12 stocks Loftus Peak is backing in the AI "arms race"

While the fever around artificial intelligence may have cooled slightly since OpenAI's ChatGPT was released to the public in November 2022 (after all, we have regional and global bank collapses to worry about), the opportunities within this thematic are only just getting started.

That's according to the team at Loftus Peak, who recently held a webinar dedicated to helping investors better understand AI itself, the "arms race" between Google and Microsoft, as well as how investors can access the investment opportunity along the supply chain.

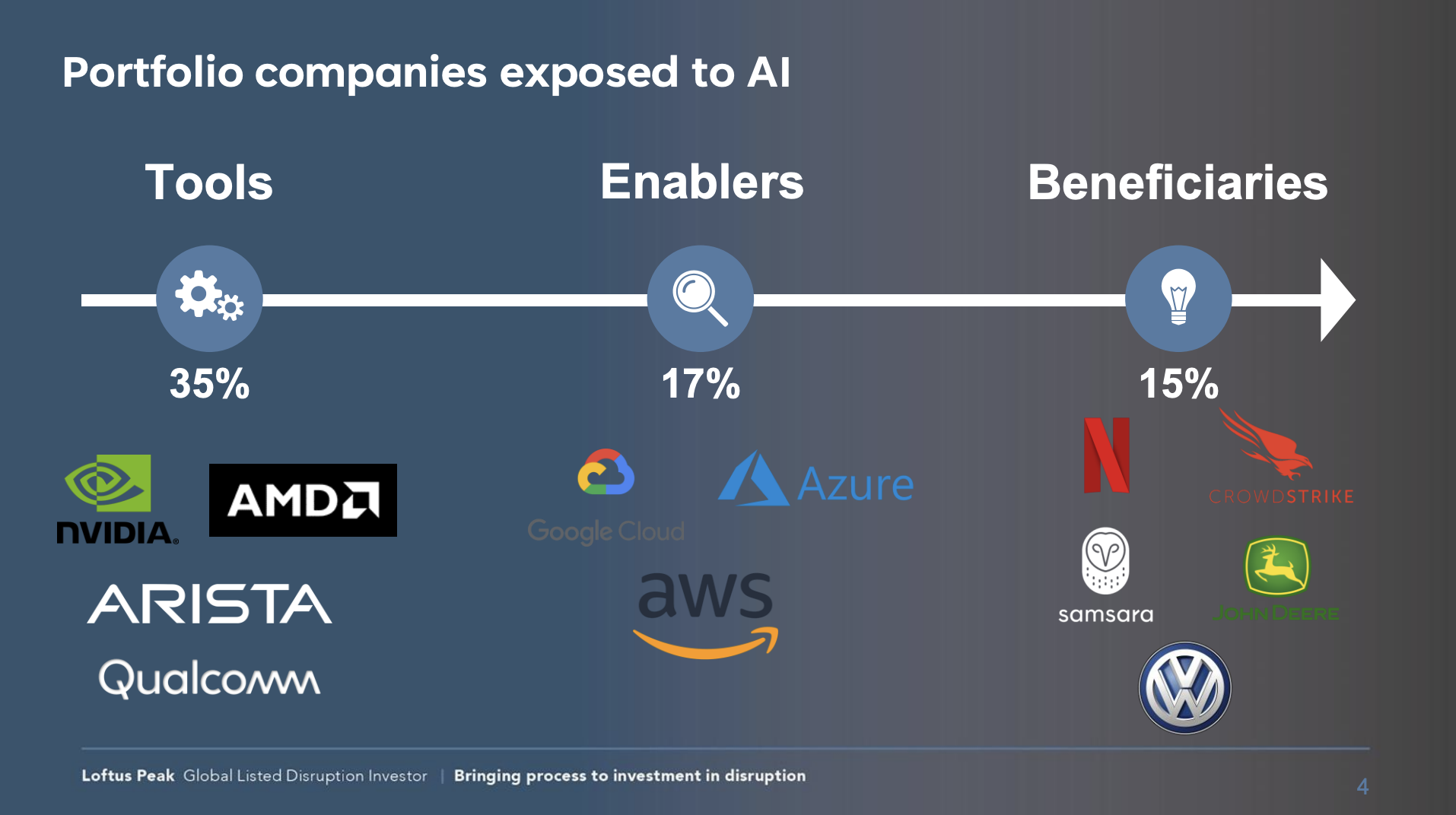

Why should you give two cents about what Loftus Peak has to say about AI? Well, the team truly understands it, having invested in this disruptive technology for nearly a decade. Today, around 65% of its portfolio is exposed to companies directly enabling or benefiting from AI.

