5 EM stocks trading at big discounts to their developed market counterparts

Emerging markets are cheap from a comparable valuation perspective.

It cannot be disputed that equity valuation in developed markets is high relative to its own history and high compared to emerging market valuations currently. Emerging market equities have historically outperformed developed markets over the long-term. This recent bout of underperformance, largely over the last 10 years, is an anomaly. We believe that this is a result of over-indebtedness and high starting valuations over a decade ago in emerging markets.

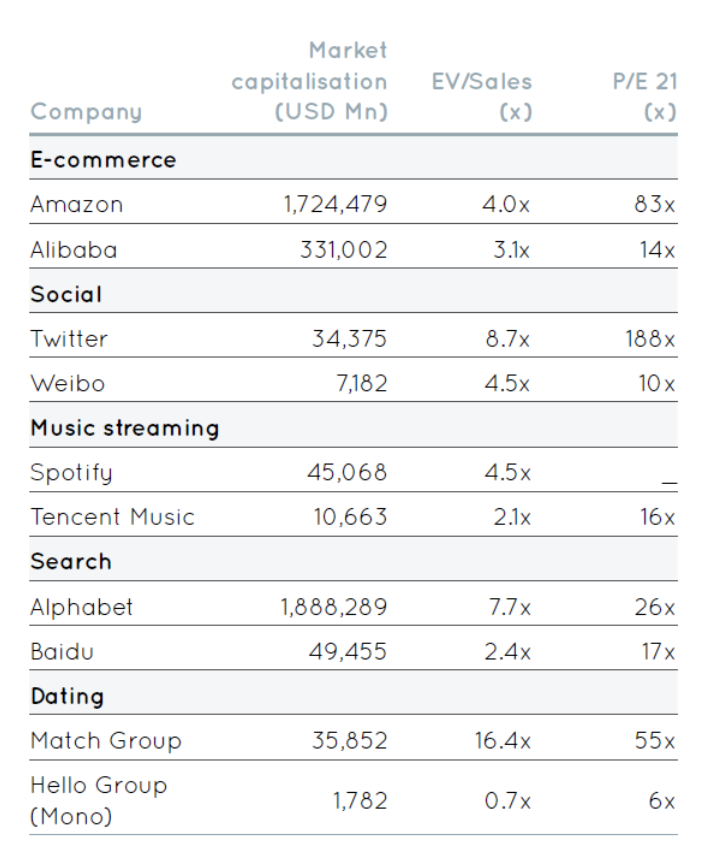

While it is not entirely accurate to compare companies from different regions given the different demographics, regulatory environments, and execution risks, it an interesting exercise is to look at some of the Chinese technology companies and compare them to their counterparts in the US. The difference in valuations between US and Chinese technology companies currently is significant.

Table 1: Valuation comparison

Source: Capital IQ consensus estimate (Data as at 20/12/21)

Let’s take the example of Alibaba. Last year, Alibaba had over 1.1bn active annual users who transacted over USD1tn. This represents over 17% of China’s total retail sales. Its cloud division is the third largest in the world and grew revenues over 50% last year. Further, it owns 33% of Ant Financial, the largest payment company in China, who processed over USD18tn in 2020.

Alibaba is the largest online advertising eco-system in China and is becoming more relevant to users in China every day. In its core business, it has the potential to not only grow users, but also grow its take rate as it handles more fulfilment, logistics, advertising, and other services for its merchants. In its non-core business, the opportunity to grow its payments, cloud, international e-commerce businesses are significant.

However, if we look at Amazon, which performs some of the same functions in the retail, fulfilment, and advertising space in the US, they are valued over 6x higher on a P/E multiple basis.

In a similar light, let’s look at some of the Chinese internet companies listed as American Depository Receipts (ADRs) in the US.

Weibo is a platform similar to Twitter in China with over 500m monthly active users (MAU) and 240m daily active users. Weibo has become the centre of news in China. It has assumed greater social importance in China than Twitter in the US and over 75% of its users are under 30. Weibo is backed by Alibaba and has an ADR listing in the US and a dual listing in Hong Kong.

Weibo’s market capitalisation is USD7bn with over a quarter of its value in cash and investments. However, it is trading at nearly half the EV/ Sales valuation of Twitter. By contrast, Twitter is a USD34bn market capitalisation company with under 400m MAU. While there is increased competitive pressure from Kuaishou and Douyin, Weibo has built trust with celebrities and content creators. Weibo is a very attractive platform for advertisers and has become the go-to platform for news consumption in China.

