Why Phil King remains bullish on Aussie small caps and resources

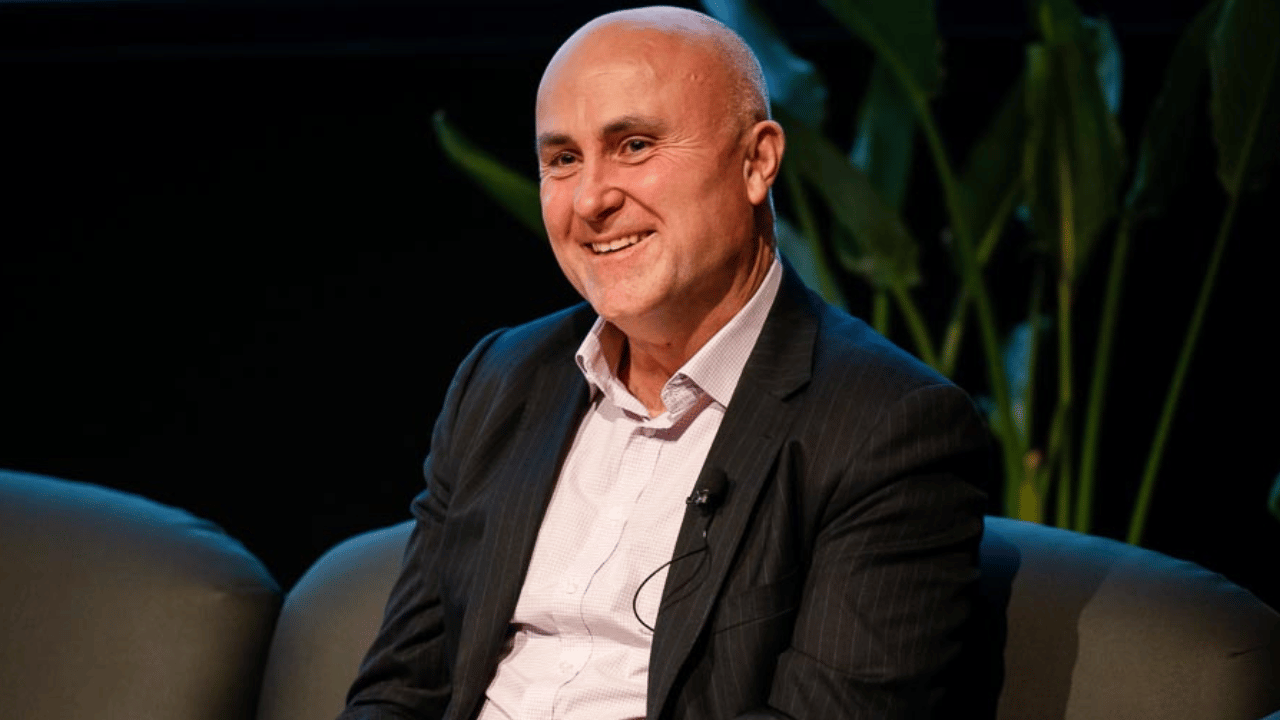

Phil King, chief investment officer of Regal Partners, is considered by many as a crucial part of the Australian market. A former colleague, Julian Barbaczy, told the Australian Financial Review last year that “the market needs him as much as he needs them.”

When this was put to him in a recent interview with Koda Capital’s David Clark, King modestly batted the suggestion aside. “I have no doubt the Australian market would continue to function perfectly well without us,” he responded.

But Regal Funds has become a prominent part of Australia’s finance sector, with around $11 billion in funds under management, up from $1 billion back in 2017. Regal operates across multiple parts of the market, with funds focused on emerging companies, resources, small-caps and healthcare and more recent additions of water assets and private credit.

.png)

“We’re not flipping stocks”

The asset manager is also regarded by many as a prodigiously active trader, with studies from the likes of Zenith suggesting its portfolio turnover is in the range of 1,000%.

King takes exception to this view, instead suggesting there are some parts of the portfolio where it is far more active than others, which boosts the overall average.

“The core of our portfolios is very consistent. In fact, I think part of the reason we’ve been successful is that we’ve held many of our stocks for many years,” King says.

“We’re not flipping them around trying to trade the whole time…it might sound a little inconsistent, but most of our core holdings are long-term holdings, though we do have a trading part of our portfolio.”

One of Regal’s top performers of recent times is its Small Companies Fund, which returned around 36% last year. As Koda’s Clark says, it has also delivered a 15% compound annual growth rate since it launched in February 2015.

“However, the volatility is there…[some have said] it’s the type of fund you put your money into and close your eyes,” Clark says.

He asks King to explain why he believes the volatility is worth the level of return.

“The last four to five years have been quite unusual in terms of the volatility we’ve seen in markets. And we all know small companies can provide higher volatility than the broader market, especially if you look at the mix of companies in the Australian small companies index,” King says.

Noting the prevalence of early-stage growth and resources companies in the index, he emphasises the distinction versus the broader Australian market: "Which, dare I say, is a little bit more boring, containing banks, supermarkets and Telstra.”

