3 reasons to own emerging markets

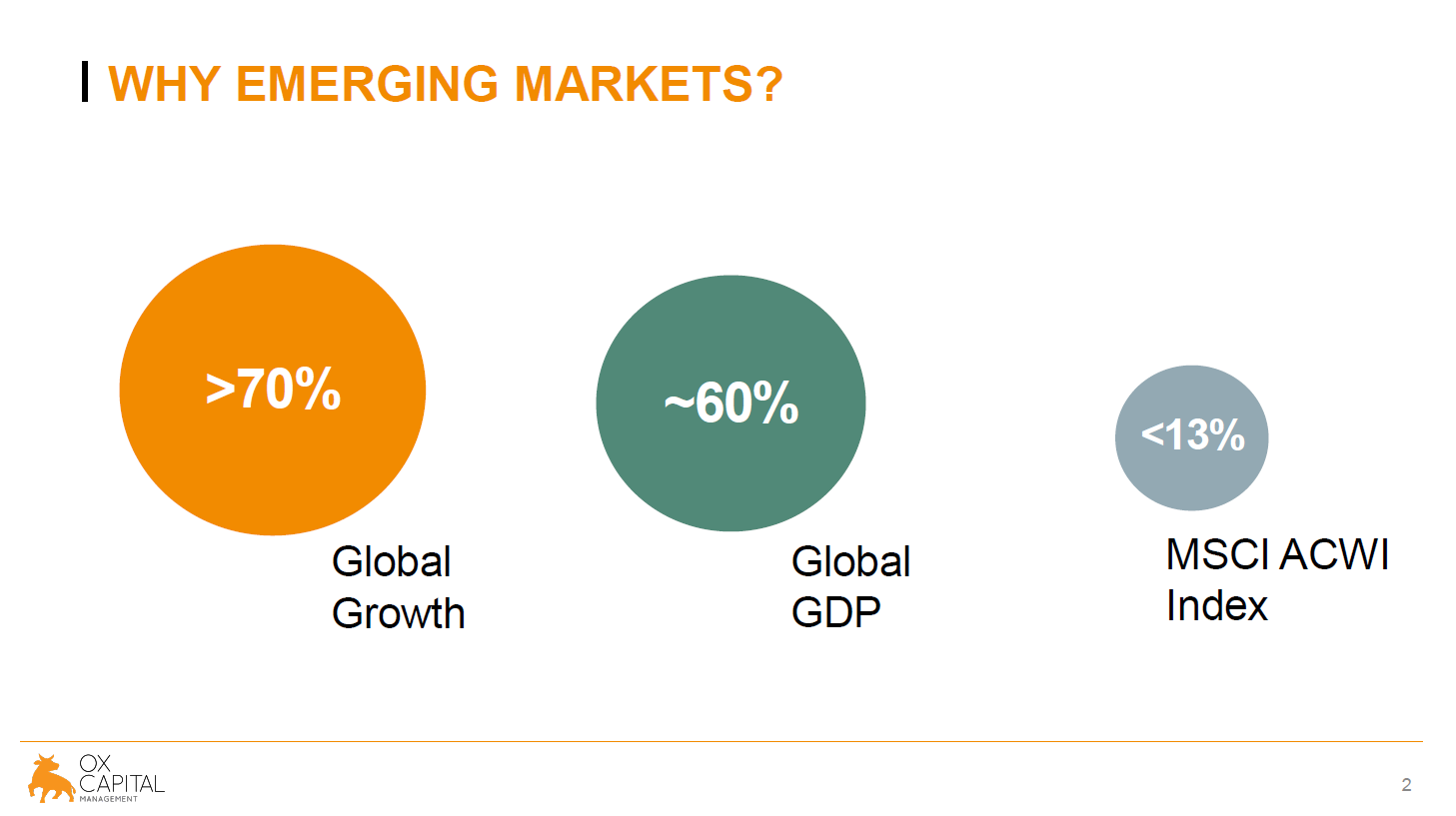

Emerging markets make up over 70% of global growth and around 60% of global GDP. However, they make up less than 13% of the MSCI All Countries World Index. This just goes to show that emerging markets are under-invested.

