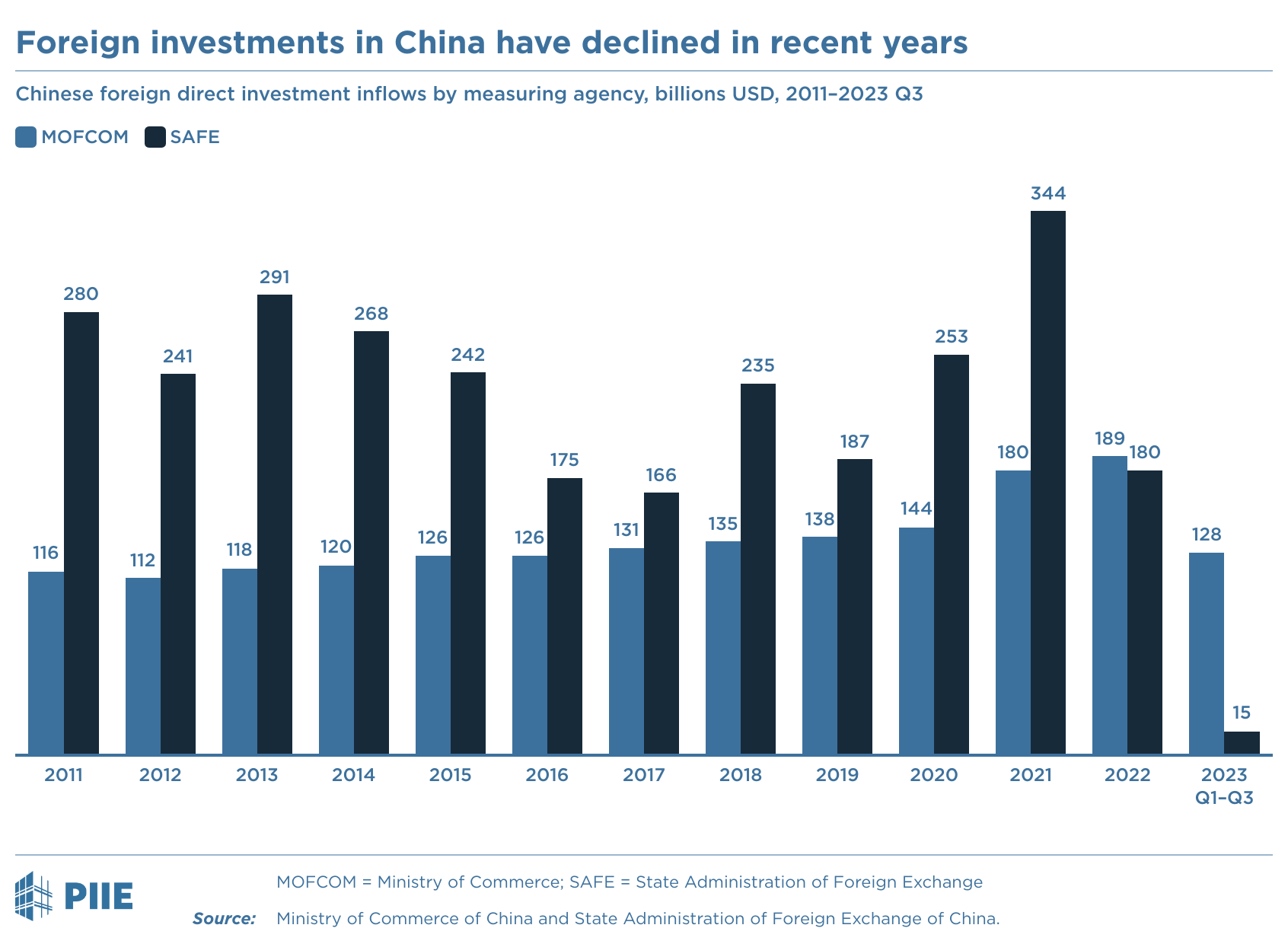

Evidently, the boom underway is policy-driven, and not mirrored by any clear demand trend elsewhere. Indeed, it has been widely noted that Foreign Direct Investment (FDI) into China has collapsed to essentially zero over the same corresponding period.

The chart below from the Peterson Institue for International Economics shows this trend in stark detail. Clearly, there is not a foreign-led factory construction boom in China.

Some may view this as decisive evidence that China has lost the battle in the U.S. versus China everything-but-all-out-war war. Indeed, if you look at the quantum of lost FDI, and square the accumulated investment lost, with that gained in the USA, it might readily appear so.

Debate on this question is likely to be the key market obsession of the coming year.

You can see from how I titled this section, that I am a contrarian.

Surely, with the data you just presented, China must be a sell, not a buy.

That is not my conclusion, and the reason has to do with tactics versus strategy.

