5 bad ideas to avoid in 2021

Catherine Wood’s ARK Invest has remained a fund to watch from its inception. Finding success through a focus on innovation, Wood and her team apply cutting-edge themes to help them beat expectations year on year. Despite the inclusion of polarising stocks in its portfolios - including Tesla (NASDAQ:TSLA) - the fund’s returns speak for themselves. ARK Invest’s Next Generation Internet ETF (NYSEARCA:ARKW) netted ~90% return this financial year and its other US funds are not far behind. It is clear that Catherine and her team know what they’re talking about when it comes to innovation.

To enlighten investors on the impact of these breakthroughs and the opportunities they will create, ARK began publishing its “Big Ideas” whitepaper in 2017. The annual research report highlights the latest developments in innovation and offers some of our most provocative research conclusions for the coming year, including the industries and sectors most at risk of disruption. Ahead of the release of Big Ideas 2021, ARK has put together five “Bad Ideas” that investors should be aware of in the years ahead. In this wire, we’ve summed up our key takeaways from the report.

Bad Idea 1 - Physical Bank Branches

The report identifies that throughout history, financial organisations have relied on physical distribution to attract and serve customers, dating back to money changers in the ports of Athens in Ancient Greece. Now, with the internet age upon us, financial institutions are found in our pockets.

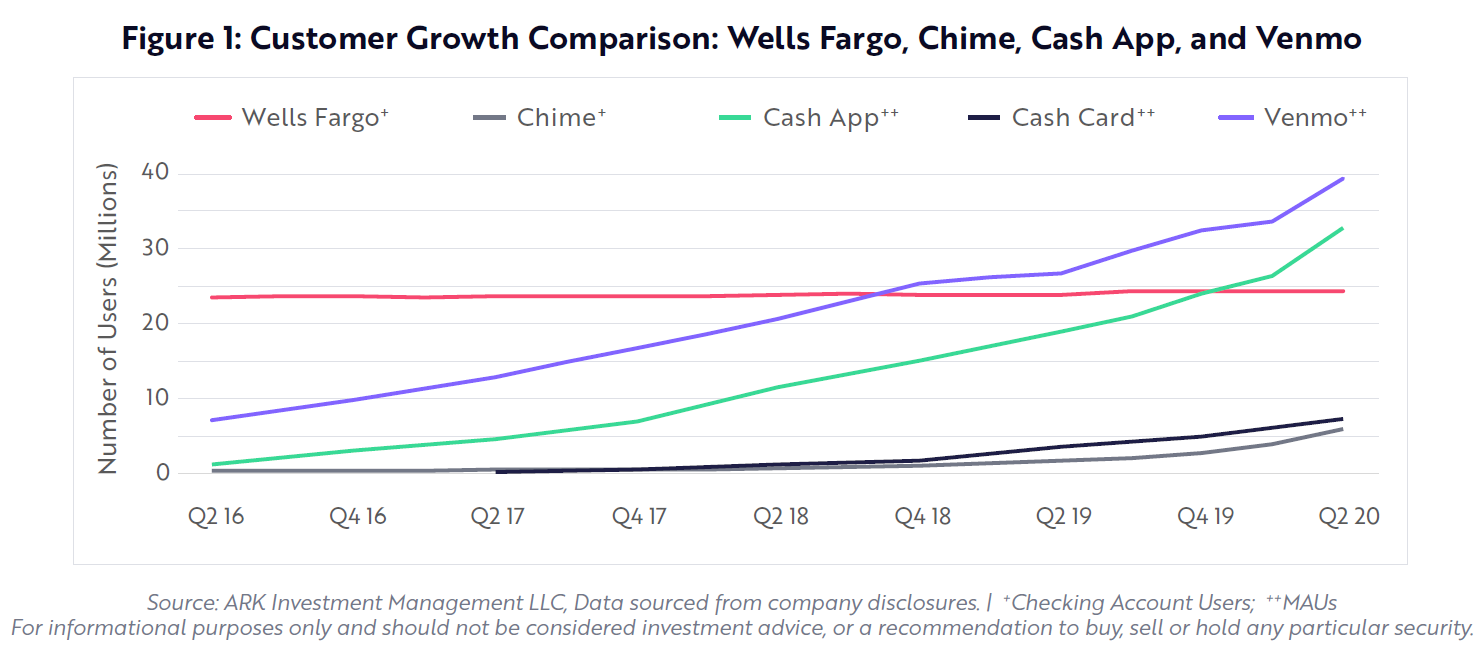

After tracking the usage of financial services between 2013 and 2017, the US Federal Deposit Insurance Corporation (FDIC) reported a drop in the use of bank branches and an increase in digital and mobile banking. They identify the online-only offerings as the biggest beneficiaries of this change including Square’s Cash App, PayPal’s Venmo and Chime.