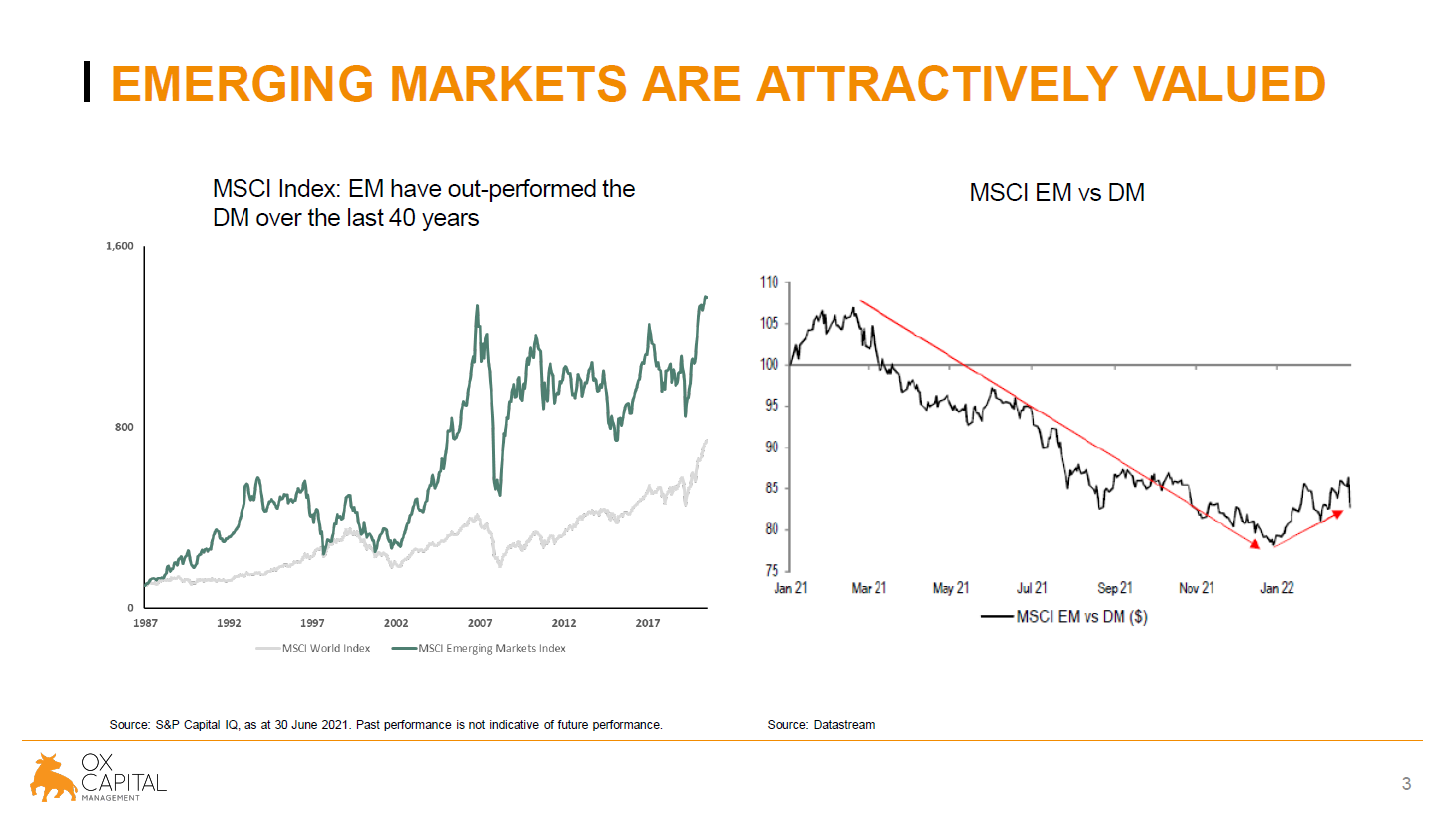

They’re also attractively valued. Despite a 40-year history of outperformance, emerging markets have underperformed developed markets over the last 10 years, leaving valuations looking far healthier.

Emerging markets also offer attractive growth profiles, with some economies well placed to handle inflation.

In this Fund in Focus, I explain how the Ox Capital Dynamic Emerging Markets Fund is finding ESG-friendly, mispriced opportunities in Asia and beyond. I also share one market that’s in a prime position to benefit from rising commodity prices, and a company that’s set to profit from huge growth in mobile internet.

Edited transcript...

Welcome everybody. My name is Joseph Lai. I'm the chief investment officer of Ox Capital. With Ox Capital, what we are doing is to bring together a few things to create a strong investment firm. By that, I mean a strong focus, alignment, culture, and experience together to bring a good investment outcome for our clients.

We are very excited about what we are doing here, and in terms of timing, I also believe that this is a super amazing time to look at emerging markets, because what's worked before in the last 10 years, in terms of the types of stocks that are going to do well, is unlikely going to be the same going forward. We're moving from a world where there's fast growth, low inflation and geopolitical stability to one that is much slower growth, high inflation, and much less stable on the geopolitical front.