The difference between tactics and strategy

What matters with investment is whether you make a return on the investment.

The tactics employed by the Biden Administration center on harnessing private enterprise to go build a whole bunch of new factory capacity when there is no clear market demand. This may be admirable in the intention. However, U.S. enterprise needs to make a profit on the investment for this to pay off. The device of tax rebates has certainly amped activity and facilitated a boom in factory construction when market signals suggested a recession.

Definitely, fiscal stimulus can help sustain economic activity through a period of weakness.

The problem I anticipate, and the reason I am not dismissive of China's prospects, is that the new factories brought online will need to make a profit on their sunk cost. The tax credits did incentivize construction, but the choice to make investment in the USA was driven by these, and not the actual cost structure of manufacturing within that country.

During the same period that U.S. factory construction boomed, China has experienced weak producer pricing dynamics, and the natural deflation that happens in a slowing economy.

The essential problem, for the Chinese economy, has been the evident lack of any massive fiscal stimulus through a period of government enforced credit tightening in real estate.

I think there has been enough public discussion of excess capacity in China for readers to readily grasp my key point. Excess factory capacity, in electronics, and aspects of the new energy transition, now looks baked in. What really matters, for the investment outcome, is which nation can best marshal their comparative advantage in manufacturing.

Historically, it was accepted that there were compelling advantages to locating factories in low cost, high productivity countries. Through a nationalistic impulse to re-shore manufacturing the USA has both erected tariff barriers and created tax incentives to attract investment.

I have no quarrel with the motivation for such a policy decision. The difficulty is whether such new capacity will prove competitive in anything but the domestic U.S. market. If it is cheaper to manufacture in Mexico, Brazil, India, or Vietnam, then why not build factories there?

I have no doubt that the USA can achieve its ambition to source more manufactured product domestically, at what will likely be a higher cost structure. This equilibrium is very plausible.

However, the politics in play seems to presume that China must fail as a result of this strategy. Implicitly, those who contend that geopolitics now guarantees a competitive retreat for China are presupposing that the new capacity in the USA will fill exports into global markets.

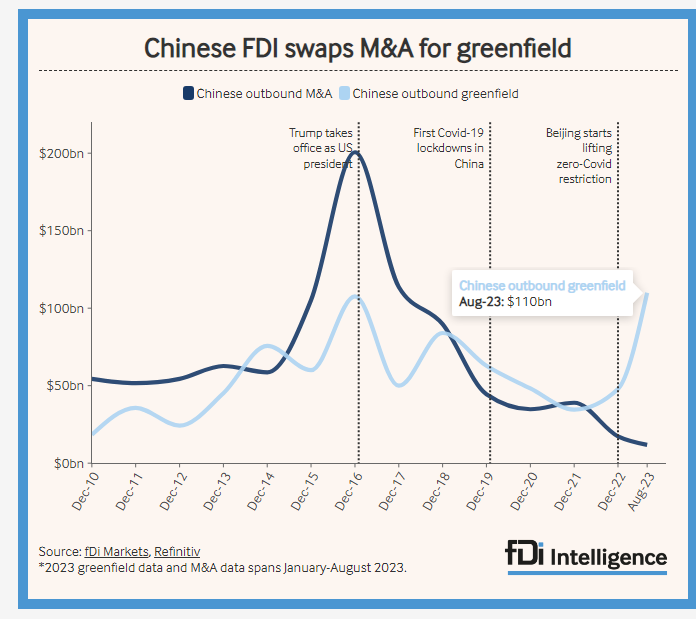

This seems very unlikely to me, since the USA did not build those factories to be competitive in the global market. In contrast, the strategic response from China has been to increase the outbound Foreign Direct Investment, from China into other developing nations.

This shift in strategy was well documented in a piece by Seth O'Farrell, writing for the research firm fDi Intelligence. There is an excellent chart in his article, which I reproduced below.

Source: Refinitiv Data, fDi markets, as reported by Seth O'Farrell (October 2023).

China has gotten the message that M&A is not welcome, so they are building new factories.

It is too early to call this trend definitive, but I am happy to draw an investment conclusion.

Due to the evident re-focusing of foreign capital, away from inbound China FDI, and the rising restrictions on Chinese outbound investment in Western nations, China has elected to parlay its own manufacturing expertise into building new factories, which it controls, located in developing nations.

This is the difference between tactical thinking and strategic thinking.

The disruptive power of the BRICS+ bloc in global markets

The problem, that I anticipate, and the reason why I am now ready to buy selected issues in the China A-Share market is captured in a recent piece in The Asset magazine, by longtime China watcher Stephen Roach, entitled: US tactics lose to Chinese strategy in tech war.

The job of a good analyst is not to gild the lily. Leave that to the folks in marketing.

