Will the BNPL stocks follow the lithium path?

The news out of the US on Tuesday night was pretty much all bad for the domestic and US BNPL space. I refer here to:

- Speculation rife that tech goliath Apple Inc (AAPL US) was developing a “Buy now Pay later” product.

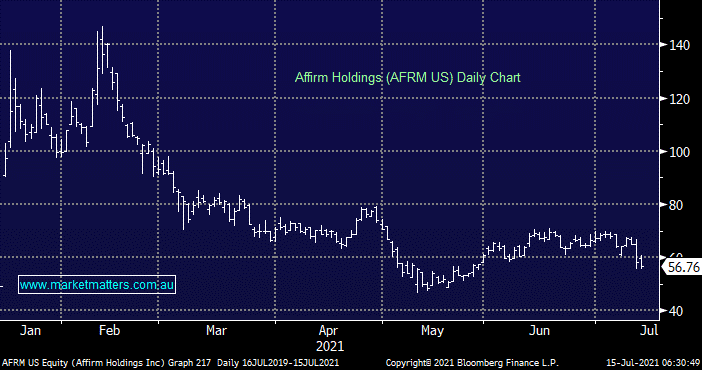

- News that the current main US player Affirm (AFRM US) has now fallen over 12% over the last two days, with a lack of bounce overnight a poor sign for the Australian players this morning.

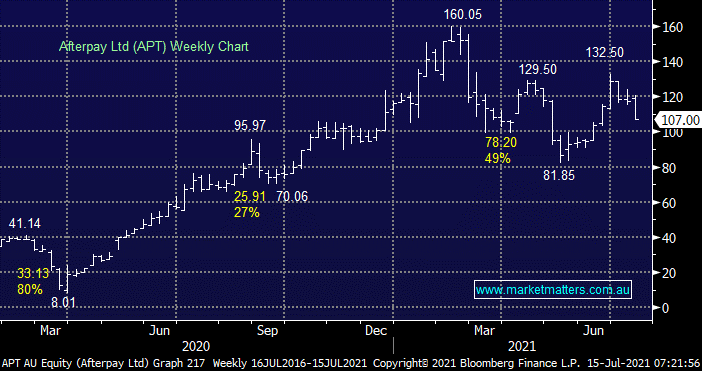

- Last August PayPal (PYPL US) announced their intention to enter our BNPL space but after an initial knee-jerk lower, both heavyweights Afterpay (ASX: APT) and Zip Co (ASX: Z1P) proceeded to double in price (although they are now well below their February highs).

As we touched on in yesterday’s Match Out report, it appears that Apple is developing a buy-in four-stage product that is similar to PayPal, plus a longer-term alternative that will incur interest payments. Initially, it will be pushed to around 6.4 million Americans that have a current Apple Card account. The brand's popularity suggests market penetration will be good wherever it evolves. Although the Apple Card has seen a slow take-up, the goliath tech player is probably hoping the BNPL offering will help both gain traction.

PayPal has indeed followed through on their planned foray into Australia with its recently launched BNPL style product appearing to be aimed at Afterpay, alongside some headline benefits: The US payments giant has said there will be no interest, no late payment fees and no sign-up fees if customers use its four instalments option for purchases between $30 and $1,500. This tells me two things:

- With these heavyweight US companies eyeing the sector it confirms to us that this will be a legitimate sector for years to come.

- However, margins are likely to be significantly squeezed as new players go in search of customers before they focus on retention.

Unfortunately, Apple (AAPL US) is a whole new proposition to PayPal (PYPL US), while the combination of the 2 is likely to significantly impact sentiment regarding all incumbent players. They could swallow any of our players from petty cash, although they have opted to deliver their own platforms/offerings which makes total sense considering their respective backgrounds.

MM is neutral AFRM around the $US55 area

Afterpay Ltd (APT)

As mentioned earlier the positive side of the coin is these moves plus the others by the likes of Commonwealth Bank (CBA) signals loud and clear that the BNPL offering is here to stay and the winners are likely to prosper in a meaningful manner for a couple of obvious reasons:

- The BNPL offering is attractive to the growing younger generation and even while margins are likely to contract, they should remain attractive especially when we consider the “fat” in the credit card industry.

- Once customer loyalty has been secured the players will be able to roll out related offerings such as online equity trading, personal finance, local/international flexible loans and even crypto.

We also shouldn’t forget that the previous launch of competing products actually led to an acceleration in merchant and customer awareness and with Apple Inc (AAPL US) now involved this is likely to be repeated in the short-term while margin/consolidation feel inevitable longer-term.

Arguably the biggest issue over the coming months for this volatile

sector is sentiment, it’s definitely unlikely to be good following this news

and a further 20-25% fall by local leader Afterpay (APT) for example wouldn’t

be a surprise, especially considering it's well within the usual swings of both

the sector and stocks. We should also be mindful that the smaller players

generally trade with a higher Beta i.e. their moves are exaggerated.

