2 small stocks with big catalysts in 2024

With inflation grinding lower and central banks toning down their hawkish rhetoric, this oversold area of the market could experience a faster turnaround than expected as risk appetite returns to the market.

The area I am talking about, of course, is small caps. In fact, Ellerston's Alexandra Clarke believes the odds of outperformance are the most favourable they've been since the Global Financial Crisis.

Over the 12 months from March 2009 to March 2010, the S&P/ASX Small Ordinaries Index rebounded more than 70%. So could we be in for a similar rebound in 2024?

To find out, Livewire spoke with Clarke for her thoughts on the IPO market reopening in 2024, three factors that are important when analysing newly listed companies, as well as two small-cap stocks that she believes could rerate significantly over the months ahead.

Plus, she also points to three interesting charts which outline the opportunity in small caps today.

%20(3).jpg)

The Small Ords has rallied 12.7% since the beginning of November last year. Will this continue in 2024?

The S&P/ASX Small Ordinaries Index has dropped 23.3% to 2708.6 points since the end of 2021 as the fastest interest rate tightening cycle in a generation erased confidence in the space. While markets have rallied recently, Australian small caps have materially underperformed large caps and have only moved back to the top of their 18-month trading range. This presents numerous opportunities to invest in the Australian small caps.

If the market continues to factor in a fall in inflation and interest rates, small caps could see big gains and a faster turnaround than expected from their current oversold levels as risk appetite returns to the space.

Can you share a few charts that have caught your attention recently? What do they show and why are they important?

Attractive Entry Point

Over the past two years, Australian small-cap companies have significantly lagged the overall market, especially their large-cap counterparts.

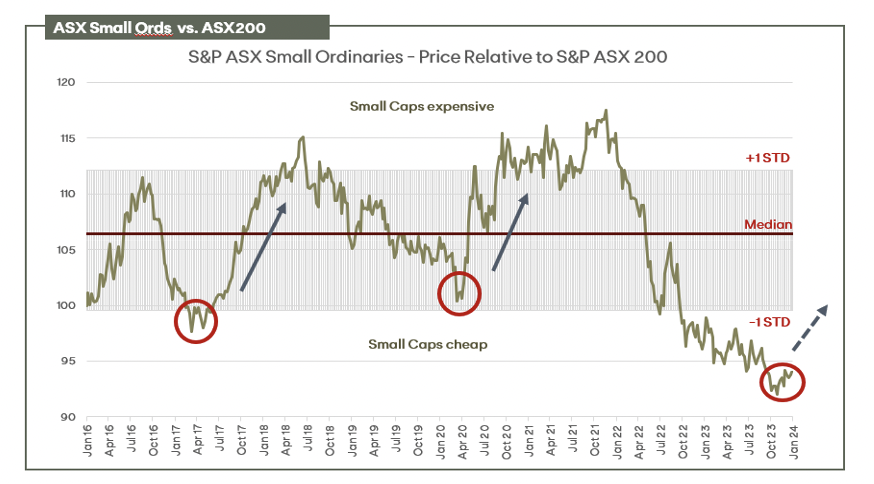

The relative performance of Small Ords versus the ASX 200 is at its lowest point in eight years. At current oversold levels, the small-caps space is presenting a compelling risk-return profile for investors.

This is especially true if inflationary and interest rate expectations continue to fade.

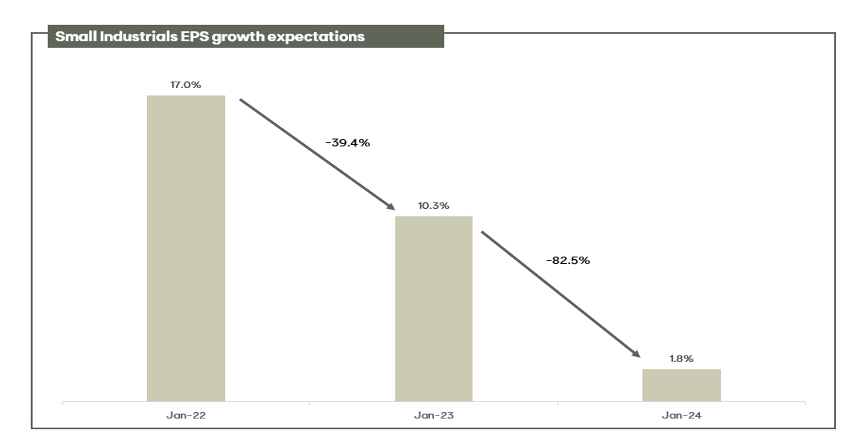

Small Industrials have seen significant EPS downgrades as markets continue to wait for further certainty on economic conditions. However, markets have already cut EPS growth expectations considerably.

We think this provides an attractive entry point for investors. We have never had more toys in our sand pit to deploy capital. This is really a stock pickers market which suits our investment style.

