10 characteristics of an outstanding company

Oscar Wilde once wrote: ‘Experience is simply the name we give our mistakes'. Based on that definition, I am a very ‘experienced’ investor. Over the past 22 years advising clients and the past 12 years managing money professionally, I have made all the usual mistakes and a few unusual ones to boot. But as the cliché reads ‘mistakes are not a problem; not learning from them is’.

So what have I learned from my 22 years of investing? In this article, I will set out the 5 most critical traits we look for in a ‘good’ company and then outline one example that rates highly on these measures.

There is much debate [even amongst our own team] as to what is the most important, critically defining trait of a successful business. However it is clear in my mind that the most important trait is:

1: Trustworthy, shareholder focused, competent management

Ultimately, inside a company there are innumerable decisions that arise each and every day. How management respond to each of those decisions will – when collated over a period of time – determine the ultimate success [or failure] of your investment.

The dilemma here, however, is that ‘management’ is also arguably the most difficult attribute to assess. There are no formulas or ratios. Face to face meetings are good, but in the short term management can ‘fake’ integrity, vision and competency. And like a race horse [Black Caviar exempt] even past form is only a partial guide to future success. So what have our mistakes taught us on this point? Our learnings are twofold:

- Do not be over enamored with management after one, two or even three meetings. It takes a good number of meetings over a period of time to truly determine if management is trustworthy, shareholder focussed and competent. Be patient and ‘test’ company performance against management guidance.

- Secondly, wherever possible meet staff and assess the corporate culture. You can fake management, but it’s a lot harder to fake corporate culture.

The second critical trait is only slightly easier to assess:

2: Robust business model with sustainable moat or competitive advantage.

Whilst this is widely reported as the holy grail of investing, what’s not reported is that a ‘sustainable moat’ in its true form is

a] a truly rare commodity, and

b] unlikely to be as ‘sustainable’ over the long term.

Capitalism and the entrepreneurial spirit are wonderful at finding ways through, under or around supposed ‘barriers to entry’. However, barriers to entry do exist in the form of legislation, patents, intellectual property, economies of scale, brand ‘pole position’, geographical and physical constraints, infrastructure constraints, corporate culture, cost of capital and more. The long term returns are likely to be well above benchmark and it is likely to be an investment that you can ‘ride’ for many years into the future. But if you are fortunate to identify a company with a true ‘sustainable competitive advantage’, then first of all rigorously test your thesis [as it may not be what it appears] and secondly remember that it does have a use by date. This is not a licence to set and forget.

While our focus is on management and the business model, we always have one eye on the price we are paying:

3: Valuation

Paying too much for a good company is a common sin of our time. Equally, the notorious ‘value trap’ has been responsible for the destruction of significant wealth – especially when we consider the opportunity or holding cost.

To overcome, both of these issues, we focus on the Price to Earnings Growth (PEG) ratio, which is simply the PE ratio divided by earnings per share growth. When we started using this ratio more than 15 years ago, it was on the fringes. Today the PEG ratio is well entrenched in mainstream analysis.

Our next priority is companies that align with:

4: Positive Macro/Sector Tailwinds

I’m sure that you do not need to hear another story about ‘rising tides’ versus ‘swimming against the current’! This trait should be self-evident to all investors. Macro factors such as ‘step-change’ technology, population and industrialisation demographics, sector growth and phases within the economic cycle, can provide a ‘free kick’ and overcome a multitude of investment sins. A strong tailwind provides strong earnings momentum and importantly sentiment momentum.

This leads us onto our last trait which I am sure will knock a few of you off your fundamental investing pedestals..!

5: Appropriate Price Action:

AKA technical analysis confirming that we are acting in sync with the greater market. You can be absolutely totally right fundamentally, but wrong on your timing. As John Maynard Keynes wrote:

"markets can stay irrational longer than you can stay solvent".

Or as I like to paraphrase for Australian investors: ‘markets can stay irrational longer than you can stay patient’!

Yes, some of the very best investment opportunities are found by taking a contrarian approach. But this is where many self-directed investors have missed the point: once you identify a high calibre contrarian opportunity, an investor should wait until the sentiment begins to turn before starting to build a stake. In doing so investors save both capital ('cheap’ stocks getting cheaper), time and emotional energy - which is substantially under-appreciated.

5 additional filters that we use at Katana

In addition to the 5 we have covered above, every investment submission within Katana must pass our tests around a further five key characteristics.