So the really hyped-up story stocks are just not going to achieve the same valuation, and they will not be the market darlings, we believe, in the coming five or 10 years. The emerging markets, however, can offer what the market may want, because emerging markets has growth and also has some economies and companies which can deal with inflation much better.

We believe that the emerging markets will be much more interesting going forward for the next five or 10 years. So what are emerging markets? Emerging markets are basically developing countries, and the stock markets within those countries. Emerging market economies are already 70% of global growth, and it makes up 60% of global GDP. However, it makes up a very small percentage in terms of the MSCI World Index. This suggests that there's a lot of underinvestment in emerging markets.

One point to make about emerging markets is that the valuation at that moment is very attractive. Over the long term, emerging markets have actually tended to outperform developed markets. On the slide, we can see the 40-year history of outperformance of emerging countries. The last 10 years, however, has been a complete reversal, where developed markets have done much better than emerging markets.

Now, the reason for that, I put it down to two reasons. The first reason was just the starting valuation of emerging markets were very high, because there's a lot of excitement 10 years ago with the rapid growth of China. Now that valuation has come down after 10 years of under-performance.

The second reason was because China was sort of slowing down, and had to do multiple rounds of debt reduction or deleveraging. They simply put on too much debt during the global financial crisis. That's the stimulus after the crisis, and had to deal with that for 10 years. But now we believe that they have almost fully reduced the amount of debt that they want to in the economy.

So going forward, we believe that growth for China, and therefore for emerging countries, would be a lot more steadier as opposed to the stop-go environment that we've been used to over the last 10 years.

