Will Big Tech save the day?

Key Points:

• Global equities have performed well so far this calendar year, driven in large part by large cap tech companies.

• This rally has been exceptionally narrow, driven by only a handful of stocks. Historically, this has suggested that it will not last.

• There is substantial optimism around the long-term earnings prospects for tech companies. We think this is mostly warranted from a structural perspective, but don’t think these companies are immune from shorter term macro headwinds. They are not recession proof.

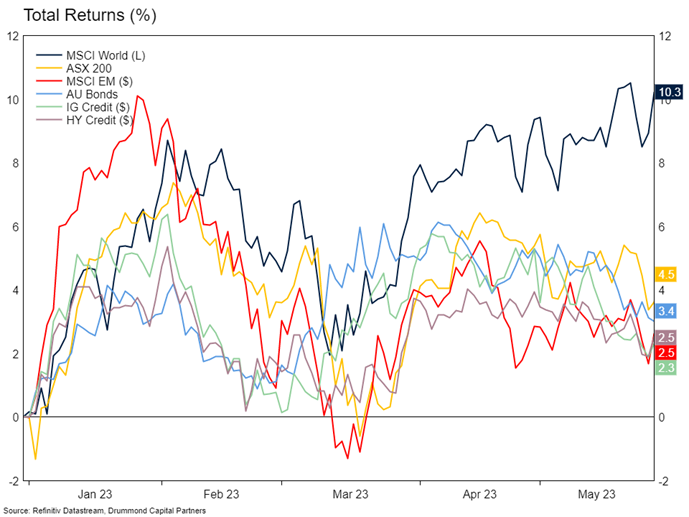

In this month’s Market Insight, we go under the hood to see what has been driving performance in markets so far this year and whether that can provide any guidance for the year ahead. In 2023 so far, there has been a substantial rally in equity markets, led by global equities in particular. Returns to other equity markets, as well as credit and bond returns, have been positive, but have diverged from global equities since April.

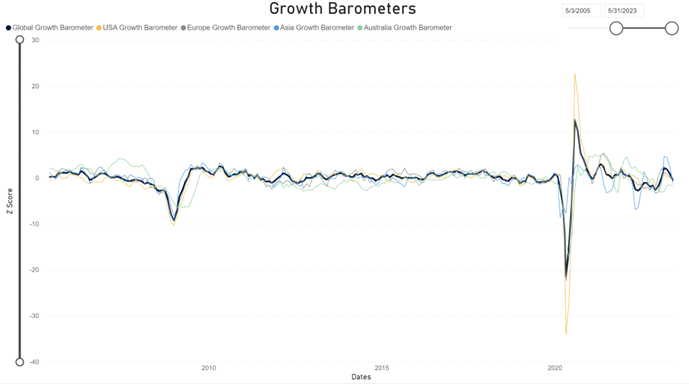

On the macro front, there hasn’t been a lot to explain the strong performance of global equities. The initial rally in January may have been supported by optimism around growth. In January and February, our Growth Barometer showed a strong uptick in economic activity. However, this recovery looks to have petered out in recent months. Meanwhile, core inflation is sticky and central bank rate cuts (though priced) look pretty far away unless a recession becomes evident. Since the beginning of the year, markets have also taken the US banking crisis and debt ceiling negotiations in their stride.

