A bridge to recovery or a financial cliff? Magellan holds the line on cash

Since Magellan’s core strategy nearly doubled its cash weighting, stock prices have been on a tear as investors (plus those Robinhood punters) chased everything from technology shares to cruise ship stocks and the bankrupt car rental group Hertz.

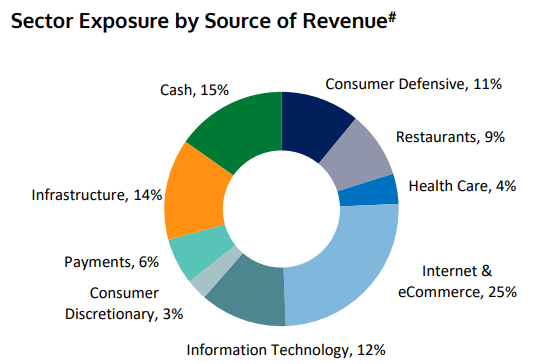

But if there’s any sign of FOMO inside the Magellan fortress, CIO Hamish Douglass and his team aren’t yielding to temptation. At the end of June, the Magellan Global Equities Fund was hoarding 15% cash, up from 8% a year ago. The underlying portfolio mix had also shifted to a more-than-usual defensive posture, with consumer staples, infrastructure and healthcare stocks accounting for 30% of sector exposure by revenue.

It’s a tough conundrum for fundies and investors alike. Go all out in a blaze of glory to maximise gains and beat the competition? Or keep cash for a possible crash, and risk precious alpha? For Douglass and his team, it’s the latter.

“We remain cautious and have positioned our portfolios to withstand a further downturn in the economic outlook and markets. We don’t know whether the world is on a bridge to recovery or on a bridge with a cliff at the other end. We understand the limits of our knowledge. We have no fear of missing out.”

But arriving at this stance was the result of an enormous piece of forensic analysis which should be noted by investors. Here, I summarise the thought process that led Magellan to conclude that defence is the best game right now.

The ‘Rumsfeld framework’

As a starting point, Douglass takes inspiration from a powerful statement once made by Donald Rumsfeld, the former US Secretary of Defense in the administrations of George W Bush and Gerald Ford. It went like this:

“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say, we know there are some things we do not know.”

Magellan finds the Rumsfeld framework is useful in assessing what course of action to take at the present time, which shows that there are simply too many “known unknowns”. This list can be bucketed into three broad areas: the virus, the potential cure, and the impact on the economy.

The virus

The knowns

- As of July 1, there had been over 10 million cases identified and over 500,000 reported deaths.

- The disease is still accelerating including across much of Asia (with concerning trends appearing in India and Indonesia), Africa, the Middle East and much of Latin America (especially in Chile, Brazil and Mexico) and the US.

- There is some evidence that mutations have made the virus more infectious.

The known unknowns

- Are people immune if they have had the virus or will their immunity fade over time and can they be reinfected?

- In the absence of a vaccine, how long will it take to achieve global herd immunity?

- How might governments respond to a second wave of infection? Will countries reintroduce lockdowns? Will governments provide similar amounts of financial support to those affected as was provided in the first wave?

The cure

The knowns

- A sobering reality is that no vaccine has been developed for any of the known human coronaviruses.

- There are over 200 potential therapeutics being tested in more than 1,100 clinical trials. To date, none of the therapeutic drugs that have been evaluated for the treatment of covid-19 have proven to be effective cures.

- To be effective, a vaccine will need to provide people with long-term protection.

The known unknowns

- Will scientists be successful in finding a vaccine?

- How long will it take to test the safety and efficacy of a vaccine for a widespread rollout? To effectively test the safety and efficacy of a vaccine, extensive human trials will need to be undertaken across a wide cross-section of people.

- How long will it take to scale manufacturing to billions of doses of the vaccine?

The economic impact

The knowns

- The response to the pandemic has resulted in the largest reported loss of economic output in modern history in many countries.

- Central banks are expected to keep interest rates at very low levels for many years. In June, the Fed said it expects to keep its policy rate at zero at least until the end of 2022.

- In many countries, banks and landlords have been required to defer loan and interest repayments and defer foreclosures and evictions during the pandemic.

Known unknowns

- What is the true level of unemployment? Millions of people remain employed with their wages being subsidised by government funded job-protection programs.

- What will be the economic impact if there is a material second wave of infections?

- How will consumers and businesses change their behaviour post the pandemic? Will the pandemic shock lead to a prolonged increase in the savings rate?

- Will increasing tensions with China lead to a material pullback in expenditure by Chinese nationals on tourism and education in certain countries?

- How will banks respond at the end of servicing holidays? Can they continue to ‘extend and pretend’ or will they need to foreclose on borrowers?

Tying it all together

These are just some of the key concerns among the more than three dozen on Magellan’s list that led to their defensive conviction.

While some may argue that the ~40% rally in global shares from their nadir in March shows that markets are pricing in a recovery, Douglass opts to not take comfort in the bulls' sudden return. He says events of the past six months are without precedent and the way forward is subject to a multitude of highly uncertain, complex and interdependent variables.

“... investors should be prepared for a wide range of potential outcomes in the next 12 months. There is a real possibility of a collapse in equity markets, just as there is for a continued grind higher in equities supported by low interest rates.”

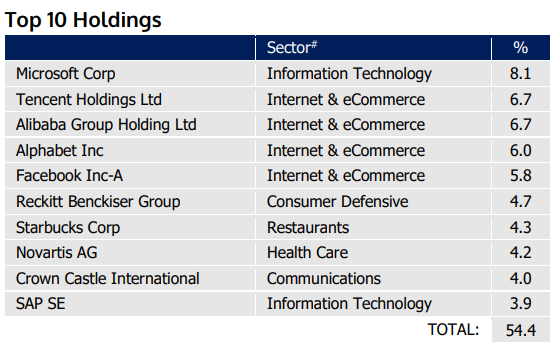

MAGELLAN GLOBAL EQUITIES FUND (AS AT 30 June 2020)

MAGELLAN GLOBAL EQUITIES FUND (AS AT 30 June 2020)

Given the complexity and uncertainty of the situation, Magellan would rather wait until they can more clearly assess the probabilities on the pathway forward. For now, Douglass chooses to heed the sage advice of Warren Buffett when he said: “To finish first, you must first finish.”

Magellan have put together a dedicated portal looking back on 2020, as well as previewing some of our most compelling insights for the year ahead. and what lies ahead for the year. You can access all of our content here.

5 topics

2 stocks mentioned