180 Markets: Movers and Shakers

180 Markets

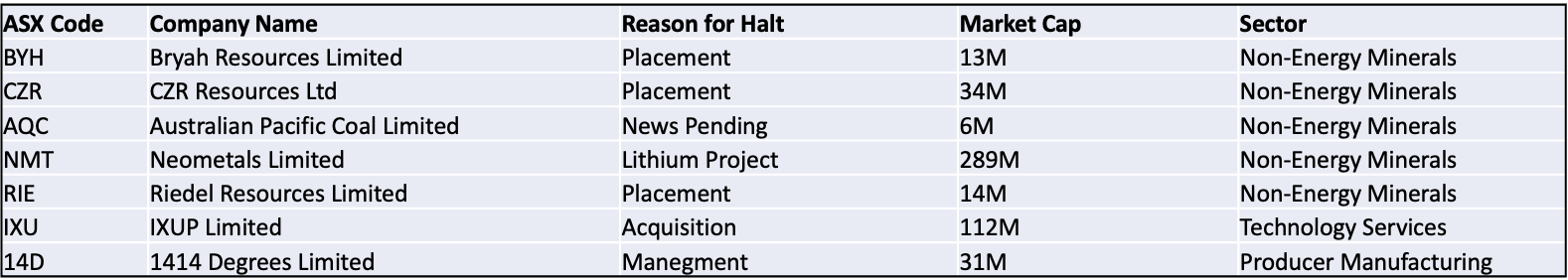

TODAYS' TRADING HALTS

Bryah Resources Limited (ASX: BYH) is seeking to raise $2.95 million at an issue price of $0.075 per new share. For every new share subscribed for in the placement, participants will also receive one free attaching (ASX: BYHOA) listed option, which has a strike price of $0.09 and expires on June 31 2023. Funds raised will be applied for drilling at the company's Bryah Basin and Gabanintha projects, for sample analyses, technological staff & contractors, remote sensing and metallurgical testwork. Bryah Resources (ASX: BYH) has successfully been granted an allocation of up to $585,000 in JMEI tax credits for the 2020/2021 income tax year. These are potentially available to eligible shareholders who are issued new shares via the capital raising being conducted today. 180 Markets is lead manager on the placement.

CZR Resources Limited (ASX: CZR) is raising $7 million at an offer price of $0.0115 per new share via a two-tranche placement. This represents a 17.86% discount to the last closing price and a 20.98% discount to the 30-day VWAP. The company also intends to undertake a share purchase plan (SPP) to raise an additional $500,000 at the same price as the placement. Funds will primarily be used for DFS and development planning for the company’s Robe Mesa project.

Riedel Resources Limited (ASX: RIE) is currently in a trading halt pending an announcement regarding a capital raising.

1414 Degrees Limited (ASX: 14D) is currently in a trading halt pending an announcement regarding the company’s management.

Neometals Limited (ASX: NMT) is in a halt regarding a material update in relation to its Lithium Refinery Project.

Australian Pacific Coal Limited (ASX: ACQ) is in a trading halt pending a release by the Company in relation to the Modification 7 Application.

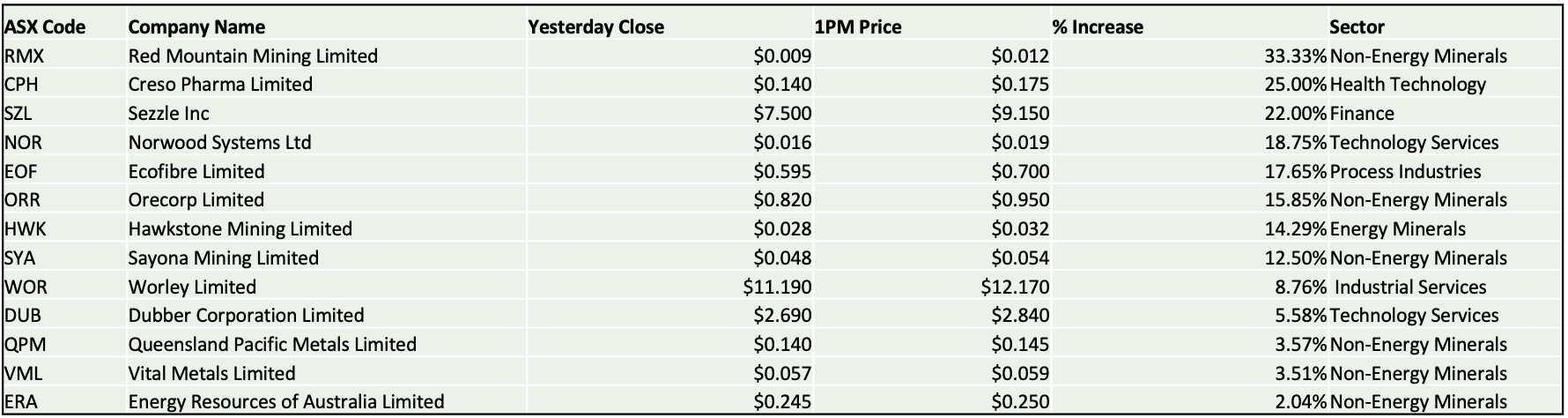

WHATS HOT

***The above is stocks we have noticed to be rising based on price and volume***

Sezzle Inc. (ASX: SZL) hit an intraday high of $9.45 after signing a three-year agreement with Target Corporation. Sizzle’s product is set to be used in-store and across Target’s digital platforms, providing customers with access to interest-free payment plans for purchases made at Target. This comes off the back off a number of successful announcements for the company, including entering into the interest-based lending space, launching a solid March quarterly and revealing plans to list on the NASDAQ.