Quoting Sun Tzu, Roach is no stranger to the effective use of "fire for effect":

Tactics without strategy is the noise before defeat.

Ouch!

His essential point is that the U.S. continues to pursue tactical window-dressing, through extraterritorial sanctions, tariffs, trade policy, and now tax credit led industry policy, at the expense of long-term strategy. I am inclined to agree with his viewpoint.

He mentions the example of the "smart phone" war and the ongoing saga of Huawei.

Huge political capital has been expended by the USA in the attempt to encourage allies to reject Huawei telecommunications equipment for 5G mobile operations. The collateral damage to these measures was the Huawei Mate smart phone business.

Excuse me, but I never considered a smart phone to be a weapon of mass destruction. I thought it was what folks used to waste time not working.

There you go, I was wrong. Life, as we know it, depends on Huawei not making smart phones.

There was great commotion, a celebration of tactical victory, and then a tactical defeat.

I think that this will be the unfolding pattern. One tactical victory to the USA, for every new restriction on China's access to US-sourced technology, followed by a tactical defeat once China engineers a way around that restriction.

The Chinese strategy will be unchanged:

Pursue a whole-of-nation effort to ensure no such foreign leverage remains.

The assumption underlying the US strategy is that this peacetime restraint of trade, when there is no actual war, will ensure that the USA retains a permanent technological edge.

In my view, the outcome will likely be the exact opposite to this stated policy intention.

The USA has an ever-expanding arsenal of tactical economic weapons.

China has one unrelenting long-game development strategy.

I think that tactics will be defeated by strategy.

What is the Chinese strategy?

Whereas, for domestic political reasons, the USA would like to decouple from dependency on Chinese imports, the effect of these progressively ramped sanctions is to instruct China on where they should expend most effort to ensure that they are not restricted by the USA.

Since the stated aim is to prevent Chinese military development, but the US sanctions are so poorly targeted that they now impact a wider array of purely commercial activity, China will simply double down on Made in China 2025. The US tactics have simply validated it.

The reasons why I think that the US policy will not work are two-fold:

- When measured by purchasing power parity China is already the largest market.

- When measured by scientific citations, China has clear domestic innovation capacity.

In seeking to contain China, US policy will likely embolden China to respond in two ways:

- Double down on long-term government support to enhance domestic innovation capacity.

- Pursue geopolitical efforts to cohere new markets for China in trade outside the US bloc.

