A profitable growth company is hard to find

Johns Lyng Group (ASX: JLG) recently announced the acquisition of US insurance repair company, Reconstruction Experts. An acquisition by JLG was widely expected, but the market underestimated its blockbuster 64% earnings-per-share (“EPS”) accretion. When JLG shares resumed trading, the stock price jumped 16%.

Over the last three years, the market has consistently underestimated JLG’s ability to achieve strong EPS growth, both organically and through a steady flow of astute acquisitions. The predictable nature of JLG’s growth is a great example of a recurring situation that we use at Monash Investors to recognise future business outcomes that the market underestimates.

The profitable growth company that we found

JLG provides building, restoration and strata management services in Australia and the US through a portfolio of strategically aligned businesses. Insurance Building and Restoration Services (“IB&RS”) is JLG’s core business. It works on behalf of insurance companies which accounts for 80% of its FY21 revenue. Since listing in 2017, JLG has delivered a 23% compound average growth rate (“CAGR”) in revenue and 16% CAGR in EPS. JLG has done this consistently, while maintaining an average of 80%+ cash flow conversion and return on equity of 30%(1). Over the same time period, JLG’s stock price has risen almost 600%, entering the ASX 300 Index in September 2021.

The premium of reliability

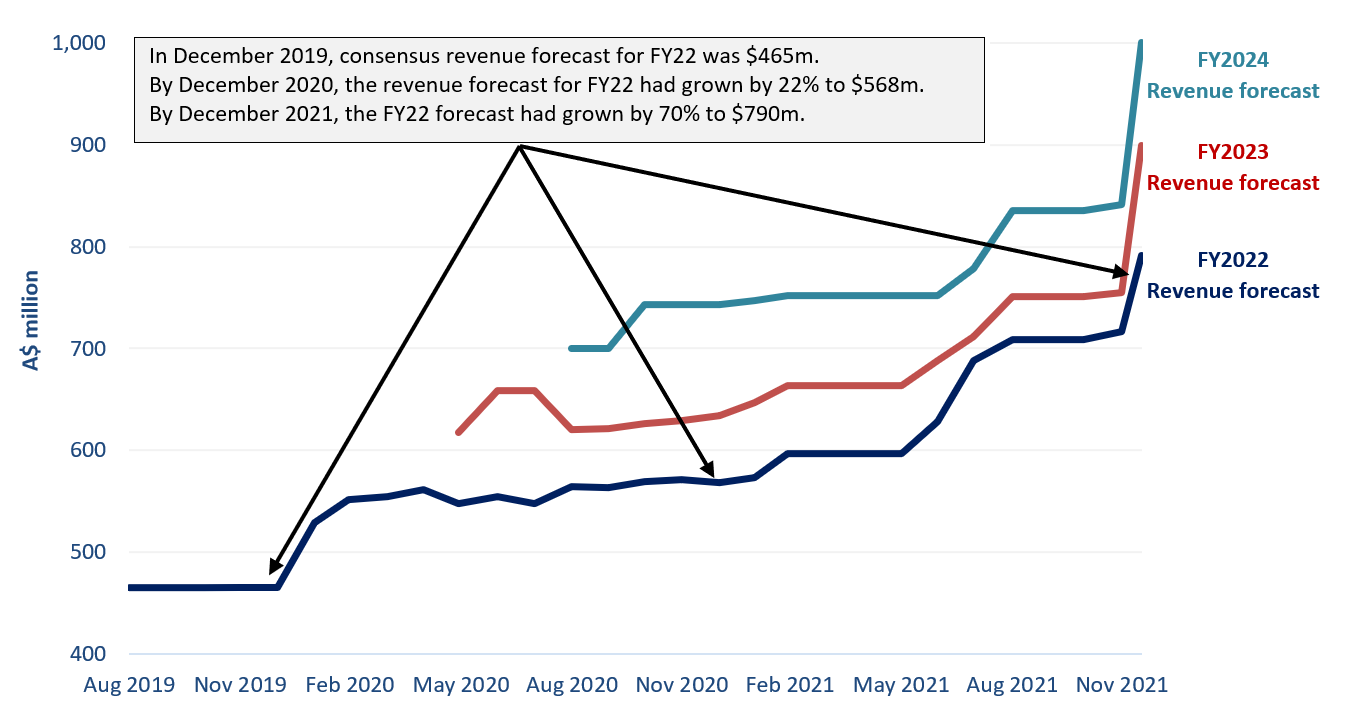

Analyst consensus estimates for JLG’s medium and longer term forecasts have been conservative, underestimating the benefits of scale and profitability that organic growth and bolt-on acquisitions provide to its business. The chart below shows the trend of analysts periodically upgrading their revenue forecasts as JLG consistently delivered its growth strategy above market expectations.

