Why the equity market should resume its advance

Mason Stevens

The problem with most economic data and company profit announcements is that they are backward-looking, while the share market is forward-looking. That is why we place so much emphasis on leading economic indicators that are designed to lead the business cycle by up to a year.

The Conference Board's latest US Leading Economic Index (LEI) for March was released last week. It increased by 0.3% to 109.0 (2016 = 100), following a 0.7% increase in February (revised up from +0.6%) and a 0.8% increase in January. The LEI is a composite of ten variables that lead the business cycle by 6 to 12 months.

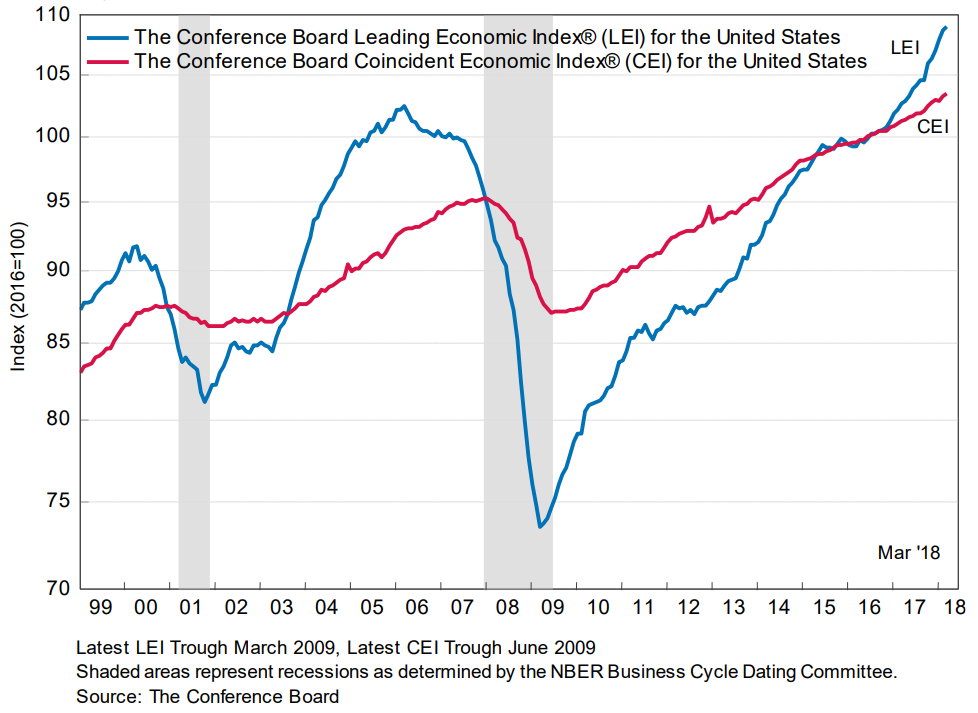

The business cycle is represented in the chart below by the Conference Board's Coincident Economic Index (CEI), a composite of high-frequency economic data that are coincident with GDP. The shaded areas in the chart show the official US recession periods. During recessions the CEI is falling, having been foreshadowed by earlier falls in the LEI.

The ten variables used in the LEI are:

- Average weekly hours for the manufacturing sector;

- Average weekly initial claims for unemployment insurance;

- Manufacturers' new orders for consumer goods and materials;

- ISM Index of New Orders;

- Manufacturers' new orders for non-defense capital goods excluding aircraft;

- Building permits for new private housing units;

- S&P 500 Index;

- Leading Credit Index;

- Interest rate spread, defined as 10-year Treasury bond yield less Federal Funds rate; and

- Average consumer expectations for business conditions.

Commenting on the latest result, the Conference Board's Director of Business Cycles & Growth Research said:

“The US LEI increased in March, and while the monthly gain is slower than in previous months, its 6-month growth rate increased further and points to continued solid growth in the US economy for the rest of the year. The strengths among the components of the leading index have been very widespread over the last six months. However, labour market components made negative contributions in March and bear watching in the near future.”

The share market discounts future growth in earnings and is therefore forward-looking in nature. Inevitably, it attempts to forecast the future direction of the economy. Bear markets precede recessions, often before they are obvious. The LEI has historically turned downward before a recession and upward before an expansion. It has generally proved capable of predicting recessions over the past 50 years. Three consecutive monthly declines in the LEI is normally considered a bad sign for the share market and the economy. In the current context, consecutive rises are being recorded.