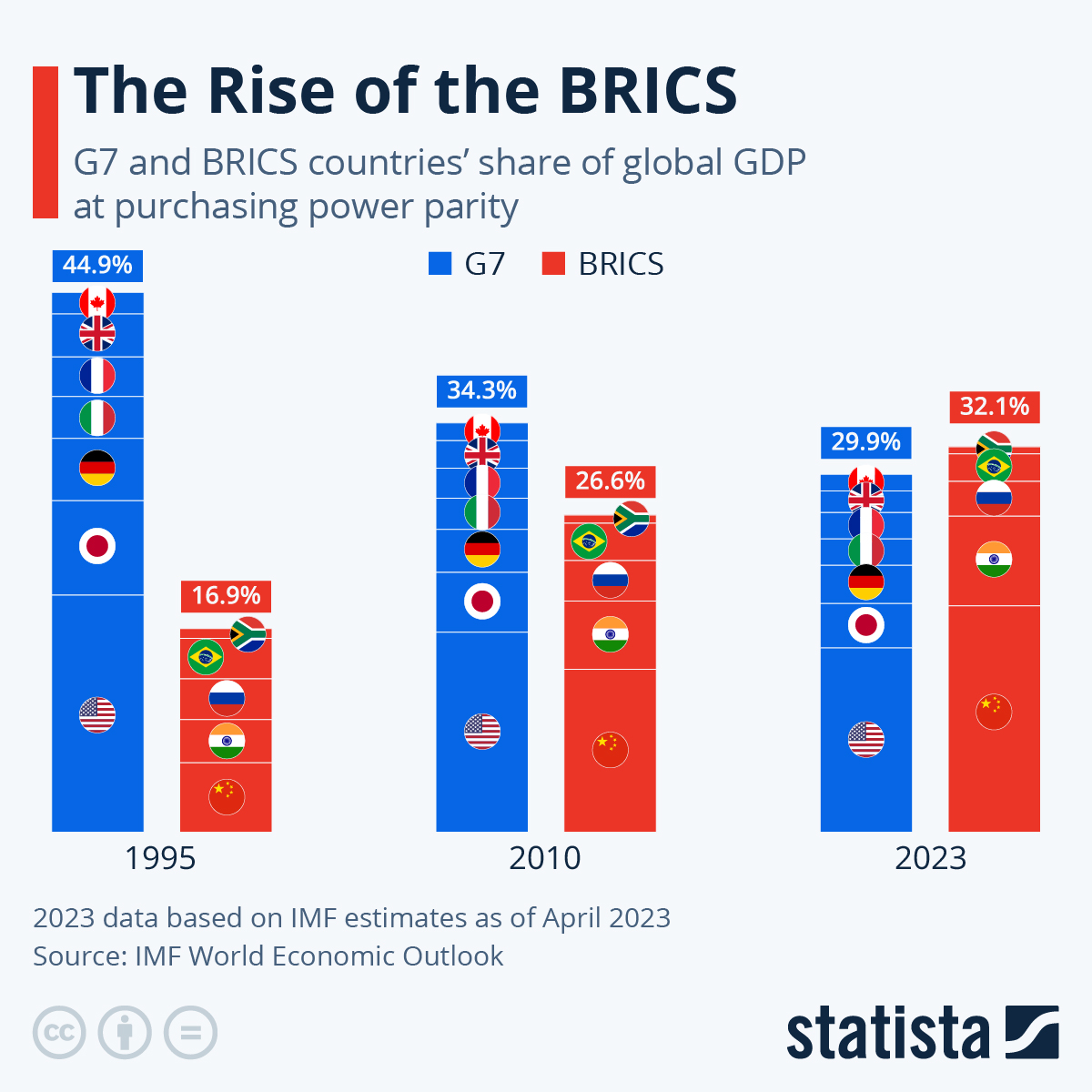

Since the US bloc is a smaller global market, the major prize for China is the BRICS+ market.

While the combined purchasing power of the BRICS+ bloc exceeds that of the G-7 grouping the per-capita GDP levels are significantly lower. The investment opportunity is crystal clear. Manufactured goods sold into BRICS+ must be at lower unit-price points, and high volume.

This growth market can be served with a price-leading volume strategy.

China has recognized that, along with India, who cooperate within BRICS+ as frenemies.

Numerous nations within the BRICS+ community were already alienated by the US framing of the present geopolitical contest as a struggle between autocracy and democracy. This strikes a high moral tone on the (il)legitimacy of any government in the identified autocratic grouping.

This is (presumably) why none of the original BRICS members supported sanctions against their fellow member nation Russia, for its unprovoked invasion of Ukraine.

Developing nations bristle at the notion that their governments lack legitimacy. They are also annoyed at Western dominance of global economic and financial institutions. These are the social facts that lie behind the advance of the BRICS+ geopolitical movement.

The founding principle of the United Nations is that nationhood is the requirement of any membership of that organization. There is nothing in there about the form of government.

Clearly, China views the BRICS+ movement as positive for developing new markets. There is a grab bag of nations, whose approach to governance is very different, but which share concerns about their own economic development, hopefully on terms more favorable to them.

The approach is looser than the original European Common Market, but analogous.

Many in the West scoff at this grouping and insist that it will not succeed.

I am open minded.

What about the Taiwan question?

Taiwan is a greatly respected democracy, but it is not a member of the United Nations.

It may shock some people to learn that, but it is the case. The history is long, and convoluted, but lies at the very heart of present geopolitical tensions over the future of that island.

This is why the cause of Taiwanese self-government gains much respect and support in the international community, but not at the expense of their own right to self-determination.

On my reading of present geopolitics, China will most emphatically not accede to any claim that the Communist Party of China (CPC) lacks legitimacy to govern its own territory.

Equally, most thoughtful observers would likely urge China to respect the Taiwanese choice on what system of governance they choose to arrange their own affairs, absent any nation status.

China is certainly assertive of its own system of government and its claims to Taiwan.

We do have to worry that events might degenerate into outright conflict.

Will there by a war over Taiwan?

The Peoples Republic of China (P.R.C.) has made very clear that it views Taiwan, the sole place that the Republic of China (R.O.C.) was left in possession of at the end of the Civil War, as part of China. The Taiwanese have pursued successful self-government ever since.

The status quo, of no active hostilities, has largely persisted since 1949.

Could there be a war?

Yes, of course there could, but it is not likely the preferred option, for any party.

I won't debate the likelihood, except to reveal my relative ranking of possible conflict.

