Why Xero is a strong buy

Xero provides affordable accounting software for small and medium-sized enterprises (SMEs) that is entirely cloud-based, outmanoeuvring slower incumbents that retain server-based solutions. It operates in an industry with structural growth driven by regulation and a broader shift to the cloud.

It has invested heavily in software development, enabling its intellectual property to drive consistent revenue growth of 30-40%. We forecast market-share gains and monetisation of its accounting platform ecosystem.

The business is highly cash-generative in its incumbent markets and scalable and we expect it to continue enjoying operating leverage. The management team is disciplined in capital allocation and has more than NZ$100 million in cash, which it can allocate as opportunity arises. This business is really set up for the next level of growth.

Risks and opportunities

Xero’s customers are SMEs, so it is exposed to a market segment that has been significantly affected by Covid-19. Hence it’s reasonable to expect an impact on Xero. We see three near-term risks.

- Firstly, there is a risk to new subscriber growth as business formations in the economy likely slow and impact Xero’s subscriber base.

- Secondly, there’s a risk to existing businesses and subscribers through a potentially higher degree of SME turnover.

- Thirdly, there is a risk to average revenue per user, with the potential for existing customers to downgrade their subscription as they cut costs.

However, governments in the markets that Xero operates in have launched substantial amounts of stimuli to support small businesses and help see them through this disruptive period. In Australia, for example, this funding is available for six months, allowing SME customers some respite to use Xero’s products.

Irrespective of Covid-19, businesses will continue to have tax obligations to tend to in Xero’s core markets of Australia, New Zealand, UK and the USA. This provides a degree of resilience for Xero.

More broadly, working from home/remote working is likely to speed up businesses’ transition to the cloud. Certainly we have seen growing demand for data storage, which supports remote cloud usage. In fact we see potential for Covid-19 to accelerate the shift to digital and cloud solutions which Xero offers over the medium term.

Of course, we will get a clearer picture of how Xero has been impacted by Covid-19 when it releases its full-year financial results in May.

Structural growth drivers remain intact

In some ways, the outlook for 2020 will depend on the duration of Covid-19 and efficacy of government stimuli. Restrictions are being lifted or about to be lifted in numerous countries, with some returning to more normal working conditions.

But Xero was well-positioned prior to this crisis, with a self-funding business model on the back of good capital discipline and a strong balance sheet. It has established dominant software as a solution (Saas) position in New Zealand and Australia, a growing offshore presence in the UK and US and is now evolving to provide a platform solution.

Before Covid-19 it was also enjoying healthy subscriber growth. While we might expect these growth rates to slow in the near team because of the pandemic, structural growth drivers remain intact, including government accounting regulations accelerating the transition to the cloud.

How we value the company

We utilise both financial and operating metrics to assess the health of Xero. The company is generating a very high gross margin of more than 85% and a growing Ebitda margin.

That underlines the operating leverage of this business, which we expect to continue growing over time due to its scale advantages. Xero has only recently turned a profit because of its need to invest to build a dominant position, given the substantial growth opportunity of an underpenetrated addressable market.

To assess its profitability, we measure success via growth in subscribers and the lifetime value of those subscribers. The cost to acquire customers is key, too, with Xero required to strike a balance between maximising the value of each customer with the optimum level of investment in its customer base.

In its first-half financial results, this metric for the group as a whole stood at 6.9 – meaning the average lifetime value of a subscriber is 6.9x the cost of acquiring that subscriber. In its dominant markets of Australia and New Zealand, this ratio is over 12x.

That is a highly profitable outcome. We expect this and other metrics to continue to improve over the medium to long term. Still, in terms of how its metrics compare to pre-Covid-19, we can’t say yet. We’re still waiting to see the numbers.

Is a capital raising likely?

Xero is in a financially strong position with a net cash position of more than NZ$100 million at its last financial reporting date, including the proceeds of convertible notes it issued in 2018. Disciplined capital allocation and strong cash flows mean that Xero is generating positive free cash flow. Hence we don’t foresee a capital-raising.

It means the company is in a strong position precisely for this type of adverse market environment. We expect Xero to use its convertible funding to build out the functionality of its platform via an acquisition or investment in technology.

Xero is a strong buy

We maintain a ‘strong buy’ rating on Xero, whereas the broker community has a cross-section of recommendations evenly split among buy, hold and sell.

Our analysis suggests Xero is well placed to create value and deliver compounding returns over time. It might face near-term challenges to growth in subscribers and average revenue per user due to Covid-19. But over the medium to long term we are confident in Xero’s products, management, strategy and execution.

It has been able to build a dominant position in New Zealand and Australia from scratch and taken market share from desktop players. It is now deploying this playbook in offshore markets and has successfully built a position in the UK market. Hence we are attracted to its strong market position and potential for expansion domestically and globally, alongside a structural shift to the cloud.

We see valuations really growing from here. We use near-term revenue multiples and long-term discounted cash values to assess its value.

