Zenith Energy: Fueling Growth

Zenith Energy (ASX:ZEN) builds, owns and operates (BOO) remote energy power stations for a range of industries including the resources industry. Clients include Newmont Mining, Chevron, Northern Star, Independence Group, Incitec Pivot and Dacian Gold, among others. The group currently has an owned installed generation capacity base of 183MW in Australia, and 237MW of managed capacity in Australia and Papua New Guinea. The company has had a successful track record over the last several years of growing its installed base through take-or-pay Power Purchase Agreement (PPA) contract wins, and has a substantial pipeline of both brownfield and greenfield opportunities in place.

Conservative assumptions would see the company grow earnings 30-40% p.a. over the next 3-4 years.

Return on invested capital is strong in the 25-30% range. And the stock remains undervalued.

Growth abound

While ZEN was founded in 2006, the company listed in mid-2017 and has grown strongly in recent years. At the IPO, insiders did not sell down any stock (a positive signal) and funds were raised purely for growth capital purposes. Focusing on the owned assets (which are more profitable and where the pipeline largely exists) – this has grown from 88MW at IPO to 121 MW in the space of one year, a growth rate of ~38%. In addition to this existing installed base, ZEN’s most recent win is a very substantial contract with Newmont Mining for 62MW at its Tanami Mine, which is currently under construction and on track to have a full year contribution in FY20. This is an important point – without winning any further work from this point, the company is set to increase its revenue from $31m delivered in FY17 to over $80m in FY20, a CAGR of ~40%. EBITDA in this period is forecast to increase from $9.8m in FY17 to over $30m in FY20 (again, assuming no further PPA contracts are secured).

Despite the strong growth described above, growth should in fact be higher again when conservatively factoring in some contract wins. When the company listed in May 2017, they talked to a pipeline of opportunities worth 124MW in size, and impressively went on to win some 90MW of this, a ~73% conversion rate. As it stands now, the company has a pipeline in-excess of 380MW of contracts which it is competing for over the medium term. Assuming a much lower conversion rate (we forecast 33%) yields a very high growth rate for the group over the next 3-4 years which is additive to the growth rate mentioned above. In fact, this should deliver >50% EBITDA CAGR from FY17 to FY20 for the group.

Infrastructure-like quality

An important consideration is the quality of earnings being generated. Given that the vast majority of revenues are derived from resources clients (typically cyclical in nature), one might think that the multiple attributed to this business should be low (ie. akin to a mining services company). However, we'd suggest that the valuation of the company should be more in line with an infrastructure company, given the nature of the PPA contracts in place with clients, where the revenue stream is locked in and indexed for between 5 and 10 years. The PPA contracts contain monthly minimum take-or-pay agreements that earn a guaranteed minimum income irrespective of the mine production levels of the client.

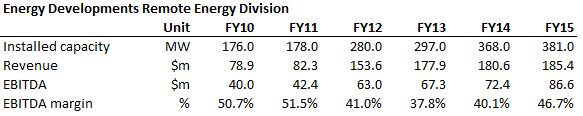

ZEN only listed recently with limited public numbers available, therefore it is instructive to look at a competitor's earnings profile who operated through the mining cycle downturn in the FY12-15 period. Energy Developments' Remote Energy Division (essentially offering the same services as ZEN) experienced an increase in their installed capacity, revenue, and earnings every year, despite a tough period for their clients (see table below). It's our expectation that this growth profile applies to ZEN as well, and that the cyclical nature of its clients will not adversely impact ZEN's own financials.

Source: Energy Developments (ASX:ENE) past ASX announcements

Management have done it before

The calibre of management is outstanding and highly desirable for an emerging company, since: 1. they have significant experience having operated in the space for decades; and 2. have large shareholdings in the business that clearly aligns interests with other investors. Executive Chairman Doug Walker established a similar business called StateWest Power in 1987 before selling it to Wesfarmers in 2003 having built over 50 diesel and gas remote power stations. Walker then established ZEN in 2006 to replicate the earlier success. Hamish Moffat is the Managing Director and collectively the two directors own 27.4% of the company.

Finally, valuation is compelling for ZEN. Focusing on FY20 when their recently won Tanami contract contributes fully (completion is expected by the end of FY19), the stock trades at 8.3x PE. Another valuation look through relates to two corporate transactions in the space in the last three years. Firstly, earlier this year a competitor, Pacific Energy (ASX:PEA), paid an implied enterprise value per installed base of $1.1m per MW for Contract Power. Secondly, in mid-2015, Duet Group paid an enterprise value of $1.9bn for Energy Developments, which implied an enterprise value per installed base of $2.1m per MW for what was arguably a better set of assets (which we believe is more similar to ZEN’s portfolio).

These recent corporate transaction multiples applied to ZEN's installed base of 183MW post Tanami completion suggest an enterprise value range between $201m and $384m, significantly above ZEN’s current $135m.

ZEN in our view is one of the most attractive small cap opportunities currently available. The company has a high double-digit earnings growth profile over the next few years, has an extremely high proportion of recurring indexed revenue, offers high returns on the incremental capital invested, and is led by an experienced management team with plenty of skin in the game that have already demonstrated a sound ability to delivery remote energy projects to several resource companies. Remembering that the quality of earnings is akin to that of an infrastructure asset, we expect the stock to re-rate over time as they deliver growth from existing projects, as well as win new contracts as per their historical track record.

2 stocks mentioned