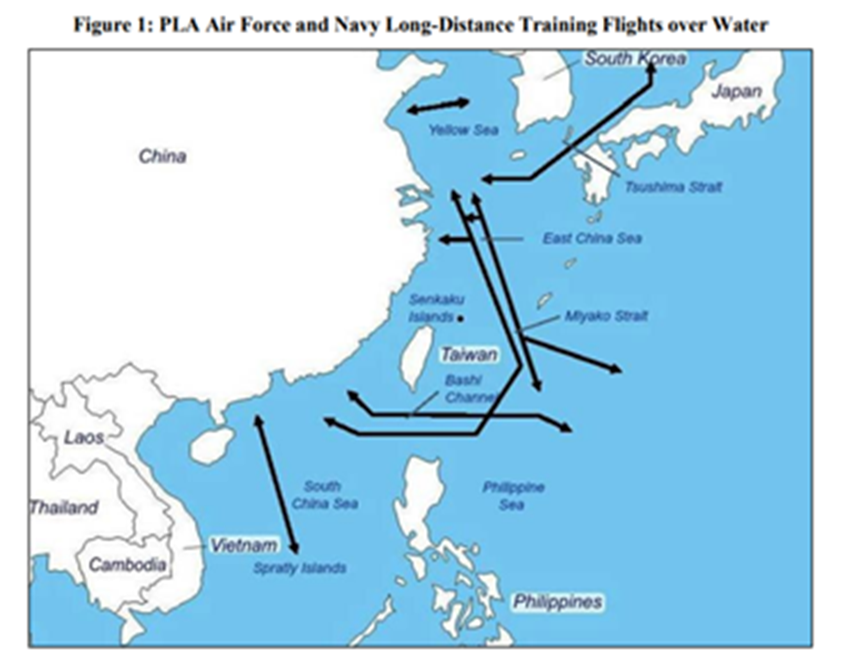

- A naval skirmish in the South China or East China Sea that escalates to war.

- A naval blockade of Taiwan, that most likely arises from an escalation of the above.

- An invasion of Taiwan, to occupy and fully assert a claim to that territory.

While the P.R.C. has not agreed to exclude the third option, it could certainly happen.

In viewing the strategic buildup, by China, of militarized islands in the South China Sea, my own strategic framework is informed by the history of the U.S. Monroe Doctrine.

This is not the popular choice among contemporary strategic analysts, perhaps because it is too obvious, and calls attention to past U.S. strategy in carving out their sphere of influence.

However, when I view the compositional changes of the Peoples Liberation Army Navy (PLAN), alongside the sortie mix for aircraft incursions into the Taiwanese Air Defense Identification Zone (ADIZ), it looks very much like concerted practice for Anti-Submarine Warfare (ASW).

I wrote, at length, about this in my 2021 wire: What is going on over Taiwan? Subsequently, there have been other analysts who have drawn a similar conclusion.

Of course, there is the madman theory of history which holds that we must read the mind of the principal actor, Xi Jinping, to determine what military strategy China might pursue.

However, from where I sit, this looks like an indefinite holding pattern of provocation, and counter-provocation, to enforce the prospect of a future war over a patch of ocean.

Whomever wins that skirmish, or a larger war, gets bragging rights over a patch of ocean. Fish don't vote, so it won't be about democracy or autocracy. It will be about military power. In ancient times, they called that a balance of power.

This is the Chinese version of the Monroe Doctrine playing out in real time.

I do not, personally, think that a Chinese invasion of Taiwan is imminent because, over the past decade, China reduced their fleet of landing craft, and greatly expanded their fleet of corvettes.

This is consistent with a muscle-bound assertion of influence in those seas China covets.

The larger Chinese strategy is not military but economic.

In short, it is the buying power represented by the Chinese market, coupled with its need to find new markets, when the USA and Europe seem to be closing, that will likely cohere the global order that emerges from this period. I doubt that this will follow present US edict.

China has the domestic innovation resources, the commitment to new markets like electric vehicles, solar energy, wind turbines, energy storage, smart cities and IoT, and decades of practical experience in expanding the production frontier at ever lower price points.

This dynamic now seems set to converge with the aspirations of BRICS+ nations to become better masters of their own destiny. Part of that involves parlaying with the USA to set aside objections to their chosen form of government. The other part involves parlaying with China over the terms and conditions to grow cost-effective manufacturing in their own countries.

Since the USA has chosen the rubric of onshoring, and reshoring, of manufacturing, the door has been effectively shut, by policy, on directing investment to build factories and capacity within developing nations. That approach is still taken by private enterprise, ex-China, with China+1, through China+N, multi-sourcing strategies. However, Chinese firms are also very open to this strategy, as has been demonstrated by outward bound investment trends.

Vietnam has attracted greatly increased foreign direct investment, but China is the nation which dominates this trend. This is the Chinese version of China+1.

In my opinion, what will ultimately matter is the scale of the end-market opportunity.

The USA chose to label many nations within the BRICS+ grouping as autocracies, inside of a geopolitical framework defined as an existential fight between autocracy and democracy.

The result of this deliberate choice of strategic framing is that the USA now lies at the center of a rich nation bloc, effectively the G-7, and others, pitted against what is now called The Global South. This strategy is unlikely to succeed since the majority of global purchasing power is not to be found in the rich-country grouping. It exists within the BRICS+, and its exosphere.