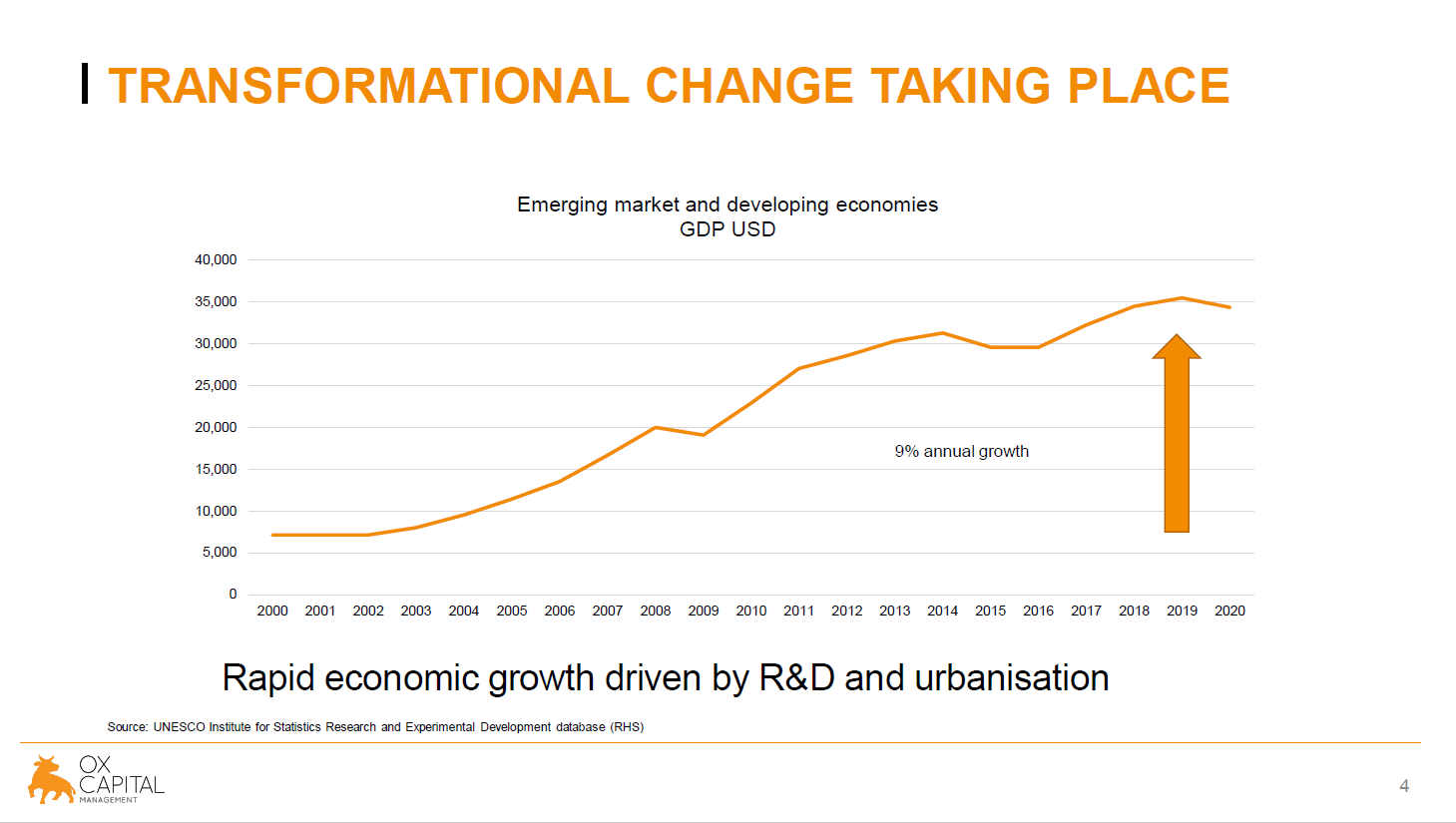

Now, transformation changes are taking place in emerging countries. Would you know that these economies have been growing an an annual rate of 9% a year for a very long time. But you know, over the last decade, a lot of these markets have hardly moved, or have hardly appreciated. So there's a lot of undervaluation, a lot of catch-up to be done.

What's more, Asia is leading the way. Now, there's a lot of Asian companies coming of age. We are seeing a lot of domestic champions emerging in Asia, which are basically doing better job than multinationals in their own game. So to actually access these companies, we have to invest directly in emerging markets.

Our core beliefs dictate how we invest your money. Firstly, we like to own structurally growing businesses and emerging markets have lots of those. An appreciation of how markets behave in different economic environments is important to us, because we believe it can help to generate excess returns and manage volatility. We are ESG focused, and lastly, and importantly, we believe that markets can be inefficient at times and we are there to seek to exploit these mispriced opportunities.

Let's move on to our approach. So we're experienced investors. We invest in a index agnostic manner. The portfolio would have 30 to 50 stocks of companies we like that can take advantage of what's going on in the emerging countries. We've got a good and robust risk management model. Really what we're trying to do is to do good bottom-up fundamental analysis, and then use the risk management process to achieve good long-term returns with reduced volatility.

So why can we deliver? We've got a robust investment process. We've worked together for 15 years. The team is experienced, and it's got diverse backgrounds. The strong alignment in the team and the culture is extremely transparent and collaborative. We also have this risk management framework, which can help us capture or reduce volatility of returns.

