A key question most investors ignore, do you?

Investors ask themselves many different questions when considering an investment thesis; how fast can the company grow? How expensive is it? How good are the management? But one question they often fail to consider is, 'am I wrong?' Troy Angus, Head of the Australian Equities Fund at Paradice Investment Management, says it’s important for investors to always consider the counter factual.

“When a stock goes up, and you don’t own it, prima-facie, you’re wrong. You should be constantly reassessing the investment case and wondering, ‘what did I get wrong here?”

This is a question they were forced to ask themselves again recently, as expensive technology stocks on the ASX have continued to rally.

Hear the rest of the story in this week’s episode of The Rules of Investing podcast. He also shares one thematic that’s a major beneficiary of recent policies, and his preferred exposure to that theme.

Time stamps

- 2:02 – Troy’s story: from Darwin to London

- 4:42 – The Paradice history and philosophy

- 6:44 – What does the perfect investment look like?

- 7:45 – How does a large-cap strategy compare to small and mid-ones?

- 9:23 – Where are we on the boom and bust curve?

- 12:50 – Are equity prices reflecting our current reality?

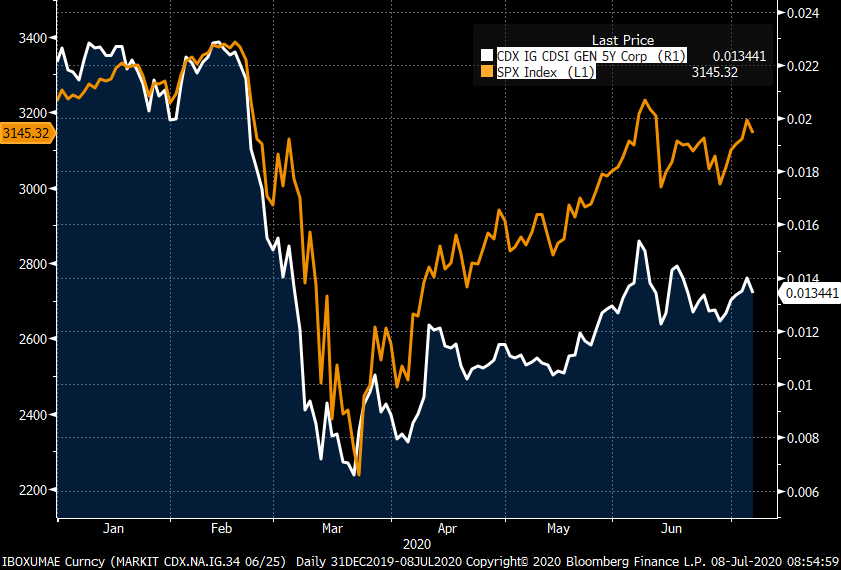

- 15:10 - The disconnect between equity and credit markets

- 16:44 – The significant changes Troy’s made in his portfolio recently

- 22:08 – Is it a good idea to chase momentum stocks?

- 23:55 – IDP Education: are the headwinds currently reflected in the share price?

- 27:23 – What to expect from oil markets

- 31:06 – The enduring challenges faced by the financial industry

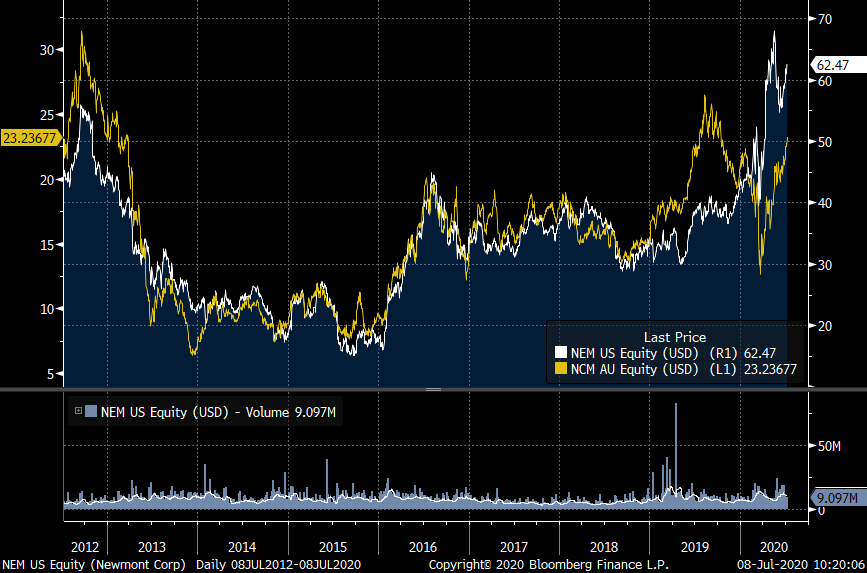

- 33:33 – An investment Troy favours over the medium to long-term

- 39:32 – Troy answers our three favourite questions

Accompanying content

Currently credit markets imply the SP500 should be about 10% lower

Gold historically has had periods where it very significantly outperforms the SP500

Newcrest (yellow) in USD has underperformed its rival, Newmont (white)

Book recommendation. Valuation: Measuring and Managing the Value of Companies. By Tim Koller, Marc Goedhart, and David Wessels.

Clients and performance come first

The Paradice difference comes down to accountability, alignment, experience and performance. Click the ‘contact’ button below to get in touch.

4 stocks mentioned