A place to hide from rising rates

While equity markets continue to tumble in the face of a rising Fed, fixed income is getting attention. Asset allocators, after being rocked by the historic sell-off in bonds earlier this year, are looking at relatively attractive yields. But developed market (DM) bonds are only part of the bond story.

Real policy rates in emerging markets (EM) are much higher. There are some strong tailwinds for EM bonds, like the GFC and subsequent debt crises when EM debt, as an asset class, shined. EM currently has the same basic fundamentals that made it perform and attract inflows back then:

- EMs have lower leverage and higher real interest rates relative to DM;

- DM authorities are being forced into more fiscal and monetary experimentation and supply - creating greater risks.

Additionally, most global bond portfolios do not have an allocation to EM, despite the impressive risk return characteristics of the asset class.

EM central banks led and are keeping it ‘real’

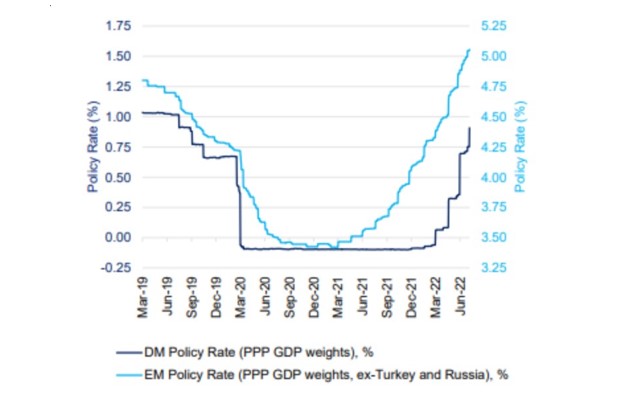

EM central banks raised rates early and significantly, relative to the DM’s late hiking cycle.

Exhibit 1: Policy rates in EM

and DM

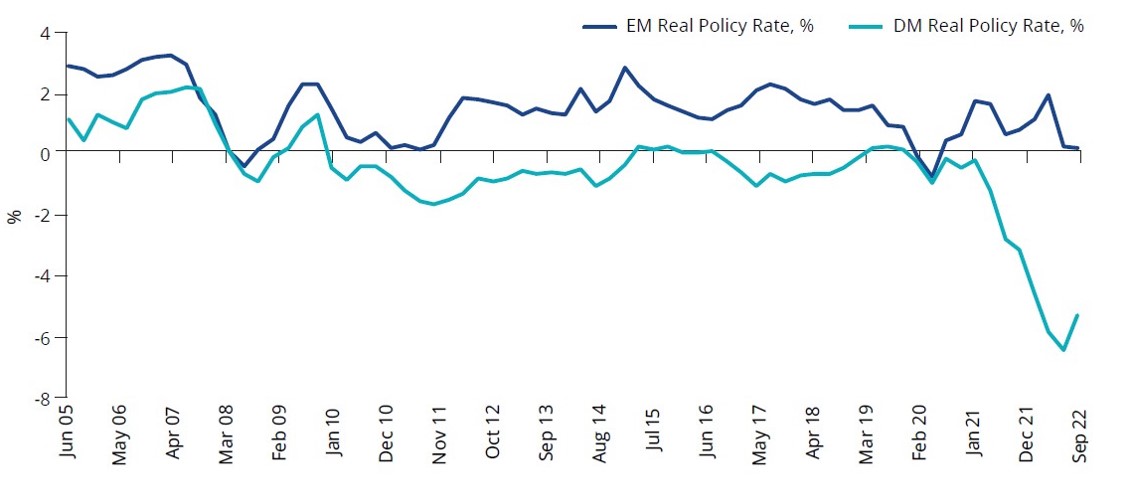

Investors have always demanded a higher premium from EM issuers, but when you consider the real policy rates (rates minus inflation), the difference is stark and investors are being rewarded in EM bonds.

Exhibit 2: Real policy rates in EM and DM (%)

Source: VanEck, Bloomberg.

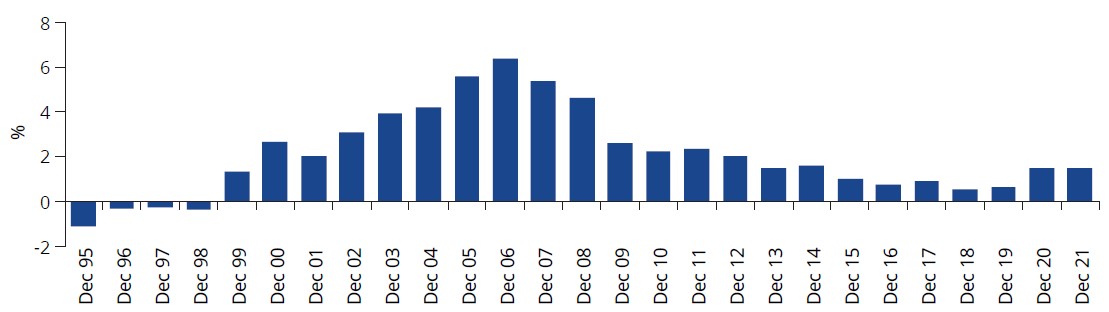

EM policymakers are awash in dollars and hiking rates way earlier and larger than the Fed and other DM central banks, as they’ve done for all of the crises of the past two decades. You can see below, surpluses as far as the eye can see, despite the many global crises we’ve faced.

