3 ASX sectors with stocks that have growth at a reasonable price

.png)

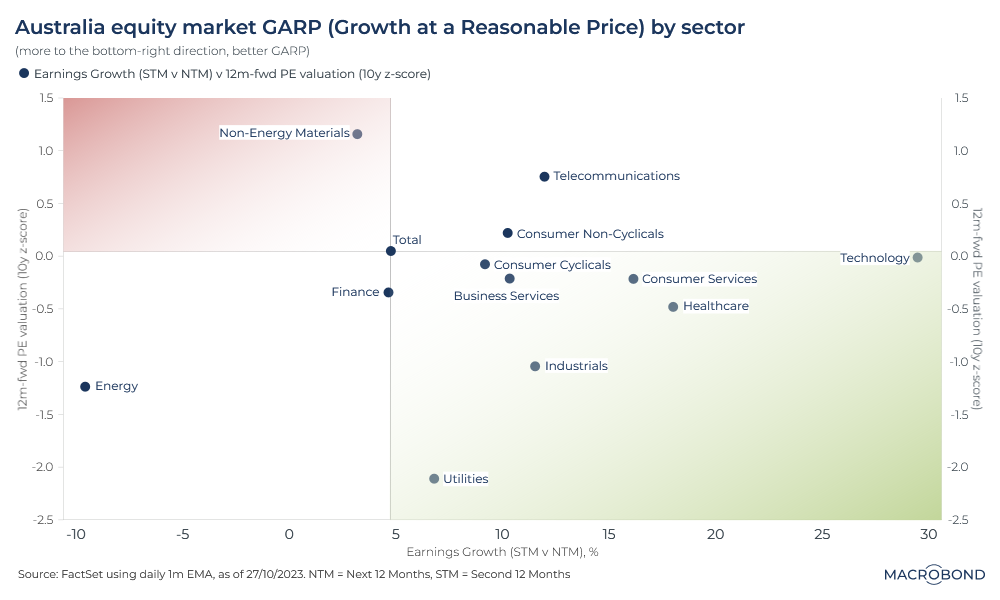

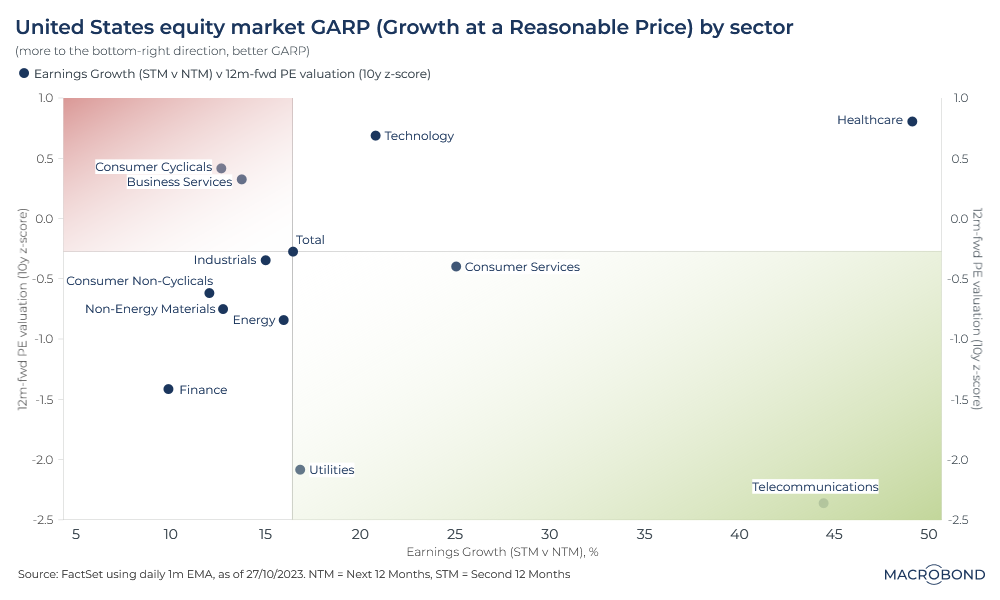

Vigilant investors might consider a GARP (Growth at a Reasonable Price) strategy that seeks stocks with high growth but low valuations as a part of their asset allocation. Such stocks tend to offer desirable diversification as this method delivers the balance between growth stocks and value stocks.

Therefore, by applying the GARP strategy, we can identify some attractive equity sectors in Australia—while also comparing them to the US—that offer high growth prospects at reasonable prices, and avoiding those that have low growth expectations but are overpriced.

4 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)