“We believe the main reason for the explosive growth in digital wallets is lower customer acquisition costs. Compared to the $1,000 on average that traditional financial institutions pay to acquire a new customer, digital wallets invest only $20 thanks to their viral peer-to-peer payment ecosystems, savvy marketing strategies, and dramatically lower cost structures”

Ultimately, the report posits that the costs to operate physical branches represents an untenable commitment. Customer acquisition is stagnating and costing 98% more per customer than digital retailers.

Bad Idea 2 - Brick and Mortar Retail

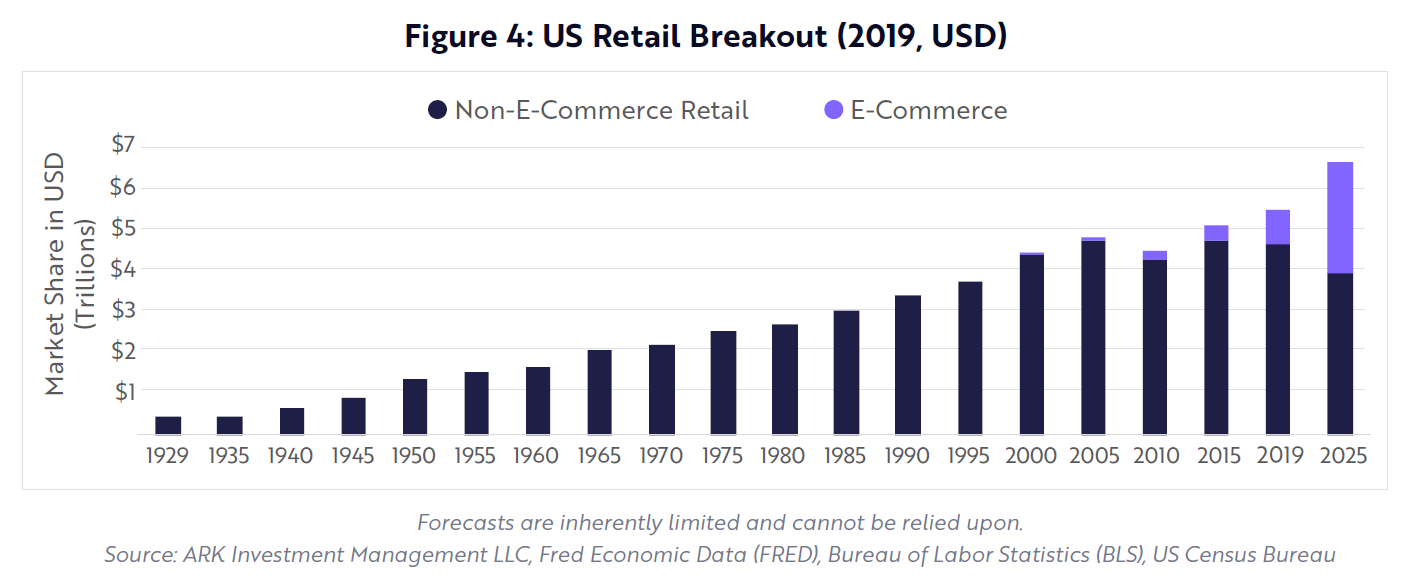

The coronavirus pandemic has accelerated a shift to e-commerce. This trend coupled with decreasing delivery costs put brick and mortar retail as a bad idea for the future.

Retail sales per square footage have been on the decline since the 1970s, however, for that same period, the square footage per capita has been increasing. ARK’s position is that even if the growth of retail space used was to stabilise, loss of market share to e-commerce spells bankruptcy for those who can’t adapt. These trends also flow to the fixed income market as the performance of REITs with high retail exposure will increase in risk, as their underlying assets become less valuable and need to be repurposed.