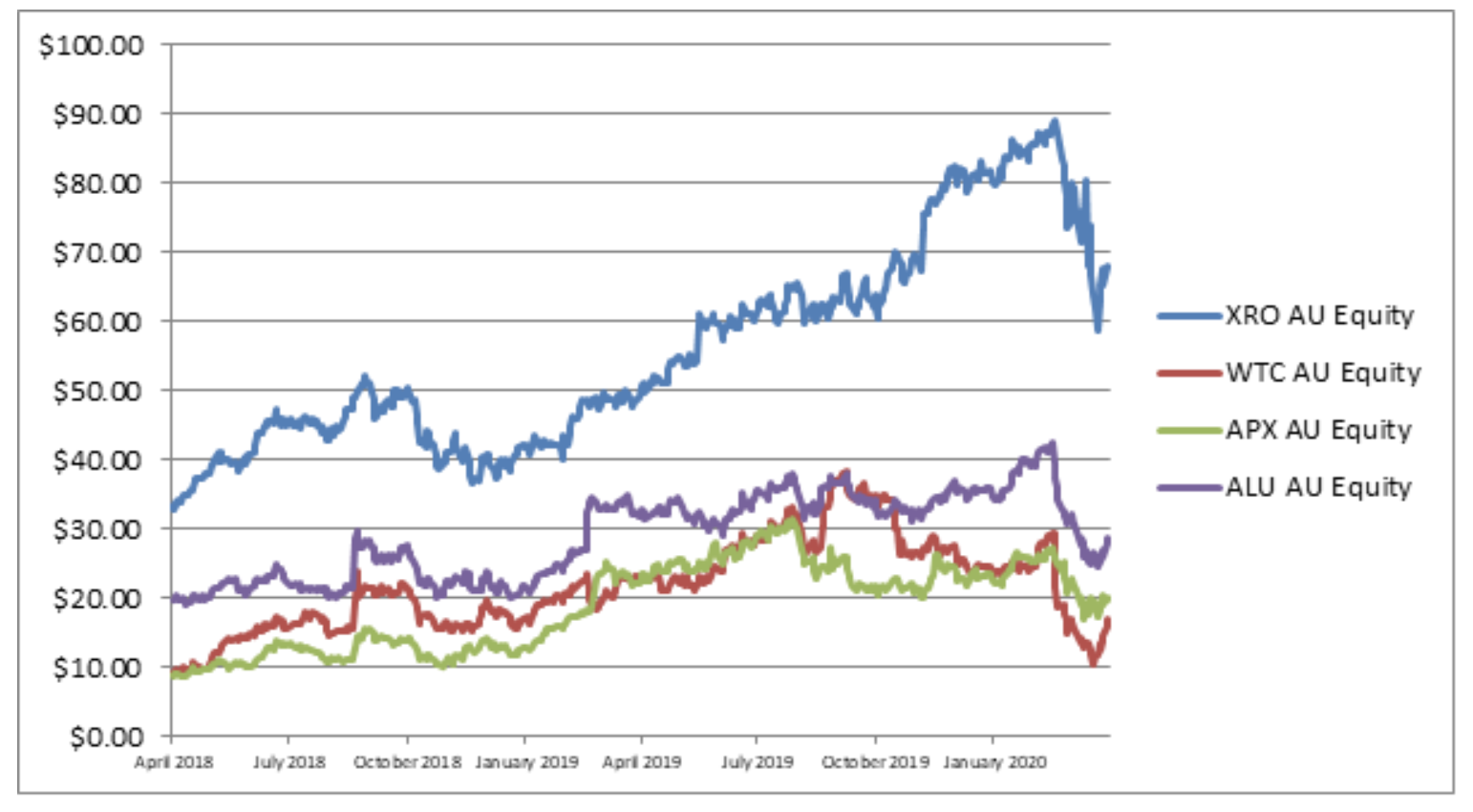

Price Chart: WiseTech, Altium, Appen, and Xero (WAAX).

Source: Bloomberg, 31 March 2020.

The chart above shows how Xero’s share price has outperformed both peers and the market over the past two years. We put this down to the quality of this business. It sold off 20% in the week of March 23 against a 12% decline in the broader market as Covid-19 fears escalated, falling to NZ$58 dollars a share. But it has performed well since the start of the year and at the time of writing was trading at NZ$76.

We still don’t think its share price fully factors in platform monetisation and potential subscriber growth in the rest of the world. We would look to capitalise on any price weakness to add to our position, having topped up on Xero in March.

In summary

Xero provides transformative cloud solutions for SMEs looking for a better way to manage their business. Covid-19 is a near-term risk to Xero’s revenue growth, but its medium to long-term outlook remains robust.

We expect its growth to come from increasing and leveraging its total addressable market and monetising its platform ecosystem – factors which are not fully appreciated by the market in our view.

Learn more

We invest primarily in a concentrated portfolio of mainly Australian and New Zealand listed companies that have the potential for capital growth and increased earning potential. Hit the 'follow' button below and you won't miss an insight.

This document is only intended for professional investors. Issued by Aberdeen Standard Investments Australia Limited, ABN 59 002 123 364 AFSL No. 240263. This document has been prepared with care, is based on sources believed to be reliable and opinions expressed are honestly held as at the applicable date. However it is of a general nature only and we accept no liability for any errors or omissions. This is not an offer of securities. This document has been prepared without taking account of your individual objectives, financial situation or needs. You should obtain your own investment, taxation and other advice and consider the fund offer document before deciding whether to acquire, or to continue to hold units in a Fund. Investments are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Past performance is not a reliable indicator of future results. Any performance forecasts are not promises of future performance and are not guaranteed. This document may describe some current internal investment guidelines and processes which are constantly under review and may change. Although this document is provided in good faith, it is not intended to create any legal liability on the part of Aberdeen Standard Investments. All indices are copyrighted by and proprietary to the issuer.

Bloomberg data are for illustrative purposes only. No assumptions regarding future performance should be made.

1 stock mentioned