The commonplace analytical position, within the mainstream, has been to claim that this large BRICS+ bloc of purchasing power can only develop economically at the pleasure of the West.

In previous times, this would have made perfect sense as there were no other global centres of science and technology innovation. With the growth of China and India, this is no longer true. Chinese science is now very good, and India is not so far behind in most important areas.

Huawei may be the subject of sanctions, but the chip design capability of Hi-Silicon is of global caliber. The engineers proved that they knew how to design world leading chips. For this they were punished with the effective denial of their means to get those chips fabricated.

Huawei has responded by doubling down on R&D to develop their own Electronic Design and Automation (EDA) tools, alongside efforts with SMIC to harness advanced patterning, in the lithography process, to achieve manufacture at 7nm process nodes, and perhaps beyond.

Since the product lines that were disrupted, at Huawei, were consumer items, such as smart phones, it is exceedingly hard to contend that the USA occupies any high moral ground.

This is simply the exercise of extraterritorial restraint of trade because you can.

That message is already very clear. It likely accelerated the BRICS expansion to BRICS+.

Since China is now proving effective at bringing down the cost of electric vehicles, solar panels, energy storage batteries, and wind turbines, by a very large margin, their intended strategy ought to be clear for any analyst with the patience to examine the data.

China clearly intends to replace the lost US and European market with a BRICS+ market. To succeed, they must meet the lower unit-price point.

The price point of an EV in the USA might be $50,000 per vehicle. In order for China to be successful in developing the purchasing power of the BRICS+ they need to hit $10,000.

The leading Chinese manufacturer of New Energy Vehicles (NEV), namely BYD, has already hit that price point and is now ramping volumes of global exports. There is very little prospect of any manufacturer in the USA, or Europe, every reaching that delivered unit-price point.

China knows, full well, the experience of Japan when it started to penetrate the US automobile market and was ultimately forced to build factories in the USA to preserve local employment.

China did not wait to be asked by prospective partners in developing nations to go build new automobile plants and battery factories in those nations. They are doing it in Thailand. They are doing it in Indonesia. They will do it in Brazil, and most likely also in Hungary.

These factories will be producing cars that are affordable for the people working in them. Decades prior, Henry Ford pursued the same strategy.

This does not mean that China will be welcome for any activity in every country.

India is becoming an obvious target for Western firms to invest, in order to diversify their manufacturing away from China. This measure is entirely healthy, and most welcome.

However, where I think that my perception of the present global market differs most clearly from consensus is the emphasis China is giving to appropriately priced products.

Now that solar panels can be made for less than $0.15 USD per watt, and China has developed the necessary factory automation to do so at scale, with consistent quality, the addressable global market opportunity is greatly expanded. The solar market will now grow like topsy.

However, this growth is not likely to proceed at a pace in the USA, or Europe. Those markets will likely respond with new tariff measures to protect local capacity. This is an old economic movie that some of us have seen before. I have lived through it once already, in the 1970s.

The economic prize, of market growth, will go to whichever party can deliver the best product value in the hands of the customer. We are witnessing the birth of the Chinese Multinational Corporation (CMC). Not very far behind, will be the Indian Multinational Corporation (IMC).

Since I remain ever alert to under-appreciated opportunity, let me run with the China play first.

What makes this work is the sheer scale of purchasing power in BRICS+, at the China price. There is no longer much of an obstacle to this strategy, since China can now innovate to surmount almost any obstacle that the West might choose to put in its way.

This has absolutely nothing to do with the military.

It is commerce, pure and simple.

My favoured picks in the China A-Share market

There are many readers who cannot buy stocks in the China A-Share market. However, those who meet professional investor criteria can do so through Interactive Brokers. I believe that this is also possible through Saxo. I doubt that too many readers are set up to do so.

The local Australian financial market seems to have few options to place such securities into a model portfolio, executed on platform, so this is mainly a sophisticated investor play.

There are Australian fund managers who are active in China A-Shares.

These positions are going into our global Self-Managed Superannuation Fund (SMSF).

My partner and I have managed this since 2011 and have been underweight China and Hong Kong markets for most of that period. We are now raising exposure to emerging markets.

You should always consider seeking licensed professional financial advice before making major investments. This is especially true of the China A-Share market due to the language in which disclosures are made being most commonly Mandarin.

I have spent many years operating in global markets and am used to using language services in order to better understand my investments.

Not everyone speaks English. I get that.

The more productive angle, for most readers, is to consider my arguments in relation to possible investment opportunities, in the emerging markets, most likely via ETFs.

Note the following Reuters exchange mnemonics:

- HK is the Hong Kong Stock Exchange

- SZ is the Shenzen Stock Exchange

- SS is the Shanghai Stock Exchange

The last two do not appear to be available in the Livewire platform.

You also need to check the HKEX for eligible securities for trading.