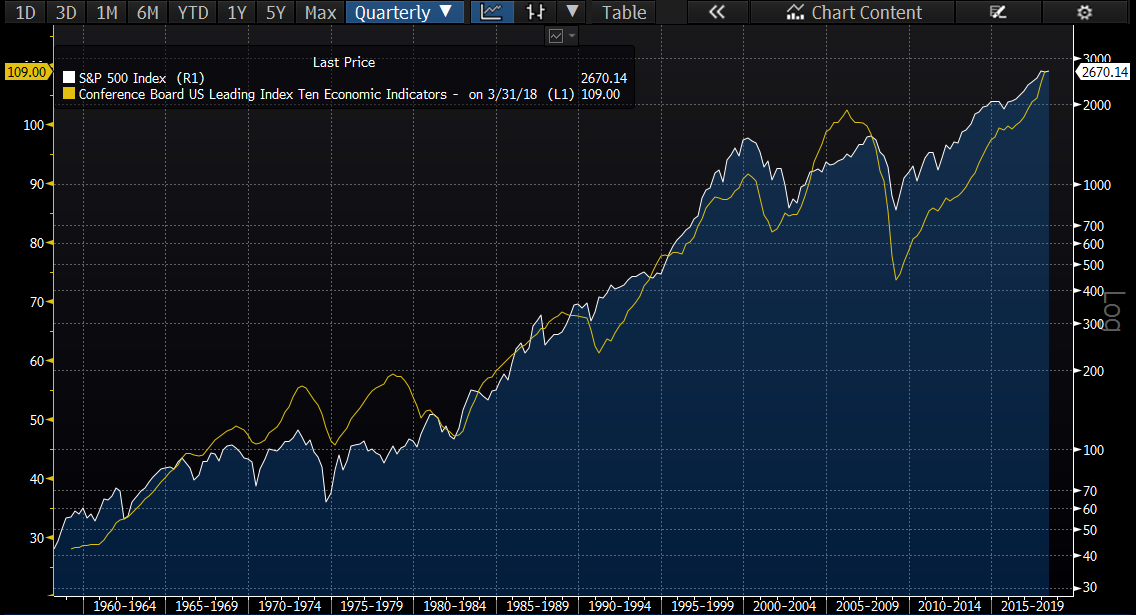

The relationship between the Conference Board LEI and the US S&P 500 Index can be seen in the chart below. Both are forward-looking, anticipating changes in the economy before they occur, therefore they are fairly coincident with each other. A falling LEI will generally confirm a bear market rather than lead it. Likewise, a positive turn in the LEI will confirm when it is safe to buy back into the market. No indicator is perfectly reliable. Very rarely the LEI has predicted a recession that did not occur. The share market has done so more often, but the false signals tend to be short-lived.

The US and global economies are growing and the latest US earnings season has started well. Of the S&P 500 companies that have already reported, 80% have delivered a positive EPS surprise and 72% have delivered a positive sales surprise. For Q1 2018 the total earning growth rate is expected to be 18.3% year-on-year (revised up from 17.1% at the end on March), with a boost coming from the lower corporate tax rate. The main negative for the share market at the moment is having to absorb a higher bond yield, with the US 10-year Treasury yield now near 3% .

Fortunately, the US 12-month forward PE ratio has come down to around 16.46x (from a high of 18.57x) due to a combination of the recent equity correction and earnings upgrades. Consequently, the US equity risk premium is still reasonable at around 3.10% [= 100/16.46 – 2.977%].

Provided the US economy and earnings continue to grow (as implied by the rising Conference Board LEI), and bond yields do not rise by more than say a cap of 100bp from here, the equity market should be able to resume its advance.

This article is prepared by Mason Stevens Limited (Mason Stevens) ABN 91 141 447 207 AFSL 351578 and is general advice only and does not take into consideration yours or your client’s personal objectives, financial circumstances or needs and should not be relied upon as personal advice. You should consider this information, along with all of your other investments and strategies when assessing the appropriateness of the information to your individual circumstances. Securities, by nature, rise and fall and as a result investing in securities including derivatives involve risk. Past performance is not a reliable indicator of future performance and may not be achieved in the future. Mason Stevens and its associates and their respective directors and other staff each declare that they may hold interests in securities and/or earn fees or other benefits from transactions arising as a result of information contained in this article.

Mason Stevens ensures that the information provided is accurate and complete but does not warrant its accuracy or reliability. Opinions and or information may change without notice and Mason Stevens is not obliged to update you if the information changes. Mason Stevens and its associated companies, authorised representatives, agents and employees exclude to the full extent by law, liability of whatever kind, including negligence, contract, fiduciary duties or otherwise, to investors or anyone else in respect of any loss or damage, including indirect or consequential loss or damage, foreseeable or not, arising from or in connection with this information.

Responsible for identifying domestic and international equity investment opportunities. 25 years of financial markets experience as an equity strategist, economist, analyst, portfolio manager and consultant.

Expertise

Responsible for identifying domestic and international equity investment opportunities. 25 years of financial markets experience as an equity strategist, economist, analyst, portfolio manager and consultant.