Funding the challenge: the impact of an ageing population on government debt

Yarra Capital Management

In part one of this deep-dive, we analysed the economic impact a demographic headwind can have using Japan as a case in point. In part two, we look at how an ageing population can impact government debt.

Demographics can have profound implications for government debt depending on how policymakers tackle its effects. There are two key mechanisms at play. Firstly, as a greater percentage of the population enters retirement it requires greater welfare spending from the government. Secondly, as the working-age population declines, it means that the number of people available to be taxed to fund those benefits decreases.

We can use a simple example of an economy with 100 people to demonstrate this concept. Assume that at year one, five people in this economy are retired and the remaining 95 work and pay taxes to fund the retiree’s pensions. If each retiree received $1,000, the total funding required would be $5,000, or $52 per working person ($5,000 / 95).

If one person retires each year over the next 10 years, then by year 10 we would have 86 workers and 14 retirees. At $1,000 per retiree this would require $14,000 of pension funding spread across only 86 people, or $162 per working person ($14,000 / 86).

This simple example shows how governments can be exposed to stresses on both revenues and expenditures as their working age population declines.

While this is a hypothetical example, which misses many nuances of the real world, it largely defines the challenges that ageing economies create for policymakers. Given governments are reluctant to cut pensions and raise taxes for political reasons, the natural release valve is for the government to increase government debt to cover its shortfalls. This is what has been observed in Japan over the past 20 years.

On the rise - the Japanese debt experience

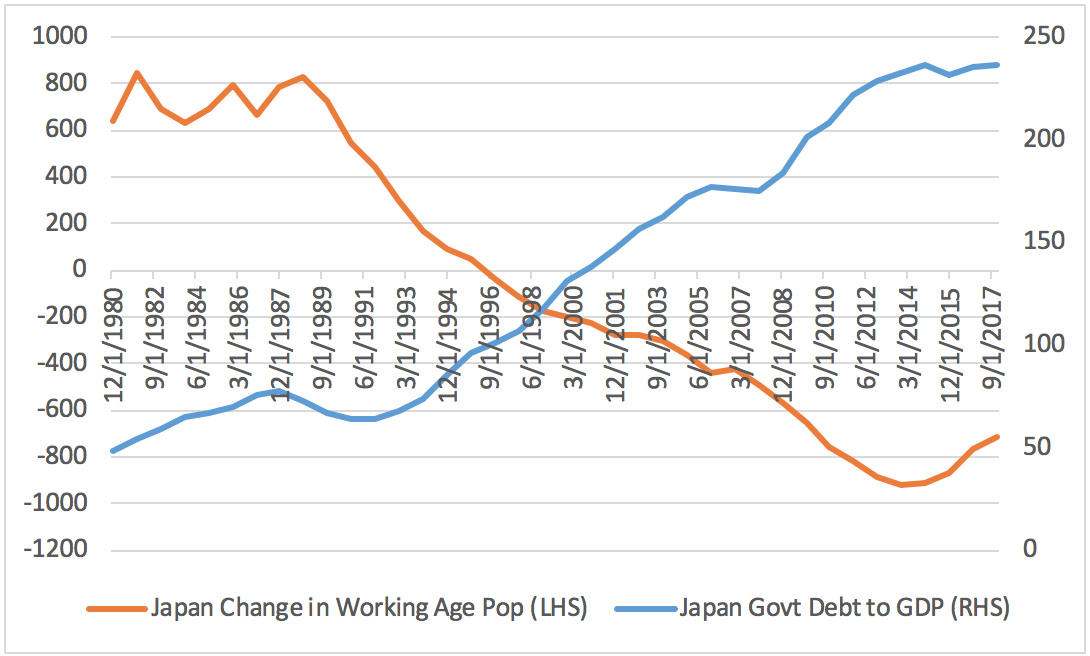

Over the past 20 years, the Japanese government has experienced an unprecedented run-up in government debt to GDP, increasing from approximately 65% in the early ’90s to over 230% today. During this period the government struggled to increase tax revenues as expenditures increased. The timing of this increase coincides with the start of the decline in the working age population.