Bad Idea 3 - Linear TV

Linear TV is real-time programming accessed over the air or by cable/satellite at scheduled times. While the primary delivery method of live programming in the US today, linear TV is giving way to over-the-top (OTT) services that deliver on-demand and live programming via the internet. It is the opinion of ARK that linear TV has not kept up with the times.

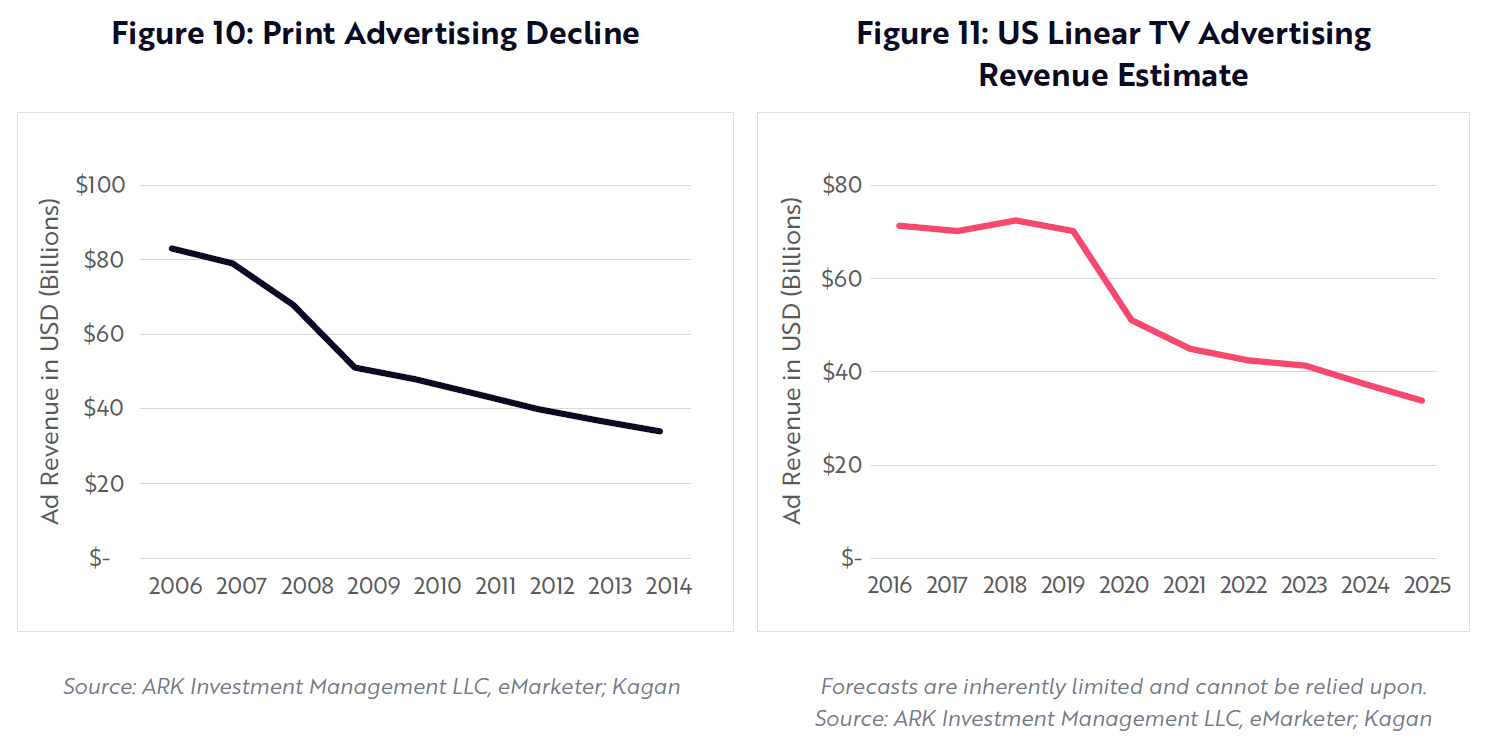

Particularly with the hiatus of sport as a consequence of the coronavirus, people have increasingly been ‘cutting the cord’ with linear TV and switching to streaming services. Paying for 1,000+ channels, 90%+ of them never watched, now seems ridiculous. Not only is Netflix providing content at a 70% discount to cable providers, as shown below, it along with other streaming services like Disney+, HBO Max, and Amazon Prime Video match subscribers with specific content thanks to AI recommendation algorithms.