You also want to know about the US Office of Foreign Assets Control (OFAC), which maintains lists of US sanctioned firms and individuals, along with the US Bureau of Industry and Security (BIS) Entity List, where most US actions against semiconductor firms are listed. This aspect of contemporary geopolitics is a nightmare. Note that any of these firms may be sanctioned.

At the time of writing, none of the firms mentioned appear to be on any US list. However, I do not assume responsibility for the accuracy of that statement, as and when you read this. You have been duly warned of the risks.

The issue is most cogent for US nationals. You should seek advice before taking any position.

These lists can change, without warning, and the overall process seems quite arbitrary.

For instance, Senator Marco Rubio was advocating recently that CATL should be listed for alleged sourcing of lithium from the Xinjiang Uyghur Autonomous Region (XUAR).

There is a possible "presumption of use" for forced labor due to the alleged point of origin.

None of these allegations, toward CATL, seem to be substantiated with hard evidence.

You have been warned, and I devote considerable attention towards figuring out what new US sanctions measures will come next. You can take it on your own advice about what to do.

Suffice to say, CATL powers 36.8% of the global EV market.

Perhaps worry about receiving delivery of your new electric car, if that firm is ever sanctioned.

With those disclaimers out of the way, here is my Crazy-Eight list of A-Share picks.

1. Contemporary Amperex Technology (CATL)

SZ: 300750

This company is the world leader in lithium-ion battery manufacture with around 36% global market share of the electric vehicle market. The firm has a market capitalization of around $100B USD and has traded on the Shenzen market since its IPO on 11-Jun-2018.

The firm is currently profitable and has traded with a net margin of around 10% throughout the recent period of rapid business expansion. It currently trades on a PER of 15.34x trailing, with a one year forecast multiple of around 12.6x, for FY Dec-2024.

CATL batteries are used by major international auto makers such as Tesla, Ford, NIO, Li Auto, Xpeng, Volvo, Hyundai and Toyota, among others.

For such a market-leading position in battery technology I think the firm is absurdly cheap.

2. BUILD YOUR DREAMS (BYD)

SZ: 002594, HK: 1211

BYD is the leading NEV manufacturer worldwide. The firm has a market capitalization of $77B USD, is currently profitable with a net margin of around 4%. It currently trades on a PER of 18.19x trailing, with a one year forecast multiple of around 13.7x, for FY Dec-2024.

This company first became widely known when Warren Buffett and Charlie Munger bought into the firm way back in 2008, with a stake of around 9.9% of the outstanding shares.

They have since reduced that stake considerably, most likely due to geopolitical tensions.

Berkshire Hathaway has a very high profile in the US market, and the US attitude towards any firm that does business in China has become quite hostile. I understand the sensitivity.

However, I am not an American. I am an Australian. I live in an altogether different country.

Our largest company, BHP Group, makes most of its revenue in China.

Our nation, Australia, makes most of its export revenues in China.

I am not hostile towards BYD competitor Tesla.

I own and drive a Shanghai manufactured Tesla Model 3 in a nation, called Australia, which does not make any automobiles outside of the specialist track and super-car market.

I can observe, in my own market-leading EV-adoption locale of Canberra, an ever-increasing array of BYD vehicles, of several model types, in a generally welcoming domestic market.

I can also observe that China accounts for 60% of global EV production, and that BYD is now the acknowledged market leader in global sales of New Energy Vehicles (NEV).

With due deference to the wisdom of Mr Buffett, I am happy to buy and hold BYD.

3. Midea Group

SZ: 000333

Midea Group is probably the largest Chinese appliance manufacturer that you never heard of, with divisions in consumer appliances, Heating Ventilation and Air-Conditioning (HVAC), and robotics and automation. They own Kuka Robotics, which was formerly a German firm.

This firm is very modestly valued, with a potentially huge opportunity in BRICS+ markets. It does not seem to be widely followed by Western analysts. I think that is a mistake.

The firm has a market capitalization of $52B USD, trades at 1x times revenue, has a yield of around 4.66%, a trailing PER of 11.08x and a forward PER of 10.05x. I think it is cheap.

The firm was founded by He Xiangjian, some 55 years ago, in 1968. He took a collection from fellow villagers to purchase equipment to run a plastic bottle lid factory. That enterprise has since grown to a $55B USD enterprise. This has not been without controversy, most notably with a major product recall of defective humidifiers in the US market, back in 2017.

That issue appears to be resolved now, although further growth by acquisition in Western markets is unlikely. HVAC, robotics and electromechanical are the main areas I think are interesting in the context of the global energy transition.

It remains to be seen if the company can fully recover its former growth trajectory, but the valuation is undemanding, and I think the emerging market opportunity is clear.

4. SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS

SZ: 300760

Hokey names do not speak to capability. I first heard of this company when lying on a hospital bed, at Royal North Shore Hospital in Sydney, in 2014. I needed an emergency ultrasound examination, which confirmed a massive blood clot in my leg, as a result of a DVT from air travel. I remembered the hokey name, Mindray. That distracted me from the thought of dying.

This firm was venture financed by Walden International back in 1997.

The firm made an IPO on 16-Oct-2018, on the Shenzen exchange.

It produces a range of high-end biomedical equipment from ultrasound machines, through patient monitors, to anesthesia workstations.

Many will be found in an Australian hospital near you.

The firm has a market capitalization of $48B USD, has a yield of around 1.90%, a trailing PER of 29.83x and a forward PER of 24.82x. I think it is fairly priced for 20% growth potential.

There is a tendency, in Western financial markets, to presume that China cannot innovate.

I think that is baloney. Mindray is a good counterexample to that prejudice.

5. Advanced Micro-Fabrication Equipment (AMEC)

SS: 688012

This company operates in the semiconductor equipment space, with technologies that are not in the central focus of US sanctions on advanced node lithography tools for high-performance computing. It operates in plasma etching equipment and thin-film MOCVD equipment.

These are typically used to make Light Emitting Diodes (LED) and power devices.

It is possible that the USA may view LEDs as a threat someday.

Anything is possible, but the leadership heritage of this company, which was founded by Chinese-American semiconductor engineer Gerald Yin back in 2004 is quality. He has a history of innovative development, including contributions to development of Inductively Coupled Plasma (ICP), etching tools. The firm is not cheap, but interesting to follow.

Some commentators have taken the view that China has no right to develop any kind of semiconductor technology. I don't think that attitude is conducive to a peaceful world.

I do not see LEDs, or power devices, as a threat to democracy.

The US Government might well correct my thinking with a new entity list edict.

6. NAURA TECHNOLOGY GROUP (NAURA)

SZ: 002371

Naura is another semiconductor equipment firm which supplies a diverse array of etching, vapour deposition, crystal growth, vacuum technology, and battery and magnet making process equipment. This basic bread and butter to the global industry.

This firm does not appear to be sanctioned, but American employees had to stop working on any internal R&D projects. Presumably, all of these folks have now left. I don't know.

The presumption, behind US sanctions activity, is that there will be no downside, or blowback, to restricting trade in a globalized industry, or the career options of individual nationals.

Naura is pretty key to the Chinese industry.

Perhaps the US sanctions them and we get World War III.

I don't know. That decision is above my pay scale. Certainly, one firm to watch.

7. Jiangsu Changjiang Electronics (JCET)

SS: 600584

JCET Group may soon be in the crosshairs of further US scrutiny because they have a major market share position in global Outsourced Semiconductor Assembly and Test (OSAT).

This is the downstream part of the semiconductor industry where chips are assembled into various forms of advanced packaging and tested for functionality and quality control.

The so-called chiplet approach to semiconductor design involves combining individual chip dies, quite possibly from different process technologies, and assembling these into a single System in Package (SiP) end product. That is a cost-effective way to combine logic, with sensors, memory and possibly optical or radio communications chips.

It is a foundational technology that would certainly be damaged by sanctions.

Hypothetically, if the US were to sanction Naura, and to sanction JCET, then we could well get World War III, and World War IV, depending on the order in which they are sanctioned.

Of course, I am joking, but the threat is real.

8. ZIJIN MINING

SS: 601899, HK: 2899

Now we are out of the semiconductor swamp, and into our last Crazy-Eight play. This is global copper-gold firm Zijin Mining Group. This company has probably the best growth profile for any major copper producer, worldwide.

Copper is essential to the energy transition.

Australia is prospective for copper, but not too many projects are being funded.

The Democratic Republic of Congo (DRC) is highly prospective for copper, and firms like Zijin are funding projects to bring them into production.

They are likely to continue growing quickly.

I would pick this firm to lead the pack of global copper producers over the next decade.

Epilogue

We are now done with that journey through my Crazy-Eight A-Share selections.

Some of that was tongue in cheek. Perhaps you can guess which parts?

However, about all of these stocks, I am clear about one thing. I think that all eight firms are set-up well for the long term. Perhaps it is only mainland Chinese investors who buy shares in these companies? Perhaps the USA eliminates some of them?

I don't know.

I am just a humble investor who looks for stocks, anywhere on Earth that it is legal for me, as an Australian, to buy a share, who I think are doing something positive for their customers, their stakeholders, and the wider problem of providing humanity with what it needs. I do not think that this world will be made any safer by wantonly eliminating Chinese business.

There I have made my point.

Enjoy your holiday season break and happy investing.

Who knows? I may check in later and tell you how my Crazy-Eight went.

Credit: Eightball Photo by Sigmund on Unsplash

5 topics