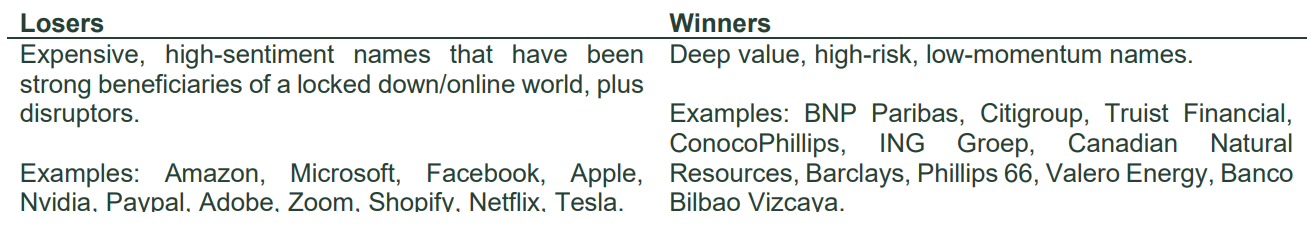

Winners and losers from the rapid rotation

In recent months, we have been discussing the vulnerability of expensive and high-sentiment stocks as they have become a more and more concentrated part of the listed equity market. On 9 November, the news of a potentially successful vaccine discovery by Pfizer unlocked a major shift in market sentiment, which continued through 10 November. There were clear winners and losers from this rapid rotation.

Losers

The steepest declines occurred in the most expensive names with the strongest market sentiment (on our multi-dimensional measures of both themes). These declines also had a large impact on market indices due to company sizes.

The 10 largest negative contributors to the overall market return in this category were Amazon, Microsoft, Facebook, Apple, Nvidia, Paypal, Adobe, Zoom, Shopify and Netflix.

These all sit in the segment of the market that is most expensive, and which shows the most positive sentiment — and they all experienced sharp reversal on the vaccine news. While the MSCI World returned around 1.5% over those two days, these companies experienced an average return of -10%.

Winners

The stocks that were most heavily purchased by investors during those two days were highly risky, deep value stocks. We would characterize “deep value” as having a low price/book ratio; risk stocks are characterized by high beta and high volatility. Many of the companies in this category are Banks, Automakers, Energy stocks, and Real Estate. The most extreme quintile — low price/ book, and high risk — had a return of 16% on average over two days. Banks and Energy stocks in this segment rallied 20% on average, and Real Estate went up 27%.

What did all the other stocks do?

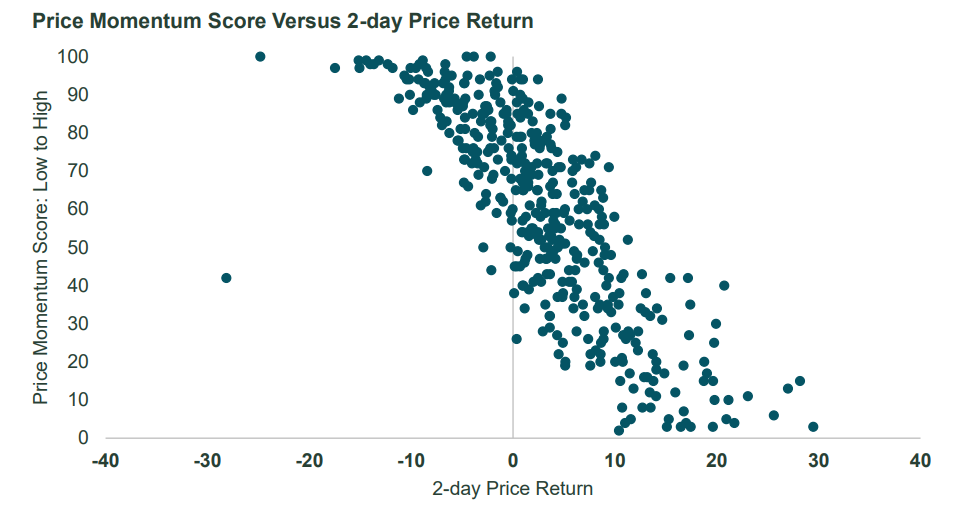

The most relevant single dimension of stocks that reacted to the news was price momentum. Figure 1 shows a very clear negative relationship between the stock price movement of MSCI World stocks and their current price momentum score.

Figure 1: Price Return Versus Price Momentum for MSCI World Stocks Greater than USD25 Billion Market Cap

Source: State Street Global Advisors, Eikon as of 10 November 2020.

The bottom line

We believe that the best places to find opportunities are outside of the extremes of value, risk, or price momentum. We have highlighted the risks associated with the expensive, high-sentiment cohort in previous commentaries. We believe the cheapest, highest-risk reversal stocks are unlikely to sustain their strong returns in the coming 1–2 months. This is due to the risk of increasing COVID-19 cases in large parts of the world and possible further economic shutdowns to curb the spread of the virus.

A widely distributed vaccine is still on the distant horizon and there are many solvency risks still present in large parts of the economy.

We prefer to hold undervalued names with balance sheet strength — i.e., companies that have the best chance of withstanding the wait for widespread vaccine distribution without going bankrupt — and those that aren’t as vulnerable to consumer weakness in the event of wider job losses or economic shutdowns.

Access high quality companies at attractive prices

Rather than building portfolios around the stocks weights represented in the benchmark index, our approach explores the market’s full opportunity set, constructing a portfolio based on stocks total return and total risk characteristics. Click to follow button to stay up to date with all our latest insights.