Why the HVAC industry loves heat pumps

In February, we wrote about heat pumps and how WHEB invests in the technology1. But we aren’t the only ones interested in the topic. This month, I traveled to Frankfurt for the world’s leading trade fair for HVAC (heating, ventilation, and air conditioning), and there was just one thing on everyone’s mind: heat pumps.

ISH is the world’s largest exhibition space for the HVAC sector to showcase its products. The previous event in 2019 attracted over 2,500 exhibitors from all over the world, and almost 200,000 visitors. According to ISH, 71% of visitors have an influence on purchasing and procurement decisions. That means the trends seen at the exhibition could be an important indicator of the direction of the industry2.

Overview of attendees

.png)

Energy transition

Climate was a hot topic. The top themes highlighted by the ISH organisers were ‘Solutions for Heat Transition’ and ‘Climate Protection and Energy Efficiency & Sustainability’3. Heat pumps were a central part of that discussion because they are key to achieving climate targets in the heating sector.

It was clear at the event that heat pumps have reached a tipping point. In his blog post Seb made reference to the fact that, for a long time, heat pumps were seen as a niche technology. Several companies I spoke to said the same thing – the legacy companies had always dismissed heat pumps, but now it was the only thing they were talking about. One company quipped: the bigger the booth, the bigger the legacy fossil fuel business.

That’s important for us. As impact investors we look for companies where the majority of revenues come from sustainability solutions. Our holdings, Daikin Industries, Trane Technologies and Ariston Group, all have material revenue exposure and a clear strategic focus on technologies contributing to the energy transition.

What’s hot in heat pumps?

Clear themes emerged through the day: technology mix, competition, and refrigerants.

