A disastrous drug approval

At midnight a couple of days ago the US Food and Drug Administration announced the approval of Biogen's Alzheimer's drug Aducanumab.

Usually, when a drug is approved it's cause for celebration, the culmination of perhaps decades of academic and clinical work. The moment is hugely meaningful for patients, doctors, and their families.

Not in this case. The FDA's independent scientific panel and own statisticians concluded this drug had no measurable effect.

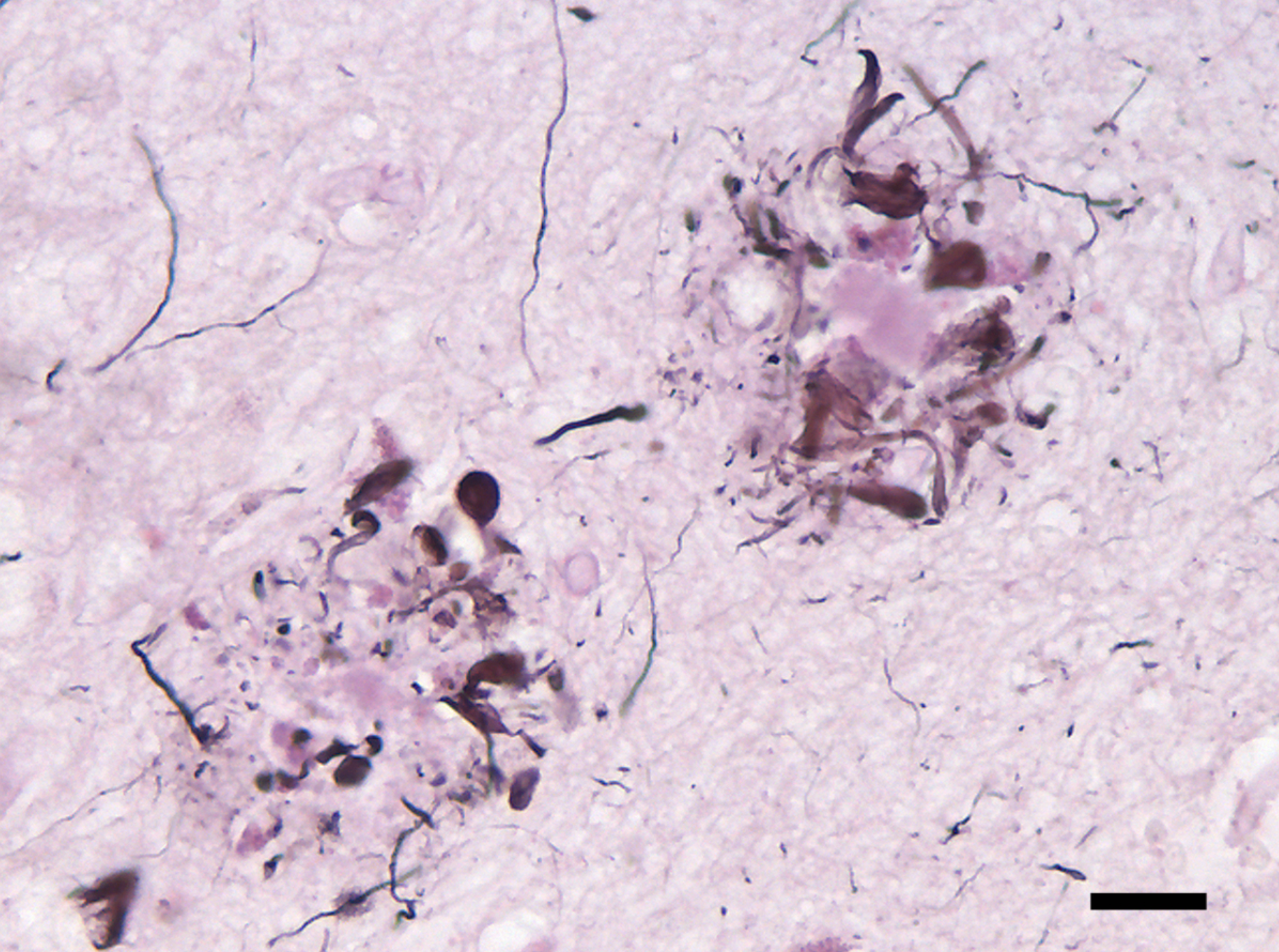

Two amyloid beta plaques (source)

