3 ways to play a potential vaccine or cure

The Covid-19 vaccine debate produces a basic conundrum for investors: will companies that have performed well during the pandemic suddenly flop if a vaccine is discovered and widely distributed? Conversely, who will be the winners if the production of a safe vaccine takes longer than expected? And which businesses are primed to do well under either scenario?

We recently reached out to Anthony Aboud from Perpetual Investments, Andrew McAuley from Credit Suisse, and Olivia Engel from State Street Global Advisors to offer up both a stock that they want to own if a vaccine or treatment takes longer than anticipated and one that they want to own if a vaccine is found tomorrow.

Woolies on solid ground while Qantas may soar again

Anthony Aboud, Perpetual Investments

In the event that a vaccine takes longer than anticipated, one stock which will perform well is Woolworths. COVID-19 has had a mixed impact on Woolworths. On the negative side, its hotels business has suffered as they have had to shut down for extended periods. Also, the supermarkets have had elevated costs from more security measures, protective measures and a shift in customer preference to home delivery (which is currently lower margin). However, on the positive side, all supermarkets have benefited from consumers shifting spend from restaurants and bars to supermarkets and bottle shops respectively. What’s more, Woolworths has taken market share from companies like Aldi who have no online offering. Woolworths execution has been excellent. Despite having 38% of the supermarket market share, Woolworths has over 50% of the online grocery market share. In the event that a vaccine or treatment is not found for a while, I believe that Woolworths will continue to perform well and will likely expand online margins due to the high operating leverage in the business. We believe that the outlook for Woolworths is pretty solid over the medium term no matter what the outcome, however, in the event that a vaccine was discovered sooner rather than later, it would reverse some of the recent tailwinds over the next 12 months.

In the event that a vaccine was found tomorrow, the most obvious trade would be Qantas. The company has taken advantage of the downturn to take structural costs out of the business. But the thing I like about Qantas is that it is one industry where the competitive environment is going to be substantially better on the other side of the virus. Its competitor, Virgin, has gone into and is now coming out of bankruptcy. The positive news for Qantas is the new owners of Virgin are materially reducing domestic capacity and pulling back from full-service offering, leaving the market for the higher margin corporate domestic open for Qantas to dominate. While the international market will probably be pretty competitive after a while, in the short-term Qantas should perform well in the event of a vaccine being found.

We believe Qantas will perform well before international borders re-open due to the strong pent up demand for domestic leisure travel and its strong competitive position. However, a vaccine would give investors more certainty in international air travel recovery.

Microsoft: the tech giant for all seasons

Andrew McAuley, Credit Suisse

If a vaccine takes longer than expected, we will continue to happily hold Microsoft in our discretionary portfolios. Microsoft touches every point of the move to do business over the internet. It offers operating system software, server application software, business and consumer applications software, software development tools, and Internet and intranet software. It provides a cloud platform for the storage of data and processes and server products to enable use of the cloud. It provides personal computing, which includes Windows OEM, search devices, gaming and advertising.

If a vaccine is found, we want to own Microsoft.

Covid-19 has accelerated trends that were already underway. The delivery of goods and services through the internet, businesses able to work remotely, the need for ways to store data safely and provide access to individuals and business employees are not new. Microsoft is ideally placed to benefit from broader and deeper use of technology. Initially, when a vaccine is found, it may appear expensive on a PE in the high 20s. However, if you have any sort of long-term investment horizon, the valuation doesn’t look so unreasonable.

Market concentration makes defence the best form of attack

Olivia Engel, SSGA

The longer it takes for a vaccine to be discovered, the greater the risk of a solvency problem, and a major impairment to the consumer balance sheet. In this scenario, stay very defensive. The stock that will win the most when a successful vaccine is found is the stock that discovers and gets the revenue from the vaccine. Other than that, cyclical value stocks will benefit from the economy returning to normal. Given the risk of bankruptcy, don’t bet on the most fragile stocks – find some with a better buffer to withstand a longer period of below average or negative earnings growth.

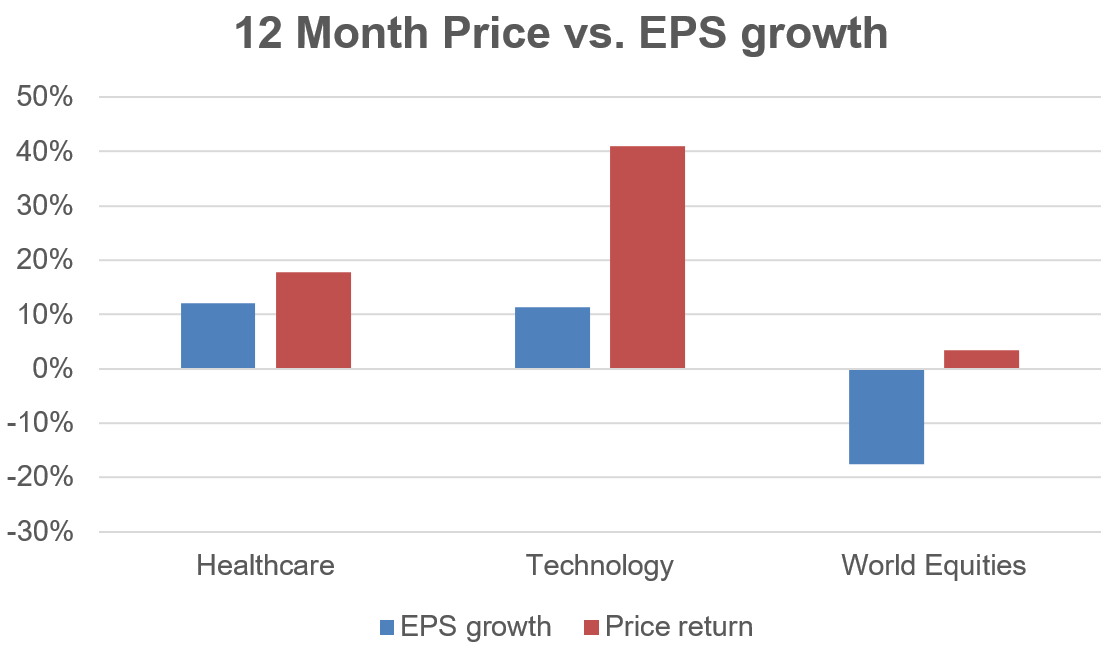

Be careful of the extreme concentration in the market from the high sentiment, expensive mega caps that have increased in value by more than 60% while their earnings have been up only 5% (As measured by highest quintile of sentiment, and most expensive quintile metrics created by State Street Global Advisors, over the period 12 months ending 31 August 2020).

Conclusion

There is no way of knowing exactly when a Covid-19 vaccine will be discovered, developed and distributed and the degree to which this timeframe will impact on individual country lockdowns and travel restrictions. It therefore makes sense to have some exposure to a range of companies with varying dependency on a short-term fix.

Enjoy this wire? Hit the 'like' button to let us know. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

2 stocks mentioned

4 contributors mentioned