Technology

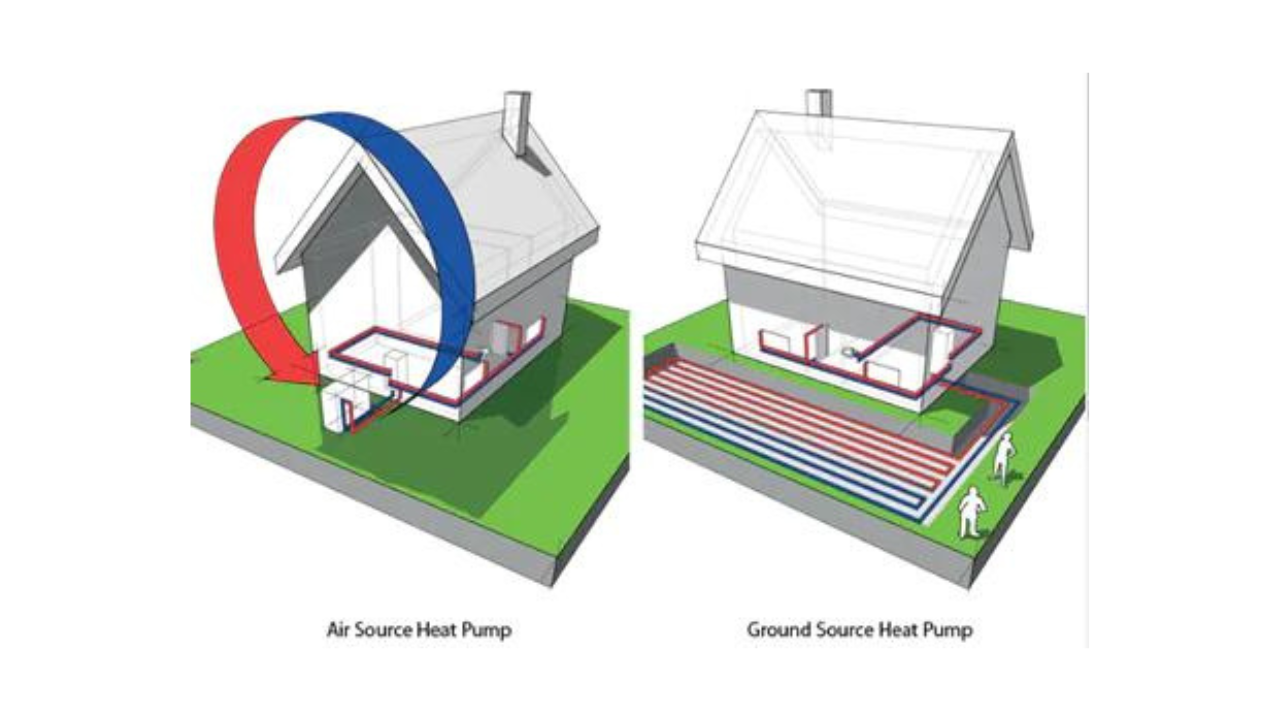

Heat pumps take heat from the ground or external air and transfer it either to water or internal air. Some companies have a legacy in a specific technology. Nibe, for example, has a long history in ground source heat pumps which are common in the Nordic countries. Others have a wider portfolio, particularly those companies with large HVAC franchises.

.png)

So which will win? The answer depends on the country, specifically the geology and the housing stock. Old buildings with bad insulation and small radiators need more heating capacity but work well with air-to-water systems because they can utilise existing pipe systems. Ground source works better in certain soil types and for new builds but is less well suited to retrofit because of the underground drilling required for installation.

Competition

There are about 41 heat pump brands in Europe alone, with some big players like Daikin and Nibe, and some very small local ones. One thing that will differentiate companies is the quality and reliability of the technology, for example in meeting efficiency claims. Installers are a major bottleneck so those with strong relationships are likely to be well-placed.

Daikin came across well on that front. They are building out a network of training centres designed to be close to installers. They are also introducing a service and maintenance approach based on certified partners. The aim is to have a unified approach to quality standards and aftersales.

.png)

In the medium to long-term the industry is likely to consolidate. Competition will influence pricing so to maintain or grow margins companies will have to reduce costs. That requires scale in manufacturing, something which Daikin already has given its experience in HVAC. What about China? I met Midea, who makes their own branded heat pumps as well as doing contract manufacturing for other companies. They have an aggressive growth target but are coming from a small base. Their annual targets are in the range of tens of thousands of units compared with Daikin’s millions4. They also commented that they have struggled to gain share-of-mind with installers because of the strong position of local brands and the quality HVAC companies. Chinese competition is certainly something to remain mindful of but it’s not a significant threat at the moment.

Refrigerants

These chemicals are crucial to the operation of heat pumps but are rightly coming under increasing scrutiny from regulators because of their potent global warming potential (GWP). There are proposals to require refrigerants to have GWPs that are significantly below the current standard5. As a result, companies are introducing products that use propane, which has a GWP of 3 compared to the industry standard refrigerant R32 which has a GWP of 675.

.png)

Using a different refrigerant requires a complete redesign of the heat pump because the thermodynamic properties are so different. The critical component in the redesign is the compressor, a technology that is very familiar to HVAC companies but less so to the traditional boiler companies. Once again this is a key advantage for Daikin.

Electrification of industrial heat

A related area that was less of a focus at ISH but has been a recent area of research for WHEB is the electrification of industrial heat. The use of heat in industry is responsible for 10-15% of global greenhouse gas emissions. Industrial-scale heat pumps are a key technology in helping to reduce these emissions. Daikin and Trane Technologies are well-placed to address this market. Spirax-Sarco, another WHEB portfolio business, is also exposed to this trend. They have built their Electric Thermal Solutions (ETS) business through a number of acquisitions including of the US company Chromalox that manufacturers electric boilers among other things. Not only are these systems significantly more energy efficient that fossil powered systems, but as grid electricity is decarbonised, so these systems enable further significant GHG reductions.

Conclusions

Heat pumps have been experiencing dramatic growth, particularly in Europe with year-on -year growth rates in many countries of over 100%. It was clear from talking to attendees at the exhibition that strong growth is likely to continue over the coming decade. Meeting so many companies in the industry was useful for understanding the market dynamics, including both the opportunities and the risks. Importantly, it painted a picture that is supportive of our holdings. They have the technology, the scale, and the relationships that will put them in a strong position to benefit from the rapid growth of the industry.

4 Based on company 2025 production capacity targets

5 Carbon dioxide has a GWP of 1.

5 topics