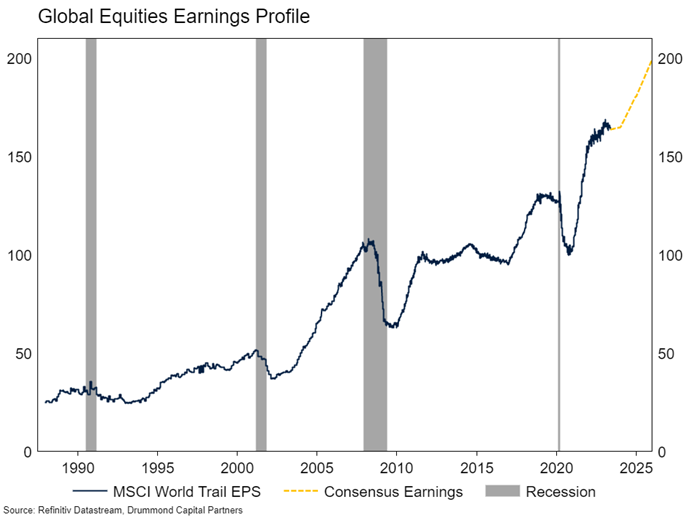

Source: Refinitiv Datastream, Drummond Capital Partners

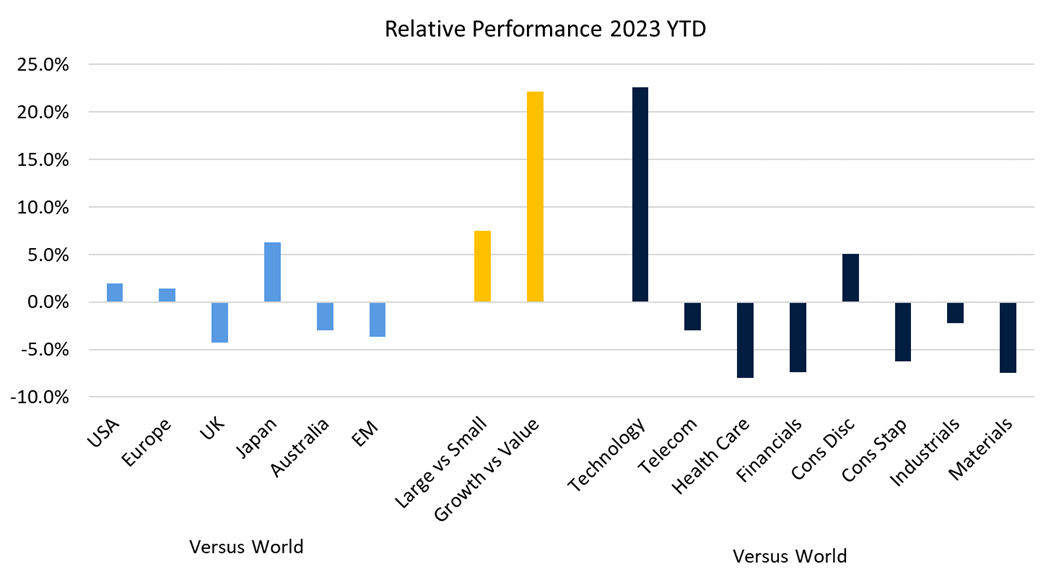

Or have they? The market is simply the sum of its parts, and sometimes those parts move in different directions. The chart below shows the relative performance of countries, style and sectors so far this calendar year. At the country level, performance has been mixed, with no country standing out as significantly outperforming the others (outside perhaps Japan). In the middle, we have style performance. Here we can see that a standout driver of performance has been the growth style (versus value). Large caps have also outperformed smaller stocks. On the right, we have sector performance. From this, it is clear that technology has been the dominant driver of performance, with most other sectors underperforming the overall index, except consumer discretionary, which also holds some tech names.

Source: Refinitiv Datastream, Drummond Capital Partners

So, is this a redux of the 2020/2021 post-Covid growth stock boom period? Anecdotally, there is much that rhymes. Crypto/Web3 hype has been replaced by AI hype. AI is the new buzzword in company earnings calls, with every mention an opportunity to add a PE point to valuations. Venture capital associates are busy scrubbing off old pitch decks and replacing references to blockchain with something about generative AI. The entire market seems to be loading into AI darling NVidia, which guided earnings higher on expected AI demand. Thankfully, the market doesn’t seem to have reached million-dollar rock picture territory yet, but we shouldn’t rule anything out.