Despite eight consecutive annual declines in viewership, linear TV advertising revenue was relatively stable, until the sports drought and economic collapse during the coronavirus crisis clobbered it. In response to accelerated cord-cutting, ARK believes advertising on linear TV will drop faster than 11% at an annual rate, or 51% cumulatively, from $70 billion to $34 billion during the next six years. This shift is reminiscent of the demise of print media during the Global Financial Crisis in 2008-2009. After levitating for years in the face of readership declines, print advertising entered years of double-digit declines.

Bad Idea 4 - Freight Rail

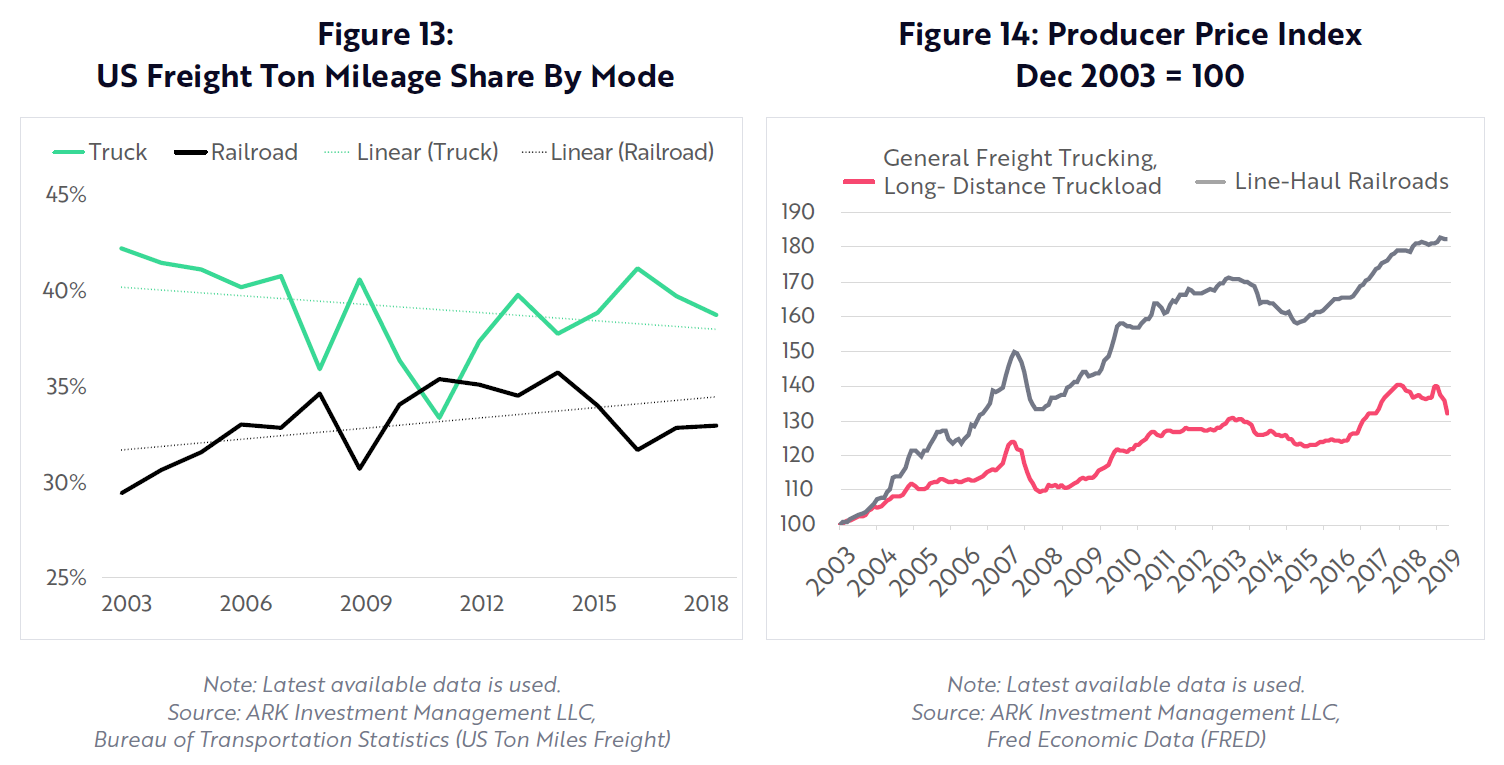

Based on ARK’s research, autonomous electric trucks will compete cost-effectively with freight rail and will offer better, more convenient service. Since the early 2000s, freight rail has been taking share from trucking and increasing prices. ARK says the commercialization of autonomous electric trucks will reverse both share and pricing dynamics, putting freight rail providers at risk.