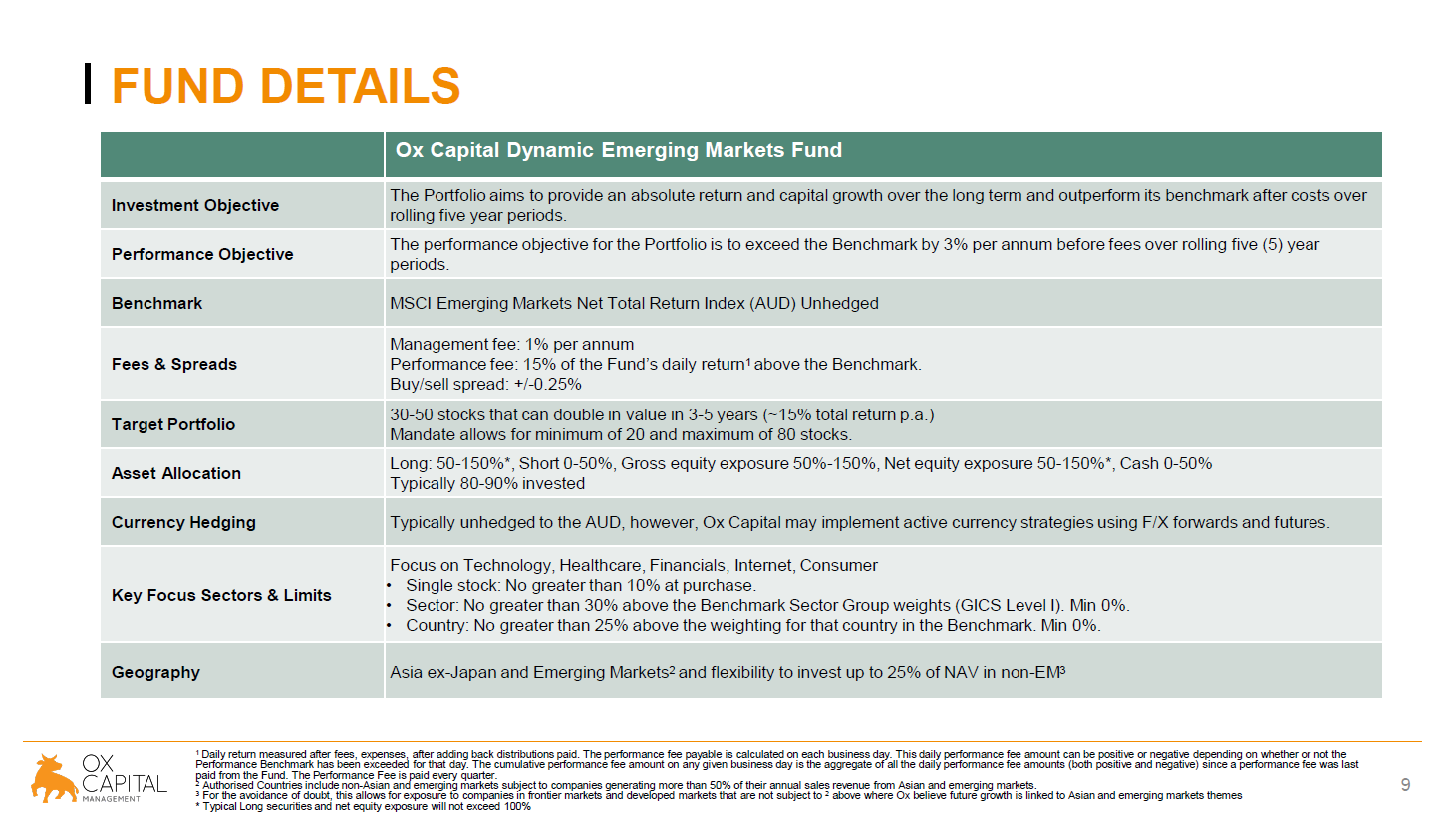

Let's talk about the fund. The fund aims to achieve 15% absolute return a year over the long term. As I mentioned before, the number of stocks would be ranging from 30 to 50 stocks. Investor position would be about 80 to 90% most of the time, although there's a limit of 50% net invested position to 100%. We don't use leverage to juice up the returns.

So where we are currently invested. There is a focus in the fund on five key sectors. The five sectors are financials, and this really refers to life insurance, internet, technology, consumers, and healthcare. We believe these are very, very powerful secular themes for emerging countries and the consumers.

In terms of the market that we are invested in, most of the stocks are going to be in Asia. There's some in stocks at the moment that we have exposure to in other parts of emerging markets. We can also access other parts of the world if the company in that country are the best position to take advantage of the secular trend that's generated from these emerging countries.

