A lack of euphoria doesn't mean this isn't the top

Investors and gamblers arguably share one common trait in common: an overdeveloped sense of optimism.

And it's a good thing they do.

Stock markets are inherently forward-looking and you'd never have another rally if investors weren't happy to take a risk on the future.

It's certainly rewarded investors in 2025 who have been willing to overlook tariff uncertainty, global instability, anaemic growth and an uneasy macroeconomic environment.

As Lazard's chief market strategist Ron Temple told me recently, there's "extreme optimism" in the markets, and investors are arguably overlooking the sting in the tail of tariffs and lingering concerns around inflation and growth.

But is that enough for the stock market to suffer a correction or, more worryingly, a full-blown bear market?

History suggests we need a seismic event to trigger a true market crash, after which point it becomes obvious that a crash was always on the cards.

Of course the stock market was going to crash after companies with little more than a website rocketed to multibillion dollar valuations.

Of course the stock market was going to crash after the worst financial crisis since the Great Depression.

Of course the stock market was going to crash after a once-in-a-century pandemic.

Yet beyond the many justified jitters for investors detailed in this article, there's no obvious catalyst on that scale right now.

At the very least, we'd need the pride to come before any market fall, and there's still too much uneasiness around to suggest markets are over-exuberant right now.

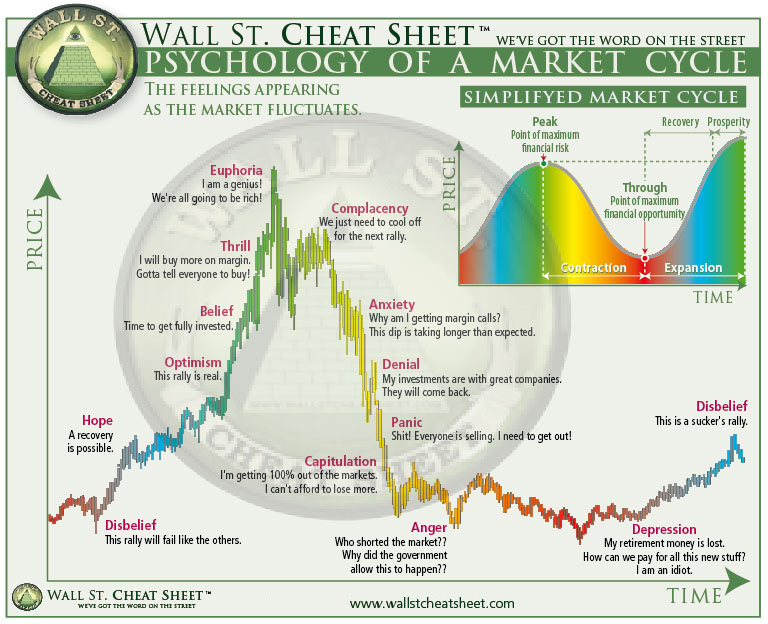

So while we clearly haven't hit the Euphoria stage as defined by the infamous Wall St Cheat Sheet, there's two other big factors that could easily make this an inflection point for markets.

Inflation, interest rates and GDP, three of the biggest drivers of the stock market, are all starting to signal they could move in the wrong direction.

Despite markets pricing in a US rate cut in September, and increasing political pressure on the Fed, it's unlikely we get more than a handful of rate cuts over the next 12 months.

CPI inflation rose to 3.1% in July, and Trump's plans around growing the US debt should worry everyone.

The same is true of Australia.

A shock hold in July surprised economists, but recent CPI data showed inflation rising to 2.8%. Some also expect June GDP data to come in under the RBA's forecasts.

The low rates paradise many are hoping for is far from a foregone conclusion.

Couple that with a number of key indicators suggesting current valuations are overheated at worst and it's not a recipe for healthy market growth.

The ASX 200's forecast earnings per share has historically been a reliable tracker for the index's performance. Over the last 12 months or so, there's been a clear deviation as valuations continued to rise while EPS declined.

As Betashares' Tom Wickenden recently wrote for Livewire, "the strong price appreciation of the ASX 200 has not been supported by underlying earnings, with the Australian market on track for a second year of negative earnings growth in FY25."

Again, it's the same story in the US.

The S&P 500's current P/E ratio is currently around 30.

The only times in history when it's been higher are just before the Dot-com bubble, during the GFC and during the Covid pandemic. We all know what happened next on each of those occasions.

History suggests the current state of play isn't sustainable.

Something has to give.

There remain plenty of factors (tariffs, political instability, inflation, poor growth) that should be worrying investors more than they seem to be right now.

If markets do crash, the history books will say it was any (or all) of them that were to blame.

In hindsight, we'll say it was obvious, even if it isn't right now.

5 topics

1 contributor mentioned