King also stresses that the Regal fund is a 150/50 strategy, investing $2 for every dollar in the fund, with up to 150% invested long and 50% in the short book.

“When it works, it really goes well. When times are challenging, like all levered products, it can be more challenging,” King says.

Why Australian small-caps are different

“In the long-term, I have conviction that the smaller companies fund will outperform…that 150/50 structure not only allows to add more alpha on the short side but we can run our long positions slightly bigger than a long-only fund, which means the returns can be very attractive.”

At this point, Clark alludes to a view that Australia’s small-cap universe differs from those of other developed markets in having such an abundance of small mining companies “and maybe some companies that shouldn’t be listed at all.”

King rejects this assertion, instead referring to the different cycles in which the various parts of the index operate.

“Over many timeframes, small companies outperform. Our view has been for a while that over the next 10 years, small companies in Australia will significantly outperform the broader market.”

King’s reasons for this view hinge on his bullish outlook for resources and what he regards as underwhelming growth prospects among the biggest listed companies in Australia: “A lot of them are, dare I say it, ex-growth. So, we think small caps is a great place to be.”

A couple of prominent examples within the Regal portfolio include:

- Location services technology company Life360 (ASX: 360), and

- Insurance software services company Fineos (ASX: FCL)

How Regal makes money

During the interview, Clark also quizzed King on Regal’s fee structure, which has a clear tilt toward performance-based fees versus management fees.

“That’s a deliberate strategy, it’s very important to have incentives aligned whereas some [fund managers] who are overly reliant on management fees have probably got an incentive to just build an empire. We’re very focused on performance,” King says.

He also notes that many Regal staff members, particularly those running the portfolios, are also invested in the funds – which is something management likes to see in helping to align incentives between the company and its clients.

The biggest lesson of recent years

We’ve heard repeatedly that the 60-40 portfolio combination of stocks and bonds is no longer a good mix, a view also shared by King.

“In the last few years, we saw both the US stock market and many bond portfolios down more than 10%, so that diversification didn’t pay off very well,” he says.

“One thing I learned after working in Europe for seven years is that many European family offices are a lot more diversified than Australian family offices – we’ve always had a high ownership of direct equities in Australia, a lot of the wealth is newer, so many families are happy to do the investing themselves.”

For this reason, Regal’s RF1 portfolio is currently positioned as follows:

- 25% Emerging Companies

- 18% Resources Royalties

- 15% Small Companies

- 12% Private credit

- 10% Market Neutral

- 7% Long-Short Healthcare

- 9% Global Alpha

- 5% Water.

Two of the most recent additions here are the Resources Royalties strategy, added in 2022, and the water strategy, which was added via its acquisition of farm and water asset manager Kilter in 2019. Regal acquired energy and environmental commodities fund manager Attunga Capital in 2021.

Two key areas of growth ahead

King’s latest interview reiterates a view he has shared repeatedly in recent years: that resources is one of the most attractive sectors from here.

“We think we’re at the start of a multi-year bull market in resources,” King told Clark.

He’s also excited at the prospects in private credit, with a strong view that banks are being hamstrung by capital requirements and regulations post-GFC that are making it more difficult for them to issue loans

In addition to its private credit fund, Regal also invested in mining finance business Taurus in late 2023. This provides exposure to the company’s resources sector loans across equity finance, debt finance, and royalty finance.

A cloudy macro scene

King was asked to provide a view on the macro environment and where he believes markets currently sit within the economic cycle. While expressing caution at such forecasts, noting they can be “dangerous” and are rarely accurate, he responds:

“We’re in a slowing economy and I’ve got no strong view whether it’s going to be a recession or a soft landing. At some stage, we’ll see the economy bounce back.”

China and lithium in focus

King says China is “a big concern” and reiterates his view that China’s property is one of the biggest bubbles out there, “a bigger bubble than Bitcoin and it’s certainly collapsed a lot more.”

“The Chinese economy looks pretty sick at the moment…there are challenges there.”

But he’s pleasantly surprised at the resilience of China’s iron ore demand, having shifted toward exporting some of the commodity it would have previously consumed itself.

“I don’t think the downturn in China will be anything like what we’ve seen in Japan over the last 30 years, the China government is very much on top of that,” King says.

“I think the stock market largely reflects a lot of the economic weakness – there are some great companies in China trading on some very low multiples."

And finally, in the battery metals space, King provides his view on lithium: “Not only has it been a bumpy ride for lithium, it’s been an absolute train crash.”

But still sees strong demand for battery metals long-term, despite the shorter-term phenomenon that has seen supply grow much faster than many expected. One of the companies he calls out from the Regal portfolios is WA1 Resources (ASX: WA1), a West Australian mining company that has discovered deposits of nyobium, which is used in strengthening steel and as a fire retardant, “which has some exciting implications for electric batteries.”

You can listen to the full interview with Koda Capital's David Clark here:

.png)

2 topics

3 stocks mentioned

1 contributor mentioned