Why this time it is different for AREITs

Historically, low interest rate environments, and particularly when bond yields have declined (ie bond prices have risen), long dated assets such as real estate have outperformed. This outperformance is underpinned by:

- 10 year bond yields being used to price commercial assets. The lower the bond yield, the higher the valuation;

- On a risk adjusted basis, AREITs provide attractive yields relative to the low interest rates

- Real estate attracting capital flows as borrowing costs are low

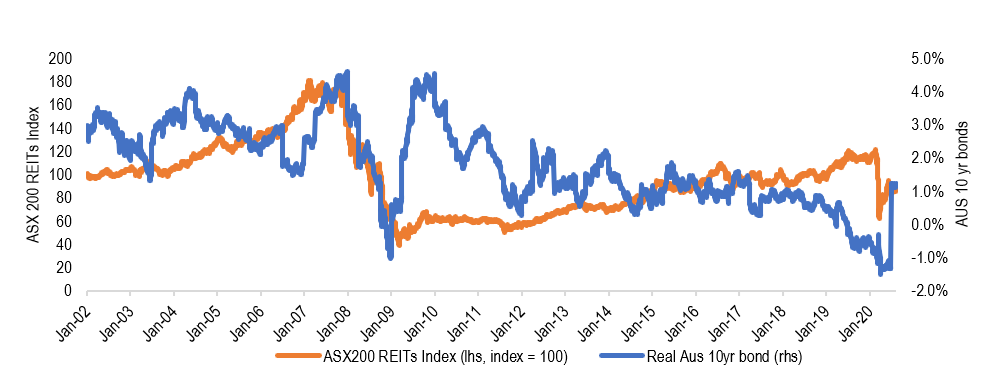

Since the beginning of the year, the Australian 10 year bond yield has fallen by approximately 0.5% to 0.9%, however AREITs have fallen by 20%, and more importantly underperformed the broader equities market by 10%.

The main reason for this break down in the relationship between interest rates and AREIT performance is COVID-19. This is not surprising as governments around the world have been forced to impose social distancing measures to curb the spread of the virus. Store closures in non-essential services and the working from home (WFH) thematic saw a significant increase in earnings uncertainty, particularly in discretionary retail and CBD office assets, as landlords work with their tenants to provide rent relief through the Code of Conduct.

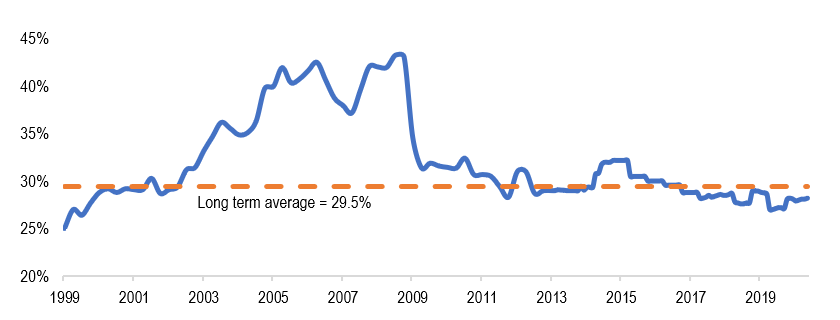

Based on the chart below, the breakdown in this relationship has only occurred once before, which was during the GFC. The problem then for AREITs was that they were taking on too much gearing (at an average of 45%) and were heavily reliant on bank debt with short durations. Coupled with highly geared offshore assets with complex hedging structures, this created a liquidity squeeze when the AUD tanked. This resulted in AREITs having to recapitalise at significant discounts to book value.

Chart 1 - Real AUS Interest Rates v REIT Index

Source: Bloomberg

This time around, AREITs having learnt the lessons from the GFC and have entered the pandemic in a much stronger financial position: not only is gearing lower at an average of 26%, but debt duration, debt diversity and liquidity are far superior. Hence investors should avoid the insolvencies and deeply dilutive rights issues that plagued the sector during the GFC.

Chart 2 - AREIT Sector Weighted Average Gearing

Source: Company data, J.P. Morgan estimates

The pandemic has however brought different challenges for the AREIT sector. Earnings uncertainty had led to many AREITs having to withdraw earnings guidance and valuations. In particular, retail assets have declined 10% to date with a further 10% expected over the medium term as the sector suffers from both cyclical and structural headwinds. In comparison, valuations for office, industrial and long WALE (Weighted Average Lease Expiry) AREITs have proved to be quite resilient.

Since the GFC, AREITs have moved from boring rent collection to more diversified earnings streams such as funds management and development, and into new growth sectors driven by secular trends such as logistics, childcare, healthcare, seniors living, agriculture, manufactured homes estates and data centres. All of which provide diversification away from the core sectors of retail, office and industrials and provide greater more sustainable earnings growth.

In addition, the quality of AREITs cash flows is more stable in comparison to industrial companies for the following reasons;

- Rents are legally contracted leases (average 4-5 years) which rank above equity holders,

- AREITs are high-margin businesses with low operating leverage (low cost bases relative to industrial companies), so falls in revenue, whilst impacting earnings and distributions, won’t be a drag on cash flows,

- AREITs provide real growth as most leases have minimum CPI rental increases.

Putting all these components together, along with the anticipated lower for longer interest rate capped at 1.5%, we see good investment opportunities in the sector, particularly for AREITs that have sustainable income, high free cash flow, good quality assets and strong balance sheets.

Learn more

Stay up to date with my latest high conviction opportunities in the property sector by hitting the follow button below. or contact us to learn more about the Pengana High Conviction Property Securities Fund.

1 topic