Consensus revenue forecasts over time

Source: FactSet, Monash Investors

At the same time JLG’s Price-to-Earnings (“P/E”) ratio expanded. Apart from the general drift upwards that we have seen in market P/E ratios since the COVID-19 lows, there are two main reasons for this.

- The first reason the P/E has expanded is because of a reduction in risk as investors’ confidence grew in JLG’s ability to reliably deliver against future years’ growth expectations. The perceived decrease in uncertainty means that the market is prepared to pay a higher price for next year’s earnings.

- The second reason the P/E has expanded is due to the increase in the growth outlook for years beyond FY22. Keeping it simple, the P/E ratio for next year’s earnings is the price that the market will pay based on that year’s forecast earnings. But the market will pay a higher price the greater it expects earnings beyond next year and to into the future.

The P/E ratio is a valuation snapshot in time and will likely continue to underestimate their future revenue and earnings. Using consensus estimates for FY24, JLG’s P/E ratio sits at a very high 41x. However, this P/E is based on revenue growth estimates of 14% p.a. for FY23 and 11% for FY24 (2). For context, JLG has achieved a 23% revenue CAGR from FY17 to FY21. This excludes potential revenue growth in the US from Reconstruction Experts and further acquisitions. Our own modelling suggests that at current prices, JLG’s FY25 P/E is well below 30x.

Organic and acquisitive growth drivers

JLG’s business model stood out to us because it benefits from multiple advantages that drive its organic and acquisitive growth:

- Positioned at the growth-tip of a defensive industry with thematic tailwinds. Insurance building and restoration work is non-discretionary spending. It is leveraged to property market expansion and an increasing severity of major weather events.

- Continues to grow its business-as-usual (“BaU”) insurance restoration revenue through increasing panel allocations, geographic and scope expansions. These asset-light jobs provide a steady stream of cash flows that can fund acquisitions and pay dividends.

- Jobs are completed on a cost-plus contract structure which acts as a natural inflation hedge against rising operating costs in building materials and wages. This also provides margin resilience during extreme events, as demonstrated during COVID-19.

- Entrenched competitive position through size, panel availability and quality-control. JLG is Australia’s largest IB&RS provider, in a fragmented industry, with 30 offices nationwide. It also sits on almost all major insurance panels in Australia. This makes JLG an attractive partner to rely upon for quality building restoration works and especially for work related to catastrophic (“CAT”) weather events such as the 2019 bushfires. These CAT events are mostly excluded from forecasts.

- Equity partnership model has effectively integrated multiple acquisitions a year and assisted the firm with retaining key staff and its managerial ownership culture. This enabled JLG to pursue M&A across multiple growth corridors. For example, the Reconstruction Experts acquisition accelerates JLG’s US expansion and provides JLG with access to a US$100bn addressable market with higher margins (14% EBITDA margin (3)) than those achieved in Australia (c.9% EBITDA margin). It also allows JLG to diversify into complementary adjacencies such as strata management which should yield strong growth through cross-selling. To date, the management team has provided a good example of what can be achieved if management and employees' incentives are adequately aligned with shareholders.

Given these drivers and the size of the US market opportunity, JLG’s bright outlook is largely theirs for the taking.

Each time we forecast how a company will perform, we deal with uncertainty and so by definition won’t always get it right. Both the opportunity and risk is magnified the further we look out. So what are some key risks? In time, long-standing CEO Scott Didier, who owns 24% of JLG, will no doubt consider a form of succession, the process of which we will monitor closely. Management expertise will be critical to sustain growth, which the market is increasingly expecting. Competitive pressures and emerging industry consolidators are also an area we keep a close eye on.

However, JLG’s skillset in residential property and its proven acquisition strategy has had demonstrable success in Australia. The Reconstruction Experts acquisition is a good foothold in the US. By exporting their property obsession to the US, a similarly fragmented market, JLG has unlocked a much larger growth path.

This is one of many recurring business situations that we look for at Monash Investors Limited. Our Co-Founder Simon Shields gave other examples in in his recent article.

Benefit at every stage of a cycle

Monash Investors Limited invest in a small number of compelling stocks that offer considerable upside and short expensive stocks that are at risk of falling. Want to learn more? Hit the 'contact' button to get in touch or visit our website for further information.

Footnotes

(1) Source: Annual Financial Statements, FactSet

(2) Source: Factset

(3) Source: Company Investor Presentation released to ASX on 9 December 2021

4 topics

2 stocks mentioned

2 contributors mentioned