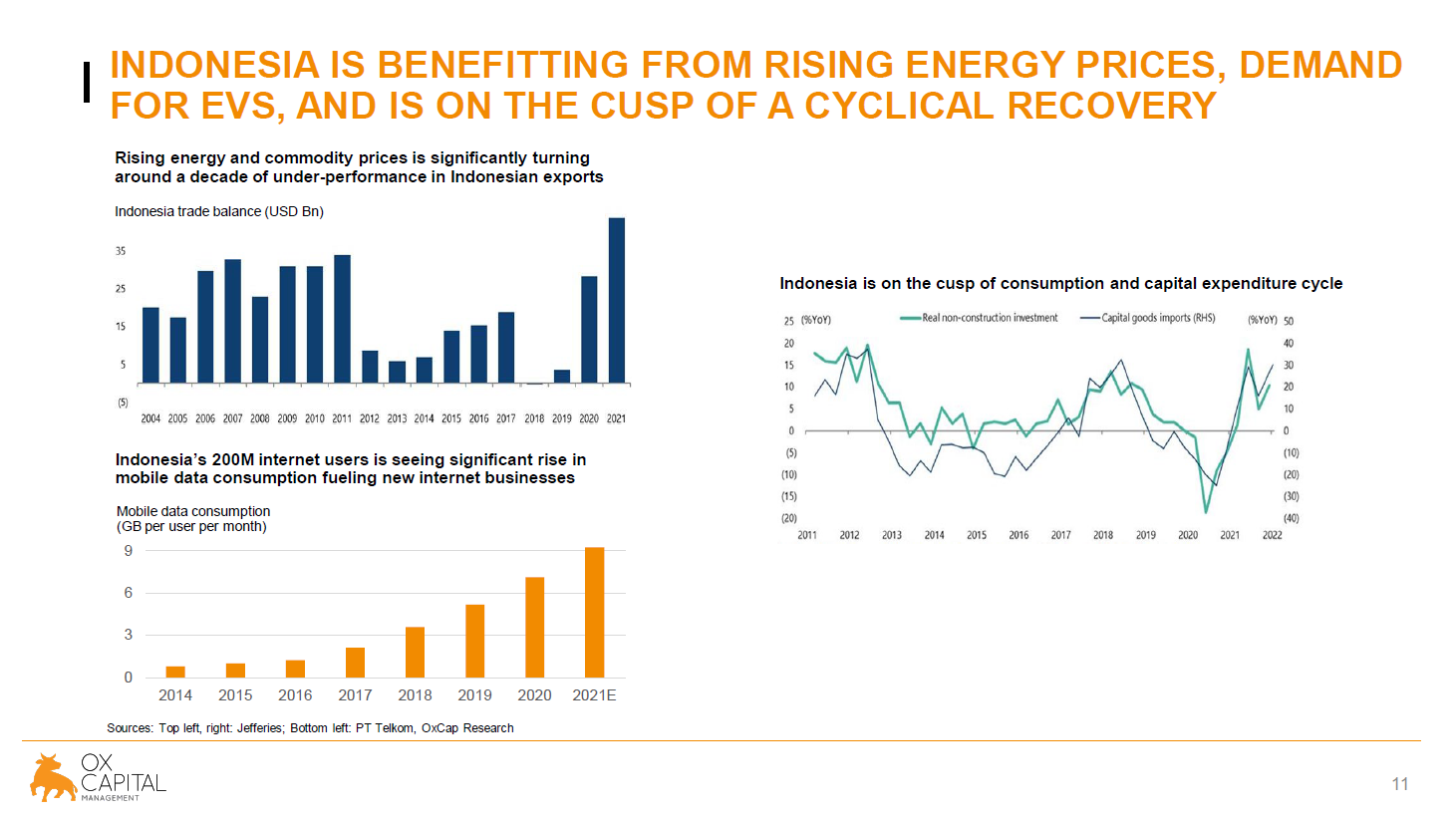

One particular country that we've spent a lot of time on in recent months was Indonesia. We believe that Indonesia is at a prime position to benefit from rising energy prices, rising commodity prices, demand for electric vehicles, and as a result is actually on the cusp of a very powerful cyclical recovery.

So Indonesia is a major energy and commodities exporter. The reality is, in the last decade, because China has been deleveraging, growth hasn't been the best. It hasn't been great for countries like Indonesia. But in the last 12, 18 months that has completely turned around, and we can see that in the trade position on the charts, in terms of trade balance. It's gone from slightly in surplus, in terms of trade balance, to significantly in surplus. And this surplus is only growing with the rising nickel prices and energy prices as we speak.

As a result of this powerful export driver, the domestic economy is benefiting significantly. We are seeing that consumers are spending up again. The businesses are investing again. We believe that Indonesia is actually undergoing a cyclical recovery without a lot of people realising that's what's going on.

Lastly, Indonesia also has a young population, which is a good, significant benefit. So the young people Indonesia are taking up mobile internet, like most other young people in other parts on the planet. That is driving the creation of a lot of interesting new internet businesses.