MM is now neutral APT over the coming weeks/months

Orocobre (ASX: ORE)

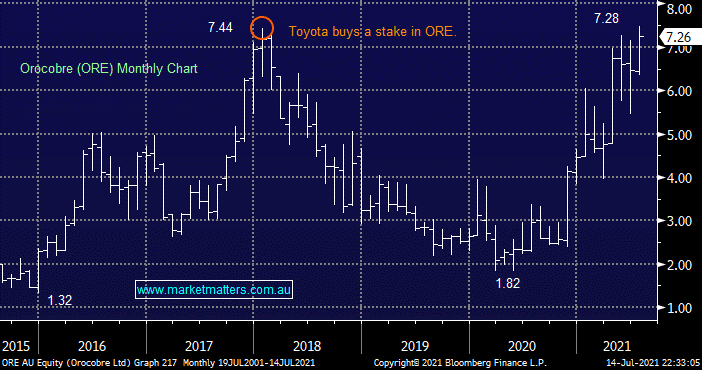

My initial perhaps random thought was can the BNPL space follow a similar path to the Australian lithium sector. It was incredibly “hot” through 2017/18 only to fall significantly over the ensuing few years as production was ramped up globally suppressing prices. This increase in commodity supply can be compared to the increase of BNPL players. Orocobre, one of Australia’s major lithium players with a market cap of $2.5 billion, witnessed its share price decline 75% following a large purchase by Japanese car market Toyota in 2018 only for the stock to regain all of the losses over the last 12-months, certainly a volatile 3-years.

When I consider the BNPL stocks as the most recent “hot” thing in town the comparisons are certainly real with volatility a clear common denominator, my initial thought’s:

- MM can see a similar path for the BNPL stocks which imply they can fall further before finding a base.

- Once the hot/trading money has left the quality names in the BNPL sector they are likely to find a base like ORE and recover but the question is from where and when.

The when is usually

easier to identify simply by when the press moves on and stops discussing the

respective companies/sector, the level is harder to call but it could

certainly, deliver some pain for investors at least on paper.

MM is neutral to bullish ORE around $7

MM currently owns Zip (Z1P) in both the Flagship Growth & Emerging Companies Portfolio while we hold Apple (AAPL US) & PayPal (PYPL US) in our International Equities Portfolio plus our ATEC BetaShares ETF position has a significant exposure to Afterpay (APT). I’m very conscious that if MM was holding no position we would probably adopt a wait and see approach hence we must consider if we’re holding too much exposure through our Z1P and ATEC positions.

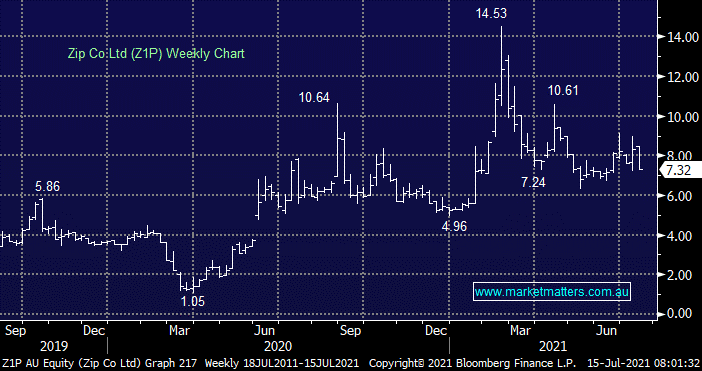

Zip Co Ltd (ASX: Z1P) $7.32

Z1P was due to deliver its quarterly update

today – I’m not 100% sure that is going to happen now. When it does happen,

it should be a strong one in MM’s view but this could easily be

overshadowed by the Apple news over the coming weeks/months. Simply it feels

likely that the short-term sentiment towards the stock which we still rate as

the best value in the sector is going to keep a lid on gains through

the $8-9 region making the risk/reward relatively average for now.

MM is considering reducing our Z1P position across portfolios

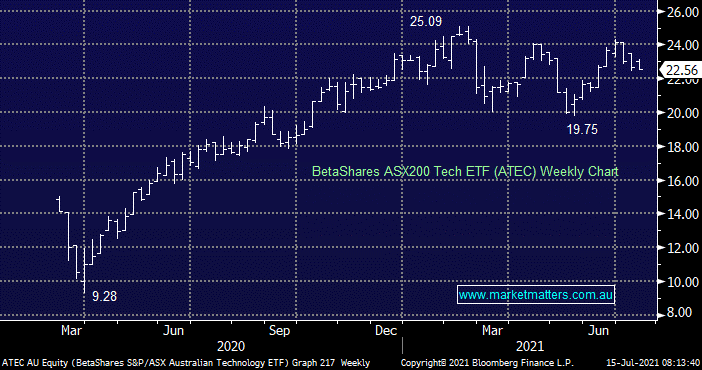

BetaShares ASX200 Tech ETF (ATEC) $22.56

This ETF has a meaningful ~20% exposure to Afterpay

(APT) but we still like it over the coming months although our target area

around the $26 level is now likely to take longer to be achieved while

APT remains under pressure.

MM remains bullish the ATEC ETF

The bottom line

MM can see a protracted period of underperformance from the BNPL

space but we do ultimately believe they can rise from the ashes hence we are

considering reducing our Z1P exposure as opposed to cutting it.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

3 topics

3 stocks mentioned