Aducanumab was tested in two well designed Phase III trials. They were double-blind, placebo-controlled, dose-ranging, and most important of all, with thousands of patients around the world, they were large enough to power a result. If this drug had any significant effect, it had plenty of opportunities to show it.

Instead, the trials were halted early for futility and the drug caused dangerous brain swelling in some 40% of recipients. Which makes the decision all the more surprising.

When China and Russia announced they had coronavirus vaccines, the world ignored them and looked to the FDA. This is the institution that stood alone against thalidomide. And this week it approved a drug with no evidence of efficacy.

Biogen tortured the data, mixing patients from one study, where the drug had a marginal benefit, with the other, that showed a marginal decline. This sort of post-hoc data mixing to prove a point is a statistical crime.

The FDA didn't approve on this sketchy basis, but rather because the drug cleared amyloid beta plaques. And it was on this, rather than Biogen's shonky data manipulation, that the drug was approved.

Long-time readers will know that we share the increasingly common view that amyloid beta hypothesis is flawed as:

- every drug that clears amyloid beta fails to show any clinical benefit (there have been many), and

- many people die naturally with plenty of amyloid beta in their brains but never get Alzheimer's.

A hypothesis that actually fits the medical data is that amyloid beta is an effect, not a cause.

The situation is worsened by Biogen's commercial cynicism.

Analysts coalesced around a $10k annual cost estimate for the drug, with the highest at $25k. Biogen has stated they will charge US$56k p.a., for a chronic disease that lasts years.

The FDA asked Biogen to conduct a confirmatory study to prove the drug's effectiveness.

Biogen promptly announced they will complete this trial in 2030, giving almost a decade to sell a dangerous, useless drug... and that's before the inevitable delays. We can be sure this study will be done as slowly as possible.

The FDA made a similar call with Sarepta, approving a drug against their own expert advice, on condition of a confirmatory trial. Five years later, the trial has not been done. Why would any company pay money to kill their golden goose?

And if they did, why would any patient sign up to a trial where they might be given a placebo when they can just buy the drug?

In another Biogen-friendly curiosity, the FDA approved the drug for all Alzheimer's patients, not just those with early stage disease or with particular biomarkers. There are over 5 million Alzheimer's patients in the US, so the cost of this could exceed US$100 billion a year. That is enough to move the needle on the entire US medical system. This decision could blow back hard onto the pharmaceutical industry.

As one of our advisers put it, it will be quite some time before the full ramifications become clear.

Recently there has been a flurry of research into alternative theoriers that fit the data, offer new clinical targets, and in early stage trials have demonstrated a clinical effect. We have small investments in two of these. The FDA's decision will starve these alternative approaches of oxygen. The rational move for every company with a failed beta-amyloid drug is now to resurrect it.

Patient advocacy groups, weaponised by Biogen, have something to answer for here.

The correct approach would have been to allow Biogen to conduct a further study, if they so wished, to prove the drug worked.

It's early days, but this looks like the biggest scandal in pharma since Valeant and Bill Ackman's corporate skullduggery led to the methodical axing of R&D departments several years ago. Three members of the FDA's advisory panel have already resigned in protest.

In Biogen, a new corporate villain has been born.

For excellent coverage from those far more qualified, see In the Pipeline, Endpoints and Stat. I also recorded a podcast on this.

Learn more

Stay up to date with all our latest Livewire insights by clicking the follow button below, or visit our website for more information.

2 topics