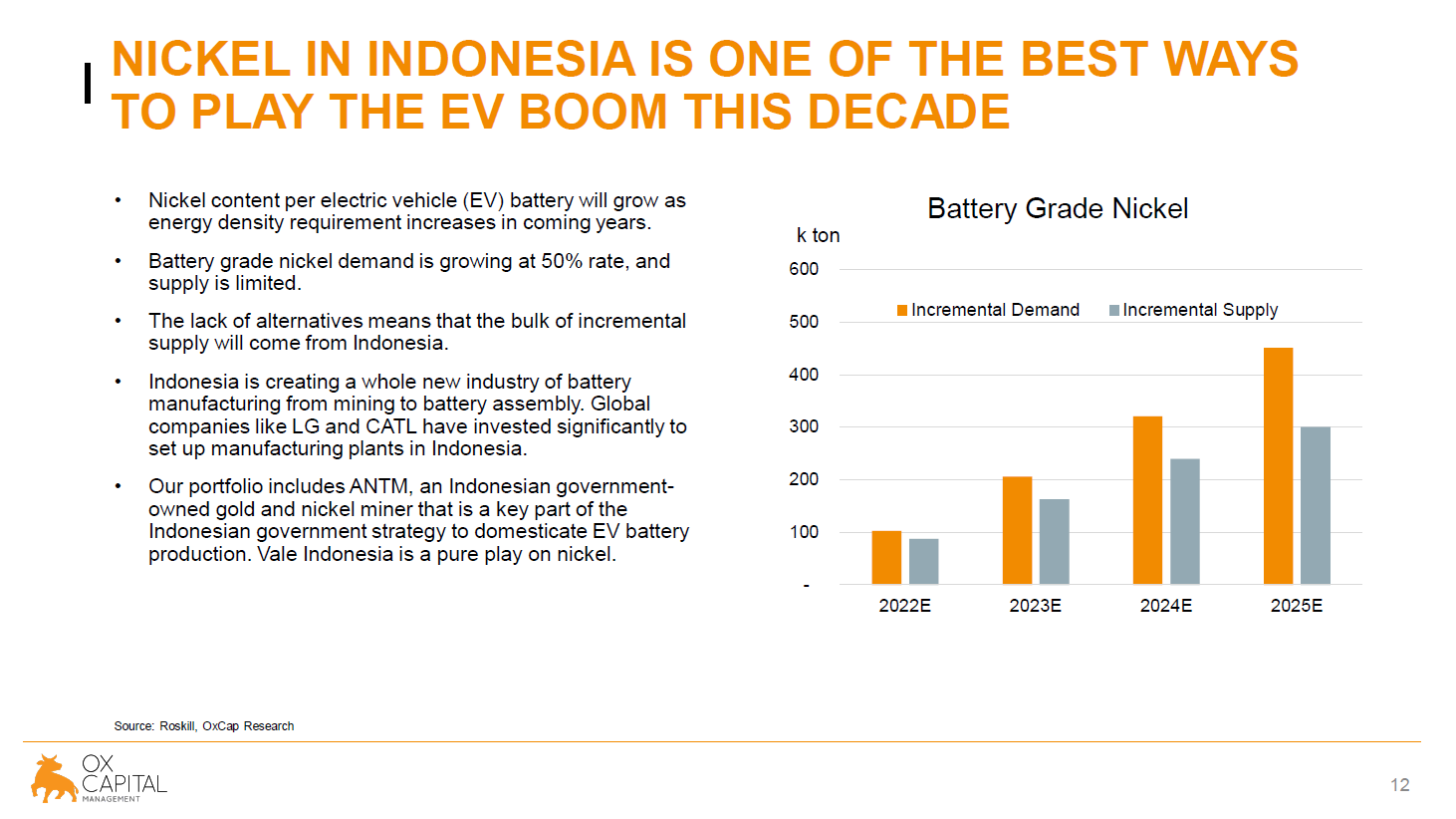

Another reason why we are excited about Indonesia is nickel. As we all know, electric vehicle are growing like the clappers in many countries. Penetration rate is still fairly low in most countries, but what most people would not know is that Indonesia is the world's biggest producer of nickel, and has one of the world's biggest reserves of nickel.

Going forward, Indonesia will provide almost 100% of incremental supply for battery-grade nickel for the world. So they've got this programme ramping up nickel production for the next three to five years to try to meet the amazing demand from electric vehicle batteries.

But based on our calculation, despite this ramp up in supply, it's very likely that there will be a huge supply and demand gap in the coming one or two years. Recently, we've seen the nickel price going through the roof, and we believe that's just the beginning of... Well, there's some technical reasons for that, but that movement, the tightness in the market, is basically what this dynamic that we're talking about represents. So what the Indonesian government has done is that they formed this company called Indonesian Battery Corporation. The aim of that is to basically create a new supply chain of EV batteries on shore in Indonesia. This is a fantastic boon for the domestic Indonesian economy. And it's great for the nickel plays that we own in Indonesia.

