Will Iluka Resources spin off Deterra?

Last year I wrote about the possibility of a spin off of Iluka Resources’ MAC royalty, and how much this asset could be worth as a standalone entity. It appears we will find out the market’s assessment of the value of the royalty – to be known as Deterra Royalties (DRR AU) – in as little as two weeks, with the Extraordinary General Meeting to vote on the proposed de-merger occurring on Friday 16 October.

Proposed key dates for Deterra spin-out

Source: Company presentations

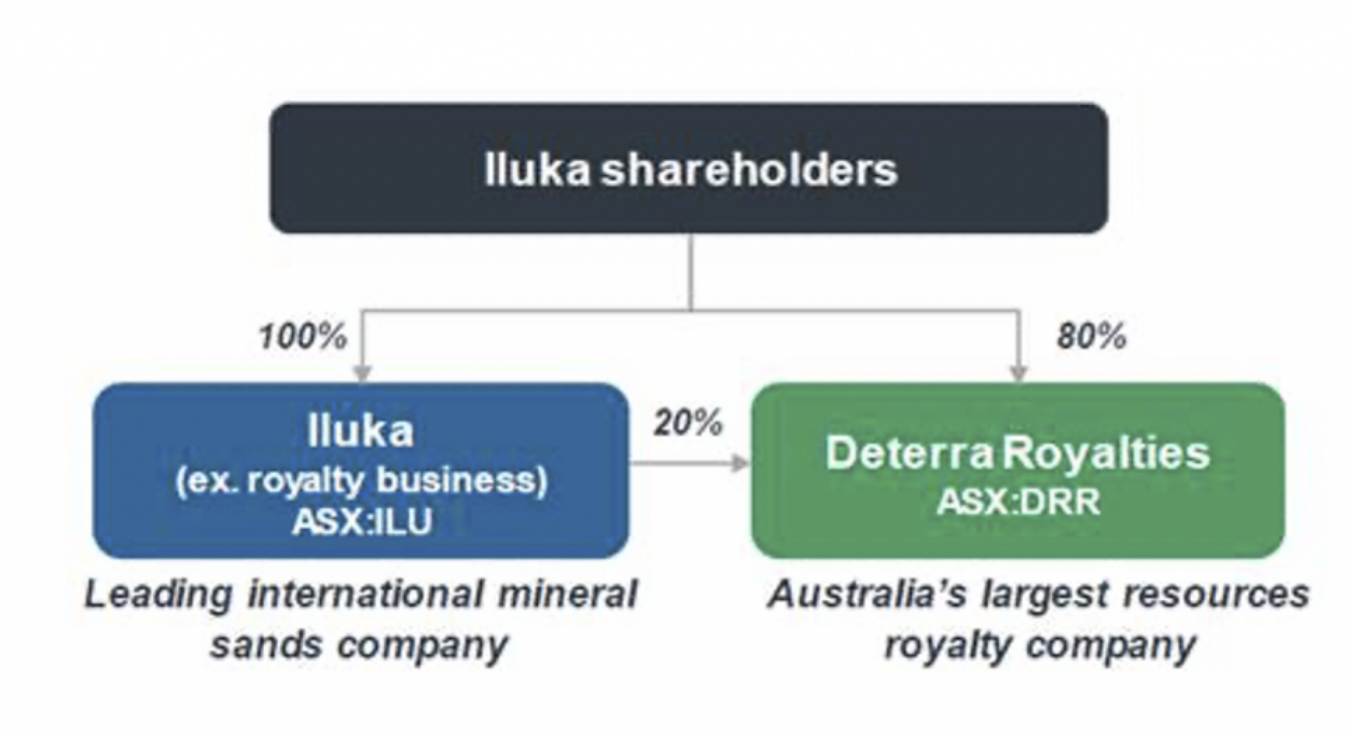

The delisting has been made possible by a favourable ruling from the ATO on demerger relief, preventing a capital gains tax (CGT) event which would have been significant given its $3.6 million book value. Iluka will continue to hold 20 per cent of Deterra, which should help Iluka’s cashflows given Deterra’s intended dividend policy will be to payout 100 per cent of net profit after tax.

Corporate costs are estimated to be around $7 million, which will be used to pay staff and for other corporate purposes including listing fees. In the case of Iluka investors, this represents cash leakage given minimal operational responsibility of Deterra initially, although this consideration is far outweighed by the expected value “creation” as existing shareholders view the combination of Iluka’s mineral sands + MAC royalty to be undervalued as a combined entity.

Deterra shareholder structure

Source: Company presentations

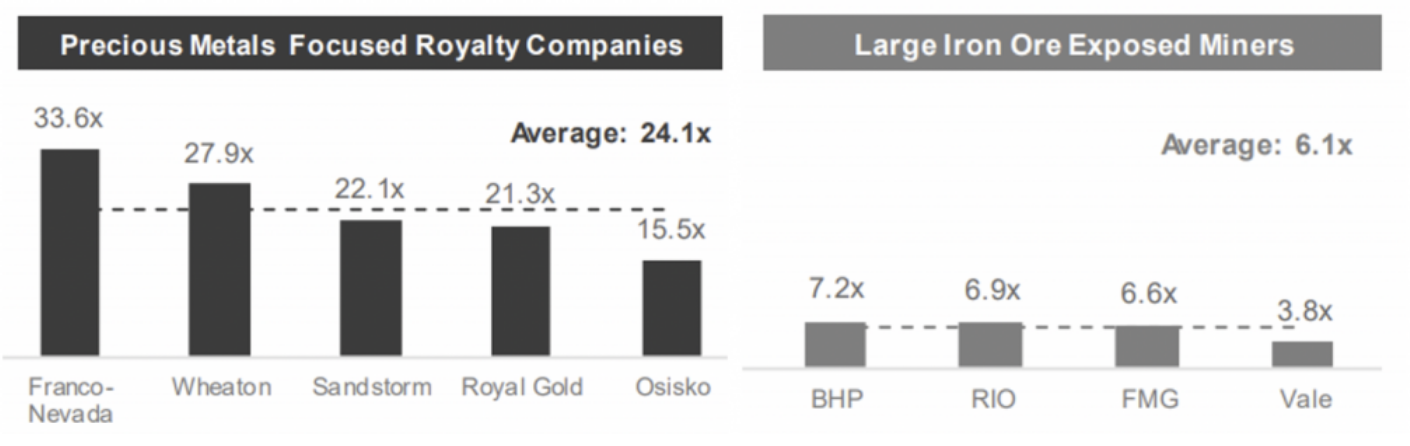

In terms of valuation, most estimates from brokers suggests a valuation range of A$1.8 billion to $2.2 billion, or between approximately 45 – 55 per cent of the existing market capitalisation of Iluka. However, the true range of outcomes may be greater than this given its precious metal peers Franco Nevada and Silver Wheaton trade on between 45 to 60x Price Earnings ratios (28-33x EV / EBITDA).

As previously noted, it is important to remember two key differences: 1) the outlook of the commodity (iron ore versus precious metals); and 2) the production profile of mine underpinning the royalty.

The fact that Deterra will begin life holding a pure iron ore royalty means it will likely be benchmarked to both precious metal peers and iron ore miners (Fortescue, Mineral Resources, Mount Gibson), with the likely outcome a blend of trading multiples of the two businesses. It’s worth noting that the aforementioned $1.8 billion to $2.2 billion valuation range equates to an EV / EBITDA multiple of around 22 to 27x earnings.

CY21 EV / EBITDA comparisons of royalty companies vs miners

Source: Company presentations

You can read my post from last year here.

2 topics

1 stock mentioned