Exhibit 3: EM current account balance

EM could be the place to hide from rising rates

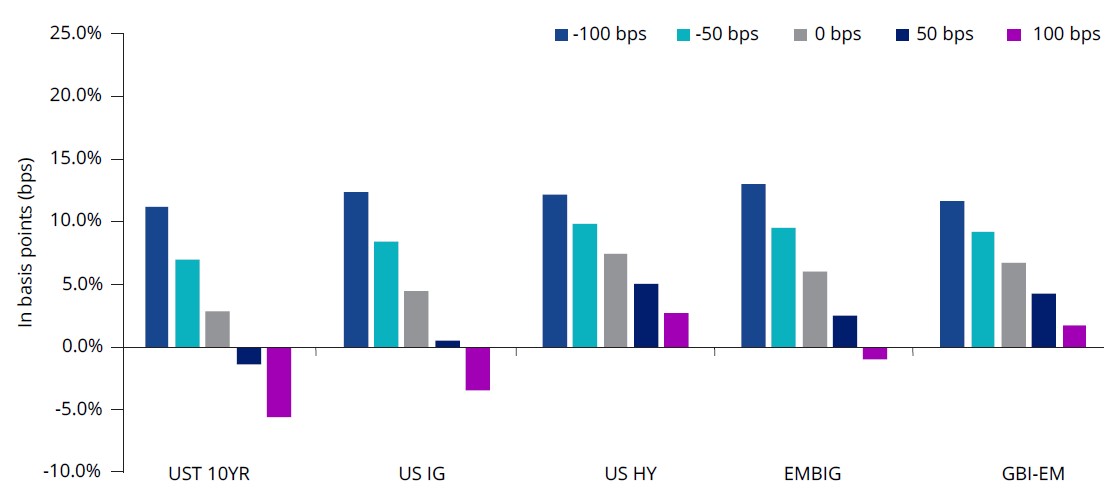

While the yields on DM bonds hit medium-term highs, investors considering bonds for yield are still concerned about duration, that is the threat that rates continue to rise, eroding capital. The chart below shows if you are worried about duration, US treasuries and investment grade have much worse upside/downside characteristics than do EM sovereigns. The spreads in EM are sufficient to better absorb rising rate scenarios.

Exhibit 4: Returns on fixed income from -100 basis points to +100 basis points shift in yield curve

Source: VanEck, Bloomberg, as at 31 August 2022. UST10YR is Bloomberg US Government 10 Year Term Index, US IG is ICE BofA US Corporate Index, US HY is ICE BofA US High Yield Index, GBI-EM is EM local - J.P. Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM); EMBIG is EM hard currency - J.P Morgan Emerging Markets Bond Index Global Diversified (EMBIGD) – EMBIGD is unhedged, EBND hedges its hard currency.

You could be missing out because most global bond portfolios don’t have an allocation

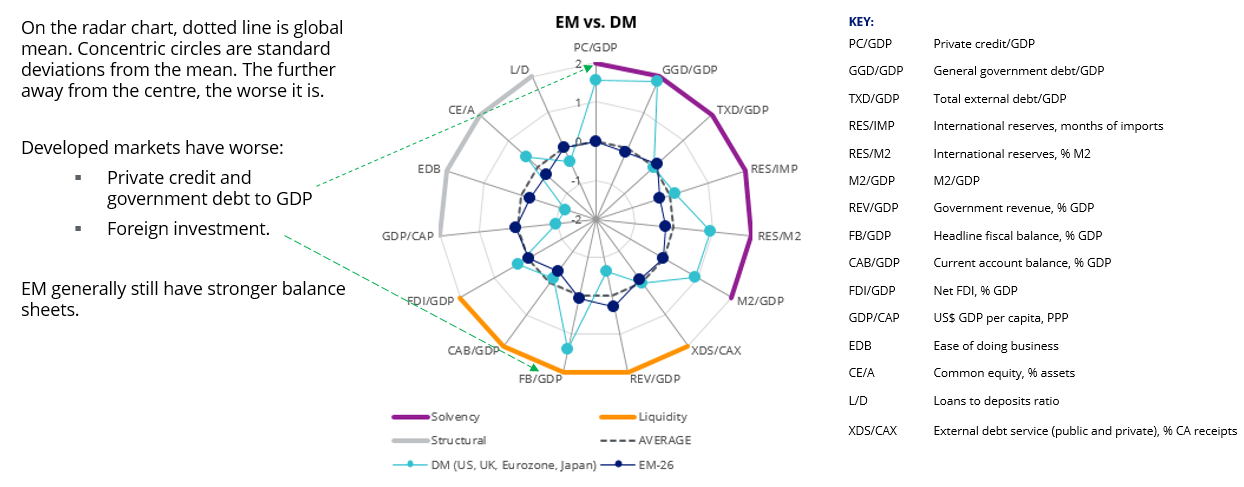

One asset class that has in the past been overlooked by Australian investors which can enhance their yield is EM bonds. There are a number of reasons Australian investors may not have an allocation to EM bonds based on old world beliefs, but we are entering a new world. Global comparisons show that many EM economies are now as liquid and structurally sound as DM, or better. EM (the dark blue lines in the chart below) generally have stronger balance sheets than DM (the aqua lines on the chart). On many metrics the G10 economies are worse than the largest 26 EM.