The combination of electric and autonomous technology will increase productivity and lower the costs of trucking dramatically. During the next five to ten years, ARK expects autonomous electric trucks to reduce the cost of trucking from 12 cents per ton-mile to 3 cents, undercutting rail prices with the help of lower electricity and maintenance, as shown below. Trucks already offer faster and more convenient door-to-door service, so lower costs overall could be a significant blow to rails.

Rail’s market share and pricing have increased since 2003, as shown below. ARK says both of these trends should reverse as more cost-effective autonomous electric trucks attract freight ton-miles at an accelerating rate.

“If autonomous vehicles proliferate into various form factors, including flying drones and rolling sidewalk robots, we believe freight rail companies will have trouble competing with antiquated technology tied to dedicated infrastructure assets. Ark wonders which, if any, freight rail operators will survive”

Bad Idea 5 - Traditional Transportation

Robotaxis could reduce the cost of point-to point-mobility discontinuously in the US, stealing $150 billion in annual demand per year from ride-hailing, short-haul flights and public transit.21 If robotaxis become the dominant form of urban transit, ARK expects US auto sales to drop from 17 million units today to roughly 10 million by the end of the decade.

“In our view, autonomous electric technology will cause a tidal wave of disruption not only in the auto industry but in many other industries. If battery system costs decline, we believe electric vehicle prices will follow, triggering mass market adoption.”

