A healthy small cap with recurring earnings

In the context of a slow growth environment, we look for businesses that can do well due to initiatives under their own steam. Integral Diagnostics (ASX:IDX) is probably not a name that many people are familiar with. It is a good quality business and a business that has many of the quality attributes we look for at IML – attributes like recurring earnings, a strong competitive advantage, is run by capable management, that can grow and that is trading at a reasonable price.

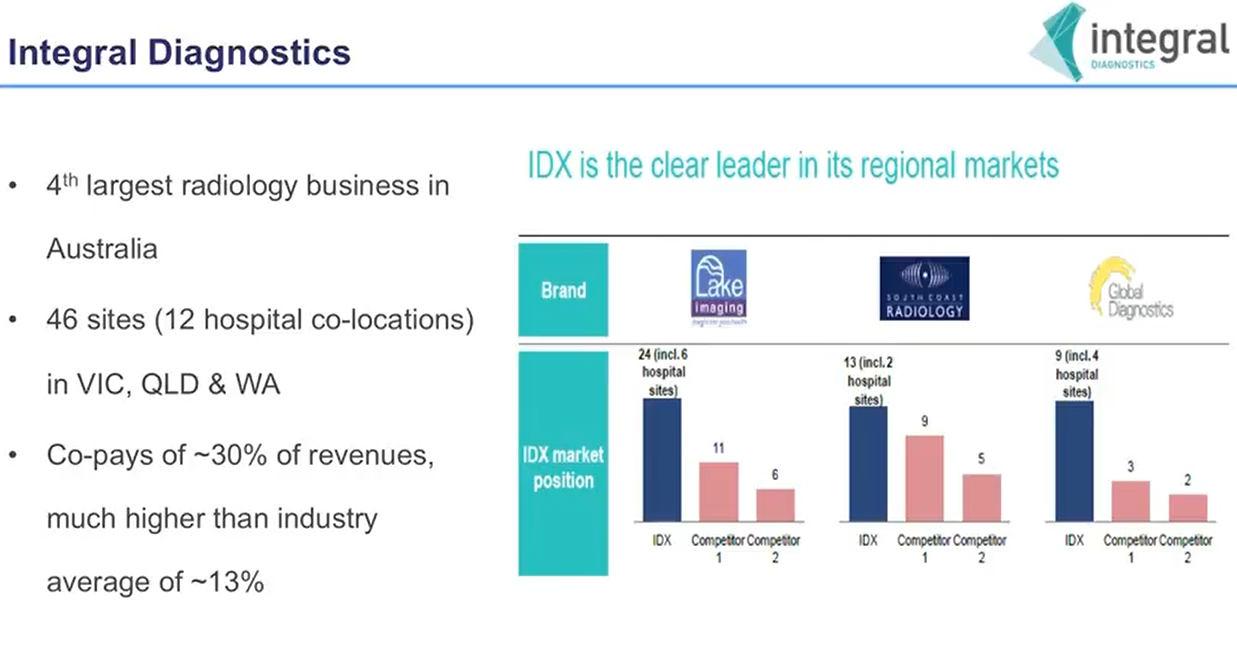

Internal Diagnostics is the fourth largest radiology company in the country. It has a significant market presence, with 46 sites predominantly in the regional areas of Victoria, Queensland and Western Australia.

They are the clear market leader in each of those regions, where they have the ability to share work between sites. 12 of their sites are co-located with hospitals, which means they have a resilient earnings stream due to the large percentage of their referral work coming from specialists. Additionally, it’s not all bulk billing work and that underpins their recurring earnings stream - about 30% of their revenue comes from co-pays because patients are being referred by a specialist.

Source: Integral Diagnostics AGM 22 November 2017

Industry Growth Drivers

In terms of the industry, it’s attractive because it’s got a long-term growth trajectory. That's really underpinned by three key thematics.

- Firstly, the ageing population, with Integral focused on regional areas, the population does tend to be a bit older.

- Secondly and unfortunately, the increase in the prevalence of chronic diseases.

- And lastly, the increase in the use of technology means radiologists are more frequently diagnosing an increasing range of ailments by scanning a patient’s body externally as opposed to using old methods of exploratory surgery to work out what's wrong with you. This approach is making medicine much more efficient and reducing the healthcare burden of the ageing population. It’s actually a significant industry and one that can help improve the quality of care for patients in this country.

The Management Team

Led by Dr. Ian Kadish, new management commenced in the middle of last year and in a very short period of time, have performed admirably and delivered significant value for shareholders. Kadish has been able to flex staff to match patient demand, and increase the utilisation of the quite expensive MRI and other diagnostic equipment, increasing their margins.

We've seen the stock perform quite well because they're able to improve the performance of the business. We think the outlook for the business remains strong, and while it’s trading at 15 times earnings and a yield of 4%, we think the business still looks reasonably priced and well positioned going forward.

While the information contained in this article has been prepared with all reasonable care, Investors Mutual Limited (AFSL 229988) accepts no responsibility or liability for any errors, omissions or misstatements however caused. This information is not personal advice. This advice is general in nature and has been prepared without taking account of your objectives, financial situation or needs. The fact that shares in a particular company may have been mentioned should not be interpreted as a recommendation to buy, sell or hold that stock.

For further analysis and insights from IML's Australian Small Cap team, please visit our website

1 stock mentioned