Exhibit 5: EM v DM balance sheets

Source: Credit Suisse, JP Morgan, Bloomberg, BIS, Central Bank Website.

Despite their stronger fundamentals, EM governments and corporations generally pay more than their DM counterparts when they issue bonds. This presents an opportunity for opportunistic investors.

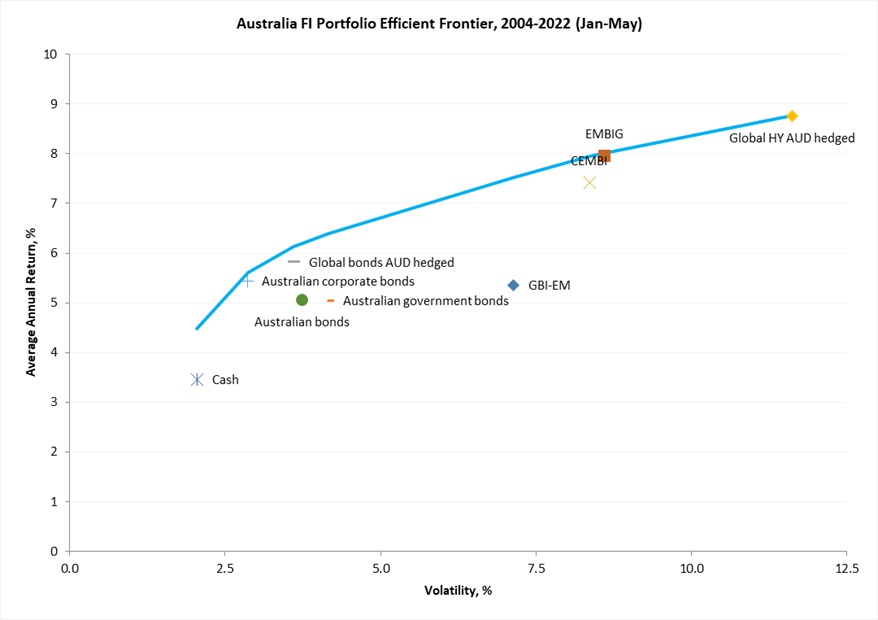

If you consider the risk and reward trade off, as you’d expect, EM bonds’ volatility are above DM bonds, but well below equities. The chart below also shows that since 2006 DM high yield bonds have experienced nearly double the risk of EM hard currency bonds for a similar return.

Exhibit 6 – Fixed

income portfolio efficient frontier, 2004 - 2022

Source: Bloomberg, VanEck, 31 August 2022. Results are calculated monthly and assume immediate reinvestment of all dividends. Volatility is Standard Deviation of returns. You cannot invest in an index. Past performance is not a reliable indicator of future performance. Indices used: Cash – Bloomberg Australian Bank Bill 0+ Yr Index; Global Bonds AUD hedged – Barclays Global Aggregate Bond Index A$ Hedged; Australian Bonds – Bloomberg AusBond Composite Index; Australian corporate bonds – Bloomberg AusBond Credit 0+Yr Index; Australian government bonds – Bloomberg AusBond Australia Government Bond; GBI-EM is EM local - J.P. Morgan Government Bond Index-Emerging Markets Global Diversified (GBI-EM); EMBIG is EM hard currency - J.P Morgan Emerging Markets Bond Index Global Diversified (EMBIGD) – EMBIGD is unhedged, EBND hedges its hard currency; CEMBI – J.P Morgan Corporate Emerging Markets Bond Index (CEMBI); Global HY AUD hedged – Bloomberg Barclay Global High Yield Index A$ Hedged.

We’ve discussed this before, but based on the 18 years of data above, through August of this year (including all the bad recent times), the efficient frontier’s implied allocation is roughly 20% of all fixed income to EM debt for 4% standard deviation, and over 60% for a 7% standard deviation.

We’re not recommending an allocation of that magnitude as a percentage of fixed income assets to EM debt, nor are we asset allocators. We believe that portfolios that continue to overlook EM debt will not survive bond stability, and if bonds recover, they will begin a major re-pricing. A dedicated allocation may be necessary, whatever the case, there is a strong argument for investors to consider an allocation greater than zero.

During the current rate rising environment and bond sell-off, it seemed babies were thrown out with the bathwater in all bond markets. Selectivity and remining vigilant, especially in EM is key.

5 topics