In this wire, I'll break down some of the major insights from the webinar, as well as the pick-and-shovel plays, AI enablers and beneficiaries that the Loftus Peak team currently hold in the portfolio.

Plus, they also share why the valuation of semiconductor darling ASML (NASDAQ: ASML) no longer stacks up, revealing they have recently exited their position in the US$240 billion company.

.jpg)

What even is Artificial Intelligence (AI)?

As portfolio manager Anshu Sharma explains, the basic unit of Artificial Intelligence is data. This data set is used to train AI models so they can make decisions of their own.

For example, we may see "discriminative AI" in a vehicle. If something jumps out in front of a car, an advanced driver-assistance system (ADAS) will trigger the vehicle to respond accordingly, so it misses the animal, person, car or whatever it may be.

But a generative AI system could write a piece of poetry or an entire essay of a desired length. And this is what has been making headlines over the past few months.

"First, with the release of OpenAI's ChatGPT to the general public, just to play around with. And then Microsoft (NASDAQ: MSFT) announced that it was going to bring generative AI features to its Bing search engine and other Microsoft applications," Kennedy says.

"And Google (NASDAQ: GOOGL) has its Bard in the background, which it is talking about releasing at some point in the future."

The data required for these systems to operate is far larger than you could imagine, Kennedy says. For example, the GPT-3 model, which is what underpins OpenAI's ChatGBT, has about 175 billion parameters. GPT-4 will likely have trillions of parameters powering it.

"This stuff is costly to operate," Kennedy adds.

"It's been estimated that for ChatGPT to service a billion queries a day, it would require up to $20 billion worth of Nvidia (NASDAQ: NVDA) graphics processing units (GPUs). So, there are potential fortunes to be made for companies that produce silicon supporting generative AI."

The "arms race" between Google and Microsoft

As it currently stands, the largest generators of AI research are Google, Microsoft and Facebook (NASDAQ: META), analyst Harry Morrow explains.

"I think it says a lot that these three companies are in the lead when it comes to producing AI research," he says.

"Google has been investing as well. They acquired DeepMind back in 2014. And Sundar Pichai has been positioning the company as an AI company for the past five years."

That said, Sharma doesn't believe either will get left behind.

"It's not that Microsoft is gaining share, it's whether Google is going to lose share in terms of revenue because the time and use cases are expanding," he says.

"With the amount of data Google has, it does have an edge on the amount of data which is generated, which it could obviously train better. So, I don't think it's going to be that stark difference that we saw, let's say in Intel and other companies, where Intel just kept on being left behind."

And, even though we have been talking about AI for what feels like a decade now, the market is still in its infancy.

"There will be a lot of iterations here ... We are at the starting stage right now in this expanding market. It's not a mature market," Sharma adds.

Identifying opportunities

- Ecosystems, networks and platforms

- Data centres, cloud and machine learning

- Connected devices and the Internet of Things (IoT)

- Genetics, life sciences and health

- Energy as a technology (not as a fuel)

- China - by virtue of its size and power

Instead of assessing these opportunities industry by industry, which Sharma dubs as "backwards-looking", Loftus Peak believes that every single industry in the world will eventually be disrupted by AI.

"We divide our portfolio in a different way. We've divided it into tools, enablers, and beneficiaries," Sharma explains. (See image below)

Data generation and storage are happening within the world of networks and ecosystems. Once this data has been generated and stored, it requires computing power to actually make use of it.

"That's where the tools, the chip companies, the semiconductors of the world come in," Sharma says.

"One of the stocks which everyone is talking about is Nvidia because its chips will enable Microsoft to do all that generative AI compute power, or at least, that is the assumption."