Tencent Music is the largest music streaming platform in China and can be likened to Spotify. Tencent Music had over 640m monthly music streaming users last year and 240m monthly social entertainment users who engage in activities such as karaoke, live streaming, and other services. The company is hosting concerts both online and offline, pushing into podcasts and audio books, creating intellectual property for artists, and investing significantly in technology.

Tencent Music has a market capitalisation of over USD10bn, valued at 16x PE, with over 40% of its market value in cash and investments. Tencent Music owns 2.5% of Spotify and 2% of the Universal Music Group. By contrast, Spotify is valued at USD45bn, and is not yet profitable. While Spotify has to compete with the likes of Amazon and Apple, Tencent Music is the clear market leader in online music in China.

Similarly, there’s the ‘Google of China’, Baidu, which is the dominant search engine in China and is also a leader in autonomous driving. Further, Baidu has an investment in the ‘Netflix of China’ called iQiyi. Baidu is trading at 17x PE, while, Google is at 26x. The ‘Tinder of China’ is a dating platform called Momo which has 80% of its market capitalisation in cash! The list goes on.

The drivers of these attractive valuations

The valuations in ASEAN markets are attractive due to a number of dynamics. The spotlight has been taken disproportionately by China and India as they are much bigger countries with more cost-competitive labour costs relative to the ASEAN countries that have industrialised earlier. Further, the whole emerging market has been out of favour because of the Chinese economy over the last decade.

The dynamics are changing. China has just finished deleveraging the property sector which is one of the last big

debt piles it had to deal with. Labour costs in China are also much less competitive now compared to a decade

ago. The RCEP will enable the ASEAN factories to better integrate with the Asian supply chain, boosting their exports

to supply the big economies.

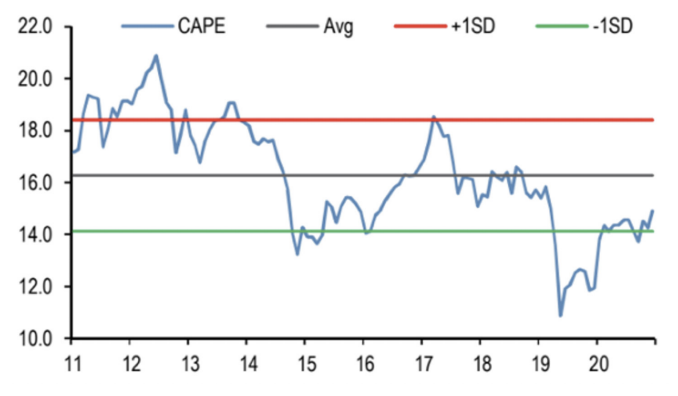

Figure 1: ASEAN equities inexpensive on CAPE basis

Source: MSCI, Refinitiv

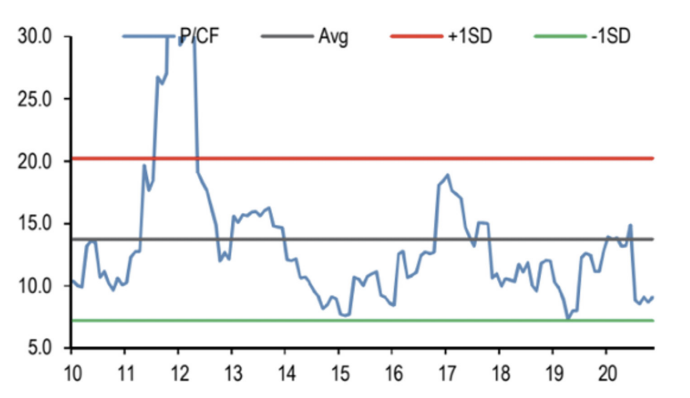

Figure 2: ASEAN price to cash flow ratio

Source: FactSet, MSCI, Goldman Sachs Global Investment Research

Overall, we believe that the fundamentals are in place of emerging markets to outperform over the next decade. This concludes our 3-part exploration into the bull case for emerging markets. Despite underperformance over the past 10 years, we believe that compelling valuation opportunities on top of economic and demographic factors present favourably for the future of these rapidly developing markets.

A detailed note on the opportunity in ASEAN is available in the PDF attached to this wire.

Make sure to check out the other parts of this collection:

- Part 1 - Why China remains a compelling investment

- Part 2 - The opportunities accross other ASEAN countries

Take advantage of the rapid growth in Asia and emerging markets

Lai's investment approach is to identify the immense changes taking place in Asia and other key emerging markets to find investment opportunities. To learn more, visit the Ox Capital website, or see the Fund Profile below.

5 topics

1 fund mentioned

.jpg)

.jpg)