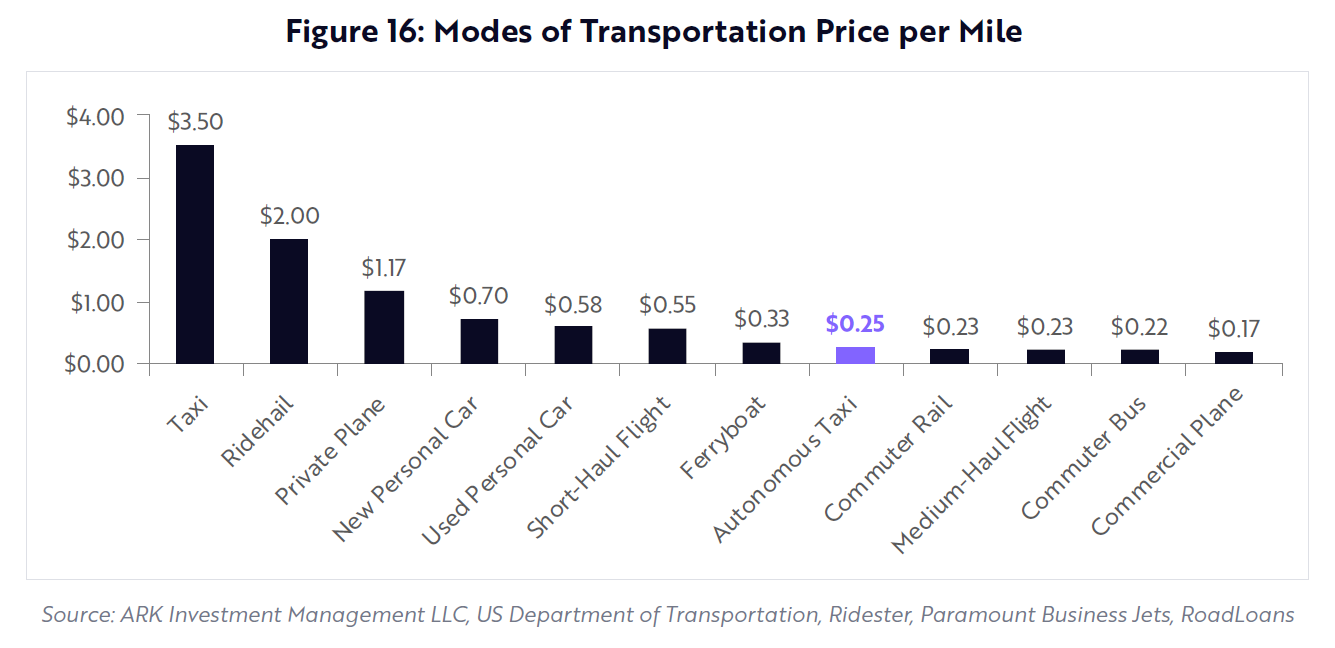

ARK’s research shows that robotaxis could cost consumers just $0.25 per mile, less than half the cost of driving a personal car, half the cost of a short flight, and at a cost close to many public transit modes, as shown below. As a result, autonomous taxis could become the dominant form of personal transportation in urban areas, obviating the need for many consumers to purchase personal vehicles. According to ARK estimates, US auto sales will fall nearly 50%, from 17 million units today to just 10 million, during the next 10 years.

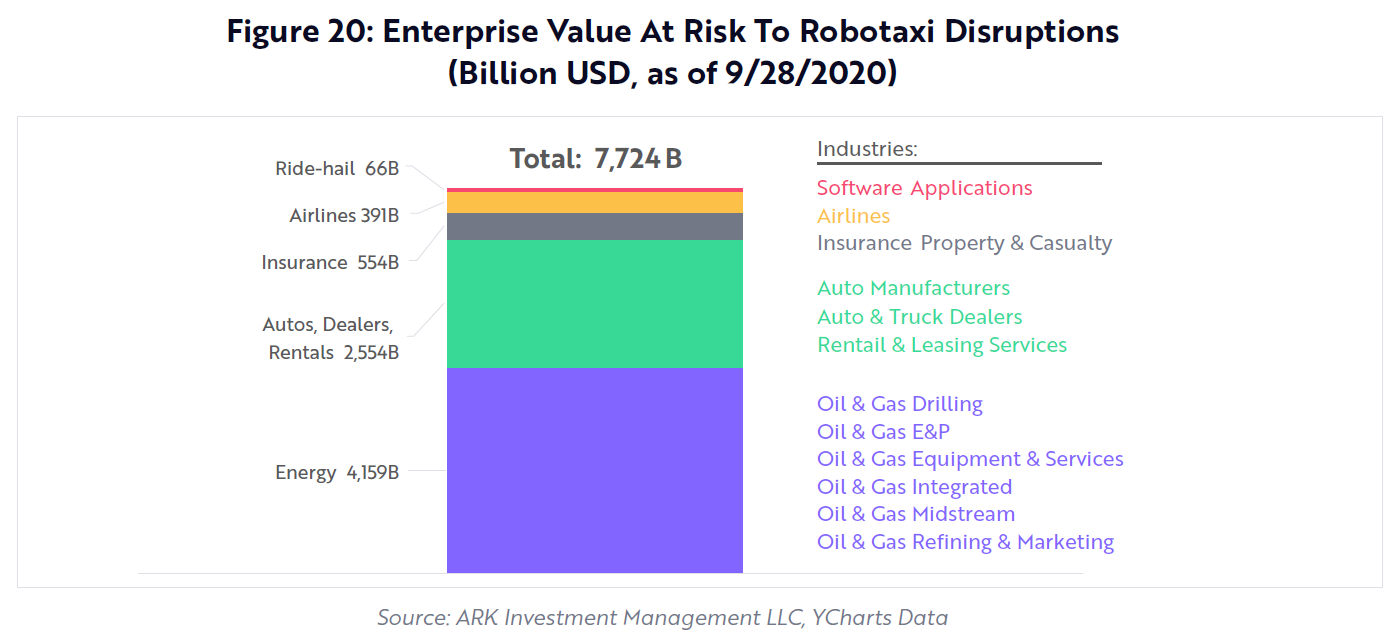

ARK believes that the entrance of robotaxis will have a significant knock-on effect. The market has not discounted adequately the robotaxi disruption likely to upend the traditional world order in transportation. Tallying up the risk to airlines, public transit, ride-hailing, insurers, automakers, auto dealers, rental companies, and oil, ARK estimates that roughly $8 trillion of enterprise value in the public markets is at risk.

It is the opinion of ARK that long before dealers sell their last gasoline-powered car, robotaxis will disrupt a dozen industries, destroying a meaningful percentage of portfolios tracking the broad-based benchmarks.

Access the full report

If you are interested in reading the full version of ARK's Bad Ideas whitepaper, please visit the ARK Invest website

3 topics

1 contributor mentioned