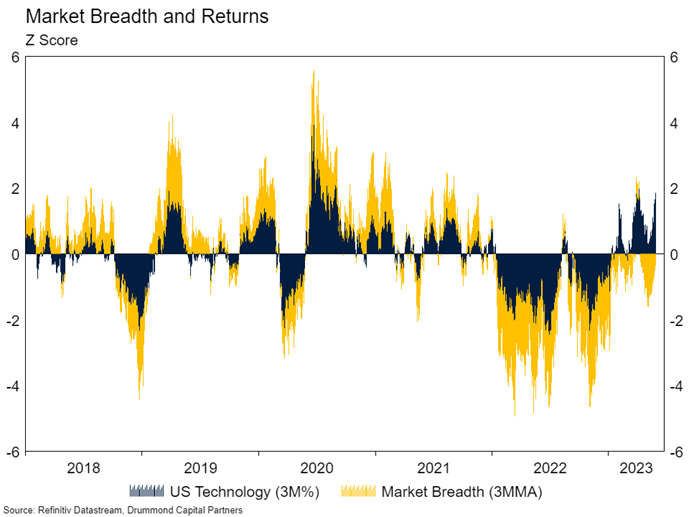

There is a key difference between now and 2021. This year, hardly any stocks are actually going up. The chart below shows the performance of the US technology sector and its breadth. Breadth is high when there are many more stocks rising than falling. A market rally is broad when there are many names going up as the overall market is going up. This was the case between mid-2020 and 2021 (yellow and blue bars move together). Likewise, the weakness in technology stocks through 2022 was also broad based, with lots of names falling (negative yellow bar) while the overall market fell. This year, the opposite has been the case. While the market as a whole has been rising, more stocks have been falling than rising. Essentially, the market is being carried higher by strong growth in a small number of large names. Indeed, to mid-May, around 80% of the entire year’s rally was driven by five mega-cap stocks.

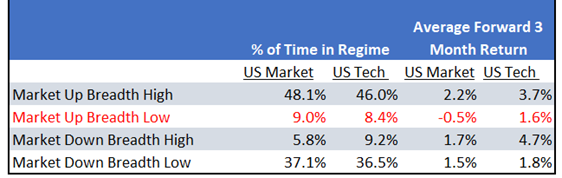

To see why this matters, we break the market into four regimes and look at the performance of equity markets in the months following each. The regime in which we currently sit (market rising, breadth low) is very rare (similar frequency as its opposite number, where the overall market is falling but many stocks are actually rising) and tends to be followed by weak overall equity market performance. Put simply, thin rallies are hard to sustain.

Source: Refinitiv Datastream, Drummond Capital Partners

Looking towards the second half of this year, a key question is whether US tech companies can continue to save the overall market in the face of a recession. Overall, consensus estimates for total corporate earnings in the next few years are quite robust (see below). Earnings this year are expected to be broadly similar to last, before they begin to secularly rise again from 2024. This would be a pretty outstanding outcome in the context of previous recessions, but the market believes technology companies are exceptional. Whether they can deliver sufficient earnings in a traditional recession to offset weakness by old economy companies remains to be seen.

We have written previously about tech exceptionalism, and the potential gains from recent developments in AI, and do believe there is something in the market narrative that these companies will continue to be relative winners. The circumstances which allowed tech companies to dominate the markets since the Financial Crisis haven’t really gone away. They are very good at engineering monopolies, shutting out new entrants, cannibalising the revenue streams of their competitors and embedding their services in other businesses. However, we don’t think they are recession proof. Ultimately, they sell things that people will demand less of if they lose their jobs. Businesses which shut their doors don’t need to spin up more cloud storage or ChatGPT subscriptions. We also think that even for high growth companies, valuation entry points matter, and it is not a fait accompli that Nvidia will be able to grow its earnings at the currently projected rate of 45% per annum over the five years to 2027. The net of the above is a view that tech deserves a sizable allocation in portfolios, which is conveniently delivered by holding passive exposure. However, tech probably won’t be completely immune from broader macro headwinds facing the broader market and their ability to out earn the rest of the market during a recession has yet to be tested. That said, under the hood, the message from the market seems to be that things are getting worse, rather than better, and our portfolios continue to be underweight equities.