The "beneficiaries" rely on the "tools" and "enablers" to provide better services and products to their customers. For example, Netflix (NASDAQ: NFLX) uses algorithms to recommend shows and movies to subscribers. This data is digested by AWS, which relies on semiconductor companies for its cloud service.

An example of an AI "tool" company (and why it's got the team at Loftus Peak excited)

"On its most recent earnings call, Lisa Su, the CEO of AMD, said that AI is one of the largest growth opportunities for the company," he says.

"This is still at a very early stage, but it is going to transform virtually every service and product, including their own."

AMD's ALVEO V70, a speed-up board for network transactions, can increase the efficiency of AI models substantially, Kennedy says.

This could be in video analytics, customer recommendation engines (like what we see with Netflix), and even in fast transaction finance, he says.

"Hedge funds are interested in that card for speeding up their transactions," he says.

AMD is set to release a new adaptive processing unit called M1300, which "contains a CPU, a GPU, and is especially good at training big AI models," Kennedy explains.

"So, a kit like this is going to become more and more important as these large language models (LLMs) really scale out."

He points to ChatGPT as an example, which requires billions if not trillions of parameters to function.

"This whole new world of generative AI is going to require some serious silicon grunt to train it," Kennedy says.

Companies that are beneficiaries of AI

As mentioned previously, Netflix uses AI to power its recommendation algorithm. In fact, 80% of the content people watch on Netflix comes from this algorithm, Morrow explains.

"There's obviously a material benefit in machine learning to Netflix in terms of user retention and acquisition," he says.

CrowdStrike (NASDAQ: CRWD) is another example.

"CrowdStrike is an endpoint cybersecurity company and it leverages data across all of the company endpoints in order to proactively detect threats and then automate the response to those threats," Morrow explains.

"On the fleet management side of things, that might be predictive maintenance in terms of when you might require some fixes to the vehicle, route optimisation, as well as driver monitoring such as drowsiness and distraction," Morrow says.

John Deere (NYSE: DE), which manufactures agricultural and forestry machinery, heavy equipment, diesel engines, drivetrains used in heavy equipment, and lawn care equipment, also is invested in AI.

"By 2030, 10% of their revenue is coming from software," Sharma says.

"That software analyses the data which comes from the tractors and the harvesters and goes into the cloud."

Volkswagen (ETR: VOW3) is another interesting opportunity, Sharma adds.

"In the last two or three quarters, we have really skewed our portfolio and increased our exposure towards automobiles. We think the market is missing this whole thing, which we are calling software-defined vehicles or digitisation of vehicles," he says.

However, in the case of Volkswagen, it's not a case of revenue upside for the stock. It's whether or not it can survive if it doesn't innovate fast enough.

"We don't think the vehicle of tomorrow can be what the vehicle of history has been," he says.

"In five years from now, vehicles will have more silicon. There will be more data being generated, more sensors, and more cameras. And the cars will have the ability to make decisions."

If that last part seems farfetched, it's not.

"That is all already happening," Sharma says.

"Even in this down market, the automobile sector across all our companies is growing and is growing at a very decent pace. Indie Semiconductor predicts that the amount of silicon and the number of radar sensors and LiDAR (Light Detection and Ranging) cameras going into the cars will go from US$700 to US$7,000."

This is where the market is getting the opportunity wrong, Sharma says.

"We think AI has a very huge application in the way cars of tomorrow will look. And when we say tomorrow, this is not 15 years, we are looking at 2025 as the inflection point," he says.

"If Tesla is doing what it's doing and it has a really good consumer experience, for us, all the cars of the future have to be much more intelligent than they have been. And all those solutions are available right now."

A position the team has exited

Sharma also revealed the team had exited its position in ASML.

"We haven't reentered yet. There's another company similar to ASML out of Japan known as Tokyo Electron (TYO: 8035). That is a part of the portfolio," he says.

"The reason we didn't re-enter ASML was essentially we feel like they have a capacity constraint. It's already running until 2025 capacity. It's already there. So, it's already in the numbers."

The company has also announced CapEx cuts, he notes, adding "we want to stay away from that."

"Tokyo Electron is a small operation, and on valuation, that makes more sense to us than ASML," Sharma says.

5 topics

10 stocks mentioned