Red Mountain Limited (ASX: RMX) hit an intraday high of $0.014, trading large volumes after announcing an investor awareness and marketing campaign with StocksDigital. The shares to StocksDigital are being issued at $0.015 per share, a 66.6% premium to the yesterday’s closing price of $0.009 per share. The company also announced that it received commitments from sophisticated and professional investors to raise $800,000 via the issue of unsecured convertible notes with a face value of $1.00. Noteholders will receive a 1 for 3 free attaching option with an exercise price of $0.011 and expiration on the 2nd of October 2022. Funds used from the issue of the Convertible Notes will be used to accelerate exploration activities in the Company’s projects in Western Australia and NSW.

Hawkstone Mining (ASX: HWK) reached a high of $0.037 this morning after announcing that it will focus its efforts entirely on the company’s Big Sandy Sedimentary Lithium Project in Arizona. As part of its shift in strategic direction, the company will change its name to Arizona Limited and spin-out its portfolio of gold and gold-copper projects to form a separate listed company called Diablo Resources Limited. The company also intends to divest and sell Diablo in the Devil’s Canyon Gold-Copper Project in Nevada, Western Desert Gold-Copper Project in Utah, and the Lone Pine Gold Project including the King Solomon Mine in Idaho.

Creso Pharma Limited (ASX: CPH) hit an intraday high of $0.175 after a Senate Bill was passed by the California State Senate legalising the use and possession of psilocybin and other psychedelic compounds. If passed into law, it will approve the use of mushrooms, MDMA, LSD, mescaline and ibogaine for combat veterans with PTSD, and people with diagnosed or undiagnosed addictions and mental illnesses. The company stated that the Bill highlighted an ongoing acceptance and regulatory shift towards psychedelics as an alternative treatment for mental health issues.

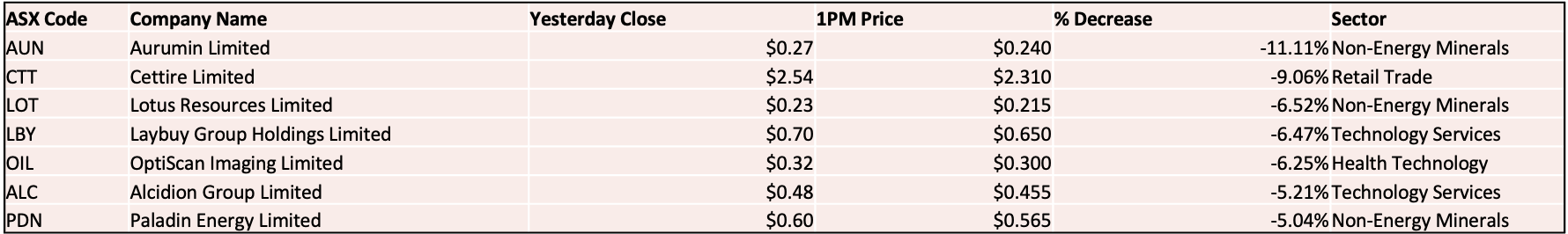

WHATS NOT

***The above is stocks we have noticed to be falling based on price and volume***

Paladin Energy Limited (ASX: PDN) is trading down this morning after it commenced trading on the Pink Market to the OTCQX Best Market in the US. The company commentated that trading on the OTCQX allowed for greater visibility and accessibility to retail and small institutional investors.

Aurumin Limited (ASX: AUN) is down this morning after receiving assay results for its Mt Palmer Project. The results did not meet expectations. Managing Director, Brad Valiukas, commented “The Mt Palmer gold system has a complex 3D geometry, and we did not intersect our projection of high-grade mineralised shoots with this first pass drilling. The Company has recently completed a structural geology review at Mt Palmer and, with on-going modelling, we expect to have a revised targeting model for Mt Palmer in the near future.”

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Check it out now for:

- First access to a list of Australia’s 100 top-rated funds

- Detailed fund profile pages to help you compare performance, fees, and philosophy

- Exclusive in-depth interviews with expert researchers from Lonsec, Morningstar and Zenith.

- One-on-one videos and articles with 16 of Australia’s best fund managers

26 stocks mentioned

Greg is Co-founder of 180 Markets which gives access to Australia's hottest IPOs and Placements. Previously Greg has spent over 20 years as a professional hedge fund investor, including with P Schoenfeld Asset Management and Credit Suisse, in...

Expertise

Greg is Co-founder of 180 Markets which gives access to Australia's hottest IPOs and Placements. Previously Greg has spent over 20 years as a professional hedge fund investor, including with P Schoenfeld Asset Management and Credit Suisse, in...