Chart 1: Working age population change and government debt - Japan

Source: United Nations DESA Population Division, Bloomberg

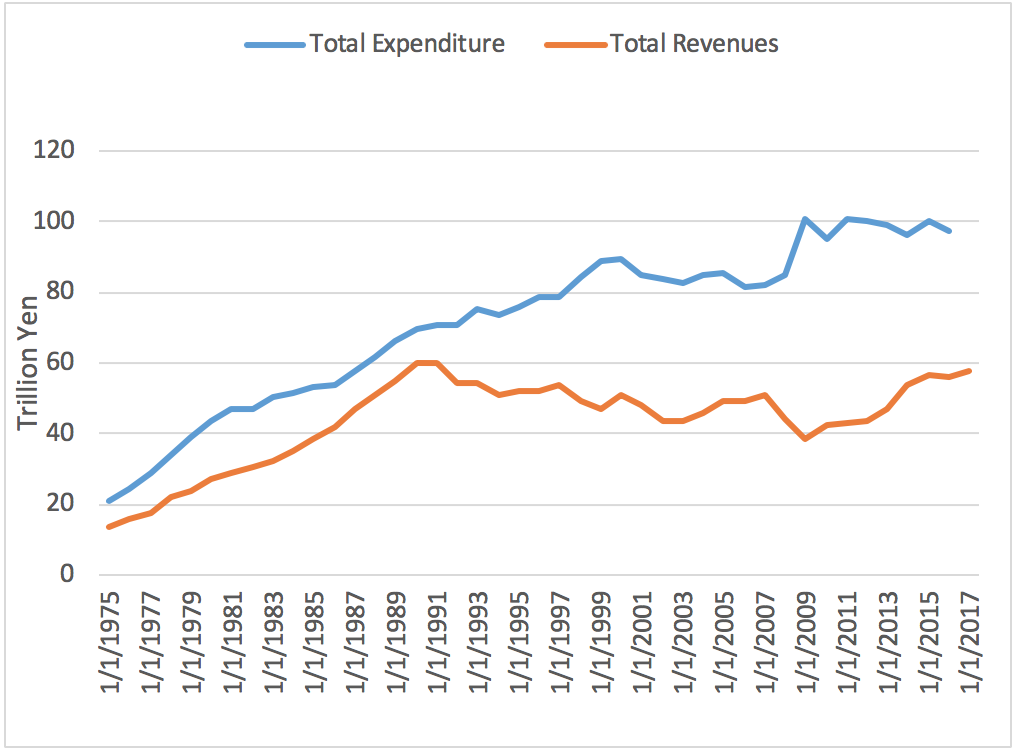

Let’s explore this point further by breaking down the Japanese budget position into revenues and expenditures. Chart 2 shows that the Japanese government’s tax revenue peaked in 1989, just before the working age population began its decline and total employment peaked. Expenditures, on the other hand, continued higher, eclipsing the spending seen in 1989.

Chart 2: Tax revenue and total expenditure - Japan

Source: Japanese Ministry of Finance

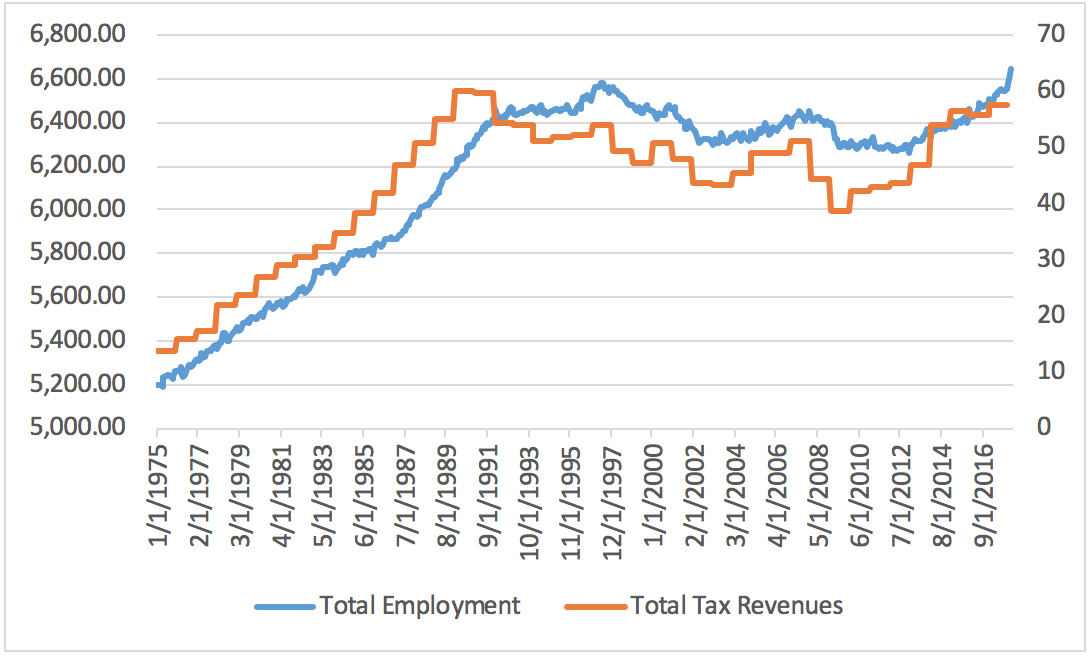

Tax revenues show the importance of increasing employment in an economy, as higher employment means a government can achieve greater tax revenues. In line with employment, Japan’s total tax revenues peaked around 1989 and struggled to recover until the workforce growth improved in 2012. This directly shows the effect that a declining working-age population can have on government finances, as it implies that there is going to be a smaller pool of employees to absorb the tax burden.

Chart 3: Employment and tax revenues - Japan

Source: Japanese Ministry of FInance, Bloomberg

Over the past two decades, government expenditures have continued to increase. This was partly driven by social security increases from 47.4 trillion yen in 1990 to 112.1 trillion yen in 2014, which currently represents approximately 33% of government expenditures. While part of the Japanese social security system is funded by contributions, the shortfall must be made up from government revenues or debt.

Chart 4: Elderly population and government expenditures - Japan

Source: Japanese Ministry of Finance, United Nations DESA Population Division

The culmination of rising social security costs and a flat tax base means the government has had to borrow large amounts of money to maintain the status quo. Given the demographic outlook for Japan, this is set to continue into the future.

In the 2017 Japanese Public Finance Sheet the government said it “projected that the size of the social security costs will increase rapidly because of the aging population” and that “in particular, the benefits of medical and long-term care will face higher growth than the projected GDP growth”.

The simple example described above, of small tax bases funding a greater number of retirees, reflects the results seen in an ageing economy and should raise some concern for governments in other developed countries that are starting to see a decline in their working-age populations.

Don't forget to follow my profile to be the first to receive parts two and three.

Further insights

For additional analysis and insights from the team at Nikko Asset Management, please visit our website.

2 topics

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...

Expertise

Chris is responsible for portfolio management, including portfolio construction and trading for various Australian fixed income portfolios including the Nikko AM Australian Bond Fund at Yarra Capital Management (Nikko AM was acquired by Yarra...