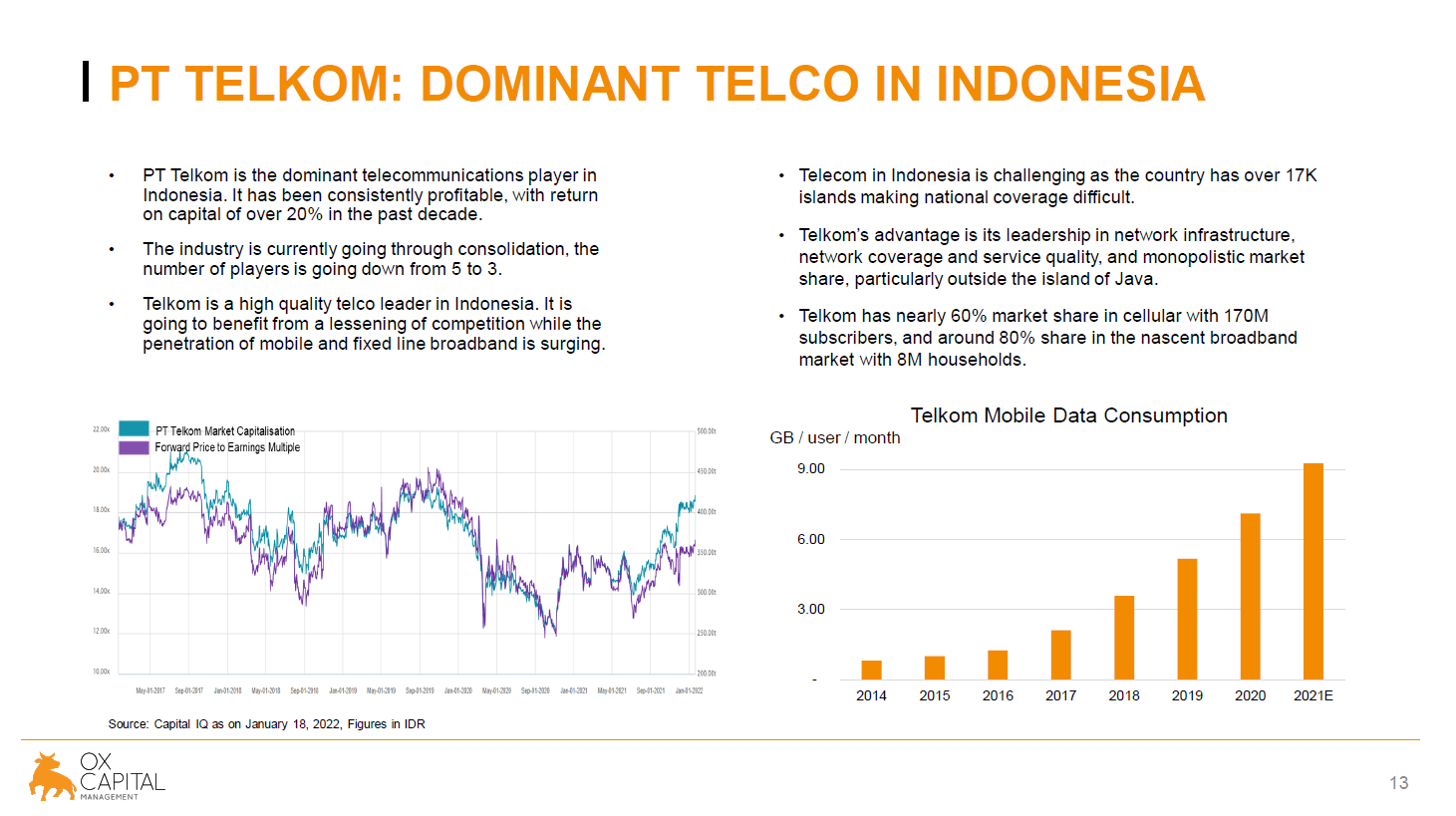

One domestic company Indonesia that we own is a company called PT Telkom. This is the dominant telecommunication company in Indonesia. There's a few things going for this company. It's a great company. It's been generating return on capital of excess of 20% a year over the decade. It's been growing at low teens rate in terms of earnings, but something good is happening.

Firstly, there's the consolidation story happening in the telecom operator space. It's going down from five players to three players, and this will help profitability, benefiting Telkom's profits going forward even more.

The second thing is just that, as we mentioned before, there's a huge growth in the mobile internet uptake in Indonesia. Telkom is the country's biggest mobile network operator.

Thirdly, because of the rise of the data demand in Indonesia, there's a huge demand for data centres. Now Telkom is like a quasi-monopoly provider of data centres in Indonesia, and they'll do very well as a result of that. The stock is not expensive. It's going to grow for a long time, and we believe it's underappreciated.

Another domestic company is called MAPI. Now, this is the largest lifestyle retailer in Indonesia. What it does is that it actually helps a lot of the foreign companies, foreign brands, to try to access the domestic Indonesian market.

It's got more than 150 brand partners. And who are some of these partners? I mean, these companies include Zara, Nike, Adidas, Planet Sports. I mean, the list just goes on and on. As a result of this huge number of partners, they actually have a tremendous degree of economy of scale and economy of scope. They can negotiate with the landlords for much cheaper rent than these branded companies can do it themselves. It's actually a very formidable, competitive advantage.

Not to mention, they also help these companies to negotiate the bureaucracies, I guess, within some of these countries. So this company will see earnings grow multiple folds in coming years as Indonesia opens up post-COVID. The stock is on a mid-teen PE multiple at the moment. We think that stock is underappreciated and is highly prospective in the long term.

Thanks very much, everybody, for watching this video. There's lots of other interesting ideas that we have worked on and are working on. If there's any questions that you want to and any issues you want to explore on, please do not hesitate to contact Ox Capital. Thank you.

Take advantage of the rapid growth in Asia and emerging markets

Ox Capital's investment approach is to identify the immense changes taking place in Asia and other key emerging markets to find investment opportunities. To learn more, visit our website, or see the Fund Profile below.

2 topics

1 fund mentioned

.jpg)

.jpg)