These 5 additional filters take into account key metrics around the:

6) Balance sheet

7) Quality of earnings

8) Free cash flow

9) ROE / ROPE

10) Liquidity

Using Pioneer Credit as an example

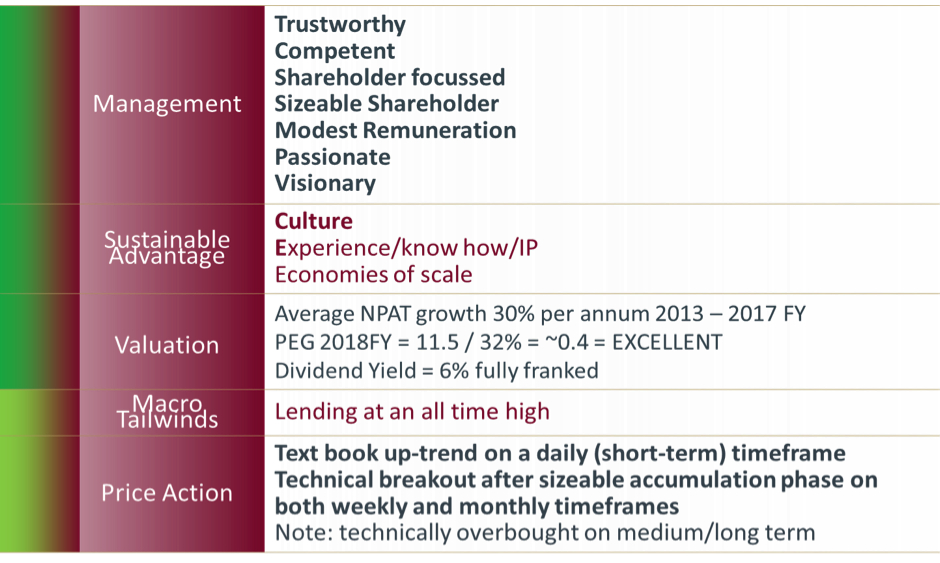

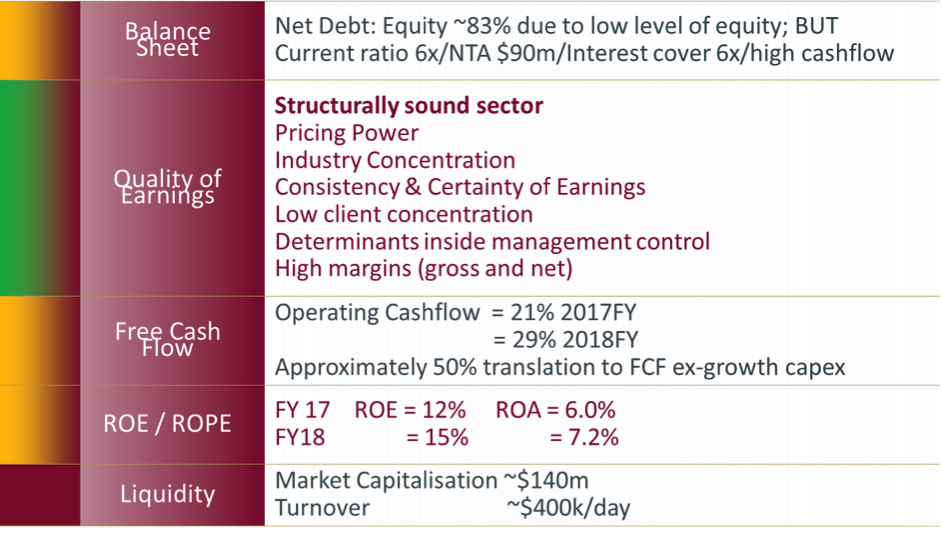

For purposes of illustration, we have included a checklist below summarising these key criteria and the things we look for.

This particular example is for Pioneer Credit Limited (ASX Code PNC), which is one of our top holdings, and hence in our view, one of our brightest prospects.

Criteria 1-5:

Criteria 6-10:

There are of course other criteria that we apply on a case by case basis. Sometimes we do so deliberately and consciously. Many times the assessment takes place in the depths of our subconscious, drawing on our catalogue of mistakes and learnings from the past 22 years.

But if we do truly learn from our mistakes and the mistakes of others, then the passage of time will work in our favour. As the Chinese Proverb reads: ‘With time and patience, the mulberry leaf becomes a silk gown.”

1 topic

1 stock mentioned

.jpg)

.jpg)