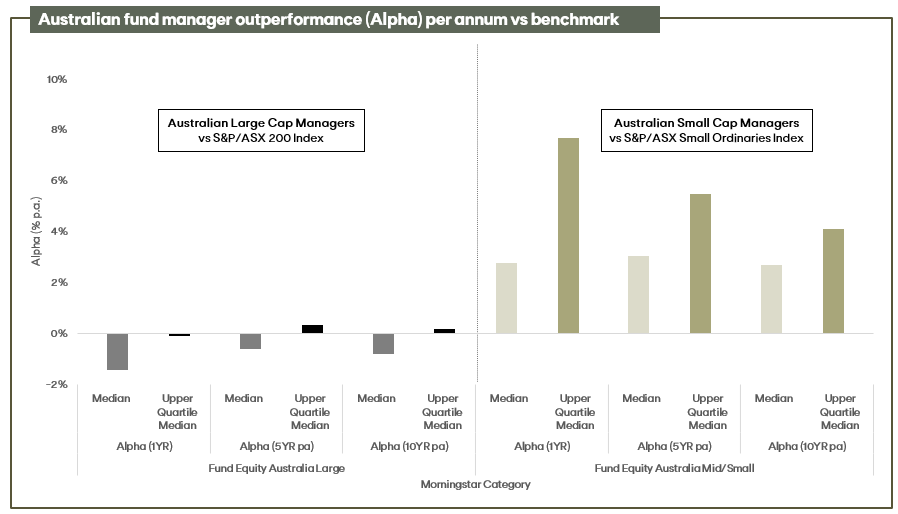

We fundamentally believe that active management at the smaller end of the market delivers outperformance over time, as you can see from the chart below:

Source: Morningstar Performance Reporting as of 31 December 2023. “Large Caps” refers to fund managers within the “Equity Australia Large Blend, Equity Australia Large Growth, Equity Australia Large Value, Equity Australia Derivative Income” Morningstar Categories. “Mid/Small Caps” refers to fund managers within the “Equity Australia Mid/Small Blend, Equity Australia Mid/Small Growth, Equity Australia Mid/Small Value” Morningstar Categories.

What is your macro base case for 2024? And what does this mean for small-cap investors?

While macro outlook is an important input into our process, we are fundamentally bottom-up stock pickers. That said, at this stage, inflation appears to be grinding lower, and central banks are starting to tone down the hawkish rhetoric, which should be supportive for markets. The wild card is the US election. If Trump starts to get traction, global markets could get moving higher.

This provides one of the most favourable environments for the Australian small-caps market to outperform in 2024 since the GFC.

The IPO market was on standby in 2023. Will that change this year?

We are eagerly anticipating the commencement of IPO markets in 2024. We believe that the volatility in equities, coupled with the shifting cost of debt amid rising rates, posed challenges for the broader market in accurately pricing risk throughout 2023. This circumstance made it challenging for the market to engage actively in IPOs, particularly those with a limited public track record. However, in our perspective, as we progress into the second half of this year, we anticipate that companies will start finding opportunities to go public and join the boards.

Which three factors are the most important when investing in IPOs?

We believe IPOs are an important part of the small-cap market, emphasising the need for careful selection of participation. In our view, the three golden rules for investing in IPOs are as follows:

1. Purpose of IPO

The reason behind a company going public holds crucial importance. We favour IPOs where the primary motivation for listing is to access growth capital. Such IPOs typically involve minimal to no sell-down from existing holders, showcasing their confidence in leveraging the newly raised capital to accelerate growth.

2. Management Quality

Particularly at the smaller end, we prefer companies led by founders or a management team with a substantial tenure. It's imperative that management is deeply committed to the future of the business rather than viewing the IPO as merely an exit strategy.

3. Prospectus Evaluation

Prospectuses or Pathfinders are often as much a marketing document as they are an information source and legal document. The substantive information is usually situated towards the end, and this reverse approach ensures a comprehensive understanding beyond the initial marketing content. Hence, we advocate reading prospectuses from back to front.

Can you take us through the two newest additions to the fund?

When we look for a new investment, we are looking for companies that can give us a three-to-one risk-return while delivering around 50% over a three-year period. Two names that have joined the Emerging Portfolio recently are Sigma Healthcare (ASX: SIG) and Nido Education (ASX: NDO).

Sigma Healthcare was originally a prospect position, we thought it was through the worst of several issues, including losing the supply of Chemist Warehouse’s PBS goods, ERP implementation issues and resulting market share losses. Following this period, SIG won back the PBS component of the Chemist Warehouse contract – while this would deliver significant earnings leverage to the business, the market had concerns about the funding of the working capital. We used this weakness to increase our weight, thinking the funding required would be less than the market anticipated. Subsequently, the merger with Chemist Warehouse was announced, which transformed SIG from a low-margin distributor with meaningful contract risk into a compounding, vertically integrated pharmacy business with global optionality. While there are a number of steps that need to be settled before the merger completes, we think this company will be on everyone’s radar and will re-rate materially.

Nido Education was an IPO we participated in late last year. What attracted us to NDO was the fact that its founder Matthew Edwards, in our view, is one of the better childcare players in the market. His previous listed vehicle Think Education was acquired in 2022 and this new vehicle has ironed out some of the kinks that are inherent to the listed childcare space. We think NDO is going to be a slow burn but over the coming years, it will really scale and deliver better returns than peers given its incubator model. We believe NDO demonstrating strong occupancy (vs peers) and the first incubator acquisition will be the big catalyst to drive the share price going forward.

What is something that not many people know about you?

My coffee-making skills are nothing short of dreadful. During my university years, I reluctantly assumed the unofficial role of "barista" at a sandwich bar. To anyone who suffered through my coffee creations, I extend my sincere apologies. I might just be among the top percentile of the worst coffee makers in the country. Even after all these years, my ability to produce anything above a subpar flat white remains questionable. I have immense appreciation for skilled baristas who can make a decent cup. I gladly contribute to supporting local cafes that feed my caffeine addiction.

Although it's not a topic I usually delve into, I must confess that I was born in New Zealand. Embracing being Australian meant bidding farewell to two things I cherish the most – New Zealand's world-class rugby team and its enticing zero capital gains tax policy.

Learn more

If you would like to learn more about Ellerston Capital's Emerging Leaders Fund please click the link below.

2 topics

2 stocks mentioned

1 fund mentioned

1 contributor mentioned