2 steps forward, 1.5 steps back

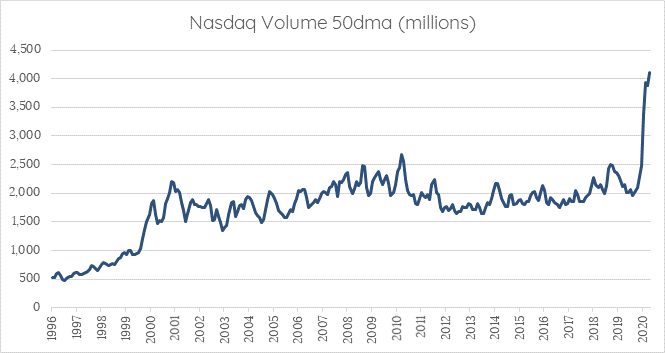

The sharp move lower in markets only 7 trading days ago (11 June) was dramatic – one of the 20 largest down days in global stock market history and the eighth largest one day spike in the volatility index (VIX). The below chart shows the increased volume of shares traded on the Nasdaq this year.

Source: Bloomberg

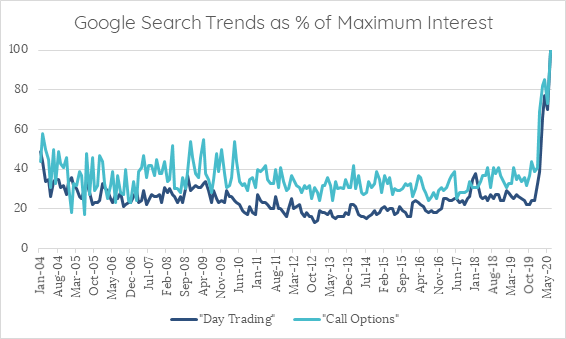

This is a timely reminder that markets have moved significantly higher in price since the March lows, while the positioning of speculative retail investment (ie. day traders) is extreme, and the path of recovery in economies and corporate profits still very uncertain.

Source: Google

So what are some of the factors driving this uncertainty?

Near term economic risks are centred around:

The US election. Typically markets struggle to make progress in the 3 months preceding the presidential election.

A lack of further fiscal stimulus in the US and progress on the European recovery fund

Neither consumers nor commercial entities currently are in any rush to expand - leaving contractionary forces difficult to overcome

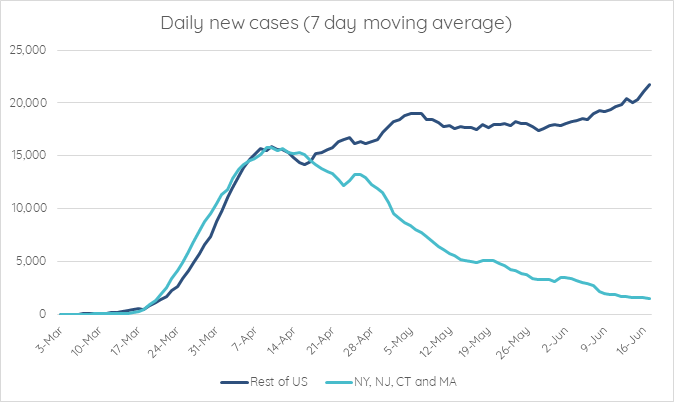

A still high level of COVID infections in the US (ex New York, New Jersey, Massachusetts and Connecticut)

Source: Bloomberg

Despite this and the recent dip, markets have rebounded strongly, and given valuations are materially higher today than the bottom in March and that these stocks / markets are dependent on the continued improvement in growth, it’s not unreasonable to expect some disappointment.

2 steps forward and 1½ steps back might be the motto for a while.

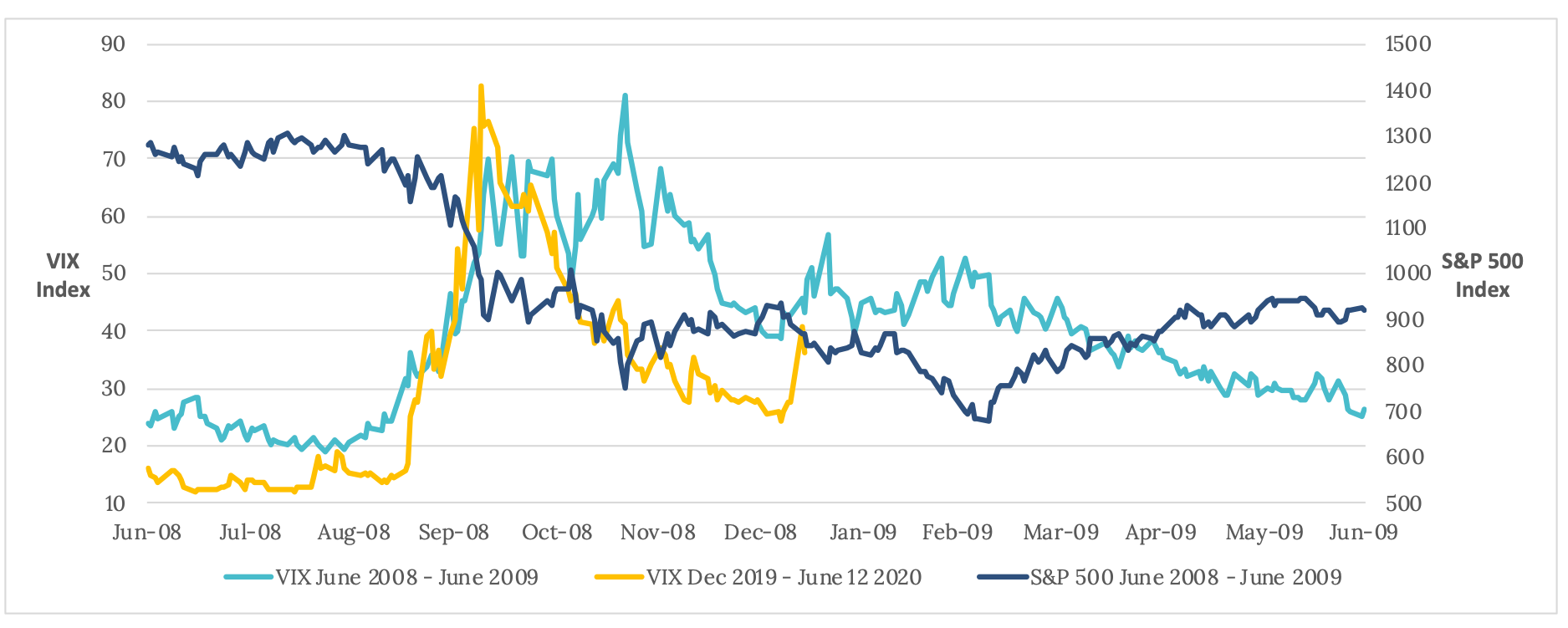

It’s worth remembering that this is not unprecedented. Last week’s ‘second correction’ is in line with history - as demonstrated by the VIX during the GFC overlaid with its path since December 2019 to now.

Source: Bloomberg

Finally performance and profits are also still uncertain. Earnings revision momentum declined again vs the week before at 21.5%. Momentum in revisions is uniformly poor across all regions – the worst being in the US where the last 3 months has seen negative earnings revisions in absolute terms of 33%, in line with Europe.

So where to go? True diversification, a differentiated income source and a strategy that not only smooths out the volatility but takes advantage of it seems like a